Computational Fluid Dynamics Market Report by Deployment Model (Cloud-Based Model, On-Premises Model), End-User (Automotive, Aerospace and Defense, Electrical and Electronics, Industrial Machinery, Energy, Material and Chemical Processing, and Others), and Region 2026-2034

Computational Fluid Dynamics Market Size:

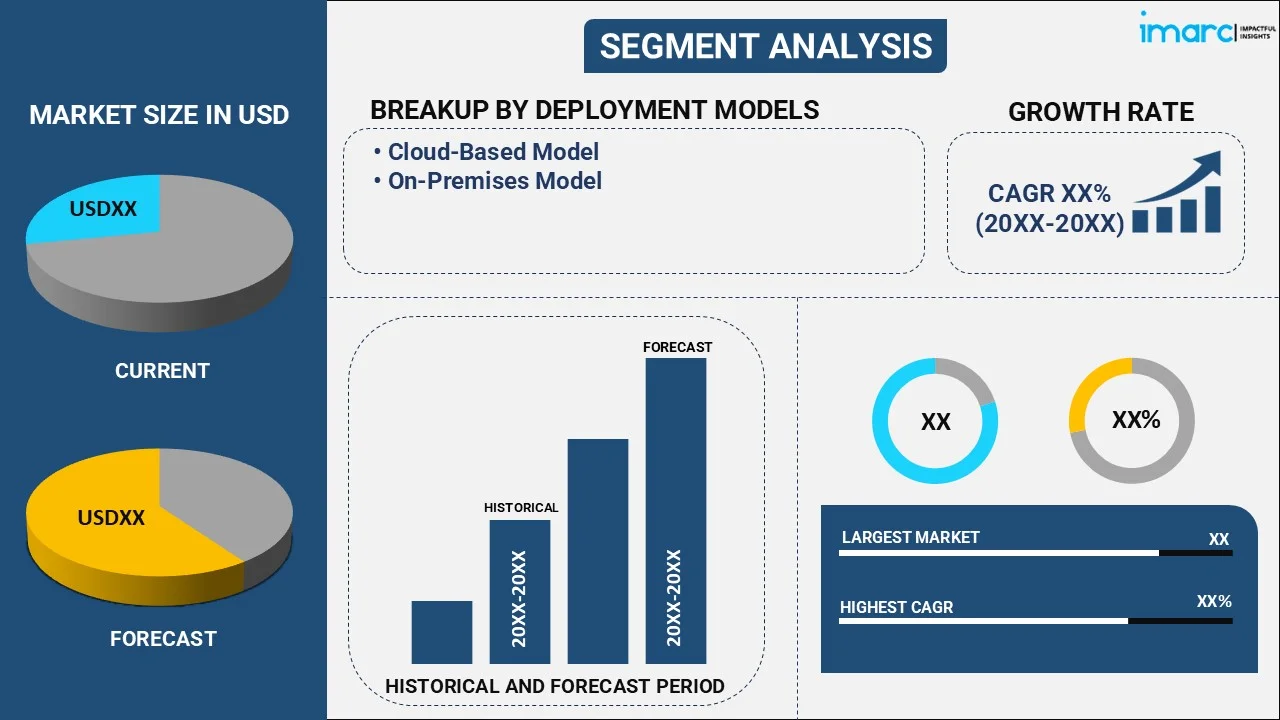

The global computational fluid dynamics (CFD) market size reached USD 2,830.4 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 5,139.2 Million by 2034, exhibiting a growth rate (CAGR) of 6.50% during 2026-2034. The market is experiencing moderate growth driven by the growing demand for efficient product design and optimization, rising awareness among the masses about environmental issues and the need for sustainable practices, and advancements in high-performance computing (HPC) and cloud-based solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 2,830.4 Million |

|

Market Forecast in 2034

|

USD 5,139.2 Million |

| Market Growth Rate 2026-2034 | 6.50% |

Computational Fluid Dynamics Market Analysis:

- Market Growth and Size: The market is witnessing moderate growth, driven by the increasing demand for efficient product design and optimization, along with the need for reducing manufacturing costs.

- Technological Advancements: Advancements in CFD software and hardware, including high-performance computing and cloud-based solutions, are enhancing simulation capabilities. This enables more complex and accurate simulations, further propelling the market growth.

- Industry Applications: CFD is widely used in various industries, including aerospace, automotive, energy, and healthcare. It plays a crucial role in optimizing designs, improving product performance, and reducing development time.

- Geographical Trends: North America leads the market, driven by its strong presence in industries like aerospace and automotive. However, Asia Pacific is emerging as a fast-growing market, driven by rapid industrialization.

