Global Data Center Liquid Cooling Market Expected to Reach USD 16.5 Billion by 2033 - IMARC Group

Global Data Center Liquid Cooling Market Statistics, Outlook and Regional Analysis 2025-2033

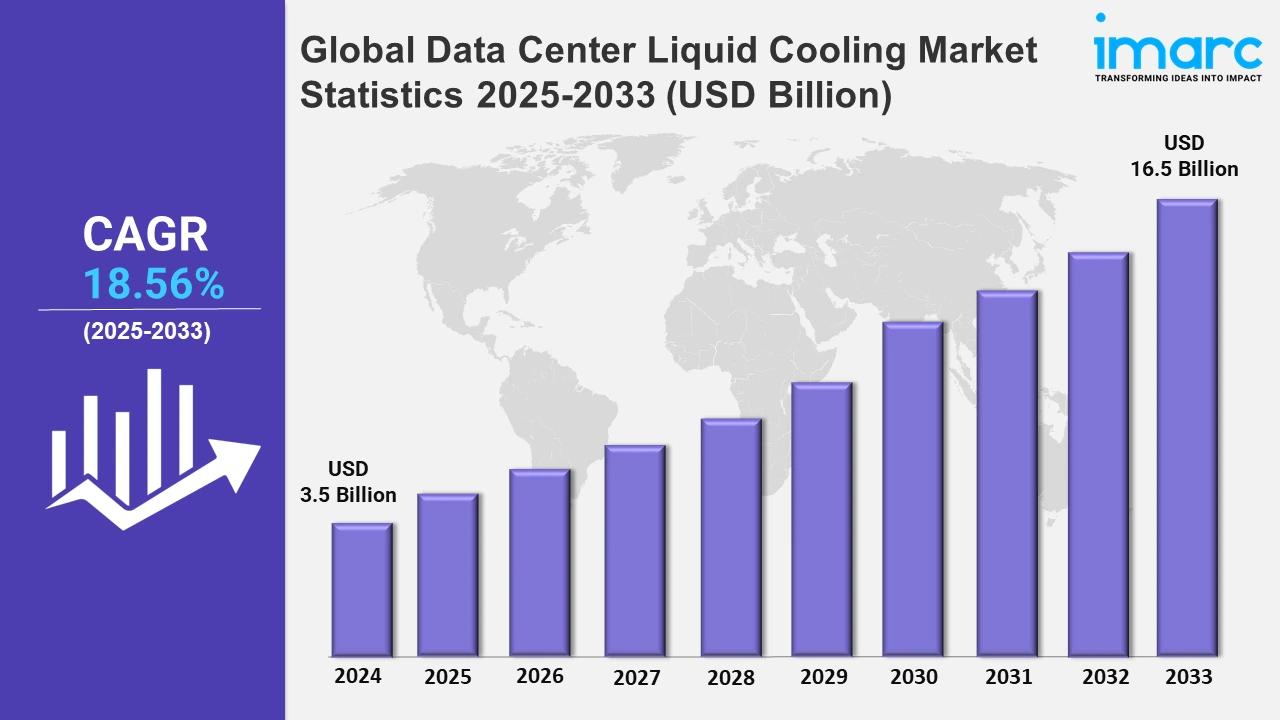

The global data center liquid cooling market size was valued at USD 3.5 Billion in 2024, and it is expected to reach USD 16.5 Billion by 2033, exhibiting a growth rate (CAGR) of 18.56% from 2025 to 2033.

To get more information on this market, Request Sample

The greater requirement for high-density computing and supercomputing is propelling the advancement of specialized liquid cooling technologies. These systems effectively regulate heat in high-performance settings, assuring peak performance and sustainability while also fulfilling the cooling requirements of proficient computer technology. For example, in February 2024, Aligned, a data center firm, launched a new liquid cooling system, which is specifically designed to support high-density computing requirements and supercomputers.

Moreover, collaboration between technology and cooling firms has accelerated the development of next-generation cooling systems for data centers. These collaborations are centered on integrating advanced liquid cooling technologies to improve energy economy, sustainability, and performance in high-demand computer settings. For instance, in February 2024, SK Enmove announced signing a memorandum of understanding (MOU) on cooperation of next-generation cooling and solutions with SK Telecom and Precision Liquid Cooling Iceotope Technologies. Furthermore, to satisfy the increased need for high-performance computing and AI workloads, data center liquid cooling providers are working to improve energy efficiency and scalability. Following this, many businesses are innovating to provide solutions that reduce operational costs and carbon emissions, therefore complying with global sustainability objectives. Additionally, the replacement and aftermarket data center liquid cooling markets provide considerable opportunities for businesses to increase income through service and maintenance contracts. For example, the presence of major tech companies such as Google and Amazon, which are investing extensively in sustainable and high-efficiency cooling technologies for their hyperscale data centers, is driving up demand for advanced liquid cooling systems in North America. These firms are using liquid cooling solutions to solve the thermal difficulties provided by AI, machine learning, and big data, all of which need advanced cooling capabilities.

