Global Commercial Real Estate Market Expected to Reach USD 9.8 Trillion by 2033 - IMARC Group

Global Commercial Real Estate Market Statistics, Outlook and Regional Analysis 2025-2033

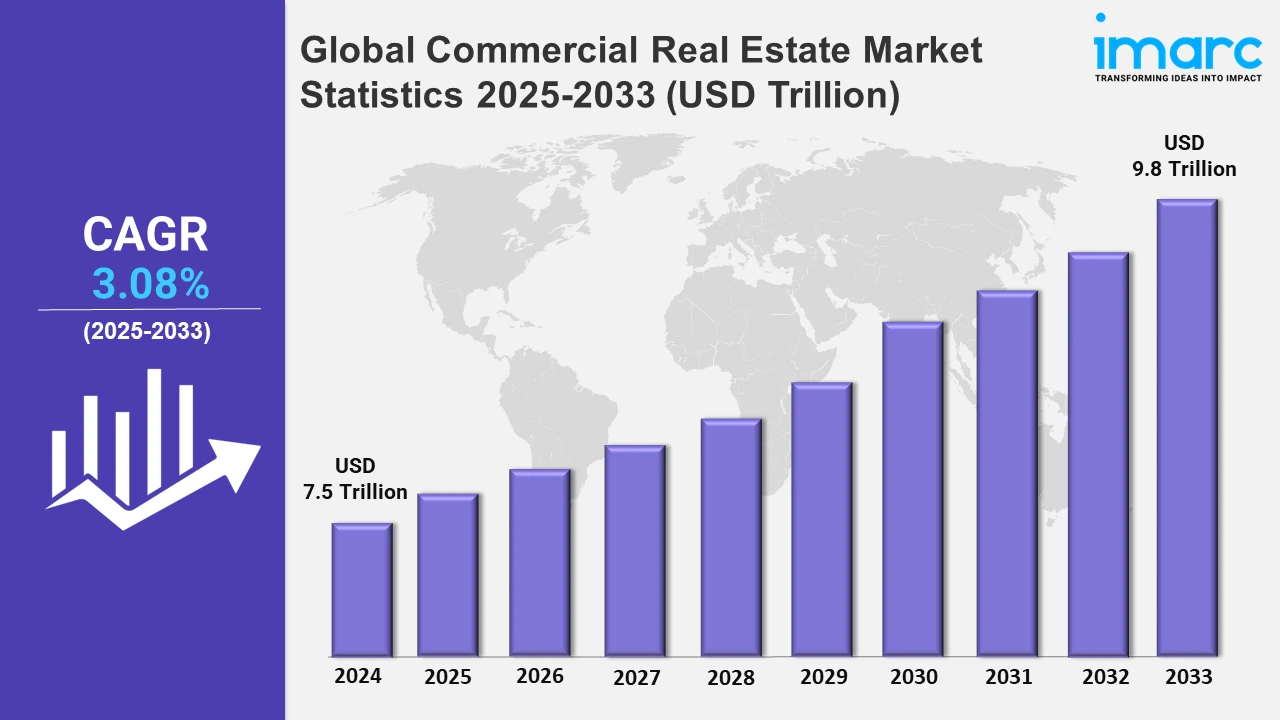

The global commercial real estate market size was valued at USD 7.5 Trillion in 2024, and it is expected to reach USD 9.8 Trillion by 2033, exhibiting a growth rate (CAGR) of 3.08% from 2025 to 2033.

To get more information on this market, Request Sample

Strong economic growth in numerous nations is driving the demand for industrial, residential, office, and public spaces, which is among the most important trends in the commercial real estate market. Aside from that, a variety of factors, including GDP growth, employment rates, and consumer spending, are all beneficial influences on market expansion. For example, in 2021, foreign investments in the European commercial real estate market accounted for half of all capital investments in the region, totaling about USD 137 Million. Furthermore, the creation of new business hubs, office spaces, retail shops, industrial facilities, and so on is driving market expansion.

