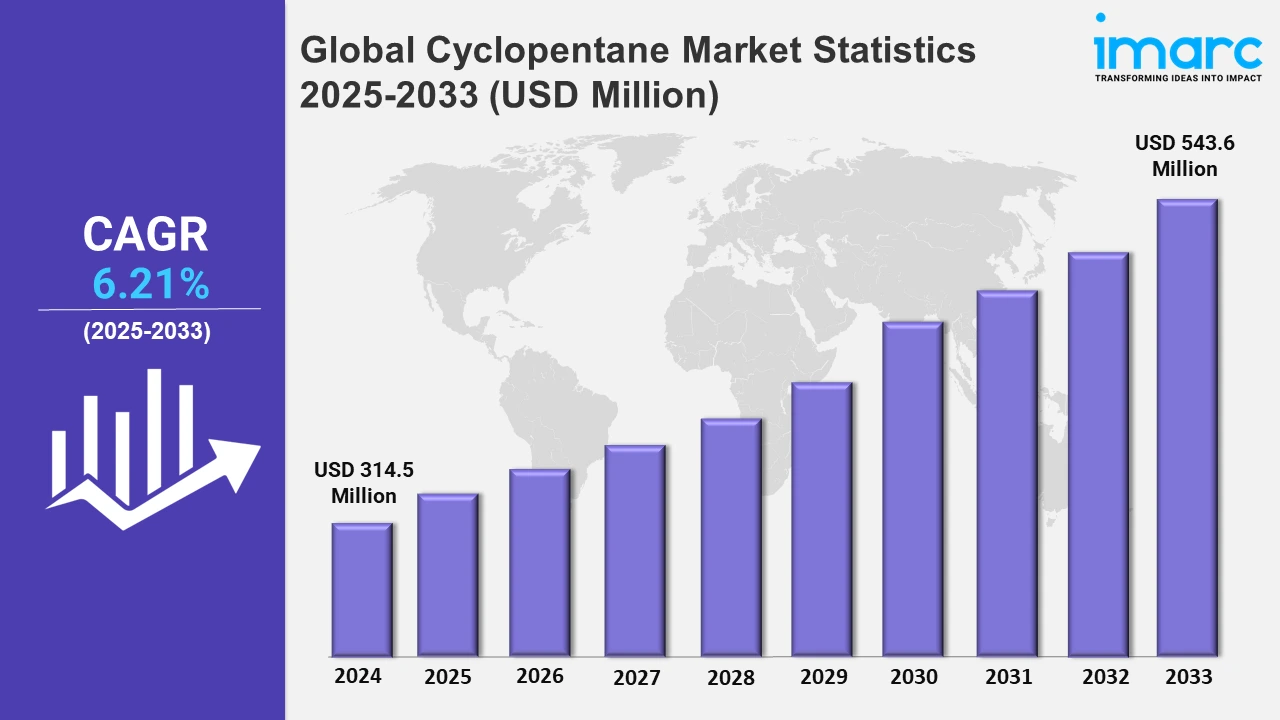

Global Cyclopentane Market Expected to Reach USD 543.6 Million by 2033 - IMARC Group

Global Cyclopentane Market Statistics, Outlook and Regional Analysis 2025-2033

The global cyclopentane market size was valued at USD 314.5 Million in 2024, and it is expected to reach USD 543.6 Million by 2033, exhibiting a growth rate (CAGR) of 6.21% from 2025 to 2033.

To get more information on this market, Request Sample

The cyclopentane industry places a premium on increasing production capacity and market presence. The installation of modern hydrogenation facilities demonstrates attempts to improve production efficiency and meet the rising requirements for high-quality cyclopentane in a variety of applications. For example, in September 2022, Haltermann Carless, a brand of the HCS Group, opened a new hydrogenation unit in Germany. This development by the company was aimed at reinforcing its status as a top cyclopentane manufacturer and broadening its business operations at the Speyer site.

Moreover, the emphasis on energy-efficient cooling solutions is growing in the appliance sector. Recognizing creative and sustainable refrigerator designs emphasizes efforts to promote environmental conservation while satisfying customer demand for high-performance and energy-efficient household appliances. For instance, in December 2022, Haier India, a leading manufacturer of cooling appliances, won the award for the energy-efficient appliance of the year 2022 in the refrigerator category by the Bureau of Energy Efficiency (BEE) at the 32nd National Energy Conservation Awards. Furthermore, cyclopentane firms serving the insulation and refrigeration sectors are focused on eco-friendly solutions to comply with environmental laws. These innovations aim to replace old HCFCs with sustainable alternatives, therefore increasing energy efficiency and lowering carbon emissions. Additionally, the increasing demand for cyclopentane-blown polyurethane foams in construction and refrigeration presents huge income prospects for manufacturers. Also, companies choose cyclopentane over other blowing agents since it has a lower environmental effect and provides better insulation. For example, environmental laws, such as the EU F-Gas regulation, are driving the use of cyclopentane in the appliance manufacturing sector in Europe. Companies, including BASF and Dow, use cyclopentane to make energy-efficient insulating foams for refrigerators and freezers. This change enables producers to satisfy sustainability targets while also meeting the region's rising customer demand for ecologically friendly products.

