Global Cyber Insurance Market Size Anticipated to Reach USD 73.5 Billion by 2033 - IMARC Group

Global Cyber Insurance Market Statistics, Outlook and Regional Analysis 2025-2033

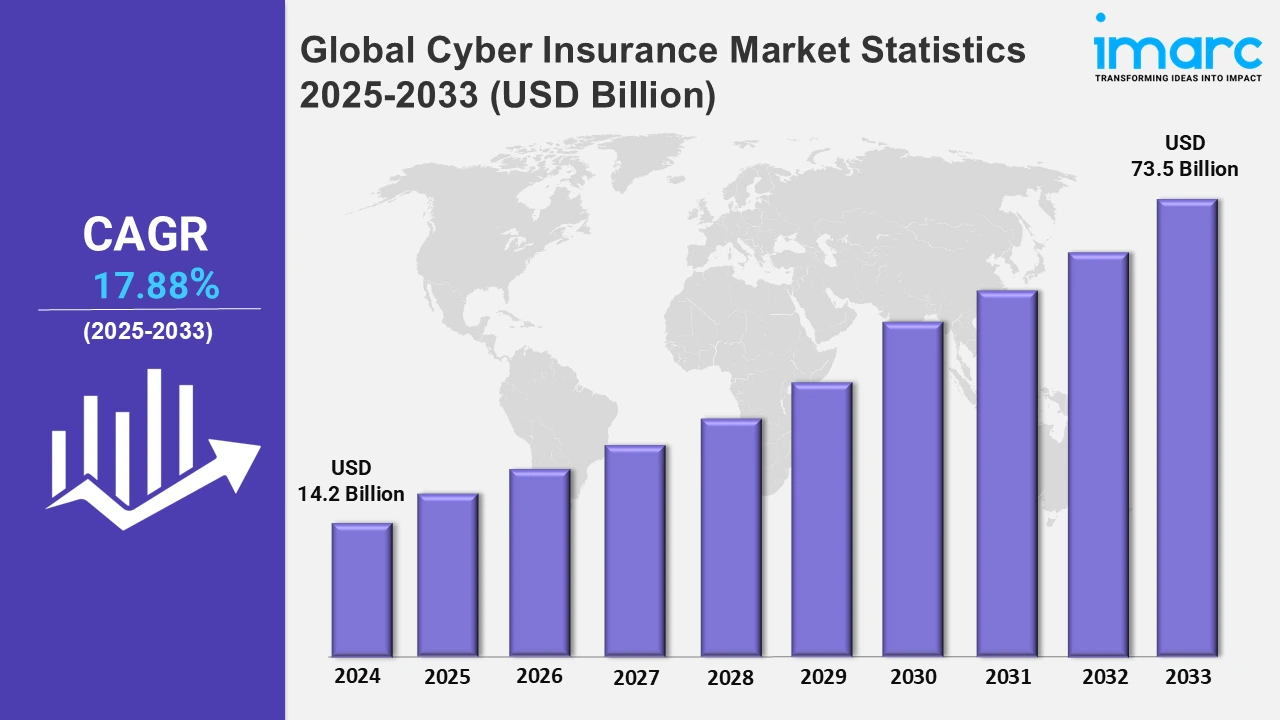

The global cyber insurance market size was valued at USD 14.2 Billion in 2024, and it is expected to reach USD 73.5 Billion by 2033, exhibiting a growth rate (CAGR) of 17.88% from 2025 to 2033. The continuous advancements in cybersecurity measures that influence insurance product development are propelling the market demand. Moreover, the incorporation of the Internet of Things (IoT) in diverse industrial applications and the rising number of connected devices are significantly driving the growth of the market.

To get more information on this market, Request Sample

Increased frequency and advancement in cybercrimes are the major factors that are significantly impacting the market. Recent events such as the SolarWinds cyber-attack and ransomware attack on the Colonial Pipeline Co. depict the impact of these threats and the critical need for cyber insurance. The increased awareness and adoption of cyber insurance among small and medium-sized businesses is resulting in broader market penetration. Besides, the advent of new technologies that enable precise risk assessment and policy customization is creating lucrative opportunities for the players in the market.

Favorable government initiatives encouraging adherence to cybersecurity measures are supplementing the growth of the market. For instance, in April 2024, consumer protections against hacking and cyber-attacks came into force, which states that all internet-connected smart devices will be required by law to meet minimum security standards. Manufacturers will be legally required to protect consumers from hackers and cyber criminals from accessing devices with internet or network connectivity - from smartphones to game consoles and connected fridges. The UK becomes the first country in the world to introduce these laws. Under the new regime, manufacturers will be banned from having weak, easily guessable default passwords and if there is a common password the user will be prompted to change it on start-up.

Global Cyber Insurance Market Statistics, By Region

The market research report has provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and the Middle East and Africa. According to the report, North America accounted for the largest cyber insurance market share, driven by the presence of a significant number of leading technology companies, which are key targets for cyber attacks.In July 2024, Resilience doubled its cyber insurance limit to US$ 20 Million per client with the help of a partnership with Lloyd’s Insurance facility. This initiative was aimed at helping Resilience’s clients and broker partners efficiently build insurance towers, while also increasing the capability to deliver loss prevention solutions to clients. Such initiatives are expanding the market potential in the region.