Moreover, the emerging urbanization trends, such as the inclination to live and work in urban areas, are key growth drivers. For instance, nearly 56% of the world's population lives in cities. This trend is likely to continue, with the urban population more than doubling by 2050, when nearly seven in ten people will live in cities. Furthermore, the increased popularity of mixed-use developments with residential, business, and recreational spaces is having a positive impact on the commercial real estate market share. For instance, according to the National Association of Realtors' April 2023 report, multifamily commercial real estate rents increased by 2.5% year on year in the first quarter of 2023. Besides this, constant technological breakthroughs, such as the integration of AI and VR techniques, are driving market growth. Furthermore, big data and analytics are two new technologies that leverage historical and real-time data to provide information on trends, patterns, associations, price, and demographic data, thus accelerating the global market. According to Alibaba, more than 5,000 real estate agents in nearly 100 cities across China have adopted the live-streaming rooms method, allowing homebuyers to view homes and make deals from the comfort of their own homes. Furthermore, the rapid expansion of e-commerce has significantly influenced the commercial real estate (CRE) market, particularly in the demand for industrial and logistics properties. For instance, according to IMARC, the global e-commerce market size reached USD 26.8 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 214.5 Trillion by 2033, exhibiting a growth rate (CAGR) of 25.83% during 2025-2033. As online shopping becomes more prevalent, retailers require extensive warehousing and distribution facilities to manage inventory and ensure prompt deliveries. This shift has led to a surge in the development and leasing of logistics centers, especially those located near urban areas, to facilitate last-mile delivery, further driving the market's growth.

Global Commercial Real Estate Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest commercial real estate market share, owing to the rising urbanization levels.

North America Commercial Real Estate Market Trends:

The surge in e-commerce has heightened the demand for logistics and warehousing facilities in North America. Goldman Sachs' US$200 Million investment in last-mile logistics properties across the U.S. is propelling the demand for commercial real estate in the region.

Europe Commercial Real Estate Market Trends:

Favorable investment policies and stable market conditions attract foreign investors. For example, Blackstone's acquisition of the Grand Hyatt Athens for €235 Million highlights the appeal of European commercial real estate to international investors.

Asia Pacific Commercial Real Estate Market Trends:

Asia Pacific accounted for the largest market share due to the increasing infrastructure development activities. Rapid urbanization leads to increased demand for office spaces, retail centers, and logistics facilities. For instance, according to Statista, in 2023, nearly one-third of India's total population lived in cities. The trend shows a more than 4% growth in urbanization over the last decade, indicating that individuals have moved from rural areas to find work and make a livelihood in cities. Moreover, the inflating consumer spending capacities and the rising infrastructure development are propelling the market growth.

Latin America Commercial Real Estate Market Trends:

The surge in e-commerce has significantly increased the need for logistics and warehousing spaces across the region. Companies like MercadoLibre are expanding their logistics infrastructure in Brazil, thereby planning new distribution centers in Porto Alegre and Brasília to meet growing demand, further escalating the market demand.

Middle East and Africa Commercial Real Estate Market Trends:

Various companies are investing in infrastructure to support economic growth. For instance, in November 2024, real estate developer Avighna Group acquired a multi-tenanted commercial property in Dubai through its UAE arm.

Top Companies Leading in the Commercial Real Estate Industry

Some of the leading commercial real estate market companies include Boston Commercial Properties Inc., Brookfield Asset Management, Dalian Wanda Group, DLF Ltd., Link Asset Management Limited, MaxWell Realty Canada, Prologis Inc., RAK Properties PJSC, and Shannon Waltchack LLC, among many others. For instance, in May 2024, RAK Properties PJSC, Ras Al Khaimah's (RAK) pioneering publicly listed property developer, unveiled EDGE, a unique residential development on Raha Island that will be completed in Q2 2027. With 237 stylish houses and amazing sea views, the tower will serve as a portal to a unique combination of contemporary city life and calm coastal living, framing the entry to Raha Island with stunning panoramas.

Global Commercial Real Estate Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into rental and sales, wherein rental represented the largest segment. The rising entrepreneurship and the growing popularity of startups globally are positively influencing the segment’s growth.

- Based on the end use, the market is categorized into offices, retail, leisure, and others, amongst which offices accounted for the largest market share. The shifting preferences of consumers and businesses and the escalating demand for well-designed, aesthetic, and functional offices to accommodate the workforce, foster collaborations, and facilitate business operations are bolstering the segment’s growth.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.5 Trillion |

| Market Forecast in 2033 | USD 9.8 Trillion |

| Market Growth Rate 2025-2033 | 3.08% |

| Units | Trillion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Rental, Sales |

| End Uses Covered | Offices, Retail, Leisure, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Boston Commercial Properties Inc., Brookfield Asset Management, Dalian Wanda Group, DLF Ltd., Link Asset Management Limited, MaxWell Realty Canada, Prologis Inc., RAK Properties PJSC, Shannon Waltchack LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Commercial Real Estate Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)