Global Dairy Alternatives Market Expected to Reach USD 76.0 Billion by 2033 - IMARC Group

Global Dairy Alternatives Market Statistics, Outlook and Regional Analysis 2025-2033

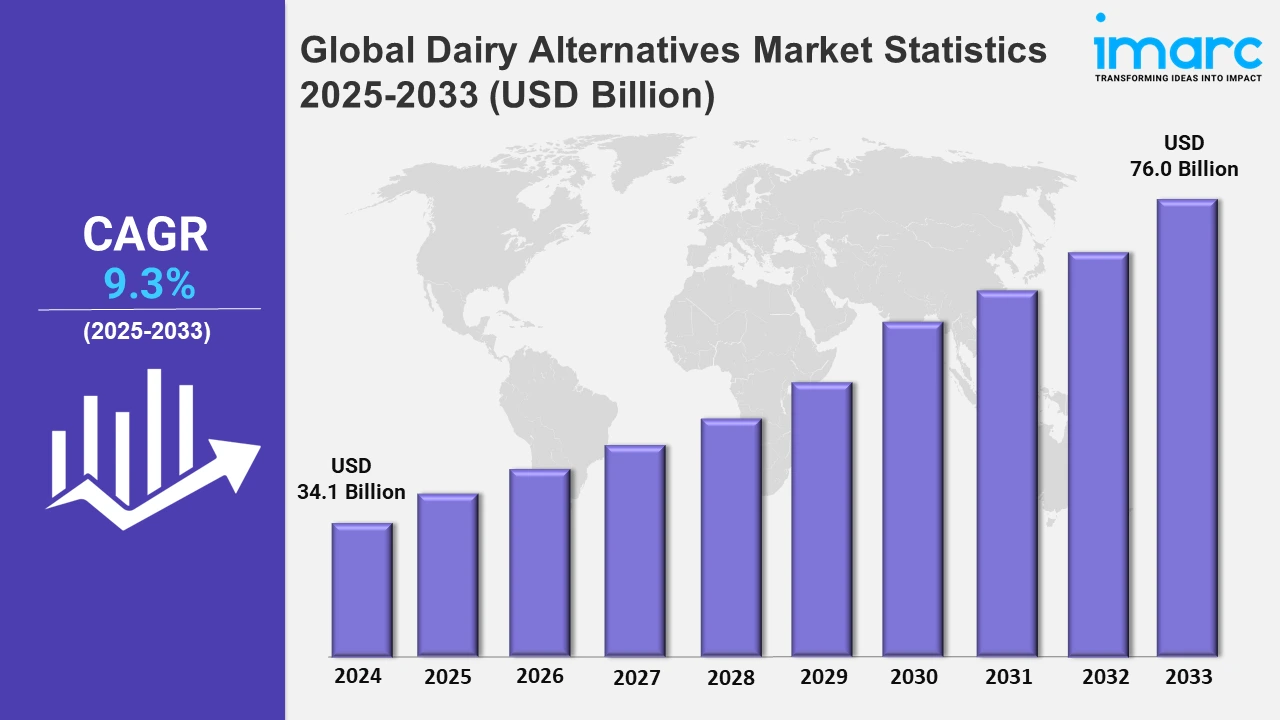

The global dairy alternatives market size was valued at USD 34.1 Billion in 2024, and it is expected to reach USD 76.0 Billion by 2033, exhibiting a growth rate (CAGR) of 9.3% from 2025 to 2033.

To get more information on this market, Request Sample

The global market for dairy alternatives is growing highly due to various key drivers, such as changed consumer preference, environment issues, and improvement in the production process. Heightening health consciousness is one of the main factors among consumers which is propelling the market demand. This rise in incidence of lactose intolerance and milk allergies with a shift toward the adoption of a plant-based diet has intensely driven individuals toward non-traditional products over traditional milk. It makes consumers choose easily toward plant-based alternatives having a similar nutrition profile compared to dairy-based counterparts with all the risks involved when taking dairy-based products. The boosting popularity of veganism and the increased accommodation of plant-based lifestyles is also among the reasons behind the speedy adoption of dairy alternatives. Furthermore, health-oriented consumers are looking for products that they believe are healthier, such as almond, soy, oat, and coconut milk, all of which are often rich in vitamins, minerals, and other beneficial nutrients. The demand for lactose-free and cholesterol-free products has also accelerated, giving rise to a greater range of dairy alternative products for different needs. For instance, in March 2024, Hiland Dairy launched fresh lactose-free milk (LFM), produced daily. Available in whole and 2%, it provides 13 essential nutrients, offering a high-quality, fresh alternative to UHT-processed lactose-free options.

