Global Cloud Storage Market Expected to Reach USD 490.56 Billion by 2033 - IMARC Group

Global Cloud Storage Market Statistics, Outlook and Regional Analysis 2025-2033

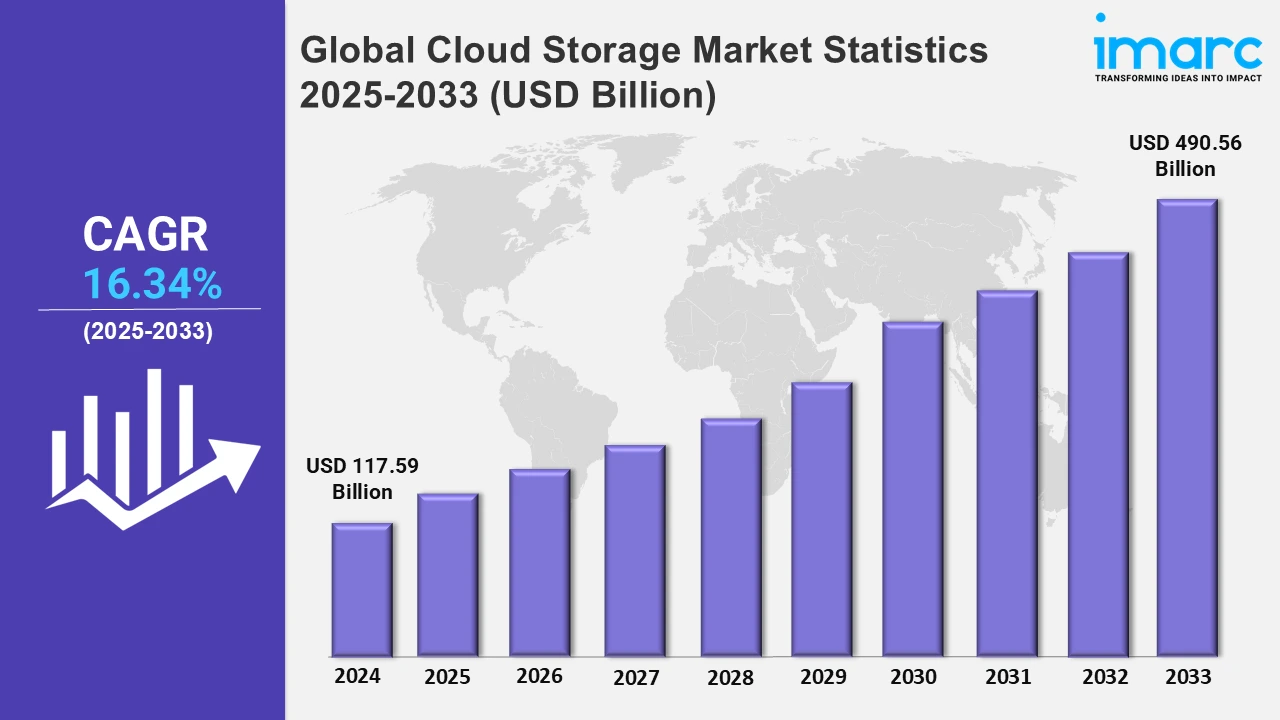

The global cloud storage market size was valued at USD 117.59 Billion in 2024, and it is expected to reach USD 490.56 Billion by 2033, exhibiting a growth rate (CAGR) of 16.34% from 2025 to 2033.

To get more information on this market, Request Sample

The growing adoption of remote and hybrid work models is a key factor propelling the global market. With more companies shifting to flexible work arrangements, there has been a rising need for centralized, easily accessible data repositories. Furthermore, advanced cloud storage technologies are increasing demand from organizations to establish secure and scalable video surveillance solutions. Organizations need secure, efficient, and inexpensive storage for the expanding surveillance data volumes created by modern video management systems. For instance, on 23rd September 2024, Wasabi technologies and Johnson controls declared a collaboration to enable high-performance, safe, scalable, and cost-effective cloud storage for video surveillance. Integrating Wasabi's hot cloud storage with Johnson Controls' exacqVision video management system ensures data protection and seamless access for mission-critical video management. Moreover, edge computing adoption is growing and thus affecting the cloud storage market.

Another major reason for growth in the market is the exponential rise in unstructured data, like e-mails, social media postings, multimedia files, and sensor data from IoT devices. Businesses are looking to adopt solutions that can handle storage, manage, and effectively analyze this data. Cloud storage provides a scalable and flexible infrastructure, which would accommodate these data types in addition to providing advanced features in metadata tagging and lifecycle management to optimize storage costs as well as access efficiency. Rising need for efficient data management in artificial intelligence (AI) and analytics fuels the demand for advanced storage solutions. Businesses require large amounts of scalable and secure storage infrastructure to handle a large volume of data that maintains energy efficiency. On November 12, 2024, Hitachi Vantara announced enhancements to its virtual storage platform one, introducing an all-new quad-level cell (QLC) flash storage array and an object storage appliance. These additions aim to improve data management for AI and analytics workloads, offering increased scalability, security, and energy efficiency. Cloud-native technologies such as Kubernetes and serverless computing are pushing the organizations to shift towards cloud environments. These applications require scalable storage solutions that can dynamically adapt to the workloads of the application, thus ensuring performance and cost efficiency.

Global Cloud Storage Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of its advanced IT infrastructure and rapid adoption by key players and industry in cloud-driven technologies.

