Global Credit Card Payment Market Expected to Reach USD 1,316.4 Billion by 2033 - IMARC Group

Global Credit Card Payment Market Statistics, Outlook and Regional Analysis 2025-2033

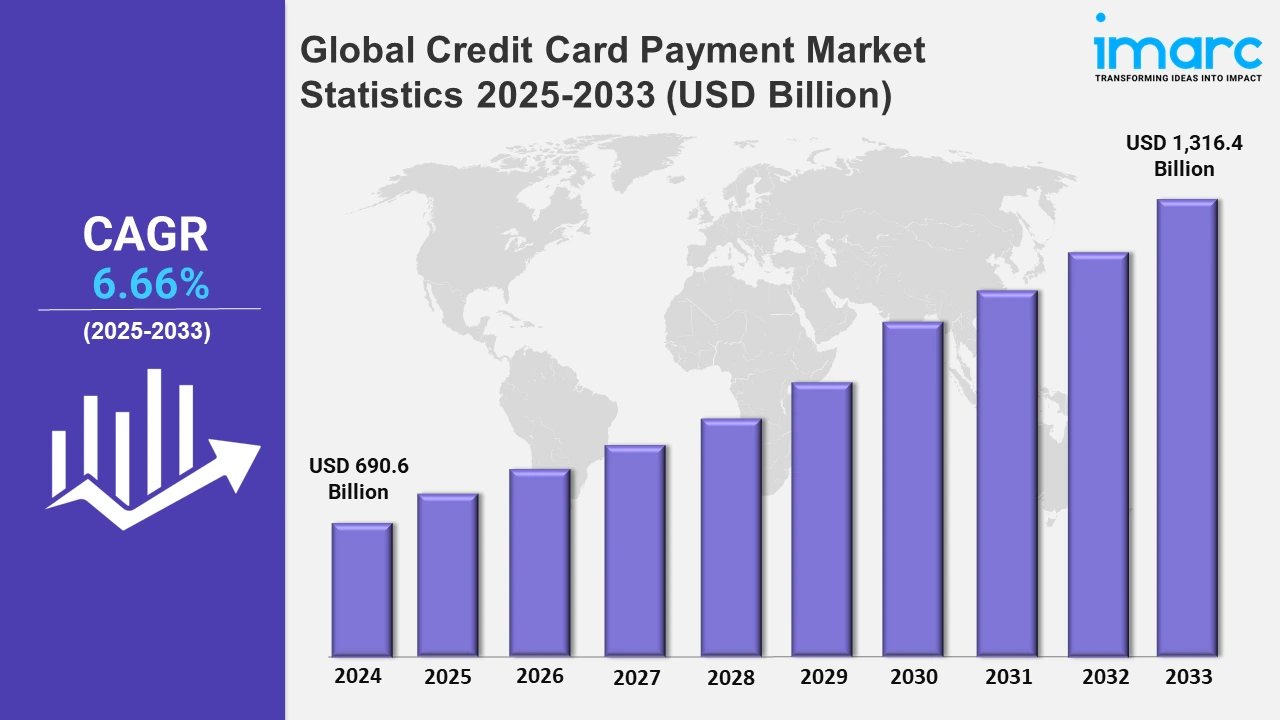

The global credit card payment market size was valued at USD 690.6 Billion in 2024, and it is expected to reach USD 1,316.4 Billion by 2033, exhibiting a growth rate (CAGR) of 6.66% from 2025 to 2033.

To get more information on this market, Request Sample

The continuous advancements in credit card technologies and payment ecosystems are stimulating the credit card payment market. In line with this, financial institutions and fintech companies are introducing innovative products to cater to the specific needs of diverse customer bases, including small businesses and start-ups. For instance, Axis Bank recently launched a corporate credit card suite tailored for start-ups in the New Economy Group (NEG) in September 2024. This suite comprises the executive corporate credit card and the purchase reward credit card, which is designed to streamline expense management, offer personalized perks, such as higher credit limits, and provide rewards for day-to-day transactions. At the same time, in September 2024, Axis Bank launched a corporate credit card suite for start-ups. It partnered with Mastercard to introduce MyBiz, offering tailored financial solutions, enhanced expense management, travel perks, and digital services, addressing the evolving payment needs of SMEs and sole proprietors.

Moreover, the introduction of digital innovations in the payments space is significantly transforming user experiences and boosting the adoption of credit-based solutions. In July 2024, NPCI launched a credit card-like feature on UPI, which allows users to access pre-approved credit lines for in-store purchases. This feature supports a ‘buy now, pay later’ model, enabling customers to manage their finances flexibly without incurring additional fees. Furthermore, these innovations are collectively driving the transformation of the credit payment landscape, thereby enabling greater financial inclusion and operational efficiency. The evolving focus on personalization and flexibility underscores the market's readiness to adapt to changing consumer expectations and technological advancements.

