Global Digital Radiology Market Expected to Reach USD 5.0 Billion by 2033 - IMARC Group

Global Digital Radiology Market Statistics, Outlook and Regional Analysis 2025-2033

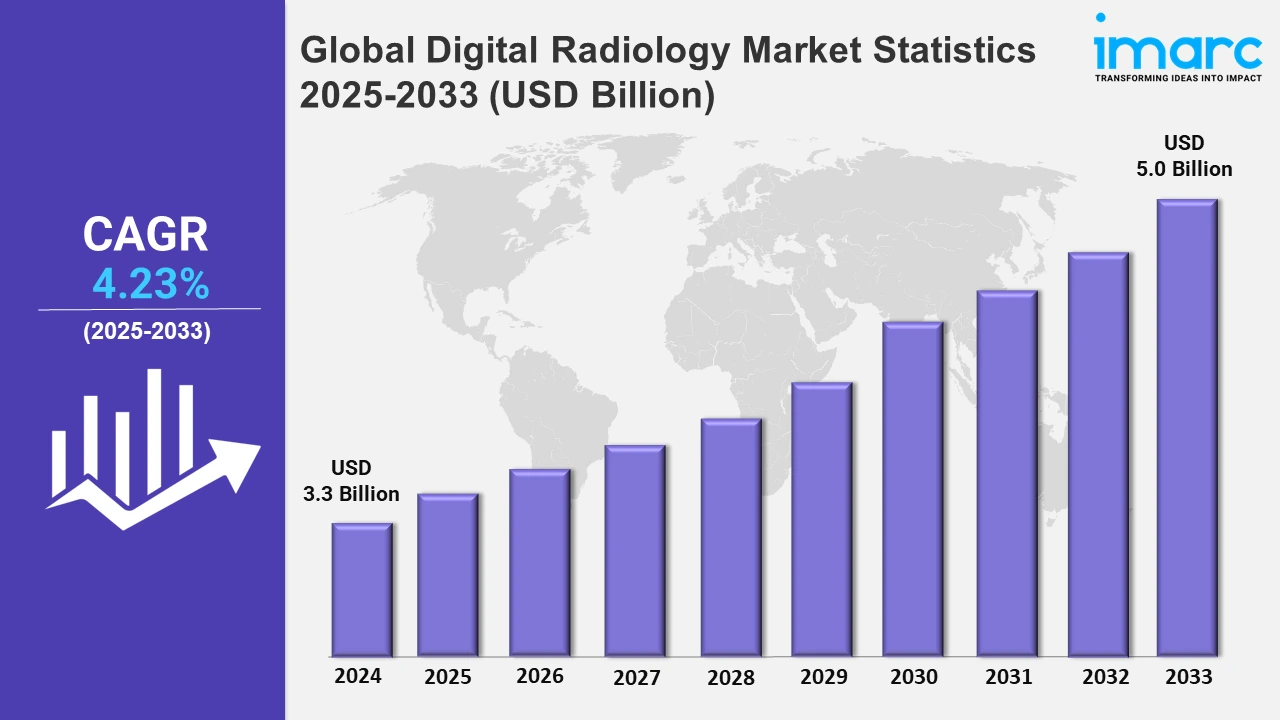

The global digital radiology market size was valued at USD 3.3 Billion in 2024, and it is expected to reach USD 5.0 Billion by 2033, exhibiting a growth rate (CAGR) of 4.23% from 2025 to 2033.

To get more information on this market, Request Sample

There has been a significant increase in chronic conditions, such as cardiovascular diseases, cancer, and musculoskeletal disorders. For instance, according to the World Health Organization (WHO), in 2022, there were nearly 20 million new cancer diagnoses and 9.7 million fatalities. Cancer affects around one in every five persons in their lifetime, with one in every nine men and one in every twelve women dying from it. Similarly, as per the American Cancer Society, in 2024, the United States is expected to see 2,001,140 new cancer cases and 611,720 cancer deaths. This has further escalated the demand for advanced diagnostic imaging solutions, including digital radiology.

The global rise in the elderly population is significantly contributing to the market growth. For instance, according to the World Health Organization (WHO), by 2030, one in every six persons in the world will be 60 or older. At this time, the proportion of the population aged 60 and up will rise from 1 billion in 2020 to 1.4 billion. By 2050, the global population of persons aged 60 and up will double (2.1 billion). Many elderly individuals require repeated imaging over time, which boosts demand for digital radiology systems capable of providing high-quality, accurate, and efficient results. Moreover, continuous innovations have enhanced image quality, reduced radiation exposure, and improved diagnostic capabilities. The integration of artificial intelligence (AI) and machine learning into digital radiology systems has further streamlined workflows and increased diagnostic accuracy. For instance, in January 2024, Boston Imaging, Samsung's digital radiography (DR) and ultrasound business's headquarters in the United States, signed a supply contract with Lunit Inc., a leading provider of artificial intelligence (AI) powered solutions for cancer diagnostics and therapeutics, to enable faster and more accurate chest screenings for timely interventions with better patient outcomes. The Lunit INSIGHT CXR, an AI-powered chest X-ray analysis solution, and the Lunit Insight CXR Triage, an FDA 510(k)-cleared AI triage solution for critical chest findings, will allow Samsung's computer aided detection (CAD) AI to assist radiologists in managing the unprecedented volume of patient exams by prioritizing those with suspected abnormalities.