- Competitive Landscape: The market is characterized by intense competition with key players focusing on mergers and acquisitions (M&A) and expanding their global footprint. They are also focusing on innovation and expanding service offerings.

- Challenges and Opportunities: While the market faces challenges, such as the complexity of CFD simulations and the need for skilled professionals, it also encounters opportunities in the increasing adoption of CFD in emerging industries like renewable energy and biotechnology.

- Future Outlook: The future of the computational fluid dynamics market looks promising, with industries emphasizing on efficiency and sustainability. The integration of artificial intelligence (AI) is making CFD an indispensable tool in product development and optimization.

To get more information on this market Request Sample

Computational Fluid Dynamics Market Trends:

Demand for efficient product design and optimization

Industries are increasingly relying on CFD simulations to streamline product design and optimization processes. With CFD, companies can virtually test and refine prototypes, reducing the need for costly physical testing and experimentation. This not only accelerates product development cycles but also results in more efficient and cost-effective designs. As companies are striving to remain competitive in the fast-paced business environment, the ability to quickly iterate and refine designs is a crucial advantage. CFD enables engineers and designers to analyze fluid flow, heat transfer, and other physical phenomena in intricate detail, leading to better-performing products. Moreover, as sustainability is becoming a priority, CFD helps in creating environment-friendly designs by optimizing energy efficiency and reducing waste, further increasing its adoption in various industries.

Rising environmental concerns and sustainability initiatives

The growing awareness among the masses about environmental issues and the need for sustainable practices are offering a favorable market outlook. Companies are under increasing pressure to reduce their environmental footprint and comply with stringent regulations. CFD plays a pivotal role in achieving these goals by enabling the analysis and optimization of fluid dynamics in various processes. CFD simulations assist industries in designing energy-efficient systems, minimizing emissions, and optimizing resource utilization. CFD is helping companies in making environment conscious decisions while maintaining competitiveness in their respective markets.

Advances in high-performance computing (HPC) and cloud-based solutions

The continuous advancement of computing technology is impelling the growth of the market. High-performance computing (HPC) clusters and cloud-based solutions are making complex simulations more accessible and efficient. HPC clusters offer immense computational power, enabling engineers and researchers to run large-scale CFD simulations with faster turnaround times. This accelerates the design and optimization processes, allowing for more iterations and improved accuracy. Furthermore, HPC allows for the simulation of highly complex, real-world scenarios that were previously impractical. Cloud-based CFD solutions offer scalability and flexibility. Companies can leverage cloud resources to perform simulations without the need for extensive on-premises infrastructure. This is especially beneficial for smaller businesses and startups, as it reduces upfront costs and provides access to powerful computing resources on a pay-as-you-go basis.

Expansion of CFD applications across diverse industries

The widespread adoption of CFD can be attributed to its versatility across a wide range of industries. CFD simulations are no longer limited to a few specialized sectors as they find applications in numerous fields. In the aerospace industry, CFD is used for aerodynamic analysis, leading to more fuel-efficient and safer aircraft designs. In automotive manufacturing, it aids in optimizing engine performance and vehicle aerodynamics, reducing emissions and enhancing fuel efficiency. The energy sector utilizes CFD to design more efficient turbines, enhance combustion processes, and optimize energy production.

Computational Fluid Dynamics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on deployment model and end-user.

Breakup by Deployment Model:

To get detailed segment analysis of this market Request Sample

- Cloud-Based Model

- On-Premises Model

On-premises model accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes cloud-based model and on-premises model. According to the report, on-premises model represented the largest segment due to its long-established presence and the preference of certain industries for maintaining complete control over their computational resources. On-premises CFD deployments are favored by organizations with stringent data security and compliance requirements. These businesses appreciate the ability to manage their hardware, software, and data in-house, ensuring complete customization and autonomy over their CFD simulations.

The cloud-based deployment model in the computational fluid dynamics market is witnessing significant growth in recent years. This segment offers the advantage of scalability, flexibility, and cost-efficiency. Organizations opt for cloud-based CFD solutions to access powerful computational resources without the need for heavy on-premises infrastructure investments. Furthermore, the cloud-based model allows for remote collaboration and easy updates, making it a preferred choice for businesses seeking agility in their CFD simulations.

Breakup by End-User:

- Automotive

- Aerospace and Defense

- Electrical and Electronics

- Industrial Machinery

- Energy

- Material and Chemical Processing

- Others

Aerospace and defense hold the largest share in the industry

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes automotive, aerospace and defense, electrical and electronics, industrial machinery, energy, material and chemical processing, and others. According to the report, aerospace and defense accounted for the largest market share.

The aerospace and defense sector relies heavily on CFD simulations to optimize aerodynamics, analyze structural integrity, and enhance overall performance of aircraft and defense systems. CFD plays a pivotal role in reducing development time and costs while ensuring safety and efficiency in aerospace and defense applications, making it an indispensable tool for manufacturers and research institutions in this sector.

