Global Commercial Insurance Market Expected to Reach USD 1,684.0 Billion by 2033 - IMARC Group

Global Commercial Insurance Market Statistics, Outlook and Regional Analysis 2025-2033

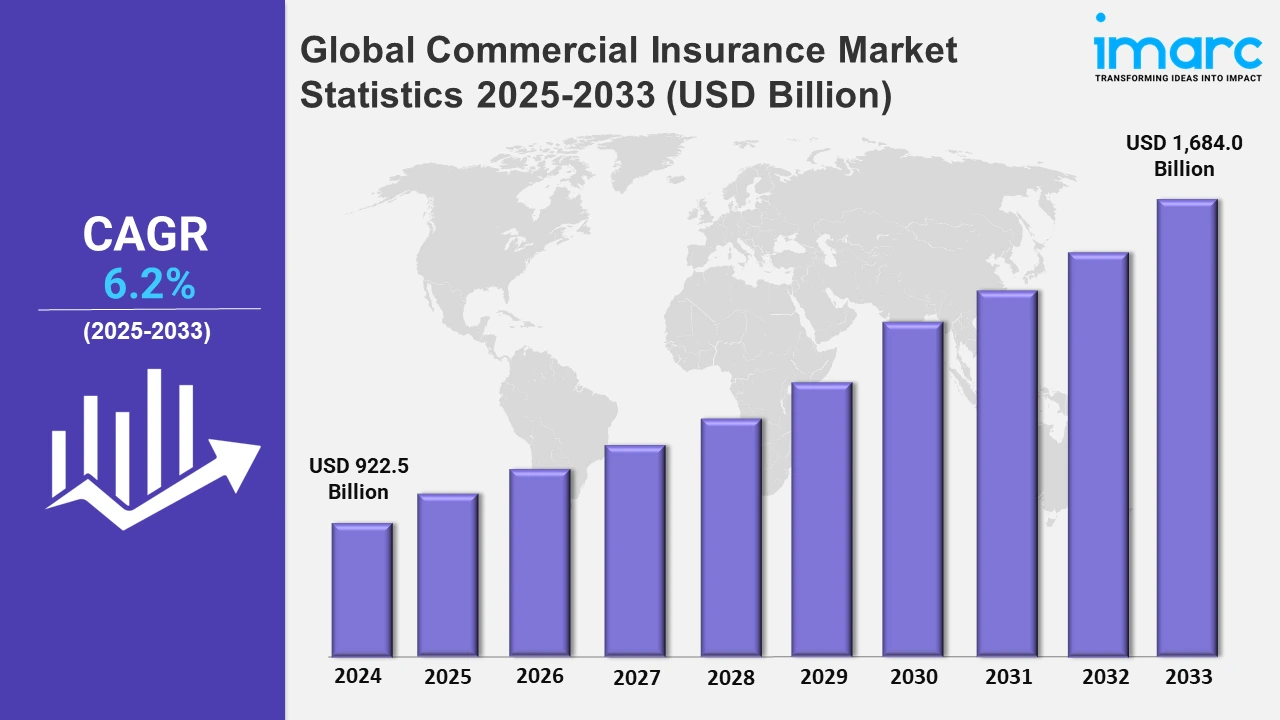

The global commercial insurance market size was valued at USD 922.5 Billion in 2024, and it is expected to reach USD 1,684.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.2% from 2025 to 2033.

To get more information on this market, Request Sample

The growing awareness towards the myriad risks that businesses face today is a significant driver in the global commercial insurance market. As businesses expand and become more complex, they are exposed to umpteen risks, including natural disasters, cyberattacks, supply chain disruptions, and regulatory changes. For instance, cybersecurity statistics indicate that there are 2,200 cyber-attacks every day, with one occurring every 39 seconds on average. Also, in Q2 2024, there was a 30% year-on-year rise in global cyber-attacks, with 1,636 attacks per company per week. This surge in attacks prompts businesses to seek comprehensive insurance coverage to protect their operations and assets. Moreover, the recognition of the financial devastation that can result from unforeseen events drives home the importance of insurance as a risk management tool. Businesses, both large and small, are increasingly proactive in assessing their vulnerabilities and securing appropriate insurance policies to mitigate these risks, contributing to the steady growth of the commercial insurance sector.

Moreover, the globalization of businesses has reshaped the commercial insurance landscape. Companies are expanding their operations across borders. For instance, in November 2024, the founder of Oyo announced an INR 550 Crore investment in the company for global expansion. Also, in September 2024, Oyo invested US $525 Million in the U.S.-based hospitality brands Motel 6 and Studio 6 from Blackstone Real Estate in an effort to expand its operations in the U.S. Moreover, in November 2024, JX Advanced Metals Corp. of Japan opened a new production facility in Mesa, Arizona, United States. This expansion exposes them to a host of new risks, including political instability, currency fluctuations, and varying regulatory environments. As a result, businesses require insurance coverage that can address these unique international challenges. Multinational corporations, in particular, rely on global insurance programs to provide consistent coverage across multiple countries, ensuring their assets and operations are protected regardless of their geographical spread. This trend has led to the development of specialized international insurance products and increased competition among insurers to offer comprehensive global coverage, making the globalization of businesses a key driver in the commercial insurance market.

