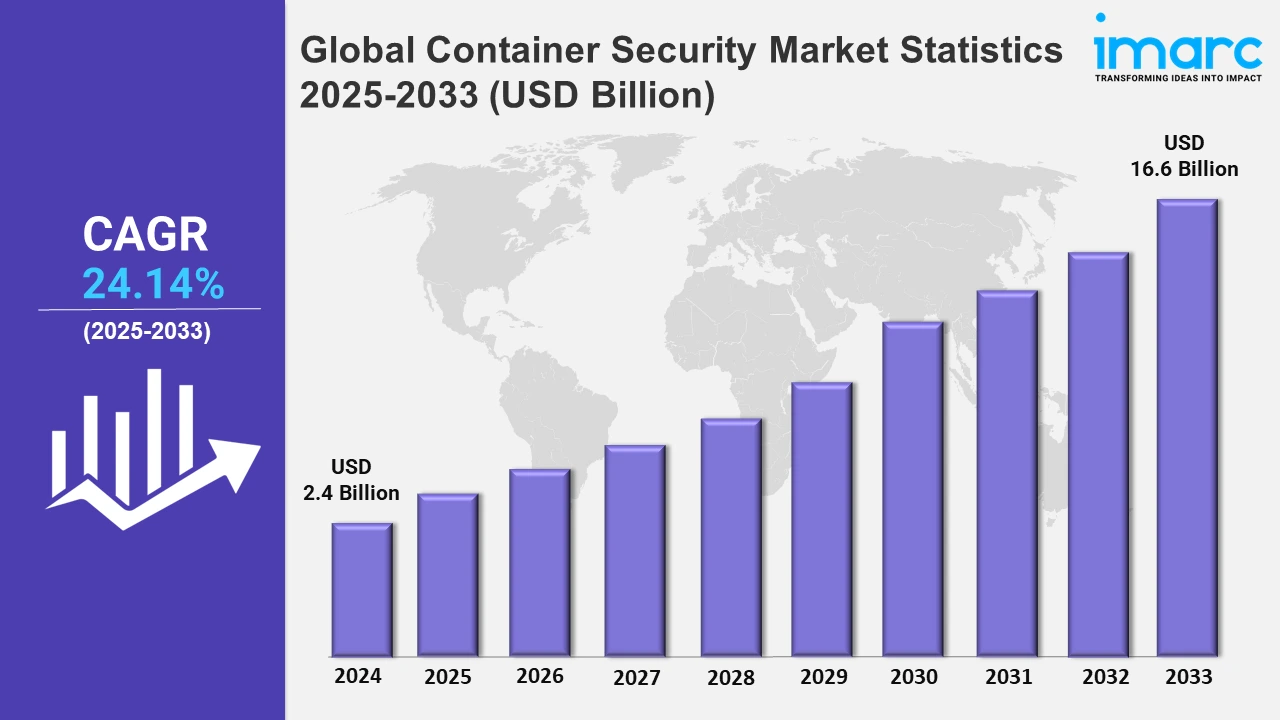

Global Container Security Market Expected to Reach USD 16.6 Billion by 2033 - IMARC Group

Global Container Security Market Statistics, Outlook and Regional Analysis 2025-2033

The global container security market size was valued at USD 2.4 Billion in 2024, and it is expected to reach USD 16.6 Billion by 2033, exhibiting a growth rate (CAGR) of 24.14% from 2025 to 2033.

To get more information on this market, Request Sample

The growing need for robust container security solutions is one of the significant drivers of the market. In addition, organizations are increasingly adopting containerized applications for their scalability and efficiency, which is also bolstering the global market. Key players in the market are addressing these concerns through innovations that enhance threat detection and mitigation processes. For instance, in August 2024, Checkmarx introduced its advanced container security solution within the Checkmarx One platform. This integration, which includes Sysdig runtime insights, image scanning, malicious package detection, and base image remediation, aims to reduce vulnerabilities by up to 40%. Such developments highlight the industry's shift toward embedding security within developer workflows, thereby streamlining the process of securing containerized environments.

Besides this, the widespread usage of artificial intelligence in container security is shaping the market's growth. For example, in December 2024, Nvidia unveiled its NIM Agent Blueprint, leveraging AI tools like Morpheus, cuVS, and RAPIDS to automate real-time threat detection and accelerate vulnerability analysis. This innovation has reduced Common Vulnerabilities and Exposures (CVE) analysis time to seconds, which is significantly enhancing the security of containerized systems. Furthermore, the use of AI improves detection accuracy as well as enables faster responses to potential threats, thereby underscoring the pivotal role of AI in modern container security frameworks. Meanwhile, enterprises increasingly adopt Kubernetes for orchestrating containerized applications and securing these deployments becomes paramount. Addressing this need, Picus Security launched Kubernetes validation for its platform in May 2024. This addition helps organizations identify and rectify security issues, including misconfigurations, across both on-premises and cloud environments. Picus Security is contributing to the overall reliability of containerized systems by making Kubernetes safer and more manageable, further driving the adoption of these technologies.

