Global Digital Shipyard Market Expected to Reach USD 8.1 Billion by 2033 - IMARC Group

Global Digital Shipyard Market Statistics, Outlook and Regional Analysis 2025-2033

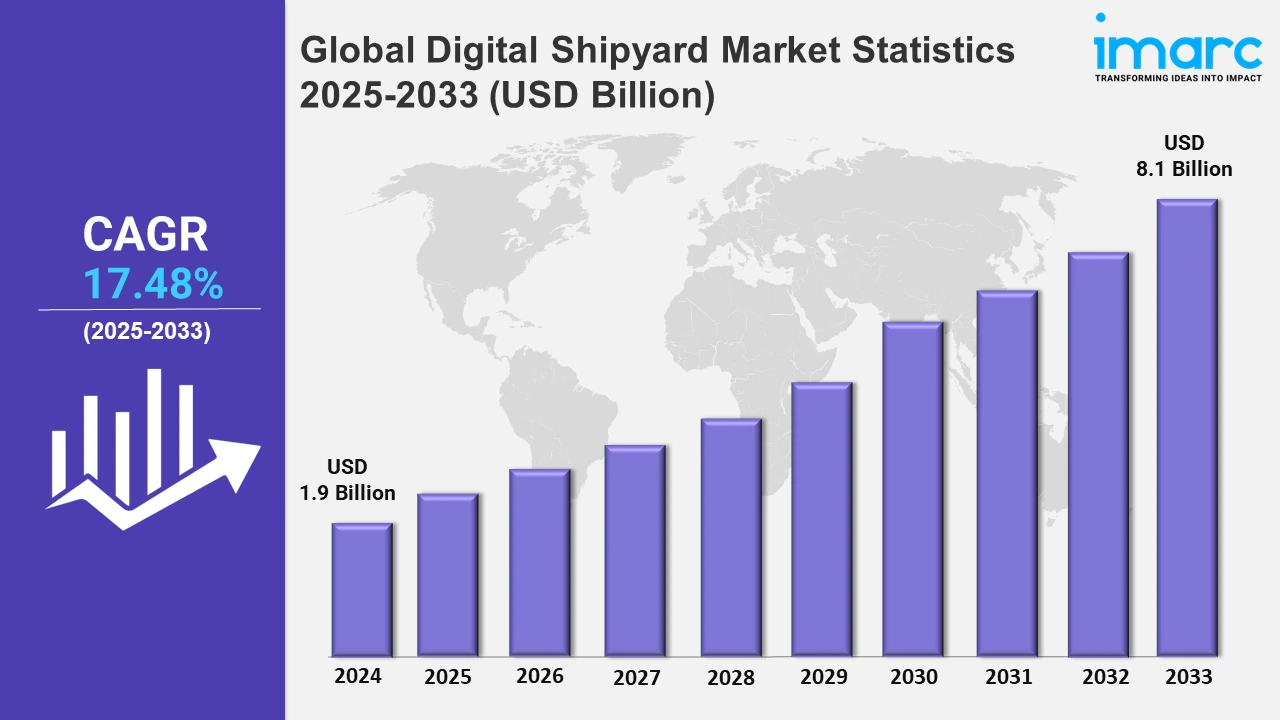

The global digital shipyard market size was valued at USD 1.9 Billion in 2024, and it is expected to reach USD 8.1 Billion by 2033, exhibiting a growth rate (CAGR) of 17.48% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing adoption of cutting-edge technologies is driving growth in the digital shipyard market, enabling shipbuilders to improve operational efficiency, streamline processes, and align with sustainability objectives. The use of tools, such as 3D modeling, product lifecycle management (PLM) systems, and digital twins, is transforming workflows while promoting better collaboration among stakeholders. In January 2024, HD Hyundai Heavy Industries partnered with NAPA and CADMATIC on a joint development initiative aimed at advancing digital shipyard innovation. This project focuses on utilizing advanced 3D modeling and digital twin technologies to improve shipbuilding processes, enhance sustainability, and foster seamless collaboration. In addition to this, the rising demand for environmentally friendly and technologically advanced solutions continues to boost market expansion.

In addition to this, innovations in eco-friendly shipbuilding and hybrid propulsion systems are also reshaping the market landscape. For example, in May 2024 Chowgule and Company launched the fourth electric hybrid vessel, MV AQUAMAR, for Sweden's AtoB@C Shipping. This demonstrates the integration of energy-efficient hybrid propulsion with digital technologies, which highlights the commitment towards reducing emissions and adopting sustainable practices. Moreover, the advancements in AI-powered smart shipyards are driving the market forward. In September 2024, ST Engineering inaugurated its AI-powered smart shipyard at Gul Yard, Singapore, equipped with 5G infrastructure, predictive maintenance, and IoT-enhanced safety systems. These features enable efficient management of complex maritime projects and offshore renewable initiatives.

Global Digital Shipyard Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific dominates the market due to the extensive adoption of advanced technologies, robust maritime trade, and the increasing government investments in digital infrastructure.

North America Digital Shipyard Market Trends:

In North America, the market is driven by advanced adoption of Industry 4.0 technologies, particularly in the U.S. Moreover, the integration of AI-powered systems is improving predictive maintenance and operational efficiency. For example, Huntington Ingalls Industries is utilizing digital twins to enhance the performance of naval vessels. Also, the U.S. Navy’s emphasis on modernizing fleets further accelerates growth in this region.