North America Cloud Storage Market Trends:

The cloud storage market is being led by North America, driven by its well established IT infrastructure, widespread adoption of cloud-based technologies, and the presence of major cloud service providers like Microsoft Azure, Amazon Web Services, and Google Cloud. Furthermore, the growing adoption of enterprise AI workloads is pushing cloud storage solutions toward scalability, high performance, and more. Organizations are always looking for platforms that can work efficiently in terms of managing data, as the intensive requirement of computation in AI applications grows. For instance, on November 22, 2024, NetApp joined the Vultr Cloud Alliance to offer scalable data management solutions for enterprise AI workloads. This collaboration combines NetApp's advanced data storage capabilities with Vultr's high-performance cloud infrastructure, enhancing cloud storage options for data-intensive industries.

Asia-Pacific Cloud Storage Market Trends:

In the Asia Pacific region, expansion in digital transformation initiatives along with the adoption of Internet of Things (IoT) and artificial intelligence (AI), as well as rising SMEs adopting the cloud, are driving high growth in the cloud storage market. Demand is highly contributed to by the key markets like China, India, and Japan, which, apart from this, have government supports through smart city projects as well as 5G rollout. The region's growing e-commerce and fintech sectors also greatly contribute to the adoption of scalable cloud storage infrastructure.

Europe Cloud Storage Market Trends:

Europe's cloud storage market is dominated by strong regulatory compliance requirements, including GDPR, that ensure secure and transparent data management. The region is also experiencing high adoption of the cloud in healthcare, finance, and manufacturing sectors. High investments in sustainable and energy-efficient storage solutions also reflect Europe's focus on green technology. Countries such as Germany, the UK, and France are leading in using hybrid cloud systems, with enterprises putting emphasis on secure and efficient data storage solutions.

Latin America Cloud Storage Market Trends:

Cloud storage is growing in Latin America due to the increase in the digitalization of services across industries, and even governments are in favor of promoting cloud. Brazil and Mexico are very significant for the growth as companies consider the cost efficiency of cloud storages and scalabilities for such storages. A high growth rate has been observed among e-commerce, fintech, and online service-based economies in the region. The scarcity of IT resources in SMEs is another factor pushing the adoption of flexible cloud storage offerings to reduce the complexity of operations and increase efficiency.

Middle East and Africa Cloud Storage Market Trends:

The MEA region's cloud storage market is growing, with a growth momentum driven by digital transformation efforts, increased cloud adoption in oil and gas and financial sectors. Countries like the UAE and Saudi Arabia lead the region with significant investments in data center infrastructure. The growth of smart city initiatives and government-backed technology projects has fueled demand for secure and scalable cloud storage solutions. In some parts of the region, limited legacy infrastructure makes it easier to adopt advanced cloud technologies directly.

Top Companies Leading in the Cloud Storage Industry

Some of the leading cloud storage market companies include Alibaba Cloud, Amazon Web Services Inc., Box Inc., Dell Inc., Dropbox, Inc., Google LLC, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, NetApp, Oracle Corporation, and Wasabi Technologies among many others.

- On 9th September 2024, Oracle and Amazon Web Services (AWS) introduced Oracle Database@AWS, offering customers the ability to access Oracle Autonomous Database and Exadata Database Service directly within the AWS environment. This strategic partnership simplifies enterprise workload migration to the cloud, enhancing agility and security. Customers can leverage a unified experience for database administration and support while benefiting from AWS's infrastructure. The offering facilitates seamless integration between Oracle databases and AWS applications, promoting innovation across various industries.

Global Cloud Storage Market Segmentation Coverage

- On the basis of the component, the market has been categorized into solution and services, wherein solutions represent the leading segment as they offer all-inclusive features, such as storage platforms, data management systems, and integration capabilities. Organizations have a preference for solutions that guarantee secure, scalable, and efficient data storage. With ever-increasing volumes of structured and unstructured data, businesses depend on solutions customized to specific industry needs to optimize data accessibility, compliance, and cost-effectiveness.

- Based on the deployment type, the market is classified into private, public and hybrid. Private cloud storage is preferred by organizations that consider data security, regulatory compliance, and exclusive control over their storage infrastructure to be critical. Public cloud storage attracts businesses seeking cost-effective, scalable, and easily accessible storage solutions for diverse workloads. Hybrid cloud attracts businesses that are in pursuit of cost-effective, scalable, and accessible storage for diverse workloads.

- On the basis of the user type, the market has been divided into large enterprises and small and medium-sized enterprises. Among these, large enterprises account for the majority of the market share. Large enterprises are leading the cloud storage market since they need huge storage infrastructure to manage massive datasets produced from operations, analytics, and customer interactions. The organizations have robust security requirements, high scalability, and seamless integration with existing systems. The rise in adoption of AI and IoT technology further amplifies the demand for reliable cloud storage solutions for maintaining efficiency and competitiveness.

- Based on the industry vertical, the market is segregated into BFSI, government and public sector, healthcare, IT and telecom, retail, manufacturing, media and entertainment and others. The BFSI sector uses cloud storage for the secure management of sensitive financial information, ensuring regulatory compliance and facilitating real-time transaction processing. Cloud storage helps in efficient data management and ensures secure citizen records besides supporting digital transformation initiatives. The health care industry relies on cloud storage for secure storage of electronic health records, medical imaging, and seamless data sharing across providers for better patient care.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 117.59 Billion |

| Market Forecast in 2033 | USD 490.56 Billion |

| Market Growth Rate 2025-2033 | 16.34% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Types Covered | Private, Public, Hybrid |

| User Types Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, Government and Public Sector, Healthcare, IT and Telecom, Retail, Manufacturing, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alibaba Cloud, Amazon Web Services Inc., Box Inc., Dell Inc., Dropbox, Inc., Google LLC, Hewlett Packard Enterprise Development LP, International Business Machines Corporation, Microsoft Corporation, NetApp, Oracle Corporation, Wasabi Technologies, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Cloud Storage Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)