Global Construction Equipment Market Expected to Reach USD 349.9 Billion by 2033 - IMARC Group

Global Construction Equipment Market Statistics, Outlook and Regional Analysis 2025-2033

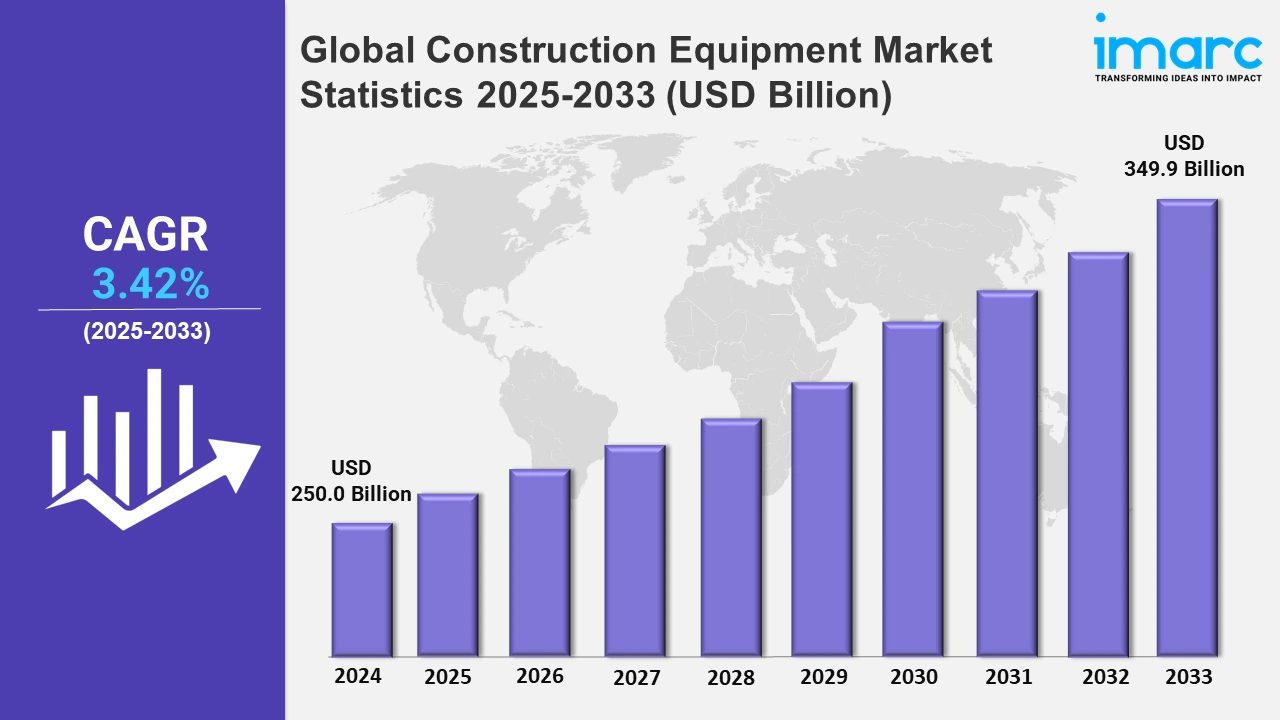

The global construction equipment market size was valued at USD 250.0 Billion in 2024, and it is expected to reach USD 349.9 Billion by 2033, exhibiting a growth rate (CAGR) of 3.42% from 2025 to 2033.

To get more information on this market, Request Sample

Infrastructure development is a major driver of the global construction equipment market. As economies grow and urbanize, there is an increasing demand for new roads, bridges, airports, and other critical infrastructure. This drives the need for heavy construction machinery such as excavators, bulldozers, and concrete mixers. Moreover, governments worldwide are investing heavily in infrastructure projects, including roads, bridges, and public facilities, to stimulate economic growth. For instance, in October 2024, the Indian government started constructing a new four-lane road in Goa to facilitate access between Panaji, Ponda, and Karnataka. With a budget of about INR 557 Crore, this project intends to reduce traffic congestion, improve road safety, and promote smoother travel for local people, companies, and tourists throughout the region. Similarly, in October 2024, the Telangana government sanctioned approximately INR 1,377.66 Crore for the construction and upgrade of rural roads under the Construction of Rural Roads (CRR) State Plan grant. The funds will be utilized to develop 1,323.86 kilometers of new roads. Besides this, in September 2024, the Union government started rectification work, beginning with the construction of two huge four-lane bridges over the Mutha River parallel to the existing bridge. This development is intended to reduce traffic congestion in Warje, Vadgaon, Narhe, and Ambegaon. This surge in construction activities is boosting the demand for construction equipment.

