Global Corporate Wellness Market Size to reach USD 128.2 Billion by 2033 - IMARC Group

Global Corporate Wellness Market Statistics, Outlook and Regional Analysis 2025-2033

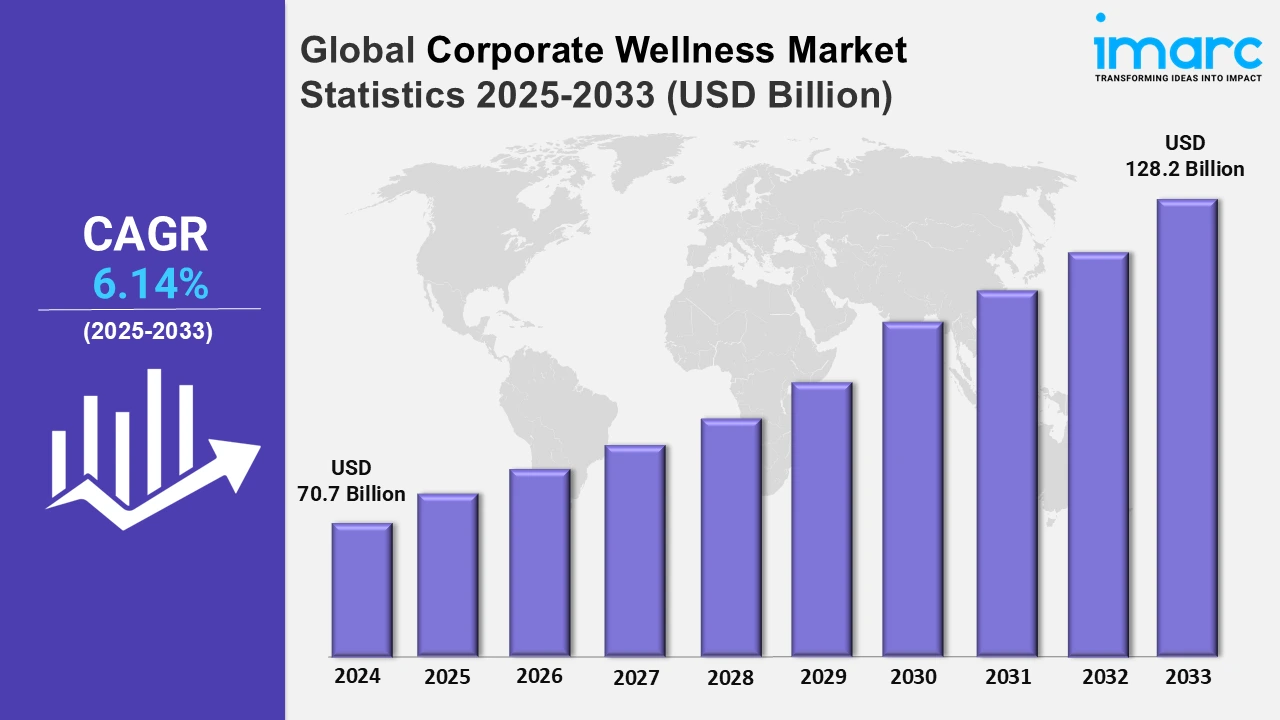

The global corporate wellness market size was valued at USD 70.7 Billion in 2024, and it is expected to reach USD 128.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.14% from 2025 to 2033.

To get more information on this market, Request Sample

The corporate wellness market is experiencing substantial growth driven by the adoption of digital health platforms. Companies are now leveraging apps and online tools to offer personalized wellness programs, monitor employee progress, and provide real-time feedback. These platforms support activities such as mental health coaching, guided exercise routines, and nutritional advice, boosting engagement and accessibility. MediBuddy’s partnership with Bank of Baroda, announced on August 20, 2024, exemplifies this trend, introducing a comprehensive, cashless healthcare initiative including annual checkups and lab services for employees. This move emphasizes enhancing employee health, satisfaction, and productivity. Digital health solutions allow employees to access wellness programs from any location, fitting well with remote and hybrid work arrangements. The platforms also provide data-driven insights, helping employers customize wellness initiatives based on individual needs. Their scalability and cost-effectiveness make digital wellness solutions attractive to companies of all sizes aiming to prioritize employee well-being.

Growing awareness regarding mental health and its impact on productivity is driving companies to integrate mental health programs into their corporate wellness initiatives. Employers recognize that stress, anxiety, and burnout can reduce performance and increase turnover. Consequently, higher investment in mental health support services such as counseling, mindfulness sessions, and stress management workshops is expected to rise. Notably, on March 7, 2024, Goldman Sachs introduced mandatory virtual mental health training for vice presidents and higher, with a one-month completion deadline. The 25-minute course instructs managers on identifying and addressing employee concerns, highlighting the company's commitment to mental health support and corporate wellness. Programs often feature access to professional mental health experts and broader wellness strategies, fostering a culture that normalizes mental health conversations and promotes a supportive workplace.

Global Corporate Wellness Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its advanced healthcare infrastructure, strong employer focus on employee well-being, and widespread adoption of wellness programs and technologies.