Global Data Center Liquid Cooling Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest data center liquid cooling market share due to the elevating popularity of direct-to-chip liquid cooling.

North America Data Center Liquid Cooling Market Trends:

North America holds the largest share of the market, owing to high-efficiency data center options. Companies, such as Microsoft, have experimented with submerging servers in non-conductive liquids to minimize energy usage and enhance cooling efficiency. As AI and high-performance computing (HPC) workloads increase, immersion cooling is viewed as a viable option for meeting the thermal demands of the region's dense server settings.

Europe Data Center Liquid Cooling Market Trends:

Europe is using free-air cooling for data centers, leveraging its milder temperature to save energy. Google has used this strategy in data centers in countries such as Finland, cooling servers with the region's natural frigid temperatures. Free-air cooling supports Europe's emphasis on sustainability by minimizing the demand for mechanical air conditioning and lowering carbon emissions in data center operations.

Asia-Pacific Data Center Liquid Cooling Market Trends:

Direct-to-chip liquid cooling technology is being adopted more widely in the Asia Pacific, particularly in Japan and China, where high-performance computing demands are increasing. Companies, such as Alibaba Cloud, have implemented liquid cooling technologies into their data centers to better manage heat from AI and cloud computing applications. This technique tackles cooling difficulties in densely packed server settings while improving overall performance.

Latin America Data Center Liquid Cooling Market Trends:

In Latin America, evaporative cooling systems are becoming more popular, notably in Brazil and Mexico, where high temperatures and limited access to water supplies make standard air conditioning uneconomical. Companies, such as Vertiv, are using these systems to provide energy-efficient and long-term cooling solutions for data centers. Evaporative cooling requires less water and consumes less energy than older techniques.

Middle East and Africa Data Center Liquid Cooling Market Trends:

In the Middle East and Africa, where severe temperatures are widespread, chilled beam cooling is becoming more prevalent for regulating data center temperatures. Teraco cools its data centers in South Africa with chilled beam systems, which are a more energy-efficient option than typical air cooling. This technology contributes to the region's need for cost-effective and long-lasting cooling solutions in challenging climates.

Top Companies Leading in the Data Center Liquid Cooling Industry

Some of the leading data center liquid cooling market companies include Alfa Laval AB, Asetek A/S, Asperitas, Chilldyne, CoolIT Systems Inc., Fujitsu Limited, Green Revolution Cooling Inc., Iceotope, Lenovo Group Limited, Rittal GmbH & Co. KG, Schneider Electric SE, Vertiv Group Corp., among many others. For example, in October 2024, CoolIT Systems Inc., a world leader in advanced liquid-cooling technology for AI and high-performance computing, announced its plan to support the NVIDIA Blackwell AI platform ramp with the introduction of a new line of liquid-cooling devices and the major expansion of its manufacturing capability.

Global Data Center Liquid Cooling Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into solution (direct liquid cooling and indirect liquid cooling) and services (design and consulting, installation and deployment, and support and maintenance), wherein solution represents the most preferred segment. The solution involves the selection and integration of cooling units, control systems, and infrastructure that are adapted to the unique needs of the data center environment.

- Based on the data center type, the market is categorized into large data centers, small and medium-sized data centers, and enterprise data centers, amongst which large data centers dominate the market. Large data centers are often owned by hyperscale cloud providers, colocation facilities, or organizations with substantial IT infrastructure needs.

- On the basis of the end use, the market has been divided into cloud providers, colocation providers, enterprises, and hyperscale data centers. Among these, enterprises exhibit a clear dominance in the market. Enterprises employ data centers to power their internal IT operations and services.

- Based on the application, the market is bifurcated into BFSI, IT and telecom, media and entertainment, healthcare, government and defense, retail, research and academic, and others, wherein IT and telecom dominate the market. Data centers are critical in the IT and telecom industries as they host and manage network infrastructure, telecommunications equipment, and digital services.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 16.5 Billion |

| Market Growth Rate 2025-2033 | 18.56% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Data Center Types Covered | Large Data Centers, Small and Medium-sized Data Centers, Enterprise Data Centers |

| End Uses Covered | Cloud Providers, Colocation Providers, Enterprises, Hyperscale Data Centers |

| Applications Covered | BFSI, IT and Telecom, Media and Entertainment, Healthcare, Government and Defense, Retail, Research and Academic, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alfa Laval AB, Asetek A/S, Asperitas, Chilldyne, CoolIT Systems Inc., Fujitsu Limited, Green Revolution Cooling Inc., Iceotope, Lenovo Group Limited, Rittal GmbH & Co. KG, Schneider Electric SE, Vertiv Group Corp., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Data Center Liquid Cooling Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)