Global Container Fleet Market Expected to Reach USD 21.9 Billion by 2033 - IMARC Group

Global Container Fleet Market Statistics, Outlook and Regional Analysis 2025-2033

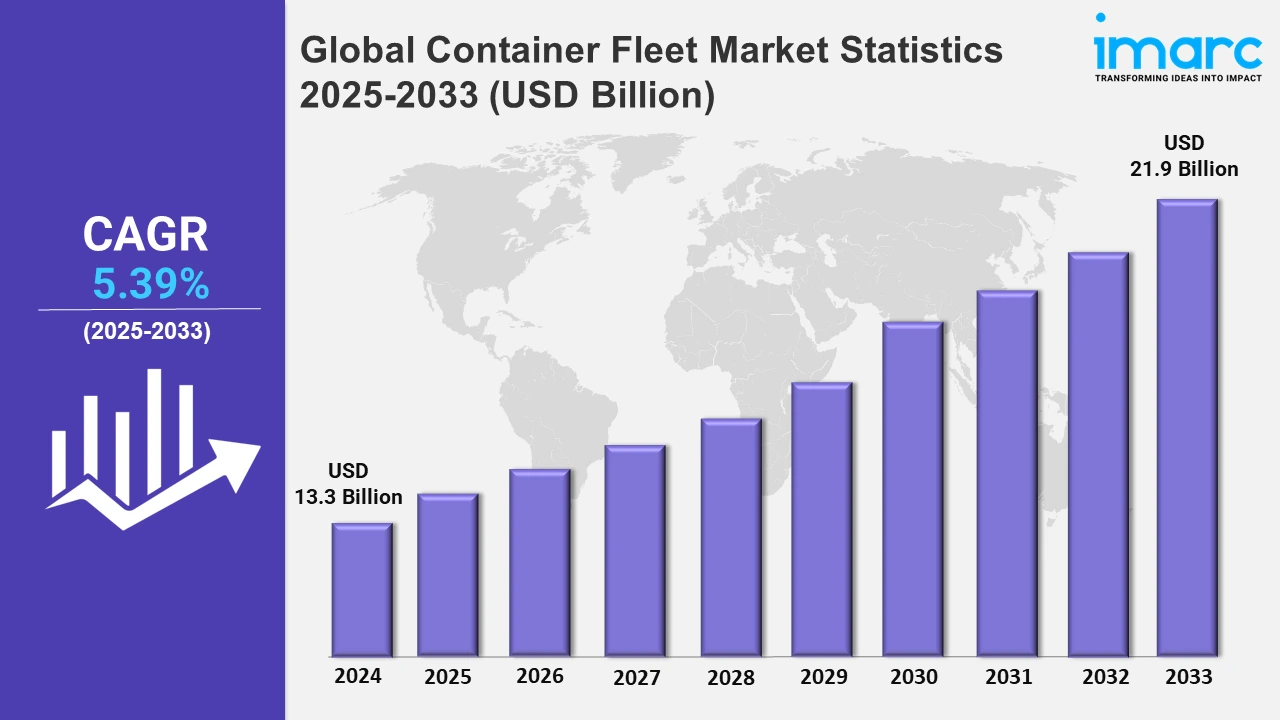

The global container fleet market size reached USD 13.3 Billion in 2024. and it is expected to reach USD 21.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.39% from 2025 to 2033.

To get more information on this market, Request Sample

The global container fleet market is driven by the increasing globalization of trade, which has amplified the need for efficient goods transportation across continents. According to the UN Trade and Development, global trade is likely to hit a historic high of nearly $33 Trillion in 2024, with an all-time rise of $1 Trillion from the previous year, adding $500 Billion to the overall growth. The growth in e-retail, especially in consumer goods and electronics, has filled much of this demand. Automotive, pharmaceuticals, and agriculture are key industries that contribute to growth and require customized containers such as reefers and tank containers for safe and efficient transport. The intermodal transportation networks are putting into place rail, road, and sea connections and should be key, providing seamless connectivity and optimal fleet utilization. The pace of industrialization and infrastructure development in the emerging economies of Asia Pacific and Latin America has also accelerated the demand for containers.