North America Corporate Wellness Market Trends:

The corporate wellness market in North America is fueled by a strong focus on comprehensive wellness programs and advanced digital health solutions. Significant investments in mental health support and personalized services, backed by a robust healthcare infrastructure, are key drivers. On September 10, 2024, EGYM, a global fitness technology provider, acquired FitReserve to enhance its Wellpass corporate wellness platform in the U.S., expanding its reach with nearly 2,000 studio partners and 600,000 fitness classes. This strategic move strengthens EGYM's foothold in the $20 billion North American corporate wellness market. Companies continue to adopt holistic approaches to augment employee productivity and satisfaction.

Asia-Pacific Corporate Wellness Market Trends:

The Asia-Pacific corporate wellness market is experiencing rapid growth due to increasing awareness of employee well-being and the rising prevalence of lifestyle-related health issues. As a result, companies are integrating wellness initiatives to reduce absenteeism and enhance workforce performance. Continual technological advancements and the adoption of digital health platforms are facilitating the development of scalable and cost-effective wellness programs across the region’s diverse workforce.

Europe Corporate Wellness Market Trends:

Europe's market is shaped by a strong regulatory environment and growing emphasis on work-life balance. Employers are investing in comprehensive wellness programs focusing on physical health, mental well-being, and preventive care. The emerging trend of remote and hybrid work is accelerating the increasing adoption of digital wellness solutions, and there is increasing collaboration between corporate entities and healthcare providers to improve employee health initiatives.

Latin America Corporate Wellness Market Trends:

In Latin America, the corporate wellness market is gradually expanding as employers increasingly recognize the impact of employee health on productivity and company culture. The region is seeing a rise in programs addressing stress management, fitness, and mental health support. Limited healthcare infrastructure challenges are being met with innovative, cost-effective solutions, including virtual wellness programs to broaden accessibility across the workforce.

Middle East and Africa Corporate Wellness Market Trends:

Awareness of workplace well-being is increasing in the Middle East and Africa, leading to growth in the market. Businesses are starting to integrate wellness programs that consist of stress management, physical fitness activities, and health screenings. Economic inequalities are leading to the development of creative and adaptable solutions, such as mobile health apps and collaborations with wellness providers, to encourage a healthier workplace.

Top Companies Leading in the Corporate Wellness Industry

Some of the leading corporate wellness market companies include Central Corporate Wellness, ComPsych Corporation, EXOS Works, Inc., Marino Wellness, Privia Health, Provant Health Solutions, SOL Wellness LLC, Truworth Health Technologies Pvt. Ltd., Virgin Pulse, Vitality Health, Wellness Corporate Solutions LLC, Wellsource Inc., among many others. On February 07, 2024, Virgin Pulse and HealthComp, merged since November, are rebranding as Personify Health, integrating wellness, health plan administration, and personalized health navigation. Serving over 18 million lives, they plan to reach 40 million by 2027. The $3 billion merger aims to improve health outcomes and reduce costs for members and employers.

Global Corporate Wellness Market Segmentation Coverage

- On the basis of the service, the market has been categorized into health risk assessment, fitness, smoking cessation, health screening, nutrition and weight management, stress management, and others, wherein health risk assessment represents the leading segment. This dominance can be attributed to it serving as the foundation for personalized wellness programs. By pinpointing possible health hazards, these evaluations help employers create focused programs to enhance employee wellness and avoid expensive health problems. Their capacity to offer practical insights for both employers and employees makes them a vital part of corporate wellness plans.

- Based on the category, the market is classified into fitness and nutrition consultants, psychological therapists, and organizations/employers, amongst which organizations/employers dominate the market as they are key drivers of wellness program implementation to enhance employee productivity and satisfaction. With a vested interest in reducing healthcare costs and turnover rates, employers invest heavily in comprehensive wellness initiatives, including physical, mental, and preventive care, positioning them as primary stakeholders in the market.

- On the basis of the delivery, the market has been divided into onsite and offsite, wherein onsite represented the largest segment. Onsite plays a crucial role in the market by directly affecting employee engagement and well-being. On-location wellness programs provide individualized, convenient access to health services such as exercise sessions, therapy, and health assessments, promoting a nurturing work atmosphere. This interactive method promotes involvement, cuts down on missing work, and increases efficiency, making it a top choice for holistic health programs.

- On the basis of the organization size, the market is categorized into small scale organizations, medium scale organizations, and large-scale organizations. Among these, large scale organizations account for the majority of the market share, due to their substantial resources, enabling investment in comprehensive corporate wellness programs and advanced technologies. These companies often have the infrastructure to implement multi-platform wellness strategies, enhancing employee engagement and productivity. Their significant budgets also allow partnerships with leading wellness providers, ensuring tailored programs that cater to diverse employee needs across various regions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 70.7 Billion |

| Market Forecast in 2033 | USD 128.2 Billion |

| Market Growth Rate (2025-2033) | 6.14% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition and Weight Management, Stress Management, Others |

| Categories Covered | Fitness and Nutrition Consultants, Psychological Therapists, Organizations/Employers |

| Deliveries Covered | Onsite, Offsite |

| Organization Sizes Covered | Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Central Corporate Wellness, ComPsych Corporation, EXOS Works, Inc., Marino Wellness, Privia Health, Provant Health Solutions, SOL Wellness LLC, Truworth Health Technologies Pvt. Ltd., Virgin Pulse, Vitality Health, Wellness Corporate Solutions LLC, Wellsource Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)