Global Data Center Generator Market Expected to Reach USD 12.5 Billion by 2033 - IMARC Group

Global Data Center Generator Market Statistics, Outlook and Regional Analysis 2025-2033

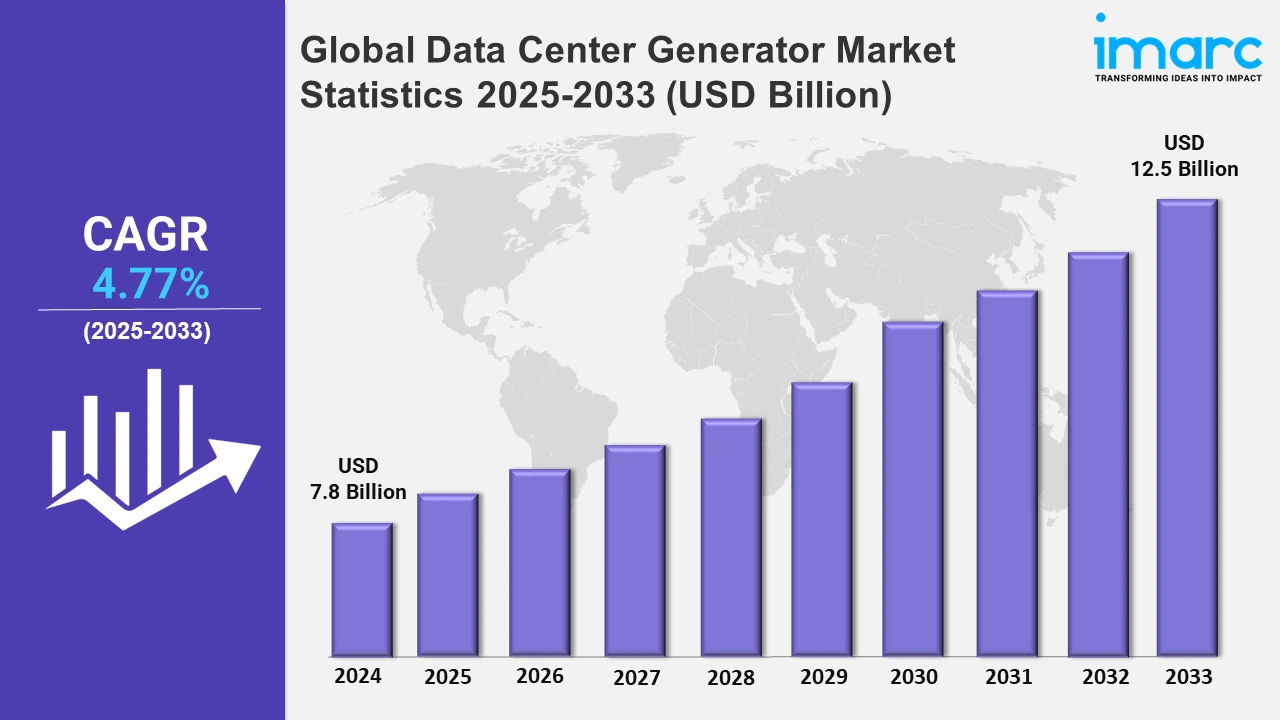

The global data center generator market size was valued at USD 7.8 Billion in 2024, and it is expected to reach USD 12.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.77% from 2025 to 2033.

To get more information on this market, Request Sample

Rising data usage is one of the major drivers of the data center generator industry. The proliferation of digital material, such as streaming services, online gaming, social media, and remote working tools, has significantly raised the demand for data centers. To meet this increased demand, data centers are expanding their capacity and improving their infrastructure. Furthermore, as more organizations and consumers rely on cloud-based services, the demand for large-scale data centers with reliable power backup systems increases. This trend is further accelerated by the growing number of smart devices and the expansion of the Internet of Things (IoT), both of which contribute to increased data generation and consumption. For instance, according to Forbes Magazine, by the end of 2024, there will be over 207 billion devices connected to the global network of tools, toys, devices, and appliances known as the Internet of Things (IoT).

Moreover, the increased investment in data center infrastructure by major IT companies is a key driver of growth for the data center generator sector. Leading technology businesses, such as Amazon, Google, Microsoft, and Facebook, are continually boosting their data center capacity to satisfy rising data storage and processing demands. Major technology companies are attempting to create data centers that are not just larger, but also more technologically advanced and sustainable. They are also employing cutting-edge generating technology to increase efficiency, lower emissions, and combine with renewable energy sources. For instance, according to Mckinsey, data centers have attracted the interest of investors, owing to their consistent, utility-like revenue flows and risk-adjusted rates. In 2021, there were 209 data center deals for more than US$48 Billion, a 40% increase from the previous year's US$34 Billion total. In the first half of 2022, 87 transactions totaled US$24 Billion. From 2015 to 2018, private equity purchasers accounted for 42% of total transaction value. Their proportion rose to 65% between 2019 and 2021, and to more than 90% in the first half of 2022. Besides this, regulatory compliance and industry standards are key in propelling the data center generator market. Governments and regulatory bodies all over the world have established stringent standards for data center operations, including specific requirements for power backup systems. For instance, in 2023, the UK government launched a new consultation aimed at safeguarding and improving the security and resilience of UK data infrastructure. The government stated that a new set of legislation will make minimum requirements essential to ensure data center operators are "taking appropriate steps" to improve their security and resilience.

