Global Dairy Ingredients Market Expected to Reach USD 124.8 Billion by 2033 - IMARC Group

Global Dairy Ingredients Market Statistics, Outlook and Regional Analysis 2025-2033

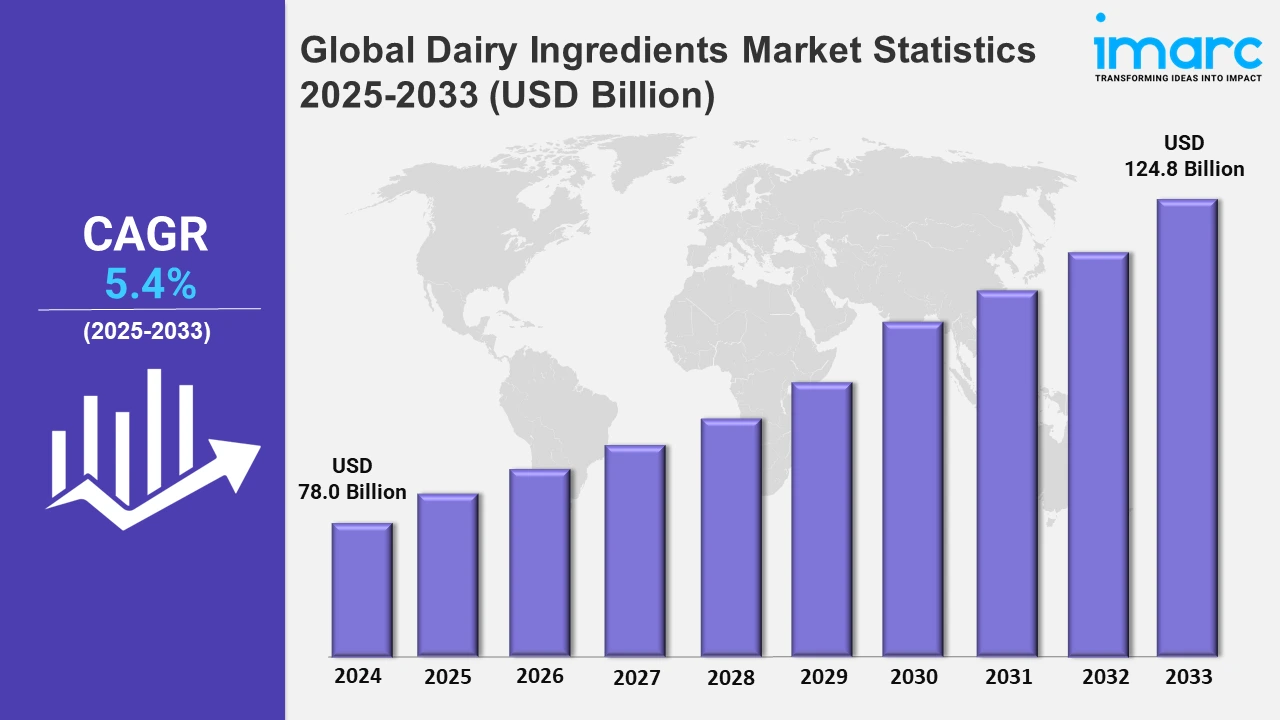

The global dairy ingredients market size was valued at USD 78.0 Billion in 2024, and it is expected to reach USD 124.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.4% from 2025 to 2033.

To get more information on this market, Request Sample

The evolving focus on nutritional advancements and sustainable dairy production is responsible for the global dairy market growth. In contrast, companies are leveraging innovative practices to enhance product quality and cater to the rising health consciousness among consumers. For instance, in October 2024, Britannia Bel Foods launched a new cheese factory producing 10,000 tons annually and supported by a strong milk procurement system sourcing 4 lakh liters daily from 3,000 farmers. The use of advanced technology ensures that their cheese products are enriched with essential vitamins, protein, and calcium, meeting consumer demand for nutrient-rich dairy. Furthermore, this development underscores the trend of integrating technology and sustainable sourcing to achieve high-quality products, positioning companies for competitive advantages in the market. Also, the market is influenced by strategic partnerships and product diversification aimed at expanding regional reach and enhancing nutritional profiles. In May 2024, Amul, in collaboration with a 108-year-old cooperative, launched fresh milk with a focus on developing dairy ingredients and marketing. Their initial offerings span major cities, and they plan to introduce a high-protein 'super milk' variant, boasting 35 grams of protein per serving, to cater to consumers seeking enhanced nutritional value. This shift toward more specialized, high-protein products reflects a broader push for functional and convenient dairy items.

In line with these trends, Danone North America introduced REMIX, a range of yogurts and dairy snacks under its Light + Fit, Oikos, and Too Good & Co. brands, in April 2024. The products include mix-ins and offer notable nutritional benefits, such as Oikos REMIX with 11g of protein per 4.5 oz cup, showcasing the company’s commitment to dairy innovation. The launch aligns with the market’s focus on snackable, health-oriented options, reinforcing the trend of blending traditional dairy products with modern consumer expectations. The push towards varied dairy offerings with enhanced protein content and creative additions demonstrates how leading brands are adapting to maintain relevance in a competitive space.

