Global Crop Insurance Market Expected to Reach USD 73.8 Billion by 2033 - IMARC Group

Global Crop Insurance Market Statistics, Outlook and Regional Analysis 2025-2033

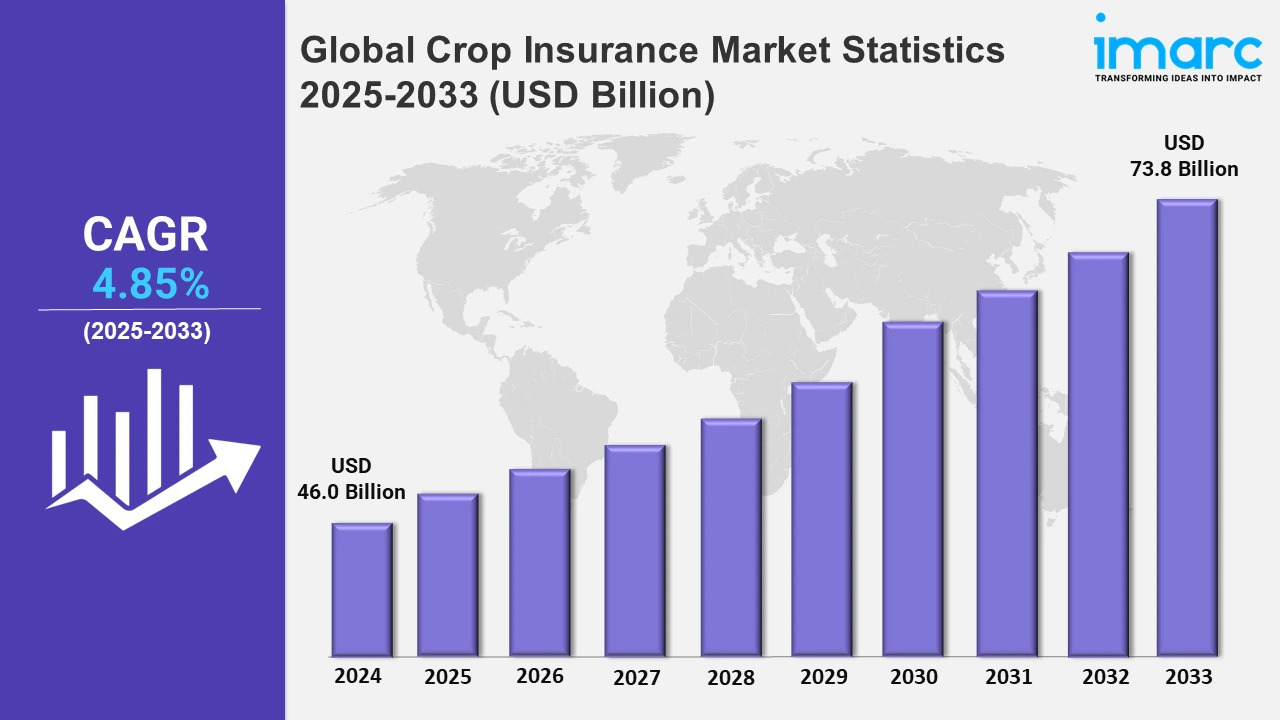

The global crop insurance market size was valued at USD 46.0 Billion in 2024, and it is expected to reach USD 73.8 Billion by 2033, exhibiting a growth rate (CAGR) of 4.85% from 2025 to 2033.

To get more information on the this market, Request Sample

The increasing frequency and severity of extreme weather events, such as droughts, floods, and storms, have heightened the risks to agricultural production. For instance, in August 2024, Tripura's agriculture and allied sectors lost Rs 2,024 Crore due to floods. The deluge left over one lakh people homeless and killed 36 people in total. Also, in November 2024, according to the U.S. Drought Information Portal, all states in the United States except Alaska and Kentucky suffered drought conditions. Over 45% of the country and Puerto Rico were hit by the harsh weather conditions. Drought affected about 150 million people and 318 million acres of crops in these states. Corn, a significant staple crop, experienced the most extensive drought, with 71% of the producing area affected. Farmers are increasingly seeking crop insurance to mitigate potential financial losses resulting from these unpredictable conditions.

