Global Data Center Cooling Market Expected to Reach USD 48.8 Billion by 2033 - IMARC Group

Global Data Center Cooling Market Statistics, Outlook and Regional Analysis 2025-2033

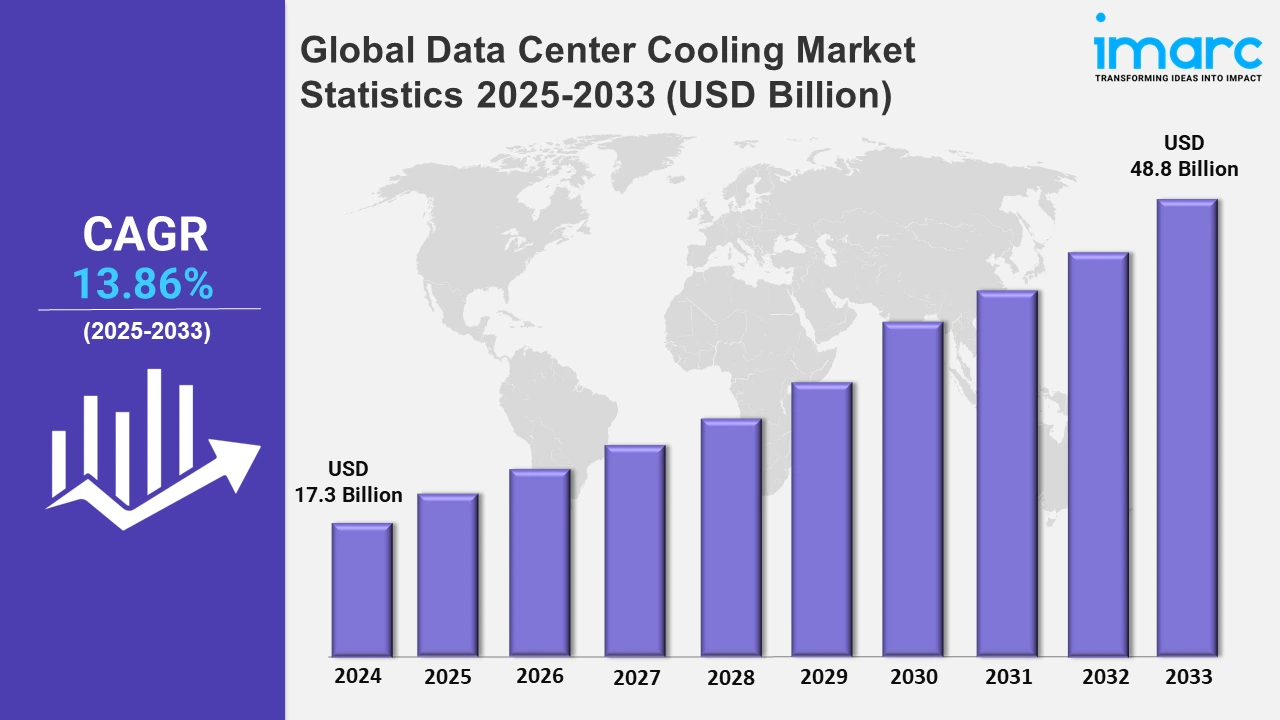

The global data center cooling market size was valued at USD 17.3 Billion in 2024, and it is expected to reach USD 48.8 Billion by 2033, exhibiting a growth rate (CAGR) of 13.86% from 2025 to 2033.

To get more information on this market, Request Sample

There is a rising interest in developing new cooling fluids for data centers to improve energy efficiency and lower environmental impact. These innovative cooling methods are intended to increase both performance and sustainability in high-density computer settings. For example, in June 2024, Petronas Lubricants International, an oil and gas corporation, collaborated with Iceotope and launched an innovative cooling fluid for data centers.

Moreover, the industry is experiencing an increase in specialized cooling solutions for data centers, with an emphasis on new hoses that boost cooling efficiency. These designed solutions improve performance in high-demand applications by minimizing energy usage. For instance, in September 2024, Gates, a worldwide global provider of unique and highly engineered power transmission and fluid power solutions, introduced the data master data center cooling hose. Furthermore, data center cooling companies are concentrating on increasing energy efficiency and sustainability to achieve worldwide environmental performance criteria. To meet tougher energy rules, suppliers are creating innovative cooling systems that use less electricity while maintaining ideal operating conditions. Additionally, the rising demand for high-efficiency cooling systems creates considerable opportunities in the replacement and aftermarket sectors. Companies are increasingly focusing on liquid cooling, immersion cooling, and free-air cooling solutions to improve performance. For example, in Asia-Pacific, Alibaba Cloud has implemented immersion cooling technology in its data centers to improve efficiency and reduce energy consumption, addressing both rising demand for cloud services and environmental concerns. These advancements are propelling the market for advanced cooling systems, as companies attempt to provide more sustainable, cost-effective choices that align with global climate objectives and data center needs.

Global Data Center Cooling Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest data center cooling market share due to the elevating digitalization of company operations to boost efficiency and reduce manual mistakes.

North America Data Center Cooling Market Trends:

In North America, the rising need for managing high-density computer systems is bolstering the market. Facebook and Google are setting the standard by implementing direct-to-chip cooling systems in their data centers to enhance energy efficiency and minimize water use. This trend is stimulated by the need for sustainable operations and lower energy costs, particularly in energy-intensive areas, such as Silicon Valley.