Europe Digital Shipyard Market Trends:

European countries, such as Germany, are leveraging automation and IoT to enhance shipbuilding efficiency. In contrast, digitalization is central to sustainability goals, with green shipbuilding projects utilizing smart designs to meet environmental regulations. For instance, Meyer Werft in Germany is employing simulation software to reduce waste and energy consumption during construction, thereby positioning Europe as a leader in sustainable shipyard technologies.

Asia-Pacific Digital Shipyard Market Trends:

Asia-Pacific is the dominating region in the market. It is driven by the region’s strong shipbuilding hubs, particularly in countries like South Korea, China, and Japan, which integrate advanced digital solutions to enhance operational efficiency and reduce costs. For instance, ZEBOX’s in partnership with Bureau Veritas, PSA unboXed, and Synergy Marine in April 2023, launched its Asia-Pacific hub in Singapore, its fifth global accelerator. Furthermore, this initiative fosters innovation for resilient, sustainable supply chains and supports digital shipyard advancements through corporate-startup collaborations across the maritime industry.

Latin America Digital Shipyard Market Trends:

In Latin America, Brazil is focusing on modernizing its shipyards to support offshore oil exploration. On the contrary, digital tools are being employed to enhance safety and efficiency in harsh environments. For example, Petrobras is utilizing digital twins to monitor and predict maintenance for offshore support vessels. Meanwhile, this adoption is strengthening Brazil’s competitiveness in both the shipbuilding and oil industries.

Middle East and Africa Digital Shipyard Market Trends:

In the Middle East and Africa, particularly the UAE, digital shipyards are advancing to support maritime logistics. Also, Dubai’s DP World has integrated blockchain and AI for efficient supply chain management at its shipyards. In line with this, smart port initiatives are boosting demand for automated vessel tracking and maintenance solutions. Furthermore, these technologies position the UAE as a hub for maritime digitalization in the region.

Top Companies Leading in the Digital Shipyard Industry

Some of the leading digital shipyard market companies include AVEVA Group plc (Schneider Electric SE), BAE Systems Plc, Dassault Systemes SE, IFS AB, Inmarsat Global Limited (Viasat Inc.), Navantia, Pemamek Oy Ltd., Siemens AG, SSI, Wärtsilä Oyj Abp, among many others. In May 2024, BAE Systems Australia announced plans to recruit over 600 workers for the Adelaide-based Hunter frigate project, emphasizing the development of sovereign continuous naval shipbuilding capabilities.

Global Digital Shipyard Market Segmentation Coverage

- Based on the type, the market has been bifurcated into military shipyards and commercial shipyards, wherein commercial shipyards represent the most preferred segment, as they cater to the construction and maintenance of merchant ships, including cargo ships, tankers, cruise ships, bulk carriers, etc.

- Based on the technology, the market is categorized into AR/VR, digital twin and simulation, addictive manufacturing, artificial intelligence and big data analytics, robotic process automation, industrial internet of things (IIoT), cybersecurity, block chain, and cloud and master data management, amongst which artificial intelligence and big data analysis dominate the market, as the integration is giving rise to the field of data science, which focuses on extracting knowledge and predictions from data.

- On the basis of the process, the market has been divided into research and development, design and engineering, manufacturing and planning, maintenance and support, and training and simulation. Among these, research and development exhibit a clear dominance in the market. This can be attributed to the innovation and development of new shipbuilding technologies and methodologies.

- Based on the capacity, the market is bifurcated into large shipyards, small shipyards, and medium shipyards, wherein medium shipyards dominate the market. They are known for their adaptability, capable of shifting between diverse types of shipbuilding projects with relative ease.

- On the basis of the digitalization level, the market is segmented into fully digital shipyard, semi digital shipyard, and partially digital shipyard. Currently, semi digital shipyard accounts for the majority of the total market share. It represents a blend of traditional shipbuilding methods and digital technologies.

- Based on the end use, the market is bifurcated into implementation and upgrades and services, wherein implementation dominates the market, as it focuses on the initial incorporation of digital technologies into shipyard operations.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 8.1 Billion |

| Market Growth Rate 2025-2033 | 17.48% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment

|

| Types Covered | Military Shipyards, Commercial Shipyards |

| Technologies Covered | AR/VR, Digital Twin and Simulation, Addictive Manufacturing, Artificial Intelligence and Big Data Analytics, Robotic Process Automation, Industrial Internet of Things (IIoT), Cybersecurity, Blockchain, Cloud and Master Data Management |

| Processes Covered | Research and Development, Design and Engineering, Manufacturing and Planning, Maintenance and Support, and Training and Simulation |

| Capacities Covered | Large Shipyards, Small Shipyards, Medium Shipyards |

| Digitalization Levels Covered | Fully Digital Shipyard, Semi Digital Shipyard, Partially Digital Shipyard |

| End Uses Covered | Implementation, Upgrades and Services |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AVEVA Group plc (Schneider Electric SE), BAE Systems Plc, Dassault Systemes SE, IFS AB, Inmarsat Global Limited (Viasat Inc.), Navantia, Pemamek Oy Ltd., Siemens AG, SSI, Wärtsilä Oyj Abp, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)