Global Craft Beer Market Size Anticipated to Reach USD 329.7 Billion by 2033 - IMARC Group

Global Craft Beer Market Statistics, Outlook, and Regional Analysis 2025-2033

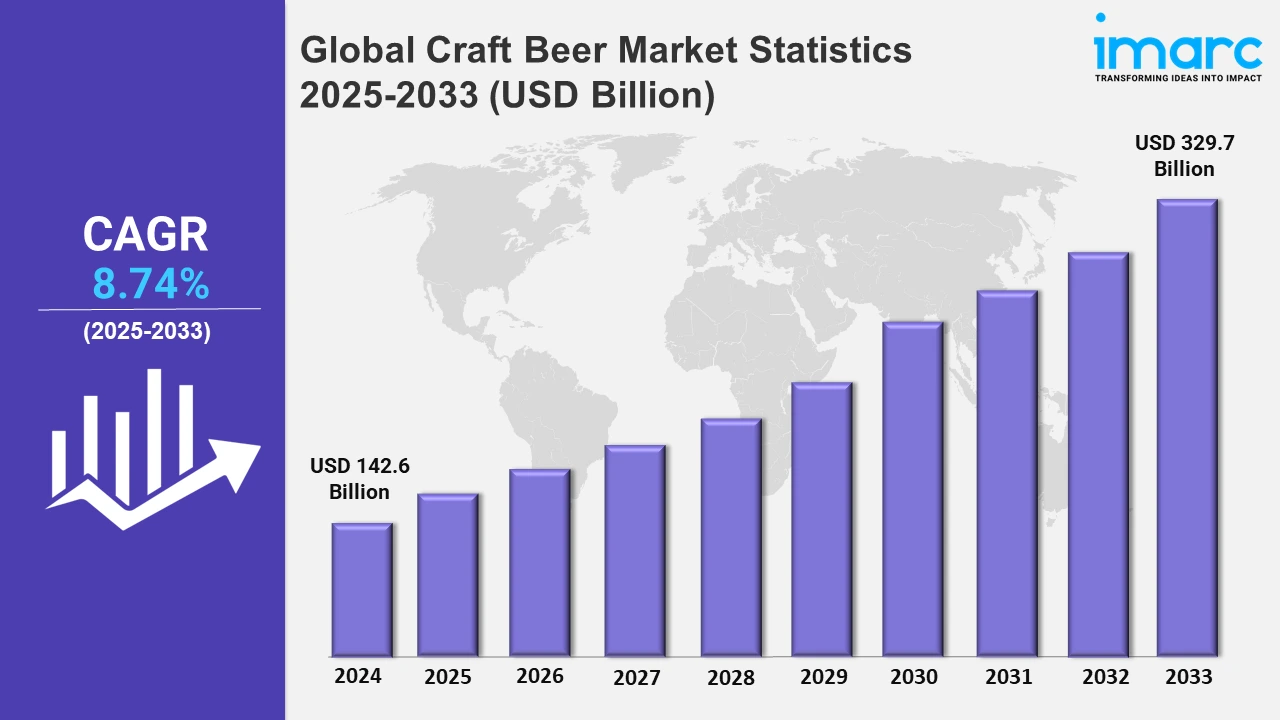

The global craft beer market size was valued at USD 142.6 Billion in 2024, and it is expected to reach USD 329.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.74% from 2025 to 2033.

To get more information on this market, Request Sample

Green packaging solutions in the craft beer industry involve using materials that are recyclable, biodegradable, and made from renewable resources. One of the most common green packaging options is aluminum cans, which are lighter, more cost-efficient to transport, and fully recyclable. Cans have a lower environmental impact compared to glass bottles, which makes them a preferred choice for craft breweries aiming to reduce their carbon footprint. Breweries are using biodegradable labels and plant-based inks that are easier to recycle, further reducing waste and the environmental impact of their packaging. Green packaging reduces excessive plastic and unnecessary packaging materials to lower waste. Consumers are choosing craft beer brands that share their values. Breweries that adopt green packaging can build strong and loyal customer bases, further fueling the market growth. As per the IMARC Group’s report, the global green packaging market is expected to reach USD 415.3 Billion by 2033.

The rise of e-commerce is making craft beer more accessible and available in the marketplace, which is having a favorable influence on the market. E-platforms enable craft brewers to sell their products outside the local market to national and even international customers. With e-commerce, small or independent brewers have access to beer lovers from other regions. E-commerce channels allow people to search, select and buy craft beers without leaving their houses. They provide beer subscription and beer boxes in which customers are enabled to try various beer styles and breweries according to their preferences. Craft breweries can market better by selling directly to customers that lead to better margins, improved brand control, and chances to create stronger ties with customers. Raw advertising and social marketing let breweries pull small audiences to sell out and build engagement with their customers. Craft breweries use e-commerce platforms to showcase their stories, brewing processes, and unique selling points, which is supporting the market growth. The IMARC Group’s report shows that the global e-commerce market is expected to reach USD 214.5 Trillion by 2033.

Global Craft Beer Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe accounts for the largest market share on account of its rich brewing heritage, increasing demand for artisanal products, and widespread presence of craft-focused pubs and festivals.

