Global Dental Insurance Market Expected to Reach USD 486.8 Billion by 2033 - IMARC Group

Global Dental Insurance Market Statistics, Outlook and Regional Analysis 2025-2033

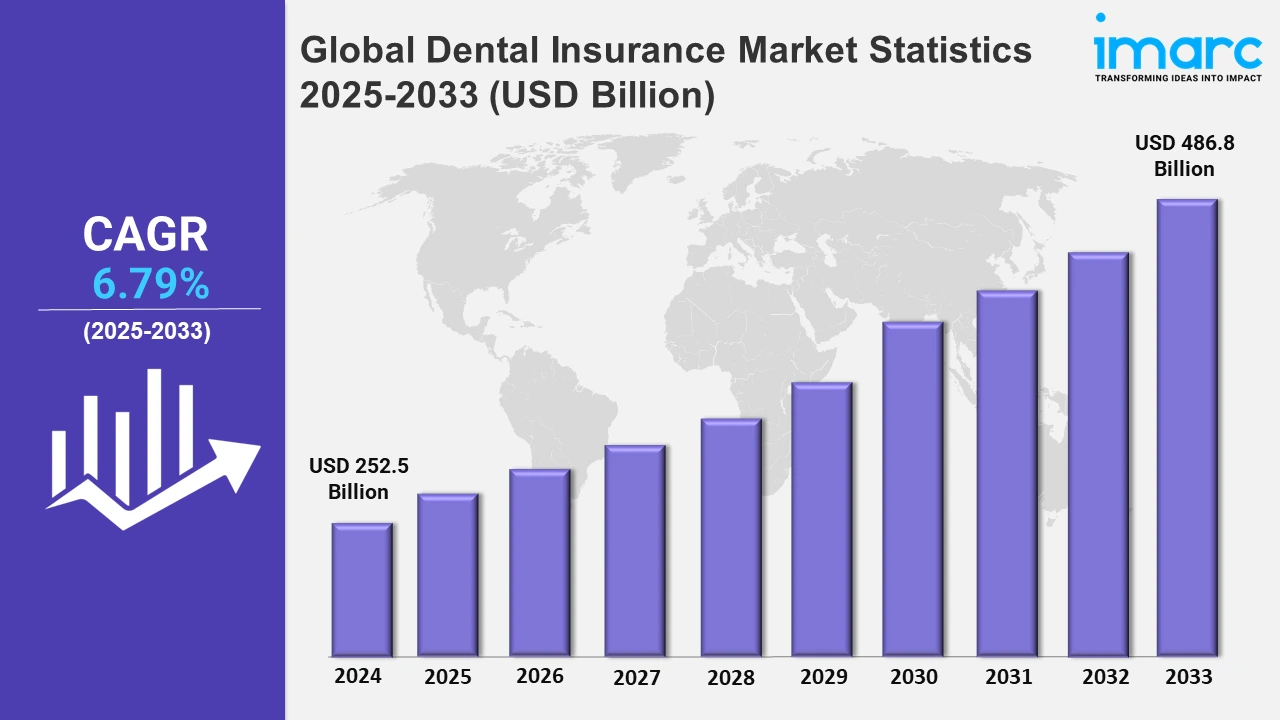

The global dental insurance market size was valued at USD 252.5 Billion in 2024, and it is expected to reach USD 486.8 Billion by 2033, exhibiting a growth rate (CAGR) of 6.79% from 2025 to 2033.

To get more information on this market, Request Sample

Expanding access to oral health care for underprivileged populations, particularly veterans, is becoming increasingly important in the U.S. Partnerships with non-profit groups are improving access to dental care, addressing crucial coverage gaps for vulnerable communities throughout the region. For example, in November 2022, Delta Dental Plans Association announced the expansion of oral healthcare access to U.S. veterans through its partnership with the Dental Lifeline Network (DLN).

Moreover, innovative group dental plans in the United States include lifetime deductible features at no additional expense, resulting in increased value and long-term affordability. This method helps firms provide more comprehensive benefits that meet changing employee healthcare demands. For instance, in August 2023, Ameritas Life Insurance Corp. announced its plan to offer a lifetime deductible at no additional charge to new tailored group dental plans. Furthermore, the dental insurance industry is seeing a greater emphasis on preventative care services as carriers seek to manage growing healthcare costs and improve member satisfaction. Companies are creating bespoke solutions to satisfy a wide range of demographic demands, assuring access to regular checkups and cleanings. Additionally, the demand for advanced dental procedures, such as orthodontics and implants, is prompting insurers to provide specialist coverage to those seeking comprehensive policies. Corporate dental insurance packages are becoming more popular as firms understand the importance of employee health initiatives. For example, Delta Dental extended its corporate operations in North America by offering low-cost preventative care packages. This measure helps firms recruit and retain talent while encouraging long-term dental health. Such advancements reflect the market's changing dynamics, emphasizing individualized and accessible solutions for individual and business customers worldwide.