North America Cyber Insurance Market Trends:

The market in North America is primarily driven by the escalating number of cyber threats, encouraging organizations to seek financial protection against potentially devastating cyber incidents. In line with this, the implementation of stringent state and federal regulations that mandate adherence to specific cybersecurity protocols is providing substantial momentum to the market. Moreover, the continuous integration of technology into daily business operations, coupled with the growing reliance on data and digital platforms, is a significant growth-inducing factor for the market demand.

Asia Pacific Cyber Insurance Market Trends:

The Asia-Pacific cyber insurance market is experiencing rapid growth, driven by increasing digital transformation, rising cyber threats, and stringent regulatory environments across the region. Key trends include a surge in demand for comprehensive policies covering ransomware, data breaches, and business interruptions, particularly among SMEs adopting digital tools. Countries such as China, India, and Australia among others are witnessing advanced technology adoption and strict regulatory mandates. Insurers are leveraging advanced analytics and AI technologies to assess risks and tailor premiums.

Europe Cyber Insurance Market Trends:

The market in Europe is growing steadily, fueled by increasing cyberattacks, stringent data protection regulations, including the GDPR, and a rising emphasis on digital resilience. Businesses across industries are seeking policies that cover ransomware, data breaches, and third-party liabilities. The market is experiencing increased demand from countries, such as the UK, Germany, and France, where cybersecurity concerns are more prominent. Insurers are focusing on risk assessment tools and collaboration with cybersecurity firms to refine coverage and pricing.

Latin America Cyber Insurance Market Trends:

The Latin American market is gaining momentum as the region faces escalating cyberattacks and increasing digitalization across sectors. Governments and businesses are becoming more aware of the need for cyber risk management, especially in countries including Brazil, Mexico, and Argentina, which are experiencing a rise in ransomware attacks and data breaches. Demand is growing for policies that address business interruption and compliance with evolving data protection laws.

Middle East and Africa Cyber Insurance Trends:

The cyber insurance market in the Middle East and Africa is expanding, driven by the region's rapid digital transformation and increasing vulnerability to cyberattacks. High-profile ransomware incidents and growing regulatory frameworks, such as data protection laws in countries including the UAE and South Africa, are pushing businesses to seek insurance coverage. Key sectors, including oil and gas, finance, and telecommunications, are driving the demand for cyber policies addressing data breaches and operational disruptions.

Top Companies Leading in the Cyber Insurance Industry

Some of the leading companies in the cyber insurance market include Allianz Group, American International Group Inc., AON Plc, AXA XL, Berkshire Hathaway Inc., Chubb Limited (ACE Limited), Lockton Companies Inc., Munich ReGroup or Munich Reinsurance Company, Lloyd's of London, and Zurich Insurance Company Limited among others. Many insurers are forming strategic partnerships with cybersecurity companies to offer integrated solutions that combine insurance coverage with preventive measures, security assessments, and incident response services. Furthermore, they are offering educational resources, workshops, and tools to help policyholders understand cyber risks and implement preventive measures, which will positively impact the cyber insurance market growth. For instance, in December 2023, Chubb Limited (ACE Limited) announced an innovative collaboration with NetSPI, a global leader in proactive security, to strengthen the cyber-risk profile of clients via enhanced attack surface management and penetration testing solutions.

Global Cyber Insurance Market Segmentation Coverage

- On the basis of component, the market has been categorized into solution and services. Solution holds the largest market share currently, as it provides businesses with a comprehensive strategy that includes prevention, risk management, response planning, and recovery.

- Based on insurance type, the market has been segmented into packaged and standalone. Stand-alone is the most commonly used technology as it offers holistic protection against an array of cyber threats.

- On the basis of organization size, the market has been bifurcated into small and medium enterprises and large enterprises. Among these, the large enterprises segment dominates the market, as these enterprises operate across international boundaries, subjecting them to various regulatory environments.

- Based on end use industry, the market has been segmented into BFSI, healthcare, IT and telecom, retail, and others. BFSI dominates the market. The increasing reliance on digital platforms for daily operations and managing vast amounts of sensitive customer data has made the BFSI sector a prime target for cybercriminals, which is leading to the rising need for robust cyber protection in the industry.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 14.2 Billion |

| Market Forecast in 2033 | USD 73.5 Billion |

| Market Growth Rate (2025-2033) | 17.88% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Solution, Services |

| Insurance Types Covered | Packaged, Stand-alone |

| Organization Sizes Covered | Small and Medium Enterprises, Large Enterprises |

| End Use Industries Covered | BFSI, Healthcare, IT and Telecom, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allianz Group, American International Group Inc., AON Plc, AXA XL, Berkshire Hathaway Inc., Chubb Limited (ACE Limited), Lockton Companies Inc., Munich ReGroup or Munich Reinsurance Company, Lloyd's of London, Zurich Insurance Company Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Cyber Insurance Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)