Global CNG and LPG Vehicle Market Expected to Reach USD 5.4 Billion by 2033 - IMARC Group

Global CNG and LPG Vehicle Market Statistics, Outlook and Regional Analysis 2025-2033

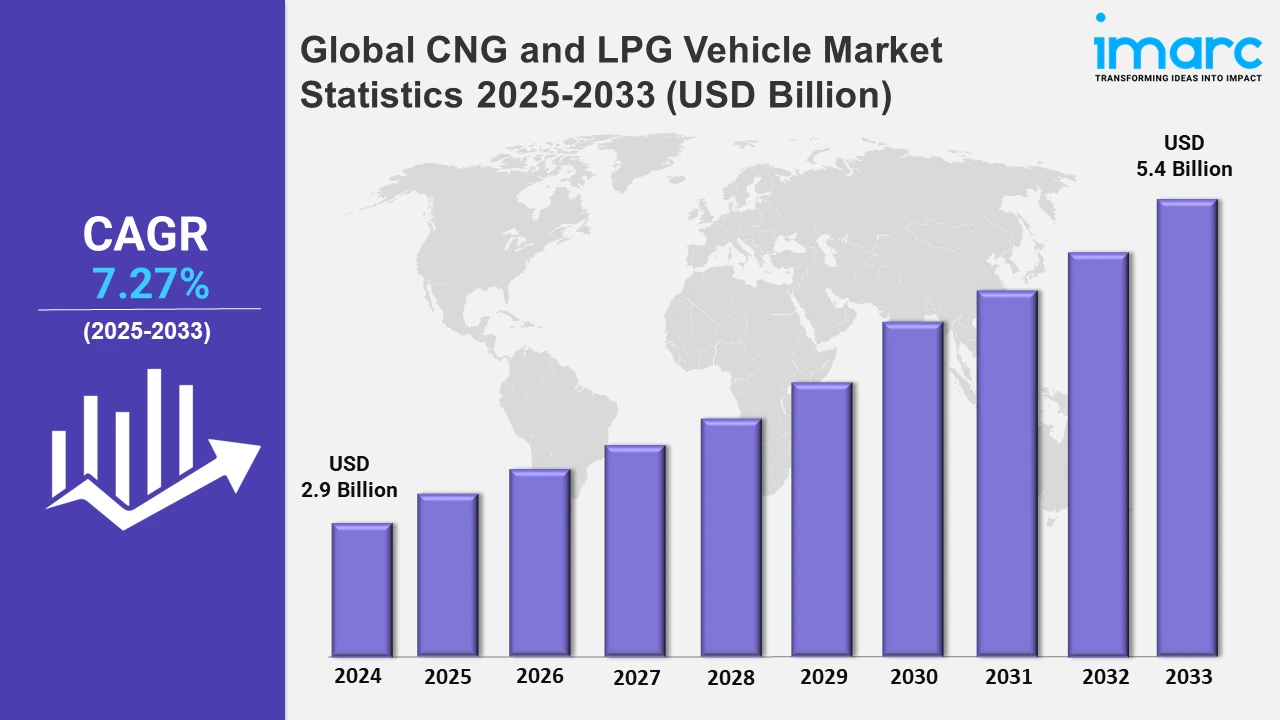

The global CNG and LPG vehicle market size was valued at USD 2.9 Billion in 2024, and it is expected to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 7.27% from 2025 to 2033.

To get more information on this market, Request Sample

The global CNG and LPG vehicle market is experiencing growth driven by the increasing focus on energy diversification and cost-effective mobility solutions. Rising environmental concerns and commitments toward reducing carbon footprints have encouraged governments to implement policies supporting alternative fuel adoption. For instance, in February 2024, the Haryana government unveiled the draft Haryana Green Hydrogen Policy 2024. The policy supports the National Green Hydrogen Mission by promoting green hydrogen and its derivatives as alternative fuels and raw materials, aiming to enhance energy security, optimize renewable resources, and reduce fossil fuel reliance through biomass use. Additionally, improvements in fueling infrastructure and advancements in technology, such as enhanced engine compatibility and reduced emission systems, are accelerating market penetration. This shift aligns with global sustainability goals and positions CNG and LPG vehicles as a practical solution for balancing affordability and environmental responsibility.