The automotive industry is another significant segment in the CFD market. Automotive companies utilize CFD simulations to fine-tune vehicle designs, improve fuel efficiency, and enhance safety features. CFD aids in analyzing airflow, combustion processes, and vehicle crash simulations, leading to the development of more fuel-efficient and safer automobiles.

In the electrical and electronics sector, CFD is employed to optimize thermal management and airflow within electronic components and devices. It assists in preventing overheating issues, ensuring the reliability and longevity of electronics. This segment is growing as electronic devices become increasingly complex and compact, necessitating precise thermal analysis.

The industrial machinery sector benefits from CFD simulations to enhance the design and performance of heavy machinery and equipment. CFD helps in optimizing fluid flow, reducing energy consumption, and improving the overall efficiency of industrial processes. This segment finds value in CFD for applications in various manufacturing and industrial settings.

The energy sector, encompassing areas, such as power generation and renewable energy, also relies on CFD to improve efficiency and reduce environmental impacts. CFD aids in the design of more efficient turbines, heat exchangers, and combustion processes, contributing to sustainable energy production and conservation.

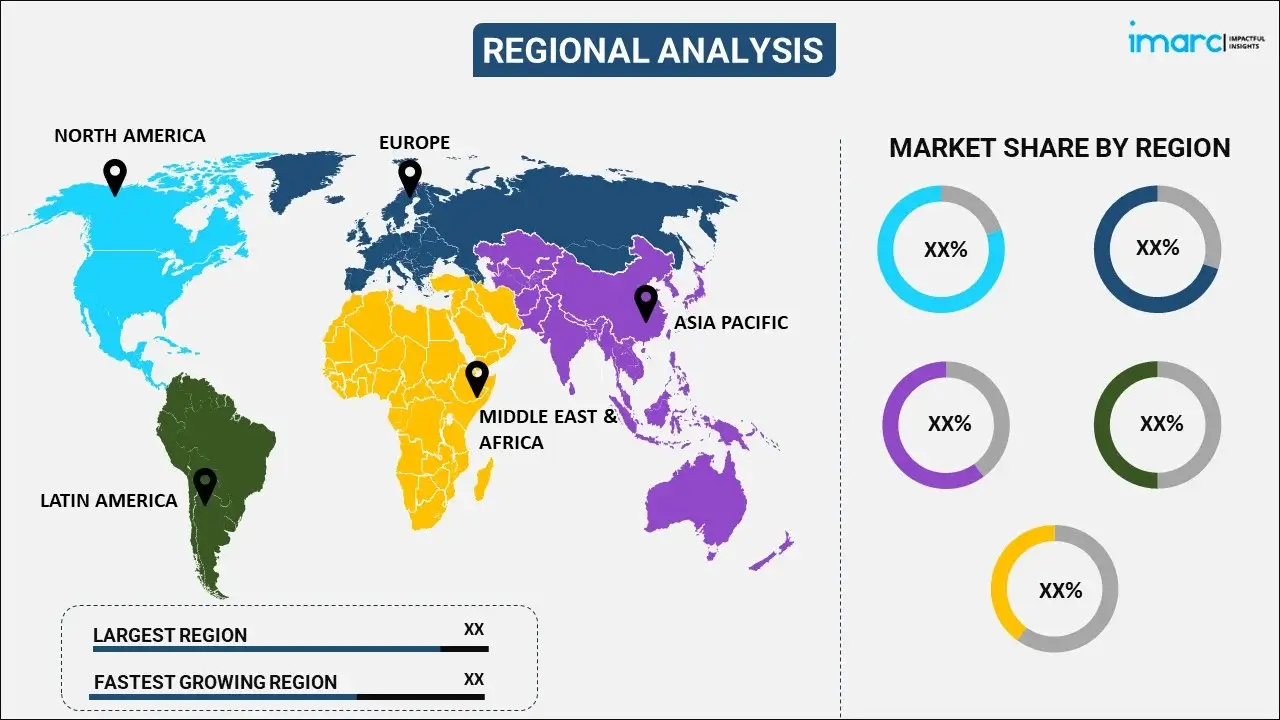

Breakup by Region:

To get more information on the regional analysis of this market Request Sample

- Europe

- Asia Pacific

- North America

- Middle East and Africa

- Latin America

North America leads the market, accounting for the largest computational fluid dynamics market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Europe, Asia Pacific, North America, the Middle East and Africa, and Latin America. According to the report, North America accounted for the largest market share due to a robust presence of key players, significant investments in research and development (R&D) activities, and a high adoption rate of CFD solutions across various industries. The increasing utilization of CFD for applications in aerospace, automotive, energy, and other sectors is propelling the market growth. The growing focus on technological innovation and the need for advanced simulation tools is offering a favorable market outlook.