Environmental issues are also some of the primary factors that have driven the growth of the dairy alternatives market. Conventional dairy farming has raised critical environmental concerns, especially high carbon footprint from greenhouse gases, water use, and land requirements. These have made it impossible for consumers not to look and opt for sustainable alternatives. Because dairy farming represents a massive source of greenhouse gas emission, most consumers tend to opt for more friendlier alternatives with increasing climatic changes. The production of plant-based milk tends to use fewer natural resources compared to that of dairy farming, thereby creating a lighter environmental footprint. It has therefore become relatively easy for the consumer to opt for options that have less environmental responsibilities with accelerating availability of sustainably sourced plant-based milks like oats and almonds. For example, In October 2024, Whole Moon launched plant-based protein drinks featuring almond, oat, and pistachio blends. Free of added oils and artificial flavorings, these beverages emphasize whole ingredients for superior taste and nutrition. In addition to these changes, food technological advancements allowed the creation of alternatives with close resemblance in taste and texture to traditionally prepared dairy products, meaning it was more acceptable in wider spectrums for consumers. As product formulas improved from better taste and nutrition profile, the dairy alternatives market is also expected to continue being one of the most promising dairy subcategories.

Global Dairy Alternatives Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of increasing health awareness, growing lactose intolerance, and rising adoption of plant-based diets.

North America Dairy Alternatives Market Trends:

The North America region is a market leader in the dairy alternatives market, as consumer health awareness and demand for diets with plants are on the increase. Concern for health, environmental sustainability, and animal welfare makes consumers take lactose-free, vegan, and dairy-free options. Moreover, novel dairy alternative products, such as plant-based milk, cheeses, and yogurts, contribute to this market growth also.

Asia-Pacific Dairy Alternatives Market Trends:

The Asia-Pacific region is experiencing significant growth in the dairy alternatives market, driven by a combination of health trends, environmental concerns, and rising lactose intolerance awareness. Many consumers are shifting towards plant-based alternatives, such as soy, almond, and oat milk due to the growing popularity of vegan and vegetarian diets. Furthermore, the rising prevalence of lactose intolerance, particularly in countries like China and India, is boosting demand for dairy-free options. For instance, In April 2024, the Vegan Drink Company (VDC) launched its innovative range of fortified plant-based milk alternatives. The lineup includes almond, coconut, millet, oat, and soy milk, all crafted to provide a nutritious, cruelty-free, and eco-friendly option for consumers. These premium products offer low-calorie, cholesterol-free, and versatile substitutes for traditional dairy milk. Furthermore, heightened awareness of the negative environmental impact of dairy due to animal-based production combined with increased attention to sustainable principles has also driven amplified utilization of plant-based dairy substitutes. In addition, greater and more convenient access through both modern retail and online markets is further propelling expansion in the market.

Europe Dairy Alternatives Market Trends:

Increasing demand from health-conscious consumers who look for plant-based and vegan diets is the prime driving factor for the European dairy alternatives market. Furthermore, increased concerns over lactose intolerance and environmental issues with the dairy production process have fuelled the growth of this market. Additionally, strong clean-label trends in Europe along with innovative options for plant-based products will boost the rise in dairy alternatives.

Latin America Dairy Alternatives Market Trends:

In Latin America, the lactose intolerance awareness and veganism and plant-based diets are driving the market for dairy alternatives. Rising urbanization and expansion of the retail channels are further escalating plant-based products. Health-conscious consumers are shifting to dairy alternatives due to obesity, high cholesterol, and other dairy-related health issues, hence driving the market.