The increasing emphasis on reducing greenhouse gas emissions is a significant driver of the global CNG and LPG vehicle market. CNG and LPG vehicles, known for their lower carbon dioxide and particulate emissions compared to conventional gasoline and diesel vehicles, align with these sustainability goals. Incentives, such as tax benefits, subsidies, and reduced fuel costs, are encouraging consumers and businesses to adopt these vehicles. Additionally, the growing investment in refueling infrastructure development ensures greater accessibility, further propelling market growth. For instance, in September 2024, the U.S. Department of Energy (DoE) announced an investment of USD 62 million for 20 projects across 15 states to advance clean hydrogen technologies. The funding focuses on hydrogen refueling infrastructure, port equipment, and equitable deployment, aiming to accelerate adoption and support standardization for medium- and heavy-duty vehicle fueling.

Global CNG and LPG Vehicle Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia-Pacific accounted for the largest market share on account of robust adoption, government incentives, and expanding refueling infrastructure.

Asia-Pacific CNG and LPG Vehicle Market Trends:

Asia-Pacific stands as the leading region in the global CNG and LPG vehicle market, propelled by strong demand in countries like China, India, and Thailand. For instance, in India, the sales of CNG vehicles recorded a 46% year-on-year growth from January to August 2024. Stringent environmental policies, coupled with financial incentives, encourage the adoption of alternative fuel vehicles. The region's robust infrastructure development and abundant natural gas resources further support market expansion. Rising fuel costs and urbanization drive consumers and businesses to seek cost-efficient and eco-friendly transportation solutions. Additionally, increasing investments in advanced vehicle technologies and collaborations among automotive manufacturers enhance product offerings, reinforcing Asia-Pacific's dominant position in this market segment and driving continued growth across the region.

North America CNG and LPG Vehicle Market Trends:

North America holds a significant position in the global CNG and LPG vehicle market, driven by rising environmental regulations and government incentives promoting alternative fuel adoption. The region benefits from established refueling infrastructure and growing consumer demand for eco-friendly, cost-efficient transportation, particularly in commercial and fleet operations.

Europe CNG and LPG Vehicle Market Trends:

Europe represents a key market for CNG and LPG vehicles, supported by stringent emission regulations and government initiatives promoting alternative fuels. The region's advanced infrastructure, combined with rising consumer demand for sustainable transportation options, drives adoption, particularly in countries like Germany, Italy, and the Netherlands.

Latin America CNG and LPG Vehicle Market Trends:

Latin America is emerging as a growing market for CNG and LPG vehicles due to the abundant natural gas reserves and cost-effective fuel availability. Countries like Argentina and Brazil lead the adoption due to government incentives and expanding refueling infrastructure, making alternative fuels a practical choice for consumers and fleets.

Middle East and Africa CNG and LPG Vehicle Market Trends:

The Middle East and Africa region is gaining traction in the CNG and LPG vehicle market, supported by abundant natural gas resources and growing awareness of clean fuel benefits. Government initiatives to reduce emissions and enhance fuel affordability, particularly in countries like Iran and South Africa, are driving adoption.

Top Companies Leading in the CNG and LPG Vehicle Industry

Some of the leading CNG and LPG Vehicle market companies include AB Volvo, Hyundai Motor Company, IVECO S.p.A, Suzuki Motor Corporation, Tata Motors Limited (Tata Group), among many others. In September 2024, Tata Motors launched the Nexon iCNG and expanded the Nexon.ev range with a new 45 kWh battery pack and the flagship Red Hot #DARK edition. The Nexon iCNG is India’s first turbocharged CNG vehicle, targets environmentally conscious customers seeking value without compromising driving quality and experience.

Global CNG and LPG Vehicle Market Segmentation Coverage

- On the basis of the fuel type, the market has been categorized into CNG (compressed natural gas), and LPG (liquefied petroleum gas), wherein CNG (compressed natural gas) represent the leading segment. The leading segment reflects growing affordability, lower emissions, and widespread availability. Governments' stringent emission regulations and incentives further boost adoption.

- Based on the vehicle type, the market is classified into passenger cars and commercial vehicles, amongst which passenger cars dominates the market. The leading segment is attributed to the rising consumer demand for cost-effective, low-emission transportation. However, stringent environmental regulations and expanding refueling infrastructure further support adoption.

- On the basis of the sales channel, the market has been divided into OEM (original equipment manufacturer) and retrofitting. Among these, retrofitting accounts for the majority of the market share. The segment is driven by cost-effectiveness and growing demand for eco-friendly fuel alternatives. Moreover, vehicle owners increasingly opt for aftermarket conversions to align with emission standards and reduce fuel expenses.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2.9 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Market Growth Rate 2025-2033 | 7.27% |

| Units | Billion USD |

| Fuel Types Covered | CNG (Compressed Natural Gas), LPG (Liquefied Petroleum Gas) |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Retrofitting |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AB Volvo, Hyundai Motor Company, IVECO S.p.A, Suzuki Motor Corporation, Tata Motors Limited (Tata Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)