Global Digital Radiology Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America held the biggest market share due to the increasing focus on medical innovation. Moreover, the growing demand for accurate and efficient diagnostic tools due to the prevalence of severe diseases is offering a positive market outlook.

North America Digital Radiology Market Trends:

The presence of key manufacturers, research institutions, and healthcare facilities is contributing to the growth of the market, marking dominance in the region. In addition, favorable regulatory frameworks are propelling the growth of the market in North America. Besides this, the rising cases of chronic conditions such as cardiovascular diseases and cancer have escalated the demand for advanced diagnostic imaging solutions. For instance, according to new research from the American Heart Association, approximately 61% of people in the United States will have cardiovascular disease by 2050.

Europe Digital Radiology Market Trends:

The rising incidence of conditions like cardiovascular diseases and cancers necessitates advanced diagnostic tools. For instance, in the UK, over 7.6 million people were living with heart or circulatory diseases in 2021, underscoring the need for effective digital radiology equipment.

Asia Pacific Digital Radiology Market Trends:

An aging population leads to a higher occurrence of age-related ailments, boosting the demand for diagnostic imaging. For instance, in India, approximately 7% of the total population was aged 65 years or older in 2022, contributing to increased utilization of digital radiology services.

Latin America Digital Radiology Market Trends:

The region faces a rising incidence of chronic conditions such as cardiovascular diseases, cancer, and diabetes. For instance, Brazil was expected to see 704,000 additional cancer cases in 2023. These ailments often require advanced imaging for diagnosis and monitoring, boosting the demand for digital radiology services.

Middle East and Africa Digital Radiology Market Trends:

The increasing incidence of chronic conditions such as musculoskeletal disorders necessitates advanced diagnostic tools. For example, according to a March 2023 study published in the MDPI Journal, knee OA increases with age, reaching up to 60.6% in people aged 66-75, compared to 30.8% in those aged 46-55 in Saudi Arabia in 2021. Digital radiography offers enhanced imaging capabilities, facilitating early detection and effective management of these diseases.

Top Companies Leading in the Digital Radiology Industry

Some of the leading digital radiology market companies include Acteon India Pvt. Ltd., Agfa-Gevaert N.V. (Interessengemeinschaft Farbenindustrie AG), Canon Inc., FUJIFILM Holdings Corporation, General Electric Company, Hologic Inc., Konica Minolta Inc., Koninklijke Philips N.V., MinXray Inc, Shimadzu Corporation, Siemens Healthineers AG (Siemens AG), and Swissray International Inc. (Swissray Global Healthcare), among many others. For instance, Fujifilm India Pvt. Ltd. launched x-ray solutions enhanced with qXR, Qure.ai's computed-assisted radiology software program built with deep-learning artificial intelligence (AI) technology.

Global Digital Radiology Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into stationary digital radiology system and portable digital radiology system. The escalating demand for providing high-quality diagnostic images for a variety of medical applications is propelling the growth of this segment.

- Based on the application, the market is categorized into cardiovascular imaging, chest imaging, dental imaging, digital mammography, orthopedic imaging, and others. The growing need for high-resolution images with minimal radiation exposure is augmenting the segment’s growth.

- On the basis of the technology, the market has been divided into direct digital radiology and computed digital radiology. Among these, direct digital radiology represented the largest segment as it provides rapid image acquisition, immediate availability of images for diagnosis, and can manipulate images for enhanced visualization.

- Based on the end user, the market is bifurcated into diagnostic clinics, hospitals, and others, wherein diagnostic clinics represent the largest segment. These clinics provide reduced waiting times, specialized expertise, and focused services, which makes them a preferred choice for individuals seeking prompt and accurate diagnostics.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.3 Billion |

| Market Forecast in 2033 | USD 5.0 Billion |

| Market Growth Rate (2025-2033) | 4.23% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products Covered | Stationary Digital Radiology System, Portable Digital Radiology System |

| Applications Covered | Cardiovascular Imaging, Chest Imaging, Dental Imaging, Digital Mammography, Orthopedic Imaging, Others |

| Technologies Covered | Direct Digital Radiology, Computed Digital Radiology |

| End Users Covered | Diagnostic Clinics, Hospitals, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acteon India Pvt. Ltd., Agfa-Gevaert N.V. (Interessengemeinschaft Farbenindustrie AG), Canon Inc., FUJIFILM Holdings Corporation, General Electric Company, Hologic Inc., Konica Minolta Inc., Koninklijke Philips N.V., MinXray Inc, Shimadzu Corporation, Siemens Healthineers AG (Siemens AG), Swissray International Inc. (Swissray Global Healthcare), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)