Global Digital Dose Inhaler Market Expected to Reach USD 11.8 Billion by 2033 - IMARC Group

Global Digital Dose Inhaler Market Statistics, Outlook and Regional Analysis 2025-2033

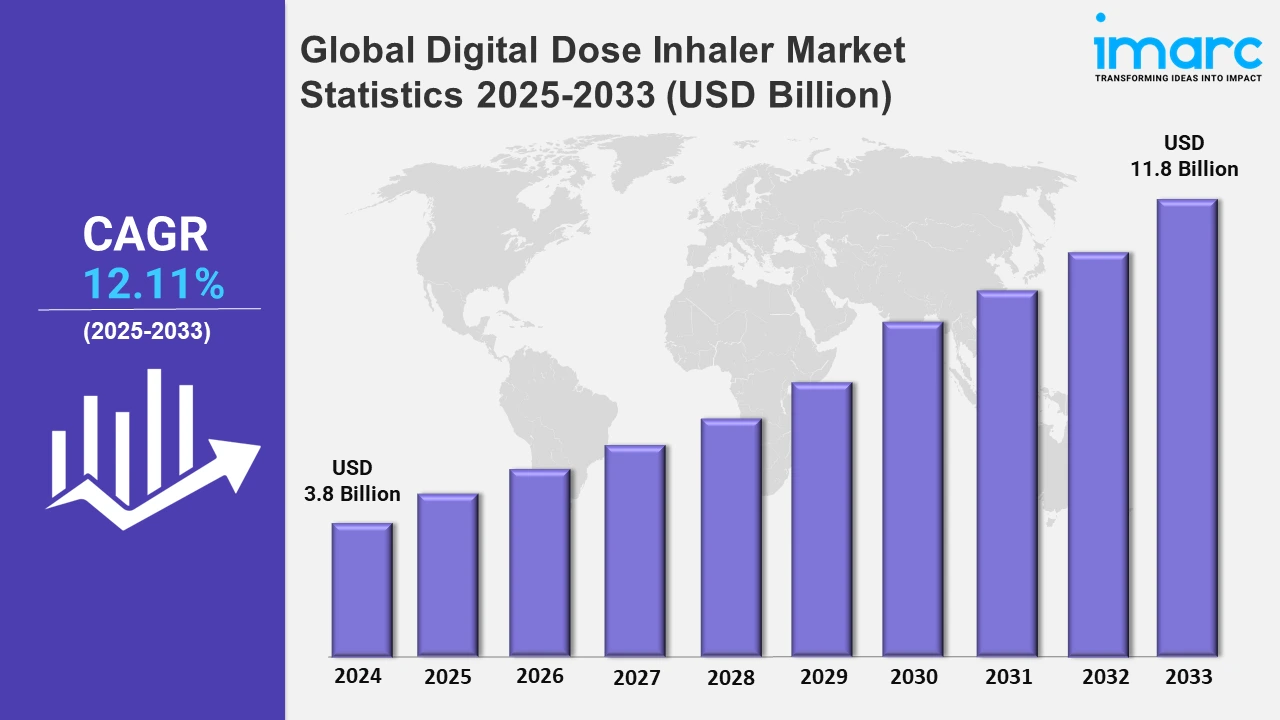

The global digital dose inhaler market size was valued at USD 3.8 Billion in 2024, and it is expected to reach USD 11.8 Billion by 2033, exhibiting a growth rate (CAGR) of 12.11% from 2025 to 2033.

To get more information on this market, Request Sample

The digital dose inhaler market is evolving rapidly, which is driven by the need to enhance patient adherence, safety, and effective medication management for respiratory conditions, such as asthma and COPD. In contrast, companies are leveraging technology to transform traditional inhalers into connected devices that provide real-time monitoring and data. For instance, in February 2022, Aptar Pharma launched HeroTracker Sense, a digital add-on for metered dose inhalers (pMDIs) that tracks inhalation technique and data, which is integrating seamlessly with the BreatheSmart app. This innovation underscores the trend of merging digital health with respiratory care, thereby providing valuable feedback to patients and healthcare providers and ensuring adherence to treatment regimens. Similarly, in June 2024, Aseptika launched PUFFClicker3, a universal digital dose counter compatible with 101 SNOMED-coded inhalers. It features IoT-based data transmission and multi-language support, facilitating adherence monitoring for a diverse patient demographic, particularly children. Accountably, PUFFClicker3 eliminates the need for smartphone dependency, thereby addressing digital hesitancy and reducing health inequities. Furthermore, this development highlights the market shift towards inclusivity, patient-centric design, and leveraging IoT for broader accessibility and real-time data sharing.