Moreover, the governing authorities and the regulatory bodies of various countries are undertaking various initiatives to increase awareness among farmers about the benefits of crop insurance policies. They are also offering premium subsidies to encourage participation in crop insurance programs. For instance, in August 2024, the Central Government released its portion of the premium subsidy under the Pradhan Mantri Fasal Bima Yojana (PMFBY). Under PMFBY, the premium subsidy is shared equally by the Centre and the states. Also, in June 2023, the Meghalaya government provided a 100% subsidy for premium support to farmers under the crop insurance scheme 'Pradhan Mantri Fasal Bima Yojana' for both the kharif and rabi seasons of this fiscal year. To assist farmers in the state in stabilizing their incomes against the risks of crop failure, the government has decided to provide free premium support amounting to Rs 4.4 Crore, covering both kharif and rabi seasons during FY24, whereby the premium for the farmers shall be paid by the state to the extent of 100% of the premium amount. Besides this, the integration of advanced technologies, such as satellite imagery, data analytics, and artificial intelligence, has enhanced risk assessment and claims processing in crop insurance. For instance, in August 2024, during a conference in New Delhi, the Minister of State for Agriculture and Farmers' Welfare of the Government of India launched the Krishi-Decision Support System (Krishi-DSS), a digital geospatial platform. Krishi-DSS is a holistic solution for flood impact assessment, crop insurance, and more. The geospatial platform is specifically built for Indian agriculture and provides complete data access, including satellite imagery, meteorological information, reservoir storage, groundwater levels, and soil health information, all of which can be accessed at any time and from any location.

Global Crop Insurance Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America held the biggest market share. The presence of a competitive private insurance sector alongside government programs enhances choices for farmers and promotes innovation and tailored coverage options. Apart from this, the agricultural heritage of the region cultivates an ingrained understanding of risk management in farming, further driving the demand for crop insurance to protect livelihoods.

North America Crop Insurance Market Trends:

Robust government-backed programs, like the Federal Crop Insurance Corporation (FCIC) in the U.S., provide substantial subsidies and incentives to farmers. This proactive support encourages high adoption rates among North American farmers, which marks the region as the largest across the market. For instance, in July 2023, American Financial Group (AFG) acquired Crop Risk Services (CRS) from AIG. CRS is a primary crop insurance general agent and the seventh-largest multi-peril crop insurer in the United States.

Europe Crop Insurance Market Trends:

The increasing frequency and severity of extreme weather events, such as droughts, floods, and storms, have heightened the vulnerability of European agriculture. For instance, in 2024, Romania faced severe droughts that significantly damaged crop yields, prompting the government to plan a drought insurance scheme for farmers.

Asia Pacific Crop Insurance Market Trends:

Governments in the region are actively promoting crop insurance through subsidies and programs to enhance agricultural resilience. For instance, India's Pradhan Mantri Fasal Bima Yojana (PMFBY) offers subsidized premiums to farmers, encouraging widespread adoption of crop insurance.

Latin America Crop Insurance Market Trends:

Many Latin American countries have implemented strategies to support agricultural insurance through technical assistance. For instance, Brazil and Mexico have substantial government expenditures on agricultural insurance, accounting for 90% of the total regional government support in this sector.

Middle East and Africa Crop Insurance Market Trends:

The increasing frequency of droughts, floods, and other extreme weather conditions has heightened the need for effective risk management solutions among farmers. For instance, in South Africa, the rising awareness about climate dangers has led to a flourishing crop insurance market.

Top Companies Leading in the Crop Insurance Industry

Some of the leading crop insurance market companies include Agriculture Insurance Company of India Limited, AXA SA, Chubb, Farmers Mutual Insurance Agency Inc., FBL Financial Group, Inc, Great American Insurance Company, ICICI Lombard General Insurance Company Limited, Kshema General Insurance Limited, Progressive Ag, Sompo International Holdings Ltd., and Tokio Marine HCC, among many others. For instance, in May 2022, Zurich American Insurance Company's crop insurance division, Rural Community Insurance Services (RCIS), introduced Climate FieldView™ as a precision agriculture provider for its customers.

Global Crop Insurance Market Segmentation Coverage

- On the basis of the coverage, the market has been bifurcated into multi-peril crop insurance (MPCI) and crop-hail insurance, wherein multi-peril crop insurance (MPCI) holds the majority of the market share as it offers protection against a wide range of perils, including adverse weather, pests, diseases, and other unforeseen events.

- Based on the distribution channel, the market is categorized into banks, insurance companies, brokers and agents, and others. The escalating demand for a seamless way for farmers to secure insurance while managing their financial needs is propelling the growth of this segment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 46.0 Billion |

| Market Forecast in 2033 | USD 73.8 Billion |

| Market Growth Rate (2025-2033) | 4.85% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Coverages Covered | Multi-Peril Crop Insurance (MPCI), Crop-Hail Insurance |

| Distribution Channels Covered | Banks, Insurance Companies, Brokers and Agents, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agriculture Insurance Company of India Limited, AXA SA, Chubb, Farmers Mutual Insurance Agency Inc., FBL Financial Group, Inc, Great American Insurance Company, ICICI Lombard General Insurance Company Limited, Kshema General Insurance Limited, Progressive Ag, Sompo International Holdings Ltd., Tokio Marine HCC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)