The growth of IoT-enabled tracking, predictive analytics, and port automation is enhancing operational efficiency, and government investments in export-driven infrastructure are strengthening the growth of the market. Emerging trends are reshaping the market, with sustainability taking the forefront. Companies are prioritizing eco-friendly containers, using lightweight and recyclable materials to meet stringent environmental standards. Digitalization is transforming logistics, with technologies like blockchain ensuring supply chain transparency and reducing fraud. Smart containers equipped with sensors provide real-time data on location, temperature, and humidity, vital for sensitive goods like food and pharmaceuticals. Infrastructure modernization, such as automated ports and expanded intermodal networks, reduces transit times and improves efficiency. The growth in free trade agreements encourages smoother cross-border trade, and consolidation among shipping companies enhances economies of scale. The increasing demand for reefer containers also underlines the importance of temperature-controlled logistics in health care and agriculture.

Global Container Fleet Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share due to its export-oriented industries and vast consumer base.

Asia Pacific Container Fleet Market Trends:

The region is a global manufacturing and export hub and drives the Asia Pacific container fleet market. Countries such as China, India, Japan, and South Korea dominate containerized trade, leveraging advanced industrial bases and expanding logistics networks. Intensification of the e-commerce and retail sectors in the region has amplified demands for efficient and low-cost shipping solutions and accelerated the growth of container fleet utilization. According to the Indian Council for Research on International Economic Relations, the Asia Pacific region has grown surprisingly in the e-commerce sector and is poised to have a value of above USD 6.146 Trillion by 2030, thereby increasing the demand for shipping. Infrastructure development plays a significant role, with massive investments made to upgrade facilities available at ports and extend intermodal transportation networks through rail and road connectivity. The increasing trend of free trade agreements and intra-regional trade partnerships together drive the movement of goods. The region also experiences enhanced operational efficiency and transparency due to the implementation of advanced technologies including smart container tracking and automation. The region is also experiencing a surge in demand for reefer containers in China and India, driven by the need for temperature-controlled shipping in the food and pharmaceutical sectors. Sustainability is also becoming a priority for logistics providers using greener containers and green practices to avoid carbon emissions.

North America Container Fleet Market Trends:

North America container fleet market experiences significant trade activities. The growth in e-commerce and retail demand is fueling containerized shipping throughout the region. In addition, intermodal transportation systems that integrate rail and trucking networks enhance efficiency and connectivity. The energy sector, including crude oil and LNG exports, is another important area, as it needs special containers. Technological advancements, for instance, real-time tracking and automated port operations, promote the growth of the market with North America being a strong key player in the global container logistics industry.

Europe Container Fleet Market Trends:

The Europe market has a strong base of a developed trade network and sophisticated ports. The region is investing a lot in sustainable containers and other forms of green logistics. It has an increasing intra-region trade that is promoted by easy customs procedures in the European Union. Key industries include the automotive industry and pharmaceutical, where the supply of specialized containers to transport without risk is driving the market's growth. Port operations improve with digitization and automation in ports, and Europe is maintaining its critical role in the international container fleet by signing new partnership agreements with Asia and North America.

Latin America Container Fleet Market Trends:

Latin America has a growing export base in its container fleet market through rising agricultural produce, minerals, and petroleum products. With growing trade volumes, Brazil and Chile are extending their port capacities. Regional intermodal infrastructure development - road and rail connectivity - is adding to this momentum. Trade links with North America and Asia are driving ever-higher demand for containers.". In addition, a boost in government investments that are meant to modernize networks for logistics and improve customs-clearing processes supports the growth in the container fleet market in Latin America and its role in regional supply chains.

Middle East and Africa Container Fleet Market Trends:

The Middle East and African container fleet market is driven mainly by the strategic location of this region between Asia, Europe, and Africa. Key trade centers, such as Dubai and South Africa, are of key importance to regional logistics. Demand for specialized containers in particular increases due to the rapid development of the energy sector through exports of oil and gas. Other key investments include port expansion and free trade zones. Growth in consumer goods and agricultural products also increases the demand for containerized shipping, hence emphasizing the importance of the region within the global trade network.

