Global Digital Asset Management Market Expected to Reach USD 32.0 Billion by 2033 - IMARC Group

Global Digital Asset Management Market Statistics, Outlook and Regional Analysis 2025-2033

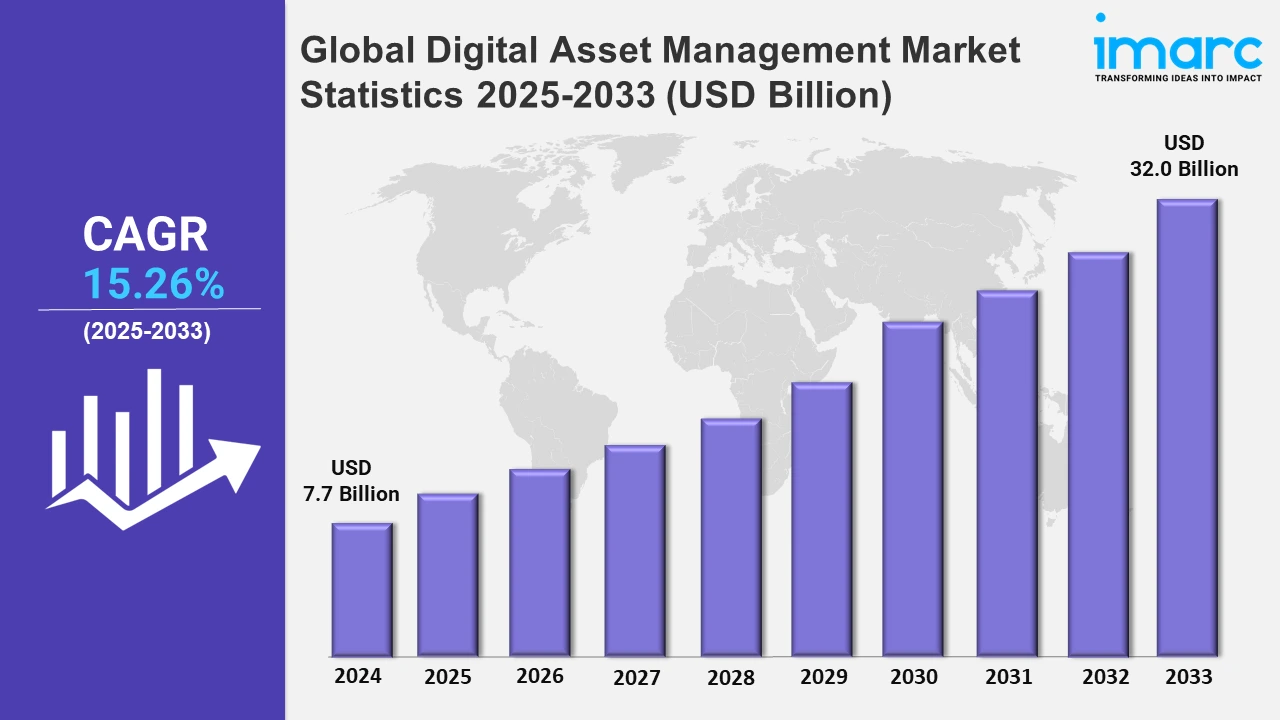

The global digital asset management market size was valued at USD 7.7 Billion in 2024, and it is expected to reach USD 32.0 Billion by 2033, exhibiting a growth rate (CAGR) of 15.26% from 2025 to 2033.

To get more information on this market, Request Sample

In today's digital age, the number and variety of digital assets, such as images, videos, and documents, have increased dramatically. This increase is mostly the result of growing online activities in businesses such as marketing, entertainment, and e-commerce. DAM solutions address the critical need to efficiently organize, store, and manage these assets. They offer search and retrieval capabilities, which streamline workflows and stimulate cooperation. For instance, in August 2024, Autodesk introduced assets catalog, a cloud-based digital asset management tool for storing, versioning, and accessing BIM assets, such as Revit families. Autodesk Docs subscribers may now access content catalog, a new integrated version of UNIFI Pro, for free. It also stores, retrieves, and shares often used searches. Moreover, DAM systems help businesses ensure brand consistency, adhere to copyright regulations, and enhance overall operational efficiency. Consequently, the burgeoning digital content landscape propels the adoption of DAM solutions across a wide array of sectors.

Moreover, the rise of remote and hybrid work models has significantly accelerated the market growth. For instance, according to Statista, globally, the percentage of employees working remotely has climbed from 20% in 2020 to 28% by 2023. The IT industry has the biggest percentage of people working remotely, with 67% reporting this. Similarly, according to CXOToday, by 2025, an estimated 60 to 90 million Indians will be working remotely, accounting for 10.12% to 15.17% of the Indian workforce. In this new era of work, cloud-based digital asset management (DAM) solutions have taken on heightened significance. Remote teams now operate from various location, necessitating secure and convenient access to digital assets for seamless collaboration. DAM systems have emerged as indispensable tools in this evolving landscape of remote work. They offer the flexibility and accessibility needed for modern work environments, ensuring that teams can work efficiently, regardless of their physical location. Besides this, advancements in AI and machine learning are enhancing DAM capabilities by automating metadata tagging, content creation, and personalized content recommendations. For instance, in January 2024, Aprimo, a global digital asset management and marketing resource management systems company, launched Aprimo AI, a cutting-edge artificial intelligence technology that accelerates content creation, improves asset discoverability, automates asset management, and assures brand governance. Aprimo AI enables teams to apply AI across the full content lifecycle, accelerating content production, increasing asset discoverability, automating asset management, and maintaining brand control.