Global Data Center Generator Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest regional market for data center generator.

North America Data Center Generator Market:

North America dominates the global market. North America, notably the United States, is home to some of the world's largest technology businesses, such as Google, Amazon, Microsoft, and Facebook. According to Forbes Magazine, 72 of the world's largest technology companies are headquartered in the United States. These organizations use enormous data center networks to support their cloud services, digital platforms, and massive data storage requirements. Furthermore, the region is at the cutting edge of innovation, with ongoing expenditures in research and development to improve generator technology. This involves combining renewable energy, IoT, and AI to improve predictive maintenance and performance. These variables combine to drive revenue in the North American data center generator industry.

Europe Data Center Generator Market Trends:

The surge in digital services and cloud computing has led to a substantial increase in data center construction across Europe. For instance, in 2024, Amazon announced investments of €15.7 Billion in Spain and €7.8 Billion in Germany to develop new data centers.

Asia Pacific Data Center Generator Market Trends:

Major technology companies are investing heavily in the Asia-Pacific region to expand their data center footprints. For instance, in September 2024, Blackstone announced its largest investment in Asia-Pacific, a US$24 Billion deal to acquire Australian data center provider AirTrunk.

Latin America Data Center Generator Market Trends:

The market is experiencing notable growth, driven by the escalating demand for high-quality, synthetic data to train machine learning models, test applications, and simulate real-world scenarios across various industries. Moreover, in countries, including Mexico, the market is also seeing increased investment in R&D activities.

Middle East and Africa Data Center Generator Market Trends:

Data centers require uninterrupted power to ensure continuous operations. The increasing frequency of power outages and the critical nature of data center services have intensified the need for robust backup power systems, including generators. For example, in April 20204, Africa Data Centres, in partnership with DPA SA, commenced the construction of a 12 MW solar farm in South Africa to provide renewable energy for its facilities, addressing the high energy demands and frequent power cuts in the country, further propelling the market growth.

Top Companies Leading in the Data Center Generator Industry

Some of the leading data center generator market companies include ABB Ltd, Atlas Copco (India) Ltd., Caterpillar Inc., Cummins Inc., Deutz AG, Generac Power Systems Inc., HITEC Power Protection, Kirloskar Oil Engines Limited, Kohler Co., Langley Holdings plc, Mitsubishi Motors Corporation, Rolls-Royce plc, and Yanmar Holdings Co. Ltd., among many others. For instance, in March 2024, Digital Realty, a provider of cloud- and carrier-neutral data center, colocation, and interconnection solutions, and Mitsubishi Corporation formed a new joint venture to support the development of two data centers in the Dallas metro area, which are 100% pre-leased to an S&P 100 investment grade customer on a long-term basis.

Global Data Center Generator Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into diesel, natural gas, and others, wherein diesel represented the largest segment. Diesel generators have a short startup time, which is critical in emergency situations where electricity must be restored fast, further driving the segment’s growth.

- Based on the capacity, the market is categorized into less than 1MW, 1MW–2MW, and greater than 2MW, amongst which less than 1MW accounted for the largest market share. Generators with capacities less than 1MW are often more cost-effective for small to medium-sized data centers.

- On the basis of the tier, the market has been divided into tier I and II, tier III, and tier IV. Among these, tier I and II represented the largest segment. Tier I and II data centers are widely used in a variety of industries, including small and medium-sized businesses (SMEs), educational institutions, and local government offices.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.8 Billion |

| Market Forecast in 2033 | USD 12.5 Billion |

| Market Growth Rate 2025-2033 | 4.77% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Diesel, Natural Gas, Others |

| Capacities Covered | Less than 1MW, 1MW–2MW, Greater than 2MW |

| Tiers Covered | Tier I and II, Tier III, Tier IV |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd, Atlas Copco (India) Ltd., Caterpillar Inc., Cummins Inc., Deutz AG, Generac Power Systems Inc., HITEC Power Protection, Kirloskar Oil Engines Limited, Kohler Co., Langley Holdings plc, Mitsubishi Motors Corporation, Rolls-Royce plc, Yanmar Holdings Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)