Global Crop Protection Chemicals Market Expected to Reach USD 141.7 Billion by 2033 - IMARC Group

Global Crop Protection Chemicals Market Statistics, Outlook and Regional Analysis 2025-2033

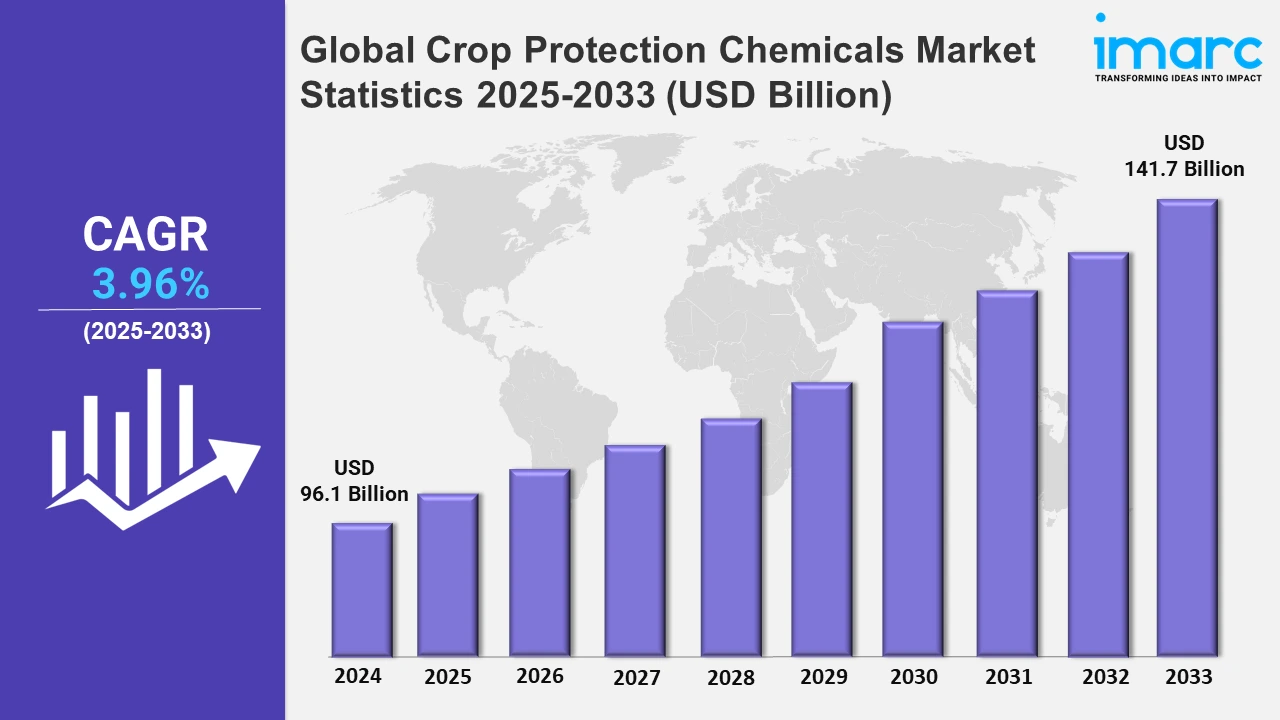

The global crop protection chemicals market size was valued at USD 96.1 Billion in 2024, and it is expected to reach USD 141.7 Billion by 2033, exhibiting a growth rate (CAGR) of 3.96% from 2025 to 2033.

To get more information on this market, Request Sample

Companies in this industry prioritize farmer-centric solutions, with an emphasis on sustainability and innovation. The emphasis is on producing solutions that increase yields and provide strong protection, supported by considerable advances in research and development. For example, in May 2023, Corteva, Inc. showcased its farmer-focused innovations, sustainability-driven initiatives, and industry-leading R&D pipeline advancements during the company's innovation update. Through key product launches, the company is expanding its leadership position in the global seed and crop protection market by continuing to deliver products that increase and protect yield potential for farmers globally.

Moreover, strategic biocontrol technology acquisitions are propelling the sector forward, with a focus on long-term solutions. Companies are increasingly focused on eco-friendly bioinsecticides to provide farmers with efficient, ecologically responsible pest management solutions. For instance, in January 2022, Syngenta acquired two next-generation bioinsecticides, i.e., NemaTrident and UniSpore, to further enhance its biocontrol technology. These developments highlight the company's commitment to providing farmers with advanced and sustainable solutions for crop protection. Furthermore, as agricultural requirements tighten, the crop protection chemicals industry sees growing investment in environmentally friendly solutions. Companies are concentrating on distinctive and biologically based solutions to reduce environmental impact and fulfill changing regulatory requirements. This adjustment is consistent with global environmental goals targeted at minimizing synthetic pesticide use. Additionally, there is substantial potential in the post-harvest crop protection industry, which provides income prospects for businesses concentrating on loss reduction and product shelf life extension. Modern farmers prefer bio-based crop protection alternatives that are both safe and effective. For example, in North America, the use of bio-based pesticides is growing as farmers seek to comply with EPA requirements while preserving production. Companies such as Corteva Agriscience and BASF SE have created bio-fungicides and insecticides to meet this need, allowing for more ecologically responsible pest management in large-scale agricultural operations.