Global Dairy Ingredients Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific dominates the market due to increasing consumer demand for nutritional products and the expansion of dairy production facilities.

North America Dairy Ingredients Market Trends:

In North America, the demand for protein-enriched products is propelling the dairy ingredients market. The U.S. focuses on producing whey protein concentrates for sports nutrition and health foods. For instance, U.S. dairy producers are investing in sustainable practices and clean-label products, reflecting consumer preferences for transparency and health-conscious options, contributing to market growth across various applications.

Europe Dairy Ingredients Market Trends:

In Europe, the market is driven by a strong tradition of dairy innovation and specialty ingredients. France, known for its high-quality cheese and dairy production, leads the way with cutting-edge lactose-free and organic dairy solutions. The region’s stringent quality standards and increased interest in functional foods boost demand for diversified dairy ingredients, meeting both local and international consumer expectations for health and specialty products.

Asia Pacific Dairy Ingredients Market Trends:

Asia Pacific is the dominating region in the market, driven by increasing consumer demand and the expansion of dairy production facilities. Countries like Japan and China are investing in advanced processing technologies and product development. In June 2023, MEGMILK SNOW BRAND Co., Ltd., based in Shinjuku, Tokyo, disclosed its attainment of halal certification for specific products, such as skim milk powder and butter produced at its Horonobe Plant in Hokkaido. This move highlights the region's focus on catering to diverse dietary requirements and meeting international standards. The push for quality and specialized products, including halal-certified dairy, positions the Asia Pacific as a leader, appealing to both local and export markets with premium and compliant offerings.

Latin America Dairy Ingredients Market Trends:

In Latin America, the dairy ingredients market benefits from a mix of traditional and modern food processing. Brazil is advancing its dairy sector with an emphasis on fortified products and milk derivatives for both local use and export. The trend towards value-added dairy ingredients supports new product lines in functional and fortified foods, catering to changing consumer lifestyles and increased health awareness.

Middle East and Africa Dairy Ingredients Market Trends:

The Middle East and Africa market is driven by a rising demand for imported dairy ingredients due to climate challenges impacting local production. Saudi Arabia, for example, imports a significant amount of milk powder and butter to meet domestic needs. The focus on nutritional and fortified dairy products supports the growth of dairy ingredients, meeting consumer demand for functional and shelf-stable goods in the region.

Top Companies Leading in the Dairy Ingredients Industry

Some of the leading dairy ingredients market companies include Agropur, Arla Foods Ingredients Group P/S, Aurivo Co-operative Society Ltd, Dairy Farmers of America, Inc., Euroserum, Fonterra Co-Operative Group Limited, Glanbia plc, Hoogwegt, LACTALIS Ingredients, MEGMILK SNOW BRAND Co., Ltd., Saputo Inc., and Schreiber Foods, among many others. In March 2024, Arla Foods Ingredients presented innovative strategies to enhance the nutritional profile of cheese. The company introduced a low-fat alternative for individually packaged cheese slices utilizing fat-mimicking proteins found in Nutrilac FO-7065, which is enriched with milk mineral concentrate Capolac, and each 20g slice offers calcium.

Global Dairy Ingredients Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into milk powders (skimmed milk powders and whole milk powders), milk protein concentrates and milk protein isolates, whey ingredients (whey protein concentrate (WPC), whey protein isolate (WPI), and hydrolyzed whey protein (HWP), lactose and derivatives, casein and caseinates, and others, wherein milk powders represent the most preferred segment. Milk powders are frequently used component in the production of dairy products, confections, baby formula, and bakeries. They provide producers with a dependable way to improve the flavor, texture, and nutritional value of their products.

- Based on the source, the market is categorized into milk and whey, amongst which milk dominates the market. As a primary source, milk is gaining traction and shaping the dynamics of the dairy Ingredients market, driving innovation and meeting the evolving needs of consumers and industries alike.

- On the basis of form, the market has been divided into dry and liquid, wherein dry represents the most preferred segment. It is gaining traction due to its ease of handling, longer shelf life, and versatility in applications across various food and beverage sectors.

- Based on the application, the market is categorized into bakery and confectionery, dairy products, infant milk formula, sports and clinical nutrition, and others. Dairy ingredients play vital roles across various sectors, enhancing texture, flavor, and nutrition. They are key in bakery and confectionery, dairy products, infant milk formula, sports and clinical nutrition, and other food applications.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 78.0 Billion |

| Market Forecast in 2033 | USD 124.8 Billion |

| Market Growth Rate 2025-2033 | 5.4% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Sources Covered | Milk, Whey |

| Forms Covered | Dry, Liquid |

| Applications Covered | Bakery and Confectionery, Dairy Products, Infant Milk Formula, Sports and Clinical Nutrition, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agropur, Arla Foods Ingredients Group P/S, Aurivo Co-operative Society Ltd, Dairy Farmers of America, Inc., Euroserum, Fonterra Co-Operative Group Limited, Glanbia plc, Hoogwegt, LACTALIS Ingredients, MEGMILK SNOW BRAND Co., Ltd., Saputo Inc., Schreiber Foods, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Dairy Ingredients Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)