Global Commercial Insurance Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share, owing to the globalization of businesses.

North America Commercial Insurance Market Trends:

Several significant reasons have contributed to the rise of the commercial insurance market in North America, including increased awareness and understanding of risk management methods among business owners. Furthermore, legal changes and compliance requirements have driven firms to seek comprehensive insurance solutions, thereby exhibiting dominance in the market. Meeting these regulatory duties has become a priority, resulting in increased demand for insurance services. In line with this, technological improvements have revolutionized the insurance sector. The use of data analytics, artificial intelligence, and automation has expedited underwriting processes, resulting in more efficient and cost-effective services that attract more business. For instance, in October 2024, AXA XL, a United States-based insurance provider, launched cyber insurance coverage to safeguard enterprises creating their own Generative AI (GenAI) models.

Europe Commercial Insurance Market Trends:

As Europe's largest economy, Germany's robust industrial sector drives demand for commercial insurance, particularly in manufacturing and engineering applications. The country's emphasis on technological innovation and Industry 4.0 initiatives necessitates comprehensive coverage of emerging risks.

Asia Pacific Commercial Insurance Market Trends:

Emerging economies in the region, such as China and India, are undergoing swift industrialization and urbanization. For instance, according to Statista, the urbanization rate in China has increased steadily over the last decades. This expansion increases the need for commercial insurance to protect businesses against potential risks associated with growth.

Latin America Commercial Insurance Market Trends:

Governments are implementing policies to enhance financial inclusion and insurance penetration. For example, Mexico's National Insurance and Bonding Commission (CNSF) has introduced regulations promoting competition and financial inclusion, allowing new players to enter the market and diversify products, further propelling the market growth.

Middle East and Africa Commercial Insurance Market Trends:

The growth of the Middle East and Africa (MEA) commercial insurance market is underpinned by significant investments and strategic partnerships within the sector. For instance, in June 2024, South Africa's Sanlam announced its plans to acquire a 60% stake in MultiChoice's insurance business for approximately US$66 Million.

Top Companies Leading in the Commercial Insurance Industry

Some of the leading commercial insurance market companies include Allianz SE, American International Group Inc., Aon plc, Aviva plc, Axa S.A., Chubb Limited, Direct Line Insurance Group plc, Marsh & McLennan Companies Inc., Willis Towers Watson Public Limited Company, and Zurich Insurance Group Ltd., among many others. For instance, in September 2023, Aviva PLC acquired a new stake in Fox Factory Holding Corp. during the first quarter of the year. The institutional investor purchased 12,063 shares of the company’s stock. Moreover, in August 2023, AON collaborated with Cover Whale to expand trucking insurance offerings.

Global Commercial Insurance Market Segmentation Coverage

- On the basis of the type, the market has been bifurcated into liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others, wherein liability insurance represented the largest segment. As laws and regulations evolve, businesses are compelled to adapt their liability insurance policies to remain compliant.

- Based on the enterprise size, the market is categorized into large enterprises and small and medium-sized enterprises, amongst which large enterprises represented the largest segment. Large enterprises often face complex regulatory requirements, necessitating comprehensive insurance coverage to mitigate potential financial liabilities.

- On the basis of the distribution channel, the market has been divided into agents and brokers, direct response, and others. Among these, agents and brokers represented the largest segment attributed to the increasing complexity in insurance products and regulations, which has driven businesses to seek expert guidance.

- Based on the industry vertical, the market is bifurcated into transportation and logistics, manufacturing, construction, IT and telecom, healthcare, energy and utilities, and others, wherein transportation and logistics represent the largest segment. The globalization of supply chains and the expansion of e-commerce have led to increased reliance on efficient transportation and logistics, amplifying the need for specialized insurance solutions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 922.5 Billion |

| Market Forecast in 2033 | USD 1,684.0 Billion |

| Market Growth Rate 2025-2033 | 6.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Allianz SE, American International Group Inc., Aon plc, Aviva plc, Axa S.A., Chubb Limited, Direct Line Insurance Group plc, Marsh & McLennan Companies Inc., Willis Towers Watson Public Limited Company, Zurich Insurance Group Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Commercial Insurance Market:

- United States Commercial Insurance Market Report

- Japan Commercial Insurance Market Report

- Russia Commercial Insurance Market Report

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)