Global Container Security Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America dominates the market due to its robust trade infrastructure, stringent regulatory frameworks, and significant investments in advanced security technologies.

North America Container Security Market Trends:

North America is dominating the market, driven by the region's emphasis on safeguarding goods during transit, which has led to the widespread adoption of smart monitoring solutions. Innovations like ORBCOMM's dry container monitoring solution, launched in November 2024, further strengthen this dominance. This technology provides shipping lines with enhanced visibility and cargo integrity by addressing critical issues, including fire risks, unauthorized access, and cargo damage. Moreover, with San Francisco and other key port cities leveraging such advancements, North America remains at the forefront of addressing container security challenges.

Europe Container Security Market Trends:

Europe is increasingly prioritizing advanced container security solutions to safeguard supply chain operations. Countries like Germany are adopting AI-driven systems to monitor container activities in real-time, ensuring compliance with stringent GDPR regulations. Also, the elevating integration of IoT sensors in shipping containers enhances tracking and tamper-proofing. For example, Siemens’ IoT-enabled container tracking solutions are widely used in European logistics to enhance shipment transparency and security.

Asia-Pacific Container Security Market Trends:

Asia-Pacific is witnessing rapid growth in the market due to its expanding export-driven economy. China, as a manufacturing hub, invests in blockchain-based systems to secure trade documentation and container tracking. Furthermore, platforms like AntChain are streamlining port logistics while reducing fraud. Smart port initiatives, including AI-enabled surveillance systems in ports like Shanghai, are strengthening container security and operational efficiency across the region.

Latin America Container Security Market Trends:

Key producers across Latin America are focusing on modernizing port security to combat smuggling and theft. Brazil has implemented advanced RFID-enabled container locks to enhance monitoring. The Port of Santos uses IoT-integrated security systems to provide end-to-end visibility of cargo movements. Overall, these technologies ensure the integrity of goods while complying with international shipping standards, thereby catering to the region's growing role in agricultural and mineral exports.

Middle East and Africa Container Security Market Trends:

The widespread usage of container security technologies in the Middle East and Africa to support expanding oil exports and trade is acting as a significant growth-inducing factor. In UAE, ports like Jebel Ali employ AI-powered video analytics for real-time monitoring of container activities. Moreover, these systems ensure compliance with international regulations while protecting against unauthorized access. Also, the region's investments in blockchain for container tracking further enhance transparency and operational trust in trade.

Top Companies Leading in the Container Security Industry

Some of the leading container security market companies include Anchore, Aqua Security Software Ltd., Check Point Software Technologies Ltd., Fortra LLC, NeuVector Inc. (SUSE), Palo Alto Networks Inc., Qualys Inc., Synopsys Inc., Sysdig Inc., Trend Micro Incorporated, VMware Inc., Zscaler Inc., among many others. In May 2024, Sysdig partnered with Mend.io to launch a joint solution aimed at enhancing container security. This integration combines Sysdig's runtime context with Mend Container to improve vulnerability prioritization and remediation.

Global Container Security Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into solution and services, wherein solution represents the most preferred segment since containerized applications are dependent at all stages of the process, from development to deployment.

- Based on the deployment, the market is categorized into cloud-based and on-premises, amongst which cloud-based dominates the market, as the cloud-based deployment models are flexible, cost-effective, scalable, easy to manage, etc.

- On the basis of the enterprise size, the market has been divided into large enterprises and small and medium-sized enterprises. Among these, large enterprises exhibit a clear dominance in the market, owing to the growing use of innovative technologies, including containers, to stay competitive and drive operational efficiency.

- Based on the vertical, the market is bifurcated into BFSI, IT and telecom, retail, healthcare, manufacturing, government, and others, wherein IT and telecom dominate the market. The use of container technology aligns perfectly with these goals, offering the benefits of agility, scalability, and faster deployment of applications.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.4 Billion |

| Market Forecast in 2033 | USD 16.6 Billion |

| Market Growth Rate 2025-2033 | 24.14% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployments Covered | Cloud-based, On-Premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Verticals Covered | BFSI, IT and Telecom, Retail, Healthcare, Manufacturing, Government, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anchore, Aqua Security Software Ltd., Check Point Software Technologies Ltd., Fortra LLC, NeuVector Inc. (SUSE), Palo Alto Networks Inc., Qualys Inc., Synopsys Inc., Sysdig Inc., Trend Micro Incorporated, VMware Inc., Zscaler Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)