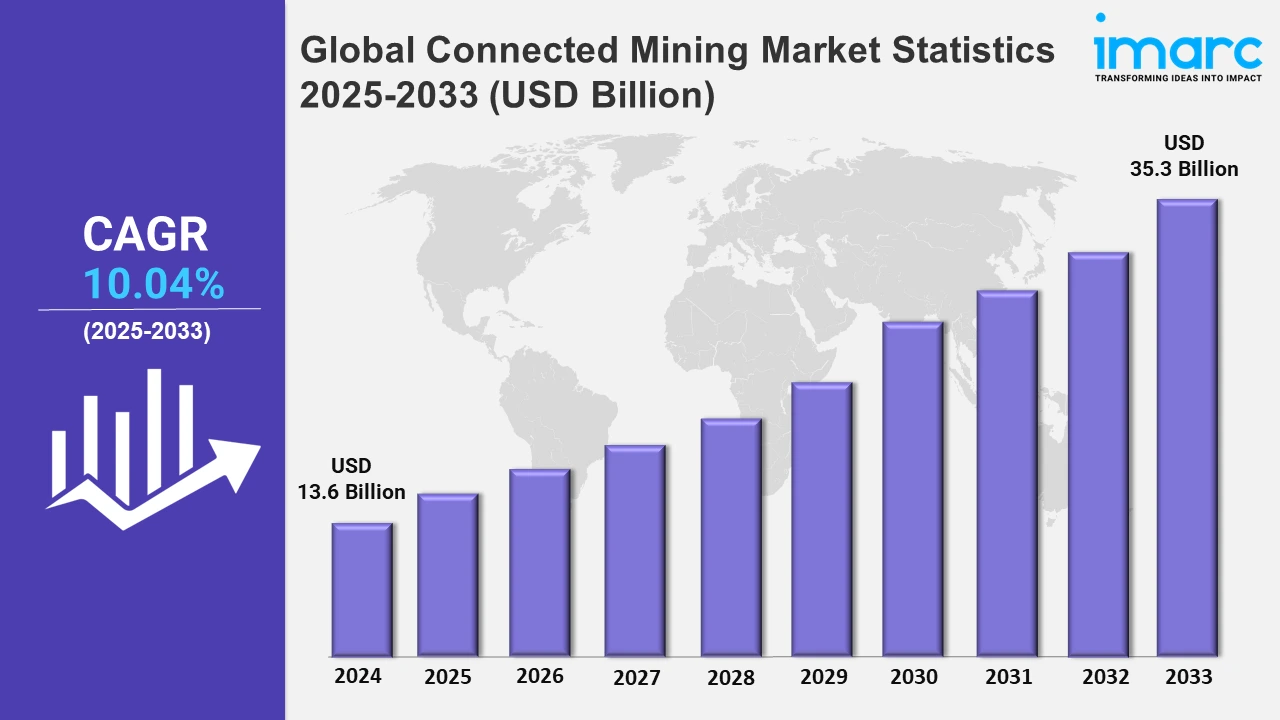

Global Connected Mining Market Expected to Reach USD 35.3 Billion by 2033 - IMARC Group

Global Connected Mining Market Statistics, Outlook and Regional Analysis 2025-2033

The global connected mining market size was valued at USD 13.6 Billion in 2024, and it is expected to reach USD 35.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.04% from 2025 to 2033.

To get more information on this market, Request Sample

The demand for sustainable and efficient mining practices is a major driver of the connected mining market, as companies seek to integrate advanced technologies that enhance productivity while minimizing environmental impact. Automation of routine human processes improves efficiency while also lowering labor expenses and reducing human error. For instance, in October 2024, ABB unveiled a new technology demonstrator designed to enable safe and efficient high-power charging on the path to a future all-electric mine. The eMine™ robot automated connection device (ACD) complements the ABB eMine FastCharge solution, promoting compatibility and synergy across electric mining trucks' connections and interfaces. The robot ACD provides more consistent and efficient truck charging without the need for human involvement. The completely automated and interoperable connecting device is designed to survive the extreme environmental conditions seen in mines.

Moreover, the rapid advancement of technologies, such as the Internet of Things (IoT), artificial intelligence (AI), and machine learning (ML), is a key driver of the connected mining market. These technologies are critical in changing traditional mining operations into more efficient, automated, and data-driven systems. The integration of IoT devices enables real-time monitoring of equipment and ambient conditions, which leads to increased safety and productivity. For instance, in October 2024, Telefónica and Halotech Digital Services introduced an innovative IoT solution for secure communication based on post-quantum encryption for safety-critical settings like mining. The solution known as TU Quantum Encryption was created based on the IoT quantum ready proof of concept (PoC). The new approach aims to provide a more secure connection to smart devices like the Halo I linked helmets and the Halo III smart wristband. Both devices include GPS, an emergency SOS button, a fall detector, and advanced sensors that measure the quality of the work environment, such as noise level, temperature, humidity, pressure, air quality, and thermal stress, among other critical factors, thereby improving operator safety and working conditions in demanding environments. AI and machine learning algorithms provide predictive maintenance, which reduces downtime and operational expenses. Furthermore, modern data analytics techniques are employed to improve resource allocation and decision-making processes. As mines become more computerized, the requirement for cybersecurity solutions to protect sensitive data and operations grows, pushing greater technology expenditures in the mining sector.

