Global Contract Packaging Market Expected to Reach USD 140.2 Billion by 2033 - IMARC Group

Global Contract Packaging Market Statistics, Outlook and Regional Analysis 2025-2033

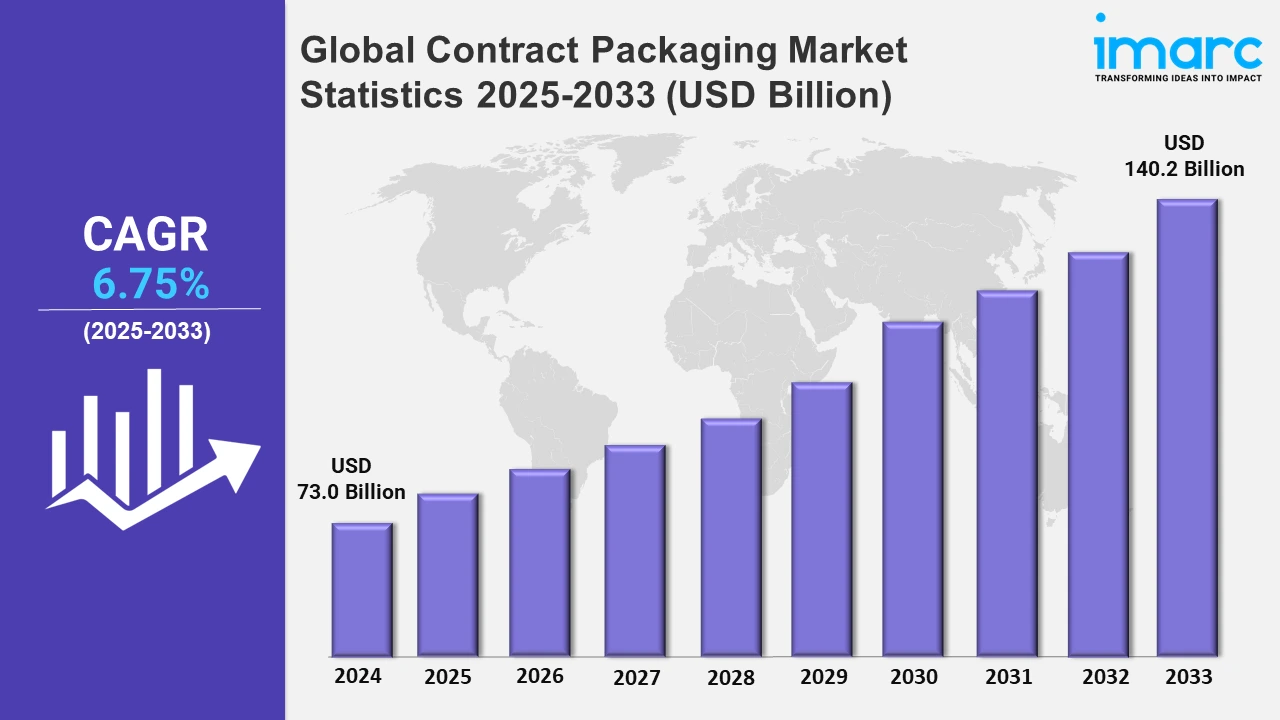

The global contract packaging market size was valued at USD 73.0 Billion in 2024, and it is expected to reach USD 140.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.75% from 2025 to 2033.

To get more information on the this market, Request Sample

The rapid expansion of the e-commerce industry is a significant driver of growth in the contract packaging market. For instance, according to IMARC, the global e-commerce market size reached US$ 21.1 Trillion in 2023. Looking forward, IMARC Group expects the market to reach US$ 183.8 Trillion by 2032, exhibiting a growth rate (CAGR) of 27.16% during 2024-2032. E-commerce requires packaging solutions that ensure product safety during transit, are cost-effective, and provide a positive unboxing experience for customers. Contract packaging companies offer tailored solutions to meet these specific needs. Additionally, the fluctuating nature of e-commerce sales necessitates packaging operations that can scale up or down efficiently. Contract packagers provide the flexibility to adjust production volumes in response to market demands, helping businesses manage resources effectively.

As consumers become more environmentally conscious, there is a rising demand for sustainable and eco-friendly packaging options. For instance, according to a report by Drapers, UK consumers' demand for sustainable packaging has significantly increased. 64% are more likely to buy from retailers who offer sustainable packaging. 50% of consumers are willing to pay more for ecological packaging and delivery. Many brands are actively seeking contract packaging companies that offer sustainable packaging solutions to align with their environmental commitments. This increasing demand for sustainable packaging is creating new opportunities for contract packagers to expand their service offering and cater to a broader client base. Sustainable packaging allows brands to differentiate themselves in a competitive market by showcasing their commitment to environmental stewardship. Companies that partner with contract packagers offer sustainable options that enhance their brand reputation and appeal to environmentally conscious consumers, leading to increased brand loyalty and positive word-of-mouth marketing. For instance, in September 2023, Mondi, a sustainable packaging and paper company, introduced paper-packed dry rice to the UK for the first time in collaboration with award-winning rice supplier Veetee. Veetee's new rice packaging was built with Mondi's FunctionalBarrier Paper, which provides a safe, secure, and durable alternative to industry-standard plastic packs. Veetee and Mondi are the first in the UK to introduce a paper-based alternative for dry rice, designed in response to consumer demand for more environmentally friendly packaging.