Europe Data Center Cooling Market Trends:

Free-air conditioning systems are becoming increasingly popular throughout Europe, particularly in cooler climates. Data centers in countries, such as Sweden and Iceland, use natural cold air to lessen dependency on standard air conditioning. Ambient cooling is part of Europe's commitment to sustainability, with firms, including Stokab and Global Switch, using eco-friendly and energy-efficient cooling systems to reduce environmental effects.

Asia-Pacific Data Center Cooling Market Trends:

Asia-Pacific holds the largest share of the market as the demand for high-performance computers grows. Companies, such as Alibaba Cloud, in China are using immersion cooling to control the extreme heat created by their high-density data centers. This technology minimizes energy consumption and increases cooling efficiency, allowing companies to grow operations while retaining sustainability, which is a major priority in the region's data center sector.

Latin America Data Center Cooling Market Trends:

In Latin America, evaporative cooling systems are becoming more popular, notably in Brazil and Mexico, where rising ambient temperatures fuel demand for low-cost cooling solutions. Companies, such as Vertiv, have installed evaporative coolers in data centers to lower energy usage and expenses while preserving system performance. These systems are especially effective in areas with limited access to water. They are gaining popularity in Latin America because of their declined environmental impact compared to conventional approaches.

Middle East and Africa Data Center Cooling Market Trends:

In the Middle East and Africa, free-air cooling and evaporative cooling are important trends for controlling excessive heat in data centers. Etisalat in the UAE uses free-air cooling to take advantage of milder nighttime temperatures, hence decreasing the demand for standard air conditioning. Similarly, Teraco in South Africa employs evaporative cooling systems in its data centers to reduce energy consumption and increase sustainability in the region's severe environment.

Top Companies Leading in the Data Center Cooling Industry

Some of the leading data center cooling market companies include Airedale International Air Conditioning, Asetek, Black Box Corporation, Climaveneta Climate Technologies, Coolcentric, Emerson Electric, Fujitsu, Hitachi, Netmagic, Nortek Air Solutions, Rittal, Schneider Electric, STULZ GmbH, Vertiv, among many others. For example, in August 2024, Airedale, a U.K.-based critical systems cooling specialist, introduced its data center cooling system optimizer in the U.S. The optimization software is an automated control layer that lies between the chiller and CRAH product controls and the site's building management system (BMS).

Global Data Center Cooling Market Segmentation Coverage

- On the basis of the solution, the market has been bifurcated into air conditioning, chilling units, cooling towers, economizer systems, liquid cooling systems, control systems, and others, wherein air conditioning represents the most preferred segment. Air conditioning in a data center is critical for maintaining appropriate working conditions for the equipment housed within it.

- Based on the services, the market is categorized into consulting, installation and deployment, and maintenance and support, amongst which installation and deployment dominate the market. The installation and deployment of a data center cooling service is an important part of data center management because it guarantees that servers and networking equipment run effectively and reliably while maintaining ideal temperature and humidity levels.

- On the basis of the type of cooling, the market has been divided into room-based cooling, row-based cooling, and rack-based cooling. Among these, room-based cooling exhibits a clear dominance in the market. Room-based cooling is a way of cooling a single space or room within a building rather than the entire building or residence.

- Based on the cooling technology, the market is bifurcated into liquid-based cooling and air-based cooling, wherein liquid-based cooling dominates the market. Liquid-based cooling is an extremely effective way to remove heat from electrical components such as computer CPUs and graphics cards.

- On the basis of the type of data center, the market is segmented into mid-sized data centers, enterprise data centers, and large data centers. Currently, enterprise data centers account for the majority of the total market share. Enterprise data centers are centralized buildings or sites that store and administer an organization's IT infrastructure, which includes servers, storage devices, networking equipment, and other computer resources.

- Based on the vertical, the market is classified into BFSI, IT and telecom, research and educational institutes, government and defense, retail, energy, healthcare, and others, amongst which IT and telecom dominate the market. Data centers are critical to the IT and telecom industries as they store and analyze massive volumes of digital information while also providing crucial services.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 17.3 Billion |

| Market Forecast in 2033 | USD 48.8 Billion |

| Market Growth Rate 2025-2033 | 13.86% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Solutions Covered | Air Conditioning, Chilling Units, Cooling Towers, Economizer Systems, Liquid Cooling Systems, Control Systems, Others |

| Services Covered | Consulting, Installation and Deployment, Maintenance and Support |

| Type of Coolings Covered | Room-Based Cooling, Row-Based Cooling, Rack-Based Cooling |

| Cooling Technologies Covered | Liquid-Based Cooling, Air-Based Cooling |

| Types of Data Centers Covered | Mid-Sized Data Centers, Enterprise Data Centers, Large Data Centers |

| Verticals Covered | BFSI, IT and Telecom, Research and Educational Institutes, Government and Defense, Retail, Energy, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Airedale International Air Conditioning, Asetek, Black Box Corporation, Climaveneta Climate Technologies, Coolcentric, Emerson Electric, Fujitsu, Hitachi, Netmagic, Nortek Air Solutions, Rittal, Schneider Electric, STULZ GmbH, Vertiv, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Data Center Cooling Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)