Global Credit Card Payment Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America dominates the credit card payment market due to widespread digital adoption and continuous innovation by financial institutions and fintech companies.

North America Credit Card Payment Market Trends:

North America is the leading region in the market due to its advanced banking infrastructure and strong consumer reliance on credit cards for purchases. The region's market strength is further bolstered by continuous innovation from financial institutions. For example, in October 2024, BMO launched PaySmart in the U.S., a credit card installment plan available via BMO digital banking. Also, the integration of modern digital tools, seamless user experiences, and robust financial ecosystems ensures sustained growth and leadership for North America in the credit card payment sector.

Europe Credit Card Payment Market Trends:

In Europe, the market emphasizes sustainability and digital innovation and countries like Sweden lead in eco-friendly payment solutions and digital wallets linked to credit cards. Moreover, the region also sees a shift towards biometric authentication for secure transactions. For example, Visa has introduced carbon-tracking features on credit cards in the UK, aligning with Europe's push for green financial practices.

Asia-Pacific Credit Card Payment Market Trends:

Asia-Pacific experiences rapid adoption of contactless and QR-code-based credit card payments, driven by markets like India and China. In contrast, the rising penetration of mobile wallets integrated with credit cards boosts convenience, which is augmenting the market across the region. For instance, India's RuPay credit cards are now linked to the Unified Payments Interface (UPI), thereby enabling seamless transactions across digital and retail platforms.

Latin America Credit Card Payment Market Trends:

In Latin America, the market focuses on financial inclusion and digital accessibility. Also, Brazil spearheads the growth with the increasing use of virtual credit cards for e-commerce. For instance, startups like Nubank offer flexible credit options and digital-only cards, catering to unbanked populations. This trend highlights the region's push to modernize financial services and support underserved demographics in accessing credit. This, in turn, will continue to bolster the market in Latin America over the forecasted period.

Middle East and Africa Credit Card Payment Market Trends:

The Middle East and Africa region is witnessing growth in cross-border credit card transactions and Sharia-compliant cards. In the UAE, banks like Emirates NBD offer cards tailored for international use with added travel rewards, thereby addressing the needs of a globalized economy. Furthermore, this trend reflects the region’s increasing focus on catering to expatriates and frequent travelers, boosting credit card adoption.

Top Companies Leading in the Credit Card Payment Industry

Some of the leading credit card payment market companies include American Express Company, Bank of America Corporation, Barclays Bank UK PLC, Capital One, Citigroup Inc, ICICI Bank Ltd, JPMorgan Chase & Co., Mastercard Incorporated, Synchrony Bank, The PNC Financial Services Group, Inc., and Visa Inc., among many others. In December 2023, Mastercard Inc. partnered with Samsung Electronics on a newly launched Mastercard program, which is known as Wallet Express. The service provides banks and card issuers with a quick and cost-effective means of expanding their digital wallet offerings. The partnership allows issuers to integrate Samsung Wallet into their services, thereby providing users with a versatile range of payment options.

Global Credit Card Payment Market Segmentation Coverage

- On the basis of the card type, the market has been bifurcated into general purpose credit cards, specialty credit cards, and others, wherein general purpose credit cards represent the most preferred segment. General purpose credit cards are versatile cards that can be used in a wide range of transactions.

- Based on the provider, the market is categorized into visa, mastercard, and others, amongst which visa dominates the market. It operates a vast network that connects financial institutions, merchants, and individuals, enabling secure and convenient payments.

- On the basis of the application, the market has been divided into food and groceries, health and pharmacy, restaurants and bars, consumer electronics, media and entertainment, travel and tourism, and others, among which food and groceries dominate the segment. Credit cards are widely used for purchasing food items in grocery stores and restaurants.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 690.6 Billion |

| Market Forecast in 2033 | USD 1,316.4 Billion |

| Market Growth Rate 2025-2033 | 6.66% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Card Types Covered | General Purpose Credit Cards, Specialty Credit Cards, Others |

| Providers Covered | Visa, Mastercard, Others |

| Applications Covered | Food and Groceries, Health and Pharmacy, Restaurants and Bars, Consumer Electronics, Media and Entertainment, Travel and Tourism, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | American Express Company, Bank of America Corporation, Barclays Bank UK PLC, Capital One, Citigroup Inc, ICICI Bank Ltd, JPMorgan Chase & Co., Mastercard Incorporated, Synchrony Bank, The PNC Financial Services Group, Inc., Visa Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)