Moreover, sustainable and innovative approaches are becoming prominent factors in the inhaler market, with a focus on eco-friendly solutions and patient convenience. For instance, in January 2024, Berry Global launched the BerryHaler, an all-plastic, dual-chamber dry powder inhaler (DPI) at Pharmapack 2024. It enhances combination drug delivery for asthma and COPD as a part of their 'Dose Better' initiative, ensuring patient safety and adherence while emphasizing sustainable packaging. Meanwhile, this development signifies the industry's dedication to balancing advanced drug delivery mechanisms with environmental consciousness, catering to growing regulatory and consumer demands for sustainability in medical devices. Overall, these advancements reflect the broader trend of integrating technology with medical devices to improve patient outcomes and adherence, while fostering sustainability and addressing diverse patient needs. Also, the digital dose inhaler market is set to expand as companies continue to innovate and align with digital health trends, which is driven by a blend of patient-centric design, advanced analytics, and eco-friendly practices.

Global Digital Dose Inhaler Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America dominates the digital dose inhaler market due to its strong focus on advanced healthcare solutions, robust infrastructure, and high adoption of cutting-edge medical technologies.

North America Digital Dose Inhaler Market Trends:

North America is the dominating region in the market due to its strong focus on advanced healthcare solutions, robust infrastructure, and high adoption of cutting-edge medical technologies. The region’s emphasis on improving patient outcomes and adherence in respiratory care further fuels this leadership. In May 2024, AstraZeneca showcased new data for Breztri Aerosphere and other innovations at ATS 2024, emphasizing advancements in inhaled therapies for COPD and asthma. The North American-focused research highlighted inhaled triple therapy’s impact on cardiopulmonary outcomes, enhancing patient care and adherence in respiratory treatment. Also, continuous support for R&D, favorable regulatory environments, and strategic partnerships contribute to the development and expansion of digital health solutions.

Europe Digital Dose Inhaler Market Trends:

In Europe, the market is driven by stringent healthcare regulations and strong adoption of digital health technologies. Countries like Germany are leading in integrating smart inhalers into healthcare systems, enhancing patient adherence and monitoring. For example, the EU-approved Enerzair Breezhaler, with its digital companion, demonstrates Europe's commitment to combining innovative technology with treatment for effective respiratory care.

Asia Pacific Digital Dose Inhaler Market Trends:

The Asia Pacific region is witnessing rapid growth in the digital dose inhaler market due to increasing investments in healthcare infrastructure and rising awareness of respiratory conditions. Countries like Japan are at the forefront, with high adoption rates of advanced inhaler technologies. The push for smart medical solutions and government initiatives to modernize healthcare drive this trend across the region.

Latin America Digital Dose Inhaler Market Trends:

In Latin America, the digital dose inhaler market is emerging, fueled by a growing need for advanced respiratory treatments amid rising asthma and COPD cases. Brazil is a significant contributor, with increasing investments in healthcare technologies. Meanwhile, companies are introducing digital solutions to improve adherence and disease management, which aligns with the region's push for modernized, accessible healthcare solutions.

Middle East and Africa Digital Dose Inhaler Market Trends:

The Middle East and Africa are adopting digital dose inhalers as part of efforts to enhance healthcare access and management of chronic conditions. The UAE is a notable leader, driven by government initiatives supporting smart healthcare technologies. Furthermore, this trend includes collaborations to incorporate IoT and mobile tech, thereby making real-time monitoring and patient adherence improvements more prevalent across the region.

Top Companies Leading in the Digital Dose Inhaler Industry

Some of the leading digital dose inhaler market companies include the 3M Company, AstraZeneca plc, GlaxoSmithKline plc, Glenmark Pharmaceuticals Limited, H&T Presspart Manufacturing Ltd., Koninklijke Philips N.V., Lupin Limited, Novartis AG, OPKO Health Inc., Propeller Health (ResMed), Sensirion AG Switzerland, and Teva Pharmaceutical Industries Ltd., among many others. In February 2022, AstraZeneca plc and Honeywell partnered to develop next-generation respiratory inhalers using the propellant HFO-1234ze, which has less Global Warming Potential (GWP) than propellants currently used in respiratory medicines. Moreover, in July 2023, Lupin launched a pressurized metered dose inhaler for the treatment of asthma and chronic obstructive pulmonary disease (COPD) in Germany.

Global Digital Dose Inhaler Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into branded medication and generics medication, wherein branded medication represents the most preferred segment. Branded medication refers to drugs that are developed and marketed by pharmaceutical companies under a proprietary name.

- Based on the product, the market is categorized into metered dose inhaler and dry powder inhaler, amongst which metered dose inhaler dominates the market. Metered dose inhalers are one of the most common types of inhalers used in respiratory therapy. When the inhaler is actuated, it releases a measured dose of medication in aerosol form for inhalation.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 11.8 Billion |

| Market Growth Rate 2025-2033 | 12.11% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Branded Medication, Generics Medication |

| Products Covered | Metered Dose Inhaler, Dry Powder Inhaler |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, AstraZeneca plc, GlaxoSmithKline plc, Glenmark Pharmaceuticals Limited, H&T Presspart Manufacturing Ltd., Koninklijke Philips N.V., Lupin Limited, Novartis AG, OPKO Health Inc., Propeller Health (ResMed), Sensirion AG Switzerland, Teva Pharmaceutical Industries Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)