Global Cyclopentane Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share due to its extensive manufacturing sector, rapid industrial expansion, and strict environmental laws.

North America Cyclopentane Market Trends:

The market in North America is expanding as the industry shifts to ecologically friendly alternatives in response to HCFC phase-out laws. For example, Whirlpool in the U.S. has used cyclopentane as refrigerator insulation to improve energy efficiency and meet environmental criteria. This transition contributes to the region's efforts to minimize greenhouse gas emissions and promote sustainable manufacturing methods in the appliance industry.

Europe Cyclopentane Market Trends:

The need for energy-efficient insulating materials in the construction industry drives the market in Europe. EU rules, such as the Energy Performance of Buildings Directive, promote the use of cyclopentane-blown polyurethane foams. For example, German manufacturers, such as BASF and Covestro, are increasingly using cyclopentane-based thermal insulation solutions to improve energy efficiency in residential and commercial buildings, align with sustainability goals, and fulfill demanding environmental criteria.

Asia-Pacific Cyclopentane Market Trends:

Asia-Pacific holds the largest share of the market, owing to rapid urbanization and environmental regulations. For example, companies, such as Haier, in China have switched to cyclopentane as a blowing agent in freezers, in accordance with worldwide HCFC phase-out plans. This move meets expanding consumer demand for eco-friendly appliances while also satisfying international climate commitments, resulting in increased market growth in the Asia-Pacific.

Latin America Cyclopentane Market Trends:

The market in Latin America is boosted by the rising appliance production and environmental initiatives. Moreover, manufacturers, including Electrolux, in Brazil have incorporated cyclopentane into refrigerator insulating procedures. This promotes energy efficiency and adherence to international environmental norms, making Latin America a prominent market for cyclopentane uses in the appliance industry.

Middle East and Africa Cyclopentane Market Trends:

The market in the Middle East and Africa region is elevating, on account of the rising demand for energy-efficient construction materials. In countries, such as Saudi Arabia, cyclopentane-based insulation is being utilized in new construction projects to increase thermal efficiency. These activities are consistent with regional sustainability goals and help energy-saving efforts in developing countries.

Top Companies Leading in the Cyclopentane Industry

Some of the leading cyclopentane market companies include Haldia Petrochemicals Ltd. (The Chatterjee Group), HCS Group GmbH, INEOS Group Limited, Liaoning Yufeng Chemical Co. Ltd., Maruzen Petrochemical Co. Ltd., MEILONG Cyclopentane Chemical Co. Ltd., Merck KGaA, PureChem Co. Ltd., Trecora Resources, Yeochun NCC Co. Ltd., Zeon Corporation, among many others. For example, in February 2022, Zeon Corporation acquired a leading manufacturer of high-performance microplates called Aurora Microplates. This helped Zeon develop new strategies to provide products and materials in research and diagnostics.

Global Cyclopentane Market Segmentation Coverage

- On the basis of the function, the market has been bifurcated into blowing agent and refrigerant and solvent and reagent, wherein blowing agent and refrigerant represent the most preferred segment. Cyclopentane is an environmental alternative to more damaging compounds, such as HFCs and HCFCs, in the production of insulating foams, which are widely utilized in blowing agents and refrigerants.

- Based on the application, the market is categorized into refrigeration, insulation, and chemical solvent, amongst which refrigeration dominates the market, as the product is adopted as a blowing agent to create polyurethane foam insulation, which enhances the energy efficiency and thermal performance of refrigeration units.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 314.5 Million |

| Market Forecast in 2033 | USD 543.6 Million |

| Market Growth Rate 2025-2033 | 6.21% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Blowing Agent and Refrigerant, Solvent and Reagent |

| Applications Covered | Refrigeration, Insulation, Chemical Solvent |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Haldia Petrochemicals Ltd. (The Chatterjee Group), HCS Group GmbH, INEOS Group Limited, Liaoning Yufeng Chemical Co. Ltd., Maruzen Petrochemical Co. Ltd., MEILONG Cyclopentane Chemical Co. Ltd., Merck KGaA, PureChem Co. Ltd., Trecora Resources, Yeochun NCC Co. Ltd., Zeon Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)