Global Debt Collection Software Market Expected to Reach USD 11.3 Billion by 2033 - IMARC Group

Global Debt Collection Software Market Statistics, Outlook and Regional Analysis 2025-2033

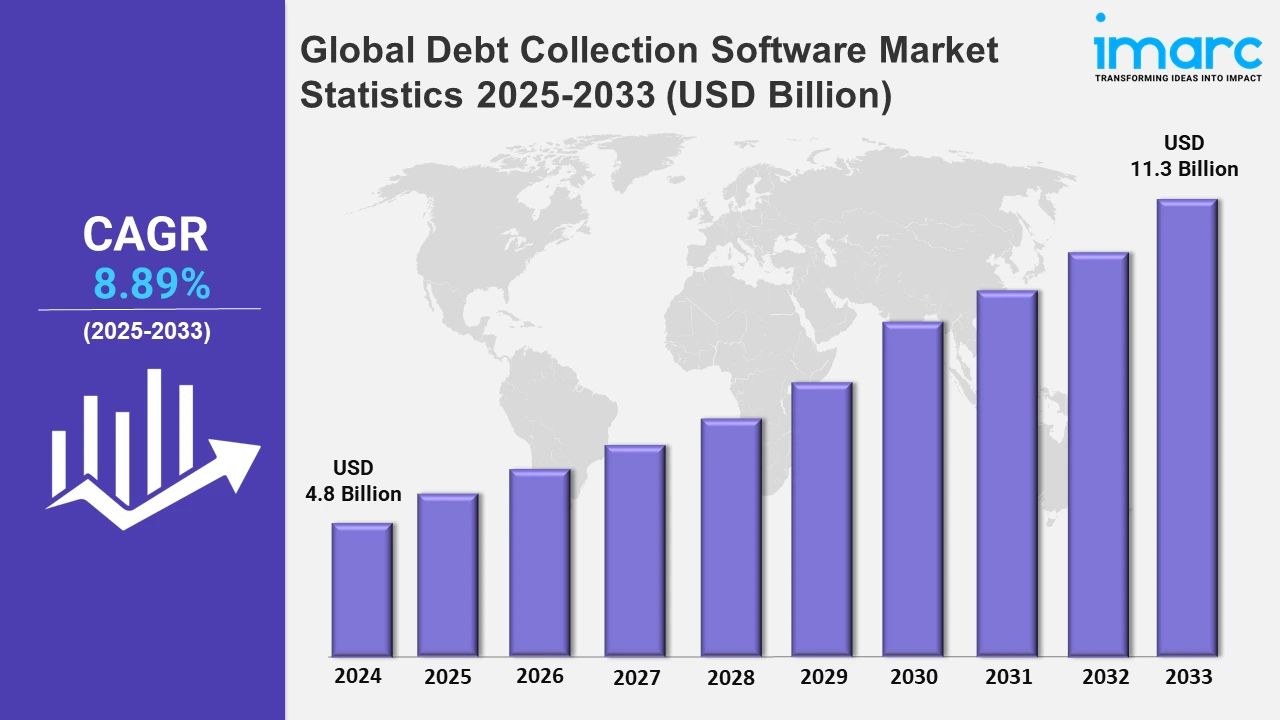

The global debt collection software market size was valued at USD 4.8 Billion in 2024, and it is expected to reach USD 11.3 Billion by 2033, exhibiting a growth rate (CAGR) of 8.89% from 2025 to 2033.

To get more information on this market, Request Sample

Organizations are focusing on streamlining their debt recovery processes and reducing manual intervention, which is encouraging the adoption of automated debt collection software. This enhances efficiency, reduces human errors, and helps companies handle larger volumes of debt cases effectively. Additionally, the use of advanced data analytics and predictive modeling in debt collection software is becoming more prominent. These capabilities help organizations better understand debtor behavior, optimize collection strategies, and improve overall recovery rates. Besides this, the growing incorporation of artificial intelligence (AI) and machine learning (ML) technologies into debt collection software is providing smarter, automated decision-making, personalized client engagement, and predictive analytics to enhance collection outcomes. For instance, in 2024, Neowise introduced two debt collection tools, NeoBot and NeoSight, which are powered by AI and created in partnership with Sarvam AI. These tools, utilizing generative AI, strive to improve communication between lenders and borrowers, boost productivity, and lower debt collection expenses. This launch is a part of Neowise's strategy to address challenges in the debt recovery process and improve compliance and use experiences.

Furthermore, the implementation of stringent regulations in the financial sector is encouraging companies to adopt debt-collection software that ensures adherence to legal requirements. In addition, modern debt collection software prioritizes user-friendly interfaces and communication channels, helping organizations maintain a positive client relationship while managing collections. Apart from this, strategic partnerships between software providers and financial institutions or credit bureaus are enhancing the capabilities of debt collection software. These collaborations bring access to comprehensive credit data and further improve debt recovery success. For example, in 2024, Experian partnered with Paylink Solutions to launch ReFi™, a debt consolidation tool aimed at simplifying debt repayment and expanding credit access through the Experian Marketplace. This tool enables direct settlement of existing debts, helping people manage loans more effectively while supporting lenders in mitigating risks. The collaboration addresses financial challenges intensified by the cost-of-living crisis and promotes responsible lending practices.