Global Digital Asset Management Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest digital asset management market share. North America leads in the adoption of digital asset management (DAM) solutions, driven by a mature market, a high concentration of businesses, and a strong focus on technology-driven innovation.

North America Digital Asset Management Market Trends:

Organizations in this region recognize the significance of DAM systems in optimizing digital asset workflows, ensuring brand consistency, and fostering collaboration across various industries. Besides this, the growing remote work trends are exhibiting it as the largest regional market. For instance, according to Upwork, by 2025, nearly 32.6 million people in the United States will be working remotely, which equates to about 22% of the workforce.

Europe Digital Asset Management Market Trends:

A key factor bolstering the market growth is the region's emphasis on technological innovation and investment. For instance, in April 2024, Lazard, a global frontrunner in active asset management, partnered with Elaia Partners, a leading European venture capital firm. This collaboration aims to establish a dominant European entity focused on investing in technology companies, guiding them from their early seed stages to public market listings. Such initiatives fuel the adoption of DAM solutions to manage complex digital ecosystems efficiently.

Asia Pacific Digital Asset Management Market Trends:

The Asia Pacific Digital Asset Management (DAM) market is experiencing significant growth, largely driven by the increasing penetration of smartphones in the region. For instance, according to Statista, in 2023, smartphone penetration in India reached 71%, and it is expected to reach 96% by 2040.

Latin America Digital Asset Management Market Trends:

The increasing internet penetration in Latin America is significantly propelling the growth of the Digital Asset Management (DAM) market. For instance, according to an article published by Data Reportal, Brazil’s internet penetration rate was 86.6% of the overall population at the beginning of 2024. This expanding user base generates vast amounts of digital content, increasing the demand for robust DAM systems to organize and manage these assets effectively.

Middle East and Africa Digital Asset Management Market Trends:

Governments and businesses in the MEA region are actively pursuing digital transformation to enhance operational efficiency and service delivery. For instance, the United Arab Emirates (UAE) has launched the "UAE Digital Government Strategy 2025," aiming to digitize government services and promote a digital economy. Such initiatives increase the demand for DAM solutions to manage and streamline digital assets effectively.

Top Companies Leading in the Digital Asset Management Industry

Some of the leading digital asset management market companies include Acquia, Inc., Adam Software, Canto Inc., Celum, Cognizant Technology Solutions, IBM Corporation, Mediabeacon Inc., OpenText Corporation, Oracle Corporation, QBank., and Webdam Inc., among many others. For instance, in July 2024, Cognizant established a five-year strategic cooperation with Victory Capital Holdings, Inc., a worldwide asset management organization.

Global Digital Asset Management Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into brand asset management system, library asset management system, and production asset management system, wherein brand asset management system represented the largest segment as they facilitate efficient collaboration among marketing teams, creative departments, and external partners, enhancing brand integrity and customer engagement.

- Based on the component, the market is categorized into solution and services (consulting, system integration, and support and maintenance), amongst which solution accounted for the largest market share. DAM solutions empower organizations to streamline workflows, enhance content distribution, and ensure brand consistency, augmenting their popularity and dominance in the market.

- On the basis of the application, the market has been divided into sales and marketing, broadcast and publishing, and others. Among these, sales and marketing represented the largest segment. Sales and marketing teams heavily rely on DAM systems to manage and distribute digital assets, such as product images, promotional materials, and branding elements, thereby propelling the segment’s growth.

- Based on the deployment, the market is bifurcated into on-premises and cloud, wherein on-premises accounted for the largest market share. On-premises DAM solutions offer a high level of control and security, making them the choice for businesses with stringent data governance requirements and concerns about data privacy.

- On the basis of the organization size, the market is segmented into small and medium-sized enterprises and large enterprises. Currently, large enterprises represent the largest segment. These organizations benefit from the scalability and comprehensive features offered by DAM systems, allowing them to efficiently manage and distribute vast volumes of digital assets across various teams and locations, further escalating segment growth.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.7 Billion |

| Market Forecast in 2033 | USD 32.0 Billion |

| Market Growth Rate 2025-2033 | 15.26% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Brand Asset Management System, Library Asset Management System, Production Asset Management System |

| Components Covered |

|

| Applications Covered | Sales and Marketing, Broadcast and Publishing, Others |

| Deployments Covered | On-Premises, Cloud |

| Organization Sizes Covered | Small and Medium-Sized Enterprises, Large Enterprises |

| End-use sectors Covered | Media and Entertainment, Banking, Financial Services and Insurance (BFSI), Retail, Manufacturing, Healthcare and Life Sciences, Education, Travel and Tourism, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Acquia, Inc., Adam Software, Canto Inc., Celum, Cognizant Technology Solutions, IBM Corporation, Mediabeacon Inc., OpenText Corporation, Oracle Corporation, QBank, Webdam Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Digital Asset Management Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)