Global Dental Insurance Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest dental insurance market share, on account of its well-developed healthcare infrastructure, which included modern dental facilities and highly qualified experts.

North America Dental Insurance Market Trends:

North America accounts for the largest share of the market, driven by the increased acceptance of employer-sponsored dental insurance programs. For instance, Delta Dental increased its corporate services in 2022, with an emphasis on preventative care and cost-effective solutions. These programs are increasingly being used by firms that want to recruit and retain talent while also boosting overall workforce health. This emphasis on group dental insurance demonstrates the region's dedication to including healthcare benefits in complete employment packages.

Europe Dental Insurance Market Trends:

Europe prioritizes digitization in the dental insurance sector to improve service efficiency and customer satisfaction. For example, Allianz implemented AI-powered claim management systems in 2023, allowing for quicker and more accurate claim processing. This integration of innovative technology contributes to Europe's focus on modernizing insurance processes, enhancing access to dental treatment, and fulfilling the growing expectations of tech-savvy customers throughout the region.

Asia-Pacific Dental Insurance Market Trends:

Individual dental insurance plans are in high demand in Asia-Pacific, driven by the expanding oral health awareness and the growing disposable income. For example, India had greater adoption rates for preventive care programs in 2023, owing to government measures encouraging dental cleanliness. This expansion is being driven by the region's growing middle class and a move towards emphasizing personal health insurance across all demographics.

Latin America Dental Insurance Market Trends:

Latin America is addressing disparities in dental care access through affordable insurance plans and public-private partnerships. For example, in 2022, MetLife cooperated with Brazilian government initiatives to provide subsidized insurance to marginalized populations. These programs seek to increase dental coverage and enhance general oral health standards, thereby resulting in considerable growth in the region's insurance market.

Middle East and Africa Dental Insurance Market Trends:

The Middle East and Africa region specializes in delivering customized dental insurance policies to satisfy the various needs of expats and low-income individuals, which is propelling the regional market. For example, in 2023, Cigna released cheap basic dental coverage in the UAE, serving to cost-conscious consumers. These initiatives promote market growth by increasing accessibility and resolving regional disparities in healthcare.

Top Companies Leading in the Dental Insurance Industry

Some of the leading dental insurance market companies include Aetna Inc., Aflac Inc., Allianz Care, Ameritas Mutual Holding Company, AXA Health, Cigna Healthcare, Delta Dental Plans Association, HDFC ERGO General Insurance Company Limited, MetLife Services and Solutions, LLC, The Guardian Life Insurance Company of America, United Concordia Companies, Inc., and United HealthCare Services, Inc., among many others. For example, in May 2022, MetLife Inc. approved a new USD 3 Billion authorization to repurchase its common stock, reflecting its commitment to delivering value to shareholders.

Global Dental Insurance Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into major, basic, and preventive, wherein preventive represents the most preferred segment. Preventive coverage covers basic dental care aimed at preserving oral health and avoiding dental issues.

- Based on the coverage, the market is categorized into dental preferred provider organizations, dental health maintenance organizations, dental indemnity plans, and others, amongst which dental preferred provider organizations dominate the market. Dental preferred provider organizations (PPOs) are managed care plans that have agreements with a network of dentists to offer treatments to plan members at consented prices.

- On the basis of the demographics, the market has been divided into senior citizens, adults, and minors. Senior citizens prioritize coverage for restorative treatment and dentures. Adults want preventative care and orthodontics, while minors frequently need braces and regular checkups.

- Based on the end user, the market is bifurcated into individuals and corporates. Individual programs prioritize preventative and particular treatments. At the same time, corporate strategies stress price and accessibility, hence increasing general market acceptance across a broad range of end users.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 252.5 Billion |

| Market Forecast in 2033 | USD 486.8 Billion |

| Market Growth Rate 2025-2033 | 6.79% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Major, Basic, Preventive |

| Coverages Covered | Dental Preferred Provider Organizations, Dental Health Maintenance Organizations, Dental Indemnity Plans, Others |

| Demographics Covered | Senior Citizens, Adults, Minors |

| End Users Covered | Individuals, Corporates |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aetna Inc., Aflac Inc., Allianz Care, Ameritas Mutual Holding Company, AXA Health, Cigna Healthcare, Delta Dental Plans Association, HDFC ERGO General Insurance Company Limited, MetLife Services and Solutions, LLC, The Guardian Life Insurance Company of America, United Concordia Companies, Inc., United HealthCare Services, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Dental Insurance Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)