Europe is another prominent region in the CFD market, characterized by a strong presence of aerospace, automotive, and industrial manufacturing sectors. European countries like Germany, the United Kingdom, and France have a long history of using CFD for engineering design and optimization. The commitment of the region to sustainability and environmental concerns are driving CFD adoption in energy and environmental applications.

The Asia Pacific region is experiencing rapid growth in the CFD market due to the expansion of industries, such as automotive, electronics, and energy. Countries like China, Japan, and India are investing heavily in CFD technologies to enhance product development and manufacturing processes. Additionally, the burgeoning aerospace sector in the region is catalyzing the demand for CFD solutions.

The Middle East and Africa region exhibit a growing interest in CFD, particularly in sectors, such as oil and gas, construction, and infrastructure. The need for efficient resource management and environmental considerations is driving the adoption of CFD simulations in these industries. While it may not be the largest segment, it presents opportunities for CFD providers to expand their presence in this emerging market.

Latin America is gradually embracing CFD solutions, with countries like Brazil and Mexico showing interest in industries, such as automotive and aerospace. The growth of manufacturing and energy sectors in the region is expected to contribute to the increasing adoption of CFD tools.

Leading Key Players in the Computational Fluid Dynamics Industry:

Key players in the market are continually innovating to enhance their offerings. They are investing in research and development (R&D) activities to introduce advanced CFD software that offers greater accuracy, faster simulations, and improved user interfaces. These companies are also focusing on expanding their consumer base by offering cloud based CFD solutions to cater to a wider range of industries and users. Additionally, key players are forming strategic partnerships and collaborations with industry-specific companies to provide specialized CFD solutions for sectors like aerospace, automotive, and energy. Overall, their efforts are focusing on delivering more efficient, accessible, and customizable CFD tools to meet the evolving needs of diverse markets.

The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Ansys Inc.

- Dassault Systemes

- COMSOL AB

- Siemens AG

- Autodesk inc.

- The MathWorks, Inc.

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News:

- January 26, 2023: Ansys Inc. announced the release of Ansys 2023 R1, their latest simulation software suite. It includes several enhancements for CFD simulations, improving accuracy and efficiency in fluid dynamics analysis. With the newly launched Ansys 2023 R1, engineers can simulate more complex products faster than ever via new cloud options and optimized use of multiple graphics processing units (GPUs). The new release also amplifies the benefits of simulation by supporting collaborative, model-based systems engineering (MBSE) workflows.

- March 2, 2020: Siemens announced its latest release of Simcenter™ STAR-CCM+™ software to enhance its CFD software with AI-driven capabilities for more accurate simulations. The latest release also includes automatic coupled solver control for reduced set up time while improving convergence speed and the first ever collaborative virtual reality (VR) feature of the company in a CFD code for enhanced team collaboration on simulation results. The latest release of Simcenter STAR-CCM+ includes major enhancements to improve simulation time and accuracy as well as enhance collaboration, giving consumers a comprehensive digital twin to help drive highly predictive simulations.

Computational Fluid Dynamics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Models Covered | Cloud-Based Model, On-Premises Model |

| End-Users Covered | Automotive, Aerospace and Defense, Electrical And Electronics, Industrial Machinery, Energy, Material And Chemical Processing, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Ansys Inc., Dassault Systemes, COMSOL AB, Siemens AG, Autodesk inc., The MathWorks, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the computational fluid dynamics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global computational fluid dynamics market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the computational fluid dynamics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global computational fluid dynamics market was valued at USD 2,830.4 Million in 2025.

We expect the global computational fluid dynamics market to exhibit a CAGR of 6.50% during 2026-2034.

The growing adoption of CFD in the aerospace and defense sector for cost reduction, operational efficiency, compliance standards, and resource management of numerous critical systems and components, is currently driving the global computational fluid dynamics market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across several nations resulting in temporary closure of numerous end use sectors for computational fluid dynamics, such as aerospace and aeronautics, industrial machinery, automotive, etc.

Based on the deployment model, the global computational fluid dynamics market has been bifurcated into cloud-based model and on-premises model. Currently, on-premises model accounts for the largest market share.

Based on the end-user, the global computational fluid dynamics market can be divided into automotive, aerospace and defense, electrical and electronics, industrial machinery, energy, material and chemical processing, and others. Among these, the aerospace and defense industry currently holds the majority of the total market share.

On a regional level, the market has been classified into North America, Europe, Asia Pacific, Middle East and Africa, and Latin America, where North America currently dominates the global market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)