Global Dietary Fiber Market Expected to Reach USD 17.6 Billion by 2033 - IMARC Group

Global Dietary Fiber Market Statistics, Outlook and Regional Analysis 2025-2033

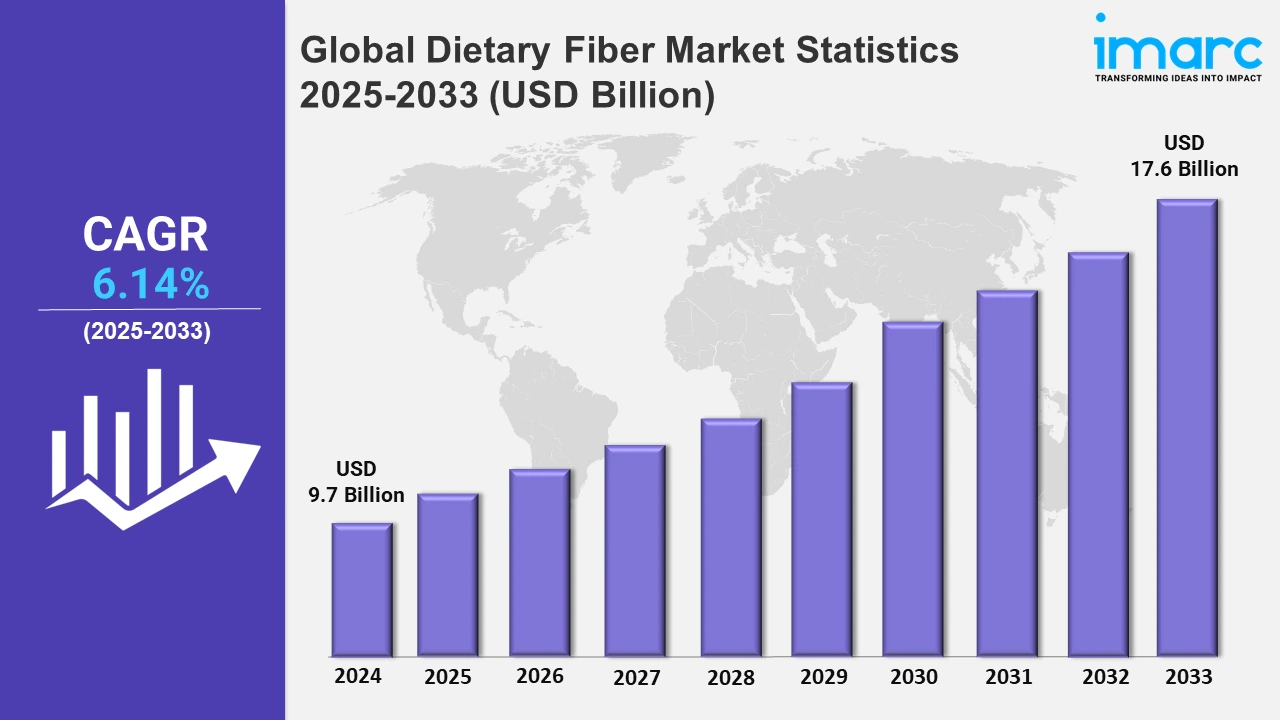

The global dietary fiber market size was valued at USD 9.7 Billion in 2024, and it is expected to reach USD 17.6 Billion by 2033, exhibiting a growth rate (CAGR) of 6.14% from 2025 to 2033.

To get more information on this market, Request Sample

Collaborations between agricultural and technology industries are aimed at combining precise technology with sustainable farming techniques. Partnerships strive to improve farmer experiences, facilitate data exchange, and promote the efficient implementation of advanced and environmentally friendly agricultural solutions. For example, in July 2023, Cargill, Incorporated announced a partnership with John Deere to enhance the digital and in-field experience for farmers utilizing John Deere technology and participating in the Cargill Regen Connect program. This collaboration aimed to assist farmers in adopting and utilizing precision technology while ensuring seamless data synchronization for those who choose to share information between systems.

Moreover, food firms are focusing on gut health advances, developing products fortified with prebiotic fiber. These treatments not only ease digestion but also provide nutritional advantages that promote overall health and wellness. For example, in May 2023, Nestlé India launched Resource Fiber Choice, a new gut health product featuring partially hydrolyzed guar gum (PHGG), a prebiotic fiber that helps relieve constipation and improve gut health. It is derived from guar gum beans. This gentle solution also includes immuno-nutrients, providing 30% of the daily allowance of essential vitamins and minerals. Furthermore, dietary fiber manufacturers are prioritizing developments that are consistent with consumer health trends and sustainability policies. These developments include improving fiber extraction technologies, increasing solubility, and finding organic and non-GMO components to fulfill escalating health and environmental concerns. Additionally, the industry offers considerable revenue prospects through fortified foods and drinks that address rising consumer awareness of gut health. High-performance fiber solutions, such as prebiotic fibers and resistant starches, are increasingly chosen over regular fibers due to their additional health benefits. For example, in North America, Ingredion and ADM have introduced novel soluble fibers and natural solutions to meet the consumer trend for clearer labeling and better digestive health. This is consistent with the market's need for functional and high-quality ingredients that promote overall well-being and meet the changing demands of health-conscious consumers.