Global Debt Collection Software Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of high rate of digital usage, advanced financial methods, and a reliable infrastructure.

North America Debt Collection Software Market Trends:

North America leads the debt collection software market because of its advanced technological landscape and a strong focus on automation and efficiency in financial operations. The region benefits from a high rate of digital adoption, sophisticated financial practices, and a well-established infrastructure. The emphasis on compliance and regulatory standards drives innovation in debt collection software, making it a preferred choice among financial institutions and other large organizations. In 2024, AgreeYa Solutions, a top US systems integrator, introduced CogentConnect, a self-service portal designed to improve debt collection efficiency and give users the ability to easily handle their debts. The platform provides debt collection agencies with cloud-based, mobile-accessible tools for managing debts, helping them improve compliance and operational efficiency.

Asia-Pacific Debt Collection Software Market Trends:

The Asia Pacific region is experiencing growth in the debt collection software market because of increasing digital transformation efforts across sectors. The region is embracing advanced software solutions that offer automated workflows, analytics, and risk management tools. The rising demand for more sophisticated debt collection practices is encouraging the adoption of modern software, enhancing recovery rates and operational effectiveness.

Europe Debt Collection Software Market Trends:

Europe represents a significant portion of the debt collection software market because of strong financial regulations and a need for efficient debt recovery solutions. The emphasis of the region on data privacy and compliance is encouraging companies to adopt sophisticated, secure debt collection software. Additionally, the adoption of automated and AI-enhanced solutions is gaining traction, contributing to more effective debt recovery practices.

Latin America Debt Collection Software Market Trends:

Latin America’s debt collection software market is advancing with a focus on improving financial processes and recovery strategies. Organizations are leveraging technology to enhance their debt management capabilities. The shift towards automated solutions is increasing efficiency and compliance, positioning the region as an emerging market for advanced debt collection systems.

Middle East and Africa Debt Collection Software Market Trends:

The Middle East and Africa are seeing a rise in the adoption of debt collection software as organizations seek more reliable solutions for handling complex debt recovery operations. The growing interest in technology-driven software that ensures compliance, streamlines processes, and improves collection outcomes is offering a favorable market outlook.

Top Companies Leading in the Debt Collection Software Industry

Some of the leading debt collection software market companies include AgreeYa.com, Chetu Inc., Debtrak, EbixCash Financial Technologies, Experian Information Solutions Inc., Fair Isaac Corporation, Katabat Corporation (Ontario System), Nucleus Software Exports Ltd., Pegasystems Inc., Seikosoft, TietoEVRY and TransUnion LLC, among many others. In 2024, Lowell extended its partnership with TietoEVRY Banking for another three years to continue using the Collection Suite Nova, a SaaS-based debt collection solution. This expansion in Sweden assists Lowell in optimizing operations, increasing flexibility, and enhancing client acquisition processes.

Global Debt Collection Software Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into software and services, wherein software represents the leading segment. Software holds the biggest market share because of high demand for solutions that streamline and automate the debt recovery process. Debt collection software includes tools that support workflow automation, compliance management, analytics, and client communication. Organizations are adopting these solutions to improve operational efficiency, minimize human error, and enhance user engagement, all while maintaining strict regulatory compliance.

- Based on the deployment mode, the market is classified into on-premises and cloud-based, amongst which on-premises dominates the market. On-premises is the largest segment because of organizations prioritizing data security, control, and customization. Companies that handle sensitive financial information often prefer on-premises solutions to maintain stricter data governance and comply with industry regulations. This deployment mode provides enhanced control over system configurations and integrates seamlessly with existing IT infrastructure, ensuring tailored operational needs are met.

- On the basis of the organization size, the market has been divided into small and medium enterprises and large enterprises. Among these, large enterprises account for the majority of the market share. Large enterprises dominate the market, as these organizations handle vast amounts of client data and complex debt portfolios. These firms require scalable and customizable debt management solutions to streamline operations, meet regulatory standards, and manage higher transaction volumes. The need for robust and secure systems that support sophisticated workflows makes debt collection software an essential tool for large organizations looking to maintain effective debt management practices.

- Based on the end user, the market is segregated into financial institutions, collection agencies, healthcare, government, telecom and utilities, and others, wherein financial institutions hold the biggest market share. Financial institutions lead the market, as they rely on debt collection solutions to manage large volumes of outstanding debts and maintain financial health. The need for comprehensive software that automates workflows, ensures compliance, and enhances collection strategies is paramount in this sector. Financial institutions prioritize features, such as predictive analytics and risk assessment tools, to optimize recovery rates and minimize operational costs.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 11.3 Billion |

| Market Growth Rate 2025-2033 | 8.89% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium Enterprises, and Large Enterprises |

| End Users Covered | Financial Institutions, Collection Agencies, Healthcare, Government, Telecom and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AgreeYa.com, Chetu Inc., Debtrak, EbixCash Financial Technologies, Experian Information Solutions Inc., Fair Isaac Corporation, Katabat Corporation (Ontario System), Nucleus Software Exports Ltd., Pegasystems Inc., Seikosoft, TietoEVRY and TransUnion LLC |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)