Global Co-Packaged Optics Market Expected to Reach USD 3,095.40 Million by 2033 - IMARC Group

Global Co-Packaged Optics Market Statistics, Outlook and Regional Analysis 2025-2033

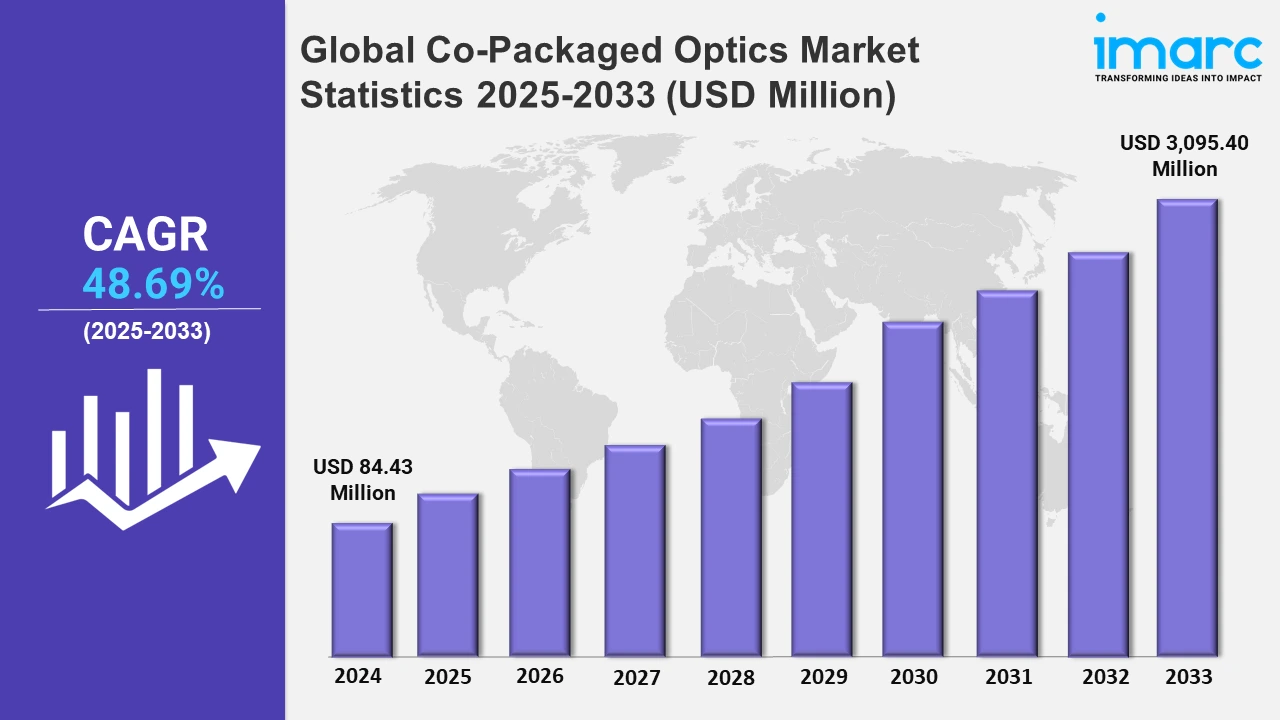

The global co-packaged optics market size was valued at USD 84.43 Million in 2024, and it is expected to reach USD 3,095.40 Million by 2033, exhibiting a growth rate (CAGR) of 48.69% from 2025 to 2033.

To get more information on this market, Request Sample

The rising adoption of 5G networks is acting as a significant growth-inducing factor in the market. For instance, by mid-2024, 5G reached 1.7 billion subscriptions worldwide, with 160 million added in only the first quarter. Approximately 320 service providers have deployed 5G networks, with 49 launching 5G Standalone (SA) networks. Users have around 2,300 5G device variants to select from. By 2029, 5G is estimated to account for 5.6 billion subscriptions, surpassing 60% of all mobile subscriptions. 5G infrastructure requires high-speed, low-latency interconnects to handle the massive increase in data traffic and support real-time applications.