Global Dietary Fiber Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); North America (the United States and Canada); the Middle East and Africa (Turkey, Saudi Arabia, Iran, United Arab Emirates, and others); and Latin America (Brazil, Mexico, Argentina, Colombia, Chile, Peru, and others). According to the report, Asia Pacific accounted for the largest dietary fiber market share due to its huge and diversified population, which leads to a high demand for dietary fiber.

North America Dietary Fiber Market Trends:

Consumers' concern about digestive wellness is boosting demand for prebiotic fibers in North America. Companies such as Ingredion have introduced soluble maize fiber to meet the growing demand for gut health products in the U.S.

Europe Dietary Fiber Market Trends:

The clean-label movement is popular in Europe, with customers preferring natural ingredients. Roquette Frères produced plant-based fiber solutions, including pea and wheat fibers, which fulfill the customer's demand for transparent and sustainable food alternatives.

Asia Pacific Dietary Fiber Market Trends:

Functional foods enriched with dietary fiber are gaining popularity in Asia Pacific, which exhibited the largest regional market. In Japan, firms such as Yakult are integrating additional dietary fiber into their goods to promote overall health, reflecting rising customer awareness of balanced nutrition.

Latin America Dietary Fiber Market Trends:

Fiber-enriched foods and beverages are becoming increasingly popular among health-conscious customers in Latin America. Brazil's food business has experienced an increase in products that contain high-fiber components, overcoming local nutritional shortages and encouraging healthy eating habits.

Middle East and Africa Dietary Fiber Market Trends:

In the Middle East and Africa, increased demand for nutritional beverages is driving innovation in dietary fiber use. Companies such as Kerry Group have extended their foothold by providing fiber components that mix perfectly into beverages, appealing to consumers who prioritize health.

Top Companies Leading in the Dietary Fiber Industry

Some of the leading dietary fiber market companies include Archer Daniels Midland Company, Cargill, Incorporated, International Flavors & Fragrances Inc., FutureCeuticals, Inc., Grain Processing Corporation, Ingredion Incorporated, Kerry Group plc, Nexira, Roquette Frères, Südzucker AG, and Tate & Lyle PLC, among many others. For example, in March 2022, Nexira announced a significant investment exceeding US$10 Million to increase its acacia fiber processing capacity by over 20%. This strategic move was in response to the growing demand for natural and organic dietary fibers, particularly following the U.S. Food and Drug Administration's decision to grant dietary fiber status to acacia.

Global Dietary Fiber Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into soluble dietary fiber (inulin, pectin, polydextrose, beta-glucan, and others) and insoluble dietary fiber (cellulose, hemicellulose, chitin and chitosan, lignin, fiber/bran, resistant starch, and others), wherein soluble dietary fiber represents the most preferred segment. The expanding need for soluble dietary fiber due to its numerous health advantages and flexibility in culinary applications is propelling dietary fiber demand.

- Based on the source, the market is categorized into fruits and vegetables, cereals and grains, legumes, and nuts and seeds, amongst which cereals and grains dominate the market. The rising need for cereals and grains-based dietary fiber due to its high natural fiber content and widespread consumption is helping drive market growth.

- On the basis of the application, the market has been divided into functional foods and beverages, pharmaceuticals, animal feed, and others. Among these, functional foods and beverages exhibit a clear dominance in the market. The increased use of functional foods and beverages (F&B) due to their improved health advantages, as well as rising consumer preference for goods that provide more than just basic nutrition, are driving market revenue.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 9.7 Billion |

| Market Forecast in 2033 | USD 17.6 Billion |

| Market Growth Rate 2025-2033 | 6.14% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Sources Covered | Fruits and Vegetables, Cereals and Grains, Legumes, Nuts and Seeds |

| Applications Covered | Functional Foods and Beverages, Pharmaceuticals, Animal Feed, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Argentina, Colombia, Chile, Peru, Turkey, Saudi Arabia, Iran, United Arab Emirates |

| Companies Covered | Archer Daniels Midland Company, Cargill, Incorporated, International Flavors & Fragrances Inc., FutureCeuticals, Inc., Grain Processing Corporation, Ingredion Incorporated, Kerry Group plc, Nexira, Roquette Frères, Südzucker AG, Tate & Lyle PLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Dietary Fiber Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)