Middle East and Africa Dairy Alternatives Market Trends:

As people continue to be more conscious about health, adopt a healthier diet, and observe dietary restrictions, there is an increasing demand for healthier, plant-based dairy alternatives. Higher lactose intolerance and higher veganism popularity also contributed significantly to the growth of this market. Furthermore, innovations in the region-specific flavors and ingredients of dairy alternatives make it more attractive to the regional consumer, thereby leading to its adoption.

Top Companies Leading in the Dairy Alternatives Industry

Some of the leading dairy alternatives market companies include Blue Diamond Growers, Döhler gmbh, Earth’s Own Food Company Inc., Eden Foods, Inc., Freedom Foods Group, Nutriops S.L., Organic Valley, Panos Brands, Sanitarium, Sunopta Inc., Hain Celestial Group, Inc., The Whitewave Foods Company (Danone North America), Triballat Noyal, Valsoia SpA, among many others.

- In October 2024, Blue Diamond Growers partnered with Oppy to launch a line of almond and almond-fruit blends for retail produce departments. Featuring flavors like Toasted Almonds & Cherries and Sea Salt Almonds & Blueberries, this launch targets perimeter shoppers with premium, oil-free, and artificial flavor-free offerings.

Global Dairy Alternatives Market Segmentation Coverage

- On the basis of the source, the market has been categorized into almond, soy, oats, hemp, coconut, rice, and others, wherein soy represents the leading segment. Soy-based dairy alternatives are popular for their high protein content and versatility in different products like milk, yogurt, and cheese. Also, soy milk is easily available and sometimes considered to be a less expensive and more accessible plant-based alternative to other types of dairy, which adds to its dominance in the market.

- Based on the formulation, the market is classified into plain (sweetened and unsweetened) and flavored (sweetened and unsweetened), amongst which plain formulation dominates the market. Plain dairy alternatives are preferred by health-conscious consumers due to their minimal added sugars and natural taste. These products are considered more versatile for use in various culinary applications, further increasing their popularity. The demand for unsweetened plain formulations is especially high among those seeking low-calorie or low-sugar options.

- On the basis of the nutrient, the market has been divided into protein, starch, vitamin, and others. Among these, protein accounts for the majority of the market share. The rising need for nutrients like proteins is becoming progressively in vogue among growing awareness among customers about healthy food products with respect to body-building activities and wellbeing in general, which may explain why plant-based and nutriologically strong alternates in dairy-based product lines for sources of soy, pea, oats-based are popular.

- Based on the distribution channel, the market is segregated into supermarkets and hypermarkets, convenience stores, online stores, and others, wherein supermarkets and hypermarkets lead the segment. These retail outlets offer dairy alternatives in a variety of formats so that the consumers can easily access their favorite products. Supermarkets and hypermarkets also gain through the increased demand for plant-based foods by providing dedicated sections for dairy alternatives and thereby ensuring high product visibility.

- On the basis of the product type, the market has been categorized into cheese, creamers, yogurt, ice creams, milk, and others, wherein milk represent the leading segment. Plant-based milk alternatives, mainly soy, almond, and oat milk, are widely consumed as the dairy alternative product, with the highest market share. These can be applied in various recipes and for beverage consumption purposes, contributing to their high demand since they are available in any grocery store.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 34.1 Billion |

| Market Forecast in 2033 | USD 76.0 Billion |

| Market Growth Rate 2025-2033 | 9.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Almond, Soy, Oats, Hemp, Coconut, Rice, Others |

| Formulations Covered |

|

| Nutrients Covered | Protein, Starch, Vitamin, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Product Types Covered | Cheese, Creamers, Yogurt, Ice Creams, Milk, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blue Diamond Growers, Döhler gmbh, Earth’s Own Food Company Inc., Eden Foods, Inc., Freedom Foods Group, Nutriops S.L., Organic Valley, Panos Brands, Sanitarium, Sunopta Inc., Hain Celestial Group, Inc., The Whitewave Foods Company (Danone North America), Triballat Noyal, Valsoia SpA, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Dairy Alternatives Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)