Global Contract Packaging Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America held the biggest market share due to the rising focus on outsourcing various operations among businesses to reduce labor costs and eliminate the requirement of investing in in-house facilities.

North America Contract Packaging Market Trends:

The rising consumption of organic packaged food and beverage items is supporting the growth of the market, making North America the largest region. For instance, according to Statista, in 2021, the U.S. consumption of organic packaged food was nearly US$ 21.26 Billion, and it is expected to exceed US$ 25 Billion by 2025. In addition, the increasing demand for eco-friendly packaging in various sectors is contributing to the growth of the market.

Europe Contract Packaging Market Trends:

The rapid growth of e-commerce has increased the demand for efficient and customized packaging solutions. There has been a significant surge in the number of people shopping online. For instance, according to Statista, by 2022, more than half a billion people in Europe were expected to purchase online. Consumers' preference for online shopping has prompted companies to outsource packaging services to meet the surge in demand.

Asia Pacific Contract Packaging Market Trends:

Countries like Australia across the Asia Pacific are experiencing strong growth in co-packaging services, owing to considerable advancements and investments from the pharmaceutical industry. For example, PCI Pharma Services (PCI) acquired Pharmaceutical Packaging Professionals (PPP), a prominent provider of packaging, storage, distribution, and trial production services in Australia. This is further propelling the market’s growth.

Latin America Contract Packaging Market Trends:

Governments in Latin America are implementing stricter packaging and labeling regulations, particularly for food and pharmaceutical products. For instance, in September 2022, Argentina introduced comprehensive food policy laws requiring clear labeling of ultra-processed products. Such regulations are broadening the scope of contract packaging services as companies seek compliance assistance.

Middle East and Africa Contract Packaging Market Trends:

The beverage sector's growth has spurred demand for contract packaging, especially for bottling and filling services. Manufacturers are focusing on core activities and relying on packaging vendors for efficient solutions. For instance, in January 2023, StrongPack, a Nigerian co-packer of non-alcoholic beverages, installed a high-speed PET water line capable of producing 86,000 bottles per hour, marking its entry into the still water co-packing market.

Top Companies Leading in the Contract Packaging Industry

Some of the leading contract packaging market companies include Aaron Thomas Company, Inc., ActionPak Inc, Assemblies Unlimited, Inc., Co-Pak Packaging Corporation, Kelly Products Incorporated, Marsden Packaging, Multi-Pack Solutions LLC, ProStar Contract Packaging, Reed-Lane, Inc., Silgan Unicep, Sonic Packaging Industries, Sterling Contract Packaging, Inc, and We Pack Logistics, among many others. For instance, in November 2023, Aaron Thomas Company, Inc., a packaging services provider, opened a 420,000 square foot contract packaging, storage, and distribution facility in Lockport, Illinois.

Global Contract Packaging Market Segmentation Coverage

- On the basis of the packaging type, the market has been bifurcated into primary, secondary, and tertiary, wherein primary represented the largest segment, owing to the increased demand for secure, sustainable, and visually appealing packaging tailored for shipping.

- Based on the material, the market is categorized into plastic, metal, glass, and paper and paperboard, amongst which plastic accounted for the largest market share. Plastic packaging provides a high level of durability and protection for products. It can resist impact, moisture, and other environmental factors, safeguarding the product during transit and storage, further acting as a growth-inducing factor.

- On the basis of the service, the market has been divided into bottling, bagging/pouching, lot/batch and date coding, boxing and cartooning, wrapping and bund, labelling, clamshell and blister, and others. Among these, bottling accounted for the largest market share. Contract bottling allows brands to avoid upfront costs and opt for a more cost-effective solution by outsourcing to experienced packagers who already have the necessary infrastructure in place, further propelling the segment’s growth.

- Based on the end use industry, the market is bifurcated into food and beverage, pharmaceutical, electronics, personal care, and others, wherein food and beverage accounted for the largest market share owing to the fluctuations in demand due to seasonality, promotions, or product launches.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 73.0 Billion |

| Market Forecast in 2033 | USD 140.2 Billion |

| Market Growth Rate (2025-2033) | 6.75% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Packaging Types Covered | Primary, Secondary, Tertiary |

| Materials Covered | Plastic, Metal, Glass, Paper and Paperboard |

| Services Covered | Bottling, Bagging/Pouching, Lot/Batch and Date Coding, Boxing and Cartoning, Wrapping and Bund, Labelling, Clamshell and Blister, Others |

| End Use Industries Covered | Food and Beverage, Pharmaceuticals, Electronics, Personal Care, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aaron Thomas Company, Inc., ActionPak Inc, Assemblies Unlimited, Inc., Co-Pak Packaging Corporation, Kelly Products Incorporated, Marsden Packaging, Multi-Pack Solutions LLC, ProStar Contract Packaging, Reed-Lane, Inc., Silgan Unicep, Sonic Packaging Industries, Sterling Contract Packaging, Inc, We Pack Logistics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)