Global Crop Protection Chemicals Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, North America, Europe, Latin America, and the Middle East and Africa. According to the report, North America accounted for the largest crop protection chemicals market share on account of the significant farming activities and a varied range of commodities grown throughout the region.

North America Crop Protection Chemicals Market Trends:

As laws become more stringent, the industry is seeing an increase in the use of biopesticides to decrease environmental effects in North America, making it the dominant region across the market. For example, farmers in the U.S. are increasingly employing bio-based fungicides and insecticides to fulfill more challenging EPA regulations while preserving crop yields.

Europe Crop Protection Chemicals Market Trends:

A major shift toward organic farming is shaping the market in Europe as rules push for a reduction in synthetic chemicals. The European Green Deal's objective of a 50% decrease in chemical pesticide use by 2030 illustrates this dedication to sustainable methods.

Asia Pacific Crop Protection Chemicals Market Trends:

In Asia Pacific, large-scale agriculture, notably in India and China, continues to boost demand for synthetic pesticides. Government efforts that promote food security, such as India's Sub-Mission on Plant Protection and Plant Quarantine, contribute to market growth.

Latin America Crop Protection Chemicals Market Trends:

Precision agricultural technologies are on the rise in Latin America, with Brazil leading the way in merging satellite and drone technology to optimize pesticide application. This method increases productivity while reducing usage and environmental effects, allowing farmers to manage resources more efficiently.

Middle East and Africa Crop Protection Chemicals Market Trends:

The market in the Middle East and Africa continues to rise due to increasing arid-region-resistant crops and accompanying pesticide use. For instance, South Africa focuses on using specific chemical treatments to protect crops from adverse weather conditions, therefore maintaining food production consistency.

Top Companies Leading in the Crop Protection Chemicals Industry

Some of the leading crop protection chemicals market companies include BASF SE, Corteva Agriscience, Sumitomo Chemical Co., Ltd, Syngenta AG, Bayer Cropscience AG, FMC Corporation, Monsanto Company, Nufarm Limited, and ADAMA Agricultural Solutions Ltd., among many others. For example, in November 2020, BASF SE and TECNALIA, a European center for research and technological development, collaborated in digitalization to accelerate the global research and development of new crop protection products.

Global Crop Protection Chemicals Market Segmentation Coverage

- On the basis of the product type, the market has been bifurcated into herbicides, fungicides, insecticides, and others, wherein herbicides represent the most preferred segment. Herbicides provide an effective option for weed management, making them an essential tool for farmers.

- Based on the origin, the market is categorized into synthetic and natural, amongst which synthetic dominates the market. Synthetic chemicals have a wide range of efficacy against different pests, illnesses, and weeds.

- On the basis of the crop type, the market has been divided into cereals and grains, fruits and vegetables, oilseed and pulses, and others. Among these, cereals and grains exhibit a clear dominance in the market. Cereals and grains are staple food crops consumed globally, forming the foundation of many diets.

- Based on the form, the market is bifurcated into liquid and solid, wherein liquid dominates the market. Liquid formulations provide convenience and simplicity of application. They are readily combined, sprayed, and distributed over vast regions, providing for effective crop coverage.

- On the basis of the mode of application, the market is segmented into foliar spray, seed treatment, soil treatment, and others. Currently, foliar spray accounts for the majority of the total market share. The foliar spray provides direct and focused treatment to plant leaves. This kind of treatment enables the efficient and effective distribution of crop protection agents to the foliage, where pests, diseases, and weeds frequently reside.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 96.1 Billion |

| Market Forecast in 2033 | USD 141.7 Billion |

| Market Growth Rate 2025-2033 | 3.96% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Herbicides, Fungicides, Insecticides, Others |

| Origins Covered | Synthetic, Natural |

| Crop Types Covered | Cereal and Grains, Fruits and Vegetables, Oilseed and Pulses, Others |

| Forms Covered | Liquid, Solid |

| Modes of applications Covered | Foliar Spray, Seed Treatment, Soil Treatment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | BASF SE, Corteva Agriscience, Sumitomo Chemical Co., Ltd, Syngenta AG, Bayer Cropscience AG, FMC Corporation, Monsanto Company, Nufarm Limited and ADAMA Agricultural Solutions Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Crop Protection Chemicals Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)