Global Dairy Snacks Market Expected to Reach USD 392.8 Billion by 2033 - IMARC Group

Global Dairy Snacks Market Statistics, Outlook and Regional Analysis 2025-2033

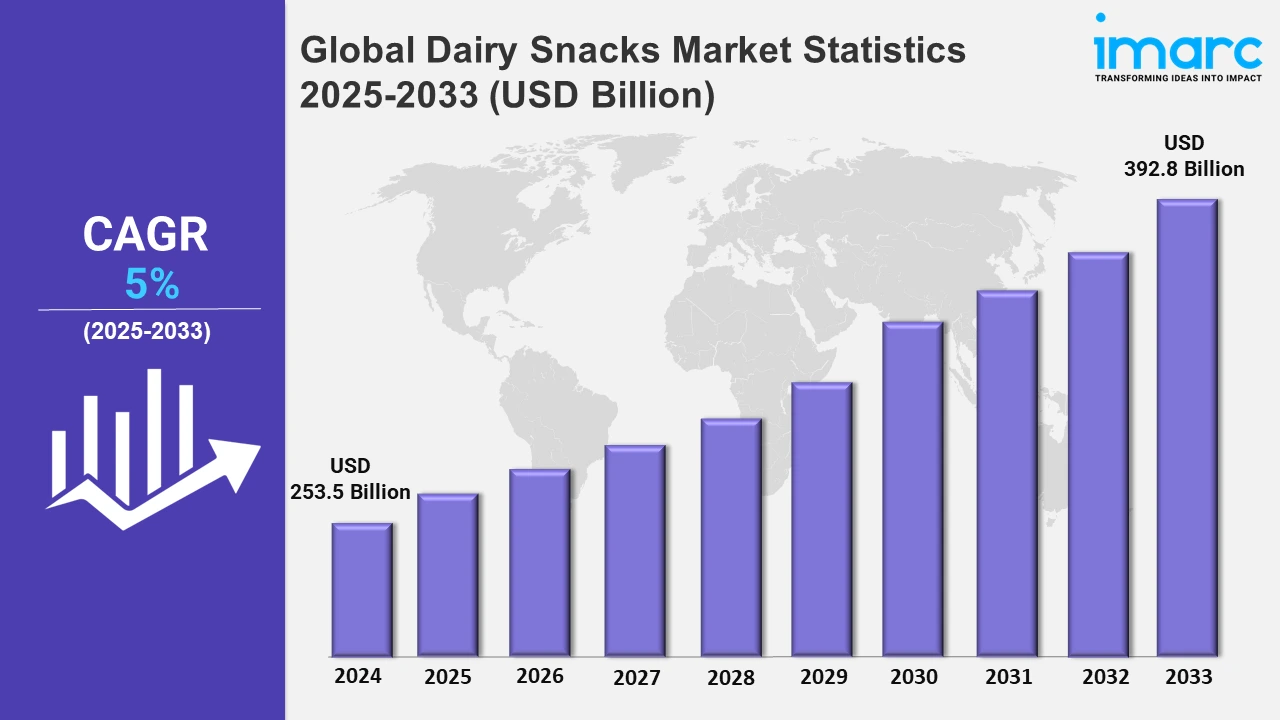

The global dairy snacks market size was valued at USD 253.5 Billion in 2024, and it is expected to reach USD 392.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5% from 2025 to 2033.

To get more information on this market, Request Sample

The market for dairy snacks is expanding significantly due to the rising demand for innovative and health-conscious snack options. Moreover, as part of the growing trend of health-focused indulgence, a lot of consumers are choosing guilt-free snacks that resemble desserts. Along with this, improvements in packaging are increasing the shelf life and attractiveness of products, catering to customer demands for eco-friendly and eye-catching designs. Aligned with these trends, in March 2024, Sargento added fun, balanced breaks, fiesta pepper, and smokehouse string cheese snacks to their snacking lineup, which now offers a variety of flavor profiles. Concurrent with this, convenience, taste, and nutritional advantages are attracting consumers, thereby giving producers the chance to expand their product lines. The popularity of snackable foods and diets high in protein has encouraged brands to concentrate on using premium-quality ingredients and developing novel products. Supporting this trend, Danone North America introduced REMIX in April 2024, adding customizable alternatives to the dairy snack market by offering mix-ins for its popular Light + Fit, Oikos, and Too Good & Co. brands.

Concurrently, in April 2024, Whisps of New York presented 'Whisps,' a baked dairy snack composed entirely of cheddar, parmesan, pepper jack, mozzarella, etc. These snacks appeal to health-conscious cheese enthusiasts as they contain 10 grams of protein per serving and come in flavors including Very Cheddar, Perfectly Parmesan, and Jalapeño Popper. Likewise, these changes highlight a larger market trend in dairy snacks toward premiumization and personalization. Producers are concentrating on developing a variety of product lines that meet emerging consumer choices.