Global Connected Mining Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share, owing to extensive investments in mining activities and the inflating levels of industrialization.

North America Connected Mining Market Trends:

The adoption of modern technologies, such as the Internet of Things (IoT), Artificial Intelligence (AI), big data analytics, and autonomous vehicles, is transforming mining operations. For instance, Rio Tinto's "Mine of the Future" initiative utilizes autonomous haul trucks and drill rigs in Australia's Pilbara region, enhancing productivity and safety.

Europe Connected Mining Market Trends:

The transition to renewable energy and electric vehicles has increased the demand for critical minerals like lithium and rare earth elements. Europe is working to reduce its dependence on imports by developing domestic sources. For example, in January 2023, Swedish state-owned mining company LKAB announced the discovery of over 1 million tonnes of rare earths in the Kiruna area, the largest such deposit in Europe. This is further driving the demand for connected mining.

Asia-Pacific Connected Mining Market Trends:

The rising urbanization across various countries, such as China, India, and Australia, led to increased demand for minerals and metals, thereby exhibiting a clear dominance in the market. For instance, according to Statista, in 2023, nearly one-third of India's total population resided in cities. The data shows an increase in urbanization of more than 4% over the last decade. This surge necessitates advanced technologies to enhance operational efficiency and productivity in mining operations.

Latin America Connected Mining Market Trends:

Latin America holds substantial reserves of essential minerals. For instance, the region accounts for approximately 40% of global copper production, with Chile contributing 27%, Peru 10%, and Mexico 3%. This wealth of resources necessitates advanced technologies to optimize extraction and processing, further driving the demand for connected mining.

Middle East and Africa Connected Mining Market Trends:

The MEA region is rich in minerals, such as diamonds, gold, and platinum. For instance, countries like South Africa, Botswana, and Namibia have significant mineral wealth, thereby driving the adoption of connected mining solutions to optimize resource extraction and operational efficiency.

Top Companies Leading in the Connected Mining Industry

Some of the leading connected mining market companies include ABB Group, Accenture Plc, Alastri, Cisco Systems Inc., Hexagon AB, Intellisense.Io, Rockwell Automation, SAP SE, Symboticware Inc., and Trimble Inc., among many others. For instance, in January 2024, ABB Group acquired Real Tech, a provider of revolutionary optical sensor technology for real-time water monitoring and testing, to strengthen its strong presence in the water industry and add optical technology, which is crucial for smart water management.

Global Connected Mining Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into equipments, software, and services, wherein services represented the largest segment driven by the need for enhanced operational efficiency, cost reduction, and improved safety standards.

- Based on the equipment breakup by type, the market is categorized into automated mining excavators, load haul dump, drillers and breakers, and others. The demand for automated mining excavators is propelled by their ability to increase efficiency and productivity while reducing operational costs. Moreover, load haul dump units in connected mining are crucial for efficient material handling and transportation within mining sites. Besides this, drillers and breakers equipped with advanced technology are essential for efficient and precise resource extraction.

- On the basis of the software and services breakup by type, the market has been divided into data/operations/asset management and security software, support and maintenance services, system integration and deployment services, and others. Among these, system integration and deployment services represent the largest segment, owing to the growing complexity of mining technologies.

- Based on the mining type, the market is bifurcated into surface mining and underground mining, wherein underground mining accounts for the largest market share. Underground mining is increasingly reliant on connected mining solutions for enhanced safety, operational efficiency, and resource management, further driving the segment’s growth.

- On the basis of the solution type, the market is segmented into connected assets and logistics solutions, connected control solutions, connected safety and security solutions, remote management solutions, and others. Currently, connected assets and logistics solutions represented the largest segment. This is primarily propelled by the growing awareness regarding the importance of real-time tracking and management of mining assets.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 13.6 billion |

| Market Forecast in 2033 | USD 35.3 billion |

| Market Growth Rate 2025-2033 | 10.04% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Equipments, Software, Services |

| Equipment Breakup by Types Covered | Automated Mining Excavators, Load Haul Dump, Drillers and Breakers, Others |

| Software And Services Breakup by Types Covered | Data/Operations/Asset Management and Security Software, Support and Maintenance Services, System Integration and Deployment Services, Others |

| Mining Types Covered | Surface Mining, Underground Mining |

| Solution Types Covered | Connected Assets and Logistics Solutions, Connected Control Solutions, Connected Safety and Security Solutions, Remote Management Solutions, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Group, Accenture Plc, Alastri, Cisco Systems Inc., Hexagon AB, Intellisense.Io, Rockwell Automation, SAP SE, Symboticware Inc. Trimble Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)