Global Digital Lending Platform Market Expected to Reach USD 39.8 Billion by 2033 - IMARC Group

Global Digital Lending Platform Market Statistics, Outlook and Regional Analysis 2025-2033

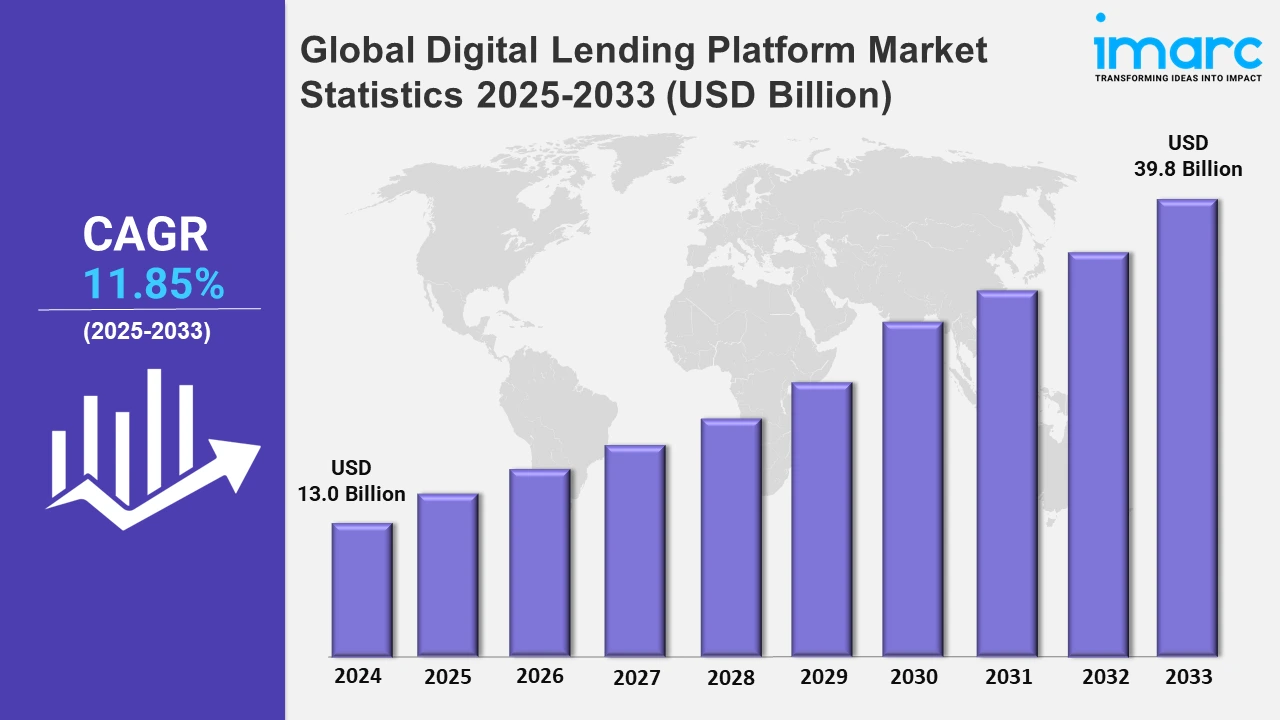

The global digital lending platform market size was valued at USD 13.0 Billion in 2024, and it is expected to reach USD 39.8 Billion by 2033, exhibiting a growth rate (CAGR) of 11.85% from 2025 to 2033.

To get more information on this market, Request Sample

The growing emphasis on customization is boosting the market. Furthermore, numerous platforms are utilizing sophisticated technology to provide simplified application procedures, user-friendly interfaces, and personalized loan products based on specific borrower requirements. For example, in May 2024, PhonePe launched its secured digital lending platform within the PhonePe app, allowing approximately 535 million registered users to obtain loans in six different categories, including gold loans, mutual fund loans, auto loans, etc.

Moreover, the need for digital lending platforms is rising as a result of regulatory agencies implementing advantageous policies to preserve the integrity of the financial system, safeguard customers, encourage innovation, etc. For instance, in June 2024, Salesforce launched its digital lending platform to enable Indian public sector enterprises and government entities to improve the lives of their citizens. Besides this, the implementation of data privacy laws is inflating the popularity of platforms, such as Temenos and Finastra. Apart from this, the increasing number of financial businesses is a major growth driver. Furthermore, alternative lending channels provide more diverse and accessible funding possibilities than traditional banking institutions. As a result, they are rapidly gaining traction around the world. For example, in March 2024, Epic River, a company that connects financial institutions with healthcare providers to streamline patient payments, launched a complete digital lending platform designed exclusively for credit unions. Besides this, the incorporation of artificial intelligence, machine learning, and blockchain technologies in digital lending platforms improves risk assessment and decision-making and reduces sales expenses, making these platforms more attractive to both lenders and borrowers. For instance, in October 2024, Tavant, a Silicon Valley-based supplier of AI-powered digital lending solutions, launched LO.ai, a new product that complements Tavant's widely used AI-powered digital lending platform, Touchless Lending®. This latest addition to the company's digital lending platform further reduces origination expenses by incorporating generative AI and straight-through processing into the sales process. This allows a lender to reduce overall sales expenses while raising borrower confidence using automated technologies that educate customers and close more loans faster.