Moreover, key manufacturers are focusing on enhancing the bandwidth of co-packaged optics. This involves the creation of new optical components and materials that can enable greater data transmission rates, satisfying the requirements of high-speed networks and applications. For instance, in June 2024, Intel's Integrated Photonics Solutions (IPS) Group showed the industry's most advanced and first-ever fully integrated optical computing interconnect (OCI) chiplet, which is co-packaged with an Intel CPU and runs live data. Intel's OCI chiplet advances high-bandwidth interconnect technology by enabling co-packaged optical input/output (I/O) in developing AI infrastructure for data centers and high-performance computing (HPC) applications. Besides this, heat management is crucial in co-packaged optics to prevent overheating and maintain reliable performance. Innovations in thermal management systems, such as enhanced heat sinks and materials, aid in heat dissipation, ensuring stable performance even in high-demand settings.

Global Co-Packaged Optics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to the increasing demand for cloud services, digital transformation, and the proliferation of data-intensive applications.

North America Co-Packaged Optics Market Trends:

North America dominates the overall market. The increasing demand for high-speed data transmission due to cloud computing, AI, and big data has led to the expansion of data centers, which is propelling the demand for co-packaged optics. For example, the U.S. is home to tech giants like Google, Amazon, and Microsoft, which are heavily investing in next-generation optical interconnect technologies to support massive data center traffic.

Europe Co-Packaged Optics Market Trends:

The rollout of 5G networks across Europe is fueling the need for high-performance optical solutions to support the increased data flow. The United Kingdom has advanced 5G adoption through initiatives like the "5G Create" program, enhancing demand for optical interconnects in telecom infrastructure.

Asia Pacific Co-Packaged Optics Market Trends:

Rapid advancements in 5G and AI technologies are stimulating the market growth in Asia Pacific. Countries like China, Japan, and South Korea are leading investments in CPO to support ultrafast data transmission in these applications. For instance, Huawei and Alibaba are developing optical solutions to enhance performance and scalability in data centers and 5G base stations.

Latin America Co-Packaged Optics Market Trends:

In Latin America, the co-packaged optics market is driven by efforts to modernize telecom infrastructure. Nations like Brazil and Mexico are adopting CPO to support growing internet penetration and bandwidth demands. Regional telecom providers like América Móvil are investing in optical networking to enhance connectivity, making CPO a crucial component in achieving these advancements.

Middle East and Africa Co-Packaged Optics Market Trends:

In the Middle East and Africa, the rise of edge computing and smart city projects drives the co-packaged optics market. Countries like the UAE and Saudi Arabia are integrating CPO in data centers to enhance connectivity for IoT and smart infrastructure. For example, initiatives like NEOM city in Saudi Arabia emphasize cutting-edge technologies, including CPO, for seamless high-speed data handling.

Top Companies Leading in the Co-Packaged Optics Industry

Some of the leading co-packaged optics market companies include Broadcom Inc., Lumentum Operations LLC, and Ranovus, among many others. For instance, in March 2024, Broadcom Inc., delivered Bailly, the industry's first 51.2 terabits per second (Tbps) co-packaged optics (CPO) ethernet switch, to its customers. The solution combines eight silicon photonics-based 6.4-Tbps optical engines with Broadcom's top-tier StrataXGS® Tomahawk®5 switch chip. Bailly allows the optical link to run at 70% reduced power consumption and achieves an 8x gain in silicon area efficiency when compared to pluggable transceiver alternatives. Also, in March 2022, Lumentum Holdings Inc., a designer and manufacturer of innovative optical and photonic products, and Ayar Labs Inc., a leader in chip-to-chip optical connectivity, collaborated to deliver high-volume CW-WDM MSA compliant external laser sources for co-packaged optical interconnect solutions.

Global Co-Packaged Optics Market Segmentation Coverage

- On the basis of the data rates, the market has been bifurcated into less than 1.6T and 1.6T, 3.2T, and 6.4T. Less than 1.6T and 1.6T dominate the segment in the market. Co-packaged optics can assist in reducing space in tiny data centers and networking equipment with data rates less than 1.6T.

- Based on the application, the market is categorized into data centers and high-performance computing (HPC), telecommunications and networking, and others. Data centers and high-performance computing (HPC) dominate the market. Co-packaged optics leverage optical interconnect technology, which is essential for long-distance data transmission in telecommunications networks.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 84.43 Million |

| Market Forecast in 2033 | USD 3,095.40 Million |

| Market Growth Rate 2025-2033 | 48.69% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Rates Covered | Less than 1.6T and 1.6T, 3.2T, 6.4T |

| Applications Covered | Data Centers and High-Performance Computing (HPC), Telecommunications and Networking, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Broadcom Inc., Lumentum Operations LLC, Ranovus, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)