Europe Craft Beer Market Trends:

Europe enjoys the leading position in the market due to the growing demand for artisanal beverages and diverse beer culture. Countries like Belgium, Germany, and the UK have long histories of beer production, which provide a strong foundation for craft breweries. Consumers are shifting towards high-quality and small-batch beers, valuing unique flavors and traditional brewing methods. Europe’s established beer distribution networks, including numerous craft beer-focused bars, pubs, and festivals, provide craft breweries with strong outlets for their products. Moreover, the thriving food and beverages (F&B) industry is encouraging beer pairing and innovations in taste, which is fueling the market growth. According to the IMARC Group’s report, the Europe craft beer market is projected to exhibit a growth rate (CAGR) of 6.57% during 2024-2032.

North America Craft Beer Market Trends:

On account of the growing demand for innovative and diverse beer styles, with consumers embracing experimental flavors, seasonal offerings, and locally sourced ingredients, North America accounts for a sizeable portion of the craft beer industry. The United States and Canada have thousands of microbreweries and brewpubs, which attracts regular and new drinkers. Moreover, taproom experiences, beer festivals, and direct-to-consumer (DTC) sales are fueling the market growth.

Asia-Pacific Craft Beer Market Trends:

The market for craft beer in the Asia-Pacific region is distinguished by rapid urbanization, rising disposable incomes, and changing consumer preferences. Countries like China, Japan, Australia, and India are experiencing an increasing adoption of premium and artisanal beers, particularly among young and affluent consumers.

Latin America Craft Beer Market Trends:

The market for craft beer is expanding gradually in Latin America, as consumers are shifting their preferences from traditional mass-market beers towards premium and handcrafted alternatives. Countries, such as Brazil, Mexico, and Argentina, are experimenting with locally inspired flavors and adopting sustainable brewing practices.

Middle East and Africa Craft Beer Market Trends:

Owing to the rising demand for premium and non-traditional beer options, the Middle East and Africa region is enjoying craft beer market expansion. Craft brewers are emphasizing on sustainability and using unique local ingredients, such as African botanicals, to create distinct flavors.

Top Companies Leading in the Craft Beer Industry

Some of the leading craft beer market companies include Bell’s Brewery, D.G. Yuengling & Son, Inc., Dogfish Head Craft Brewery, Duvel Moortgat, Minhas Craft Brewery, New Belgium Brewing Company, Oskar Blues Brewery, Sierra Nevada Brewing Co., Stone Brewing, The Boston Beer Company, and The Gambrinus Company, among many others. In December 2024, Sierra Nevada Brewing Co. announced the launch of Trail Pass Non-Alcoholic (NA) Variety Pack, which is the first nationally available variety pack of NA brews. This innovation aims to enhance the availability of flavorful NA breweries and expand the capabilities of food and beverage (F&B) industry.

Global Craft Beer Market Segmentation Coverage

- On the basis of the product type, the market has been categorized into ales, lagers, and others, wherein ales represent the leading segment due to their versatility, rich flavors, and historical significance in brewing. Ales are known for their complex flavors, which can range from fruity and sweet to bitter and spicy. Ales offer shorter fermentation times than lagers, enabling small breweries to produce diverse offerings quickly. Craft breweries focus on ales, including pale ales and stouts, as these styles allow for greater experimentation with ingredients and flavor profiles. The wholesome and complex taste of ales appeal to craft beer enthusiasts seeking unique experiences. Additionally, ales are associated with traditional brewing methods, which resonate with consumers prioritizing authenticity, artisanal quality, and innovations.

- Based on the age group, the market has been classified into 21-35 years old, 40-54 years old, and 55 years and above, amongst which 21-35 years old dominate the market because they like trying new flavors and seeking unique and high-quality beverages. Young consumers value the artisanal nature of craft beer and are drawn to its association with local production, sustainability, and creative branding. They are engaging in social experiences, such as visiting breweries, attending beer festivals, and sharing their experiences online, which is impelling the market growth.

- On the basis of the distribution channel, the market has been bifurcated into on-trade and off-trade. Among these, on-trade accounts for the majority of the market share owing to its critical role in providing immersive drinking experiences. On-trade allows consumers to sample a variety of craft beers, interact directly with brewers, and enjoy the social atmosphere, enhancing the appeal of craft beer. Taprooms and brewpubs act as marketing hubs, which showcase seasonal and experimental offerings that might not be available through other channels. The culture of beer appreciation, along with the increasing trend of pairing craft beer with food products, is making on-trade channels the preferred choice for craft beer enthusiasts.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 142.6 Billion |

| Market Forecast in 2033 | USD 329.7 Billion |

| Market Growth Rate 2025-2033 | 8.74% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21-35 Years Old, 40-54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Bell’s Brewery, D.G. Yuengling & Son, Inc., Dogfish Head Craft Brewery, Duvel Moortgat, Minhas Craft Brewery, New Belgium Brewing Company, Oskar Blues Brewery, Sierra Nevada Brewing Co., Stone Brewing, The Boston Beer Company, The Gambrinus Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Craft Beer Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)