Top Companies Leading in the Container Fleet Industry

Some of the leading container fleet market companies include CMA CGM S.A., Ocean Network Express Pte. Ltd., Pacific International Lines Pte. Ltd., Evergreen Marine Corporation, Hapag-Lloyd AG, Matson Inc., A.P. Møller – Mærsk A/S, China COSCO Shipping Corporation Limited, MSC Mediterranean Shipping Company S.A., Unifeeder A/S (DP World), Wan Hai Lines Ltd., Yang Ming Marine Transport Corporation, Orient Overseas Container Line Limited, ZIM Integrated Shipping Services Ltd. (Kenon Holdings Ltd), among many others.

- In November 2024, the Danish shipping giant A.P. Moller-Maersk, launched its dual-fueled methanol container vessel, as the company worked toward its sustainability goals. The firm had targeted that by 2030, alternative fuels would form part of its portfolio, and it would be around 15-20%. The alternatives would include green methanol and bio-methane. The fleet expansion comprises 18 dual-fuel vessels, and it purchased bio-methanol beginning in 2026.

- In September 2024, in the context of its US$2 billion investment, China COSCO Shipping contracted 54 new vessels, which consisted of 12 methanol dual-fuel container ships. Among the different vessels included in the purchase were the largest bulkers since COSCO's takeover of China Shipping, in addition to the methanol-ready vessels. The company ordered energy-efficient container vessels equipped with intelligent systems within the fleet expansion.

Global Container Fleet Market Segmentation Coverage

- On the basis of the type, the market is segmented into dry container, reefer container, tank container, and special container. Dry containers comprise the largest portion of the container fleet market, with a significant share because of their unmatched versatility and cost-effectiveness. They are the backbones of the global shipping industry, designed to carry various goods, including consumer goods, raw materials, and industrial equipment. Standardized dimensions allow for easy handling and seamless intermodal transportation on ships, trucks, and trains, making them highly adaptable to diverse logistics needs. With the expansion of e-commerce and increased manufacturing activities, global trade has picked up, increasing the demand for dry containers. Dry containers are also cheaper and available in large quantities, and hence companies prefer them for cost optimization of their operations. Governments and logistics firms are also investing heavily in containerized shipping infrastructure, thereby furthering the dominance of dry containers.

- Based on the end user, the market is divided into automotive, oil and gas, food, mining and minerals, agriculture, and others. The oil and gas sector leads the container fleet market, buoyed by escalating demand for tank containers suited to carrying hazardous and non-hazardous liquids such as crude oil, refined petroleum products, and LNG. These containers guarantee safe transportation, full regulatory compliance, and cost-effective shipment of high-value cargo over significant distances. Further increasing the dominance of the sector is the increasing global energy demand that requires the transportation of massive oil and gas volumes. Advanced insulation and corrosion-resistant materials, which have been developed for tank containers, have helped overcome some of the major problems and have become essential to the sector.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 13.3 Billion |

| Market Forecast in 2033 | USD 21.9 Billion |

| Market Growth Rate 2025-2033 | 5.39% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dry Container, Reefer Container, Tank Container, Special Container |

| End Users Covered | Automotive, Oil and Gas, Food, Mining and Minerals, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | A.P. Møller – Mærsk A/S, China COSCO Shipping Corporation Limited, CMA CGM S.A., Evergreen Marine Corporation, Hapag-Lloyd AG, Matson Inc., MSC Mediterranean Shipping Company S.A., Ocean Network Express Pte. Ltd., Orient Overseas Container Line Limited, Pacific International Lines Pte. Ltd., Unifeeder A/S (DP World), Wan Hai Lines Ltd., Yang Ming Marine Transport Corporation, ZIM Integrated Shipping Services Ltd. (Kenon Holdings Ltd), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)