Global Dairy Snacks Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounts for the majority of the total market share because of the region's robust dairy production capabilities and high customer demand for novel and decadent items.

North America Dairy Snacks Market Trends:

The market in North America for dairy snacks is rising in demand due to the increased need for convenient and healthful snack options. In parallel to this, there has been a rise in the introduction of yogurt-based snacks in the U.S., including Chobani Flip, which mixes yogurt with other ingredients. Customers' inclination for high-protein, portable foods that fit well with hectic schedules and health-conscious eating patterns further supports the trend.

Europe Dairy Snacks Market Trends:

Europe leads the overall market of dairy snacks because of its mature consumer base and rising inclination towards high-quality and handy snacks. Reflecting this trend, Arla Foods and Mondelēz International debuted Milka chocolate milk in Germany, Austria, and Poland in June 2024. This product combines the dairy snack segment made at Esbjerg Dairy in Denmark with the famous chocolate flavor of Milka. The region's emphasis on product diversity is meeting changing customer preferences and preserving its position as a leader in the dairy snacks industry.

Asia Pacific Dairy Snacks Market Trends:

In Asia Pacific, the market benefits from increasing urbanization and changing dietary habits. In countries like India, Japan, China, etc., flavored milk-based products like Mengniu’s cheese snacks are gaining traction among younger consumers. Moreover, this trend is fueled by the region’s focus on fortified foods rich in calcium and vitamins. Meanwhile, rising disposable incomes and a growing interest in international flavors also support market expansion in this region.

Latin America Dairy Snacks Market Trends:

The industry is developing in Latin America as consumers' tastes for reasonably priced, regionally based snacks continue to grow. Brazil is the leader in popular products that appeal to traditional tastes, such as cheese sticks and dairy-based pastries. On the contrary, in response to the growing demand for dietary diversity, businesses are coming out with new plant-based and lactose-free dairy snacks. Concurrently, the region's emphasis on convenient and healthful snacking is reflected in this development.

Middle East and Africa Dairy Snacks Market Trends:

The growing popularity of high-quality dairy products is driving the industry across the Middle East and Africa. The desire for flavored yogurt drinks, such as Almarai's Laban, in Saudi Arabia, demonstrates the country's penchant for locally inspired treats with added health benefits. Besides this, the market growth is also influenced by an expanding young population and the adoption of Western dietary trends, thereby blending tradition with modern snacking.

Top Companies Leading in the Dairy Snacks Industry

Some of the leading dairy snacks market companies include Arla Foods Ingredients Group, Dairy Farmers of America Inc., Danone S.A., Fonterra Co-operative Group Limited, Friesland Campina, Lactalis International, Megmilk Snow Brand Co.Ltd, Meiji Holdings Co. Ltd., Nestle S.A, Organic Valley, The Kraft Heinz Company, and Unilever PLC, among many others. Nestle's Stouffer's launched Stouffer's Supreme, a shelf-stable mac and cheese product, in September 2024 with the goal of growing its market share in the cutthroat mac and cheese industry by emphasizing quality and convenience for customers looking for quick, tasty dinner options.

Global Dairy Snacks Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into cheese, yogurt, ice cream, and others, wherein yogurt represents the most preferred segment. Yogurt remains a popular dairy snack, appealing to health-conscious consumers seeking convenient, nutritious, and versatile snacking options

- Based on the nature, the market is categorized into organic and conventional. The dairy snacks market caters to both organic and conventional preferences, offering choices for health-focused and price-sensitive consumers.

- On the basis of the distribution channel, the market has been divided into supermarkets and hypermarkets, convenience stores, specialty stores, online stores, and others. Currently, supermarkets and hypermarkets exhibit a clear dominance in the market. Supermarkets and hypermarkets dominate dairy snack distribution, ensuring widespread availability and variety to meet diverse consumer demands.

- Based on the end use, the market is bifurcated into HoReCa and food and beverages industry. This sector drives demand for innovative dairy snacks, supporting growth within the broader food and beverage industry.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 253.5 Billion |

| Market Forecast in 2033 | USD 392.8 Billion |

| Market Growth Rate 2025-2033 | 5% |

| Units | Billion USD |

| Segment Coverage | Type, Nature, Distribution Channel, End Use, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arla Foods Ingredients Group, Dairy Farmers of America Inc., Danone S.A., Fonterra Co-operative Group Limited, Friesland Campina, Lactalis International, Megmilk Snow Brand Co.Ltd, Meiji Holdings Co. Ltd., Nestle S.A, Organic Valley, The Kraft Heinz Company and Unilever PLC |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)