Moreover, numerous construction equipment machines have a finite lifespan, and as they age, maintenance costs increase, and efficiency decreases. This creates a continuous demand for replacement equipment. As construction companies seek to maintain productivity and meet emission standards, they invest in new, more technologically advanced machines. Technological advancements, such as fuel-efficient engines, better hydraulics, and telematics systems for predictive maintenance, are key drivers of replacement demand. For instance, in August 2024, Kobelco Construction Equipment India Pvt Ltd, a subsidiary of Japan's Kobelco Construction Machinery Co, introduced the SK80 Excavator as part of the Centre's ambitious 'Make in India' drive. The newly introduced SK80 excavator comes with a number of revolutionary characteristics, including superior technology, an enhanced hydraulic system, and fuel efficiency, among others. It is easily adaptable to execute a number of tasks, including digging, lifting, and grading. Also, in August 2024, New Holland Construction, a CNH Industrial brand formed in the United States and headquartered in Italy, unveiled its E70D midi excavator. The E70D has a turbocharged Kubota V2607-CR-T four-cycle, four-cylinder direct-injection diesel engine that fulfills EPA Tier 4/EU Stage V emissions requirements. The mono boom has a transport length of 241 inches (6.1 meters), a ground-level reach of 260 inches (6.6 meters), a dump height of slightly more than 14.5 feet (4.4 meters), and a dig depth of more than 13 feet (4 meters). The machine's tailswing radius is 41 inches (1 meter). It is just under 9 feet (2.7 meters) tall and 7 feet (2.1 meters) broad, with a ground clearance of 14.2 inches (36 centimeters).

Global Construction Equipment Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share owing to the increasing Infrastructure development.

North America Construction Equipment Market Trends:

Significant investments in infrastructure projects are propelling the demand for construction equipment. For instance, the U.S. government's US$1 Trillion infrastructure package aims to refurbish roads, railways, and other transportation systems, thereby increasing the need for heavy machinery.

Europe Construction Equipment Market Trends:

Increasing investments in infrastructure projects, such as roads, bridges, and railways, are propelling the demand for construction equipment. For instance, in September 2023, the German Federal Government and Deutsche Bahn announced the largest infrastructure program for the railway network and stations since the 1994 railway reform, highlighting the emphasis on enhancing transportation infrastructure.

Asia Pacific Construction Equipment Market

The Asia-Pacific region dominates the worldwide construction equipment market. Rapid urbanization, population growth, and infrastructure development in nations like China and India have created a significant need for construction machines. These countries make significant investments in roads, bridges, airports, and urban infrastructure, which increases the need for excavators, cranes, and concrete equipment. For instance, in October 2024, the Indian government planned to invest over Rs 92,000 Crore in the building of new airports and the expansion of current ones. Furthermore, the rising markets in Southeast Asia help to drive regional growth. Asia Pacific is also seeing the use of technologically advanced equipment, such as electric and hybrid machinery, to address environmental problems.

Latin America Construction Equipment Market Trends:

Governments across Latin America are investing heavily in public infrastructure projects, including roads, airports, and energy sectors. For instance, Brazil invested US$1.4 Billion in transport infrastructure projects in the first seven months of 2023, with 172 projects ranging from airports to power distribution and urban mobility.

Middle East and Africa Construction Equipment Market Trends:

Rapid urbanization and increasing populations are leading to a surge in residential and commercial construction. This trend is particularly evident in countries like the United Arab Emirates, where cities such as Dubai are expanding rapidly, necessitating advanced construction machinery.

Top Companies Leading in the Construction Equipment Industry

Some of the leading construction equipment market companies include AB Volvo, Caterpillar Inc., CNH Industrial N.V., Deere & Company, Doosan Infracore, Hitachi Construction Machinery, Komatsu Ltd., and Liebherr-International AG, among many others. For instance, in September 2024, Hitachi Construction Machinery, a Japanese corporation, collaborated with Dimaag-AI, an American corporation, to build a 1.7-ton zero-emission excavator that incorporates Dimaag's "Electric No Compromise Off-Road Ecosystem" (ENCORE) into Hitachi's machinery. The electric excavator is scheduled for completion in December 2024, with a joint introduction planned for the Bauma 2025 Trade Fair in Munich. Hitachi planned to launch the device throughout Europe by 2027.

Global Construction Equipment Market Segmentation Coverage

- On the basis of the solution type, the market has been bifurcated into products and services, wherein products represented the largest segment, owing to the rising demand for earthmoving, material handling, and concrete construction.

- Based on the equipment type, the market is categorized into heavy construction equipment and compact construction equipment, amongst which heavy construction equipment accounted for the largest market share as it plays a crucial role in projects, such as highway construction, skyscraper development, and mining operations.

- On the basis of the type, the market has been divided into loader, cranes, forklift, excavator, dozers, and others. Among these, loader represented the largest segment. These machines are known for their efficiency in loading materials, such as dirt, gravel, and debris, further driving the segment’s growth.

- Based on the application, the market is bifurcated into excavation and mining, lifting and material handling, earth moving, transportation, and others, wherein earth moving represented the largest segment owing to the infrastructure development, road construction, and land grading activities.

- On the basis of the industry, the market is segmented into oil and gas, construction and infrastructure, manufacturing, mining, and others. Currently, construction and infrastructure represent the largest segment driven by population growth, urbanization, and government investments in infrastructure development.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 250.0 Billion |

| Market Forecast in 2033 | USD 349.9 Billion |

| Market Growth Rate 2025-2033 | 3.42% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Construction Equipment Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Products, Services |

| Equipment Types Covered | Heavy Construction Equipment, Compact Construction Equipment |

| Types Covered | Loader, Cranes, Forklift, Excavator, Dozers, Others |

| Applications Covered | Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, Others |

| Industries Covered | Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Caterpillar Inc., CNH Industrial N.V., Deere & Company, Doosan Infracore, Hitachi Construction Machinery, Komatsu Ltd., Liebherr-International AG, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Construction Equipment Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)