Global Digital Lending Platform Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share, owing to the growing preference among consumers for quick, convenient, and paperless loan processes.

North America Digital Lending Platform Market Trends:

North America dominated the overall market due to the inflating popularity of peer-to-peer lending platforms. This can be attributed to the increasing opportunity to diversify the portfolios of investors. For instance, according to the IMARC, the United States peer-to-peer lending platforms market size is projected to exhibit a growth rate (CAGR) of about 14% during 2024-2032.

Europe Digital Lending Platform Market Trends:

The widespread adoption of the internet and smartphones has made digital lending platforms more accessible to a broader audience. There has been a significant increase in the number of smartphone users across the region. For instance, according to Statista, in Germany, the number of smartphone users has continued to grow in recent years, reaching over 75 million in the country in 2022. This technological shift enables consumers to apply for loans conveniently online, reducing the need for physical bank visits.

Asia Pacific Digital Lending Platform Market Trends:

Governments across the region are implementing policies to promote financial inclusion and support digital lending. For instance, in August 2024, the Reserve Bank of India launched the unified lending interface (ULI) to streamline credit access for small and rural borrowers, aiming to transform the lending landscape similar to the impact of the UPI in payments. This is further driving the market’s growth.

Latin America Digital Lending Platform Market Trends:

A substantial portion of the Latin American population remains unbanked or underbanked. For instance, in Mexico, approximately 66 million adults are unbanked. Fintech companies are addressing this gap by offering accessible digital lending solutions, which is further escalating the market’s growth.

Middle East and Africa Digital Lending Platform Market Trends:

The growing internet penetration has expanded access to digital financial services. For instance, smartphone penetration in South Africa is expected to increase by 10.7 % points between 2024 and 2029. Following the ninth straight year of growth, penetration is expected to reach nearly 37.96%, marking a new high in 2029. This connectivity enables more individuals and businesses to engage with digital lending platforms, facilitating easier access to credit.

Top Companies Leading in the Digital Lending Platform Industry

Some of the leading digital lending platform market companies include Black Knight Inc., Finastra, FIS, Fiserv Inc., Intellect Design Arena Ltd, Intercontinental Exchange Inc., Nucleus Software Exports Ltd., Pegasystems Inc., Roostify Inc., Tavant Technologies, Wipro Limited, among many others. For instance, in June 2023, Black Knight, Inc. released Validate, a fast, efficient, and simple mobile application that allows borrowers to participate in speeding up the valuation and loan approval process, saving time and money for everyone involved.

Global Digital Lending Platform Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into loan origination, decision automation, collections and recovery, risk and compliance management, and others, wherein loan origination represented the largest market segmentation, owing to rising demand for the creation, processing, and approval of new applications.

- Based on the component, the market is categorized into solutions and services, amongst which solutions represent the largest segmentation as they are pivotal in modernizing the lending landscape by improving accuracy and increasing operational efficiency.

- On the basis of the deployment model, the market has been divided into on-premises and cloud-based. Among these, on-premises represented the largest market segmentation as it allows organizations to have full control over system performance, maintenance schedules, and uptime, ensuring consistent and reliable access to the lending platform.

- Based on the industry vertical, the market is bifurcated into banks, insurance companies, credit unions, savings and loan associations, peer-to-peer lending, and others, wherein banks represent the largest market segmentation. The rising need among banks for streamlining and enhancing the traditional lending process is augmenting the segment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 13.0 Billion |

| Market Forecast in 2033 | USD 39.8 Billion |

| Market Growth Rate 2025-2033 | 11.85% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Loan Origination, Decision Automation, Collections and Recovery, Risk and Compliance Management, Others |

| Components Covered | Solutions, Services |

| Deployment Models Covered | On-Premises, Cloud-Based |

| Industry Verticals Covered | Banks, Insurance Companies, Credit Unions, Savings and Loan Associations, Peer-To-Peer Lending, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Black Knight Inc., Finastra, FIS, Fiserv Inc., Intellect Design Arena Ltd, Intercontinental Exchange Inc., Nucleus Software Exports Ltd., Pegasystems Inc., Roostify Inc., Tavant Technologies, Wipro Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)