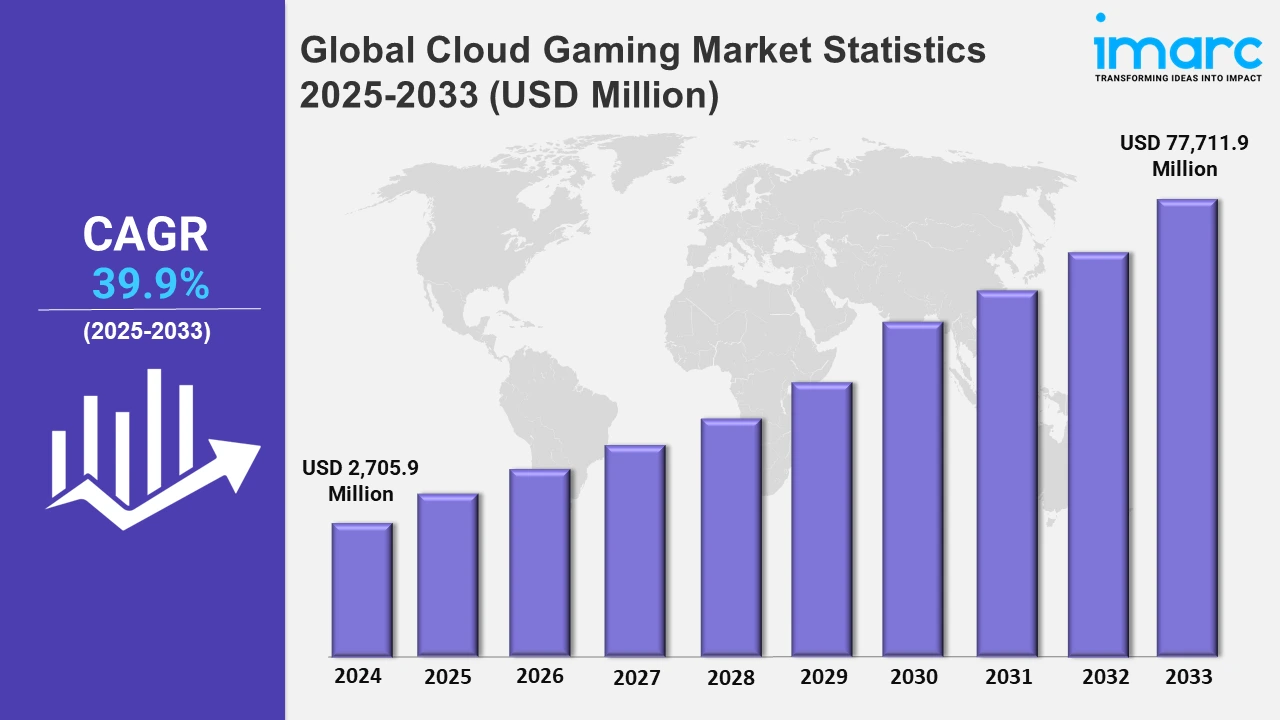

Global Cloud Gaming Market Expected to Reach USD 77,711.9 Million by 2033 - IMARC Group

Global Cloud Gaming Market Statistics, Outlook and Regional Analysis 2025-2033

The global cloud gaming market size was valued at USD 2,705.9 Million in 2024, and it is expected to reach USD 77,711.9 Million by 2033, exhibiting a growth rate (CAGR) of 39.9% from 2025 to 2033.

To get more information on this market, Request Sample

Major technology firms are entering into long-term partnerships with European cloud gaming platforms to improve their streaming offerings. These strategic agreements broaden gaming accessibility and strengthen market presence, demonstrating the industry's interest in more service integration and better user experiences. For example, in April 2023, Microsoft Corporation entered into a ten-year agreement with Nware, a European cloud gaming platform, to expand its game streaming services.

Moreover, cloud gaming providers are extending their offers with specialized subscription plans in order to reach a larger audience, including families. Platforms are introducing kid-friendly content at reasonable prices, making gaming more accessible and appealing to families looking for safe and interesting entertainment for their children. For instance, in September 2021, Amazon Web Services expanded its range of services by unveiling a subscription plan aimed at families. Customers can upgrade their Luna+ subscription to include these new features for USD 2.99 monthly and avail 36 kid-friendly games. Furthermore, cloud gaming companies are working to improve user experiences by employing innovative cloud infrastructure to minimize latency and expand game accessibility across many devices. This focus is critical as worldwide demand for seamless gaming rises. The rise of cloud gaming services offers huge income opportunities for developers and technology suppliers. Additionally, users are shifting toward high-performance cloud gaming solutions that provide console-level visuals and seamless gameplay even on low-end devices. For example, in Europe, telecom giant Vodafone collaborated with multiple cloud gaming companies to link their services with 5G networks, resulting in better gameplay and a larger audience. These agreements demonstrate the industry's commitment to increasing network stability and broadening the reach of cloud gaming, making it more accessible and appealing to a wide variety of gamers seeking flexibility and high-quality experiences.

Global Cloud Gaming Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest cloud gaming market share on account of the elevating number of casual and professional gamers.

North America Cloud Gaming Market Trends:

The market in North America is powered by high-speed internet infrastructure that allows for smooth gameplay. Cloud services such as Xbox Cloud Gaming gained popularity with Microsoft's Game Pass, which allows players to stream high-quality games across several platforms, emphasizing simplicity and accessibility for a wide range of consumers.

Europe Cloud Gaming Market Trends:

The adoption of 5G technology is accelerating cloud gaming and allowing low-latency streaming. PlayStation Now grew across Europe, using superior networks and a large user base to provide a competitive edge in the delivery of cloud-based gaming experiences.

Asia Pacific Cloud Gaming Market Trends:

In Asia Pacific, cloud gaming services are emerging through strategic alliances, with businesses working together to improve game libraries and streaming capabilities, making it a dominant region. For example, in September 2022, Mediba, Inc. and Ubitus, Inc. announced a business alliance in which Mediba Corporation provided classic games to Ubitus's cloud gaming service and streaming platform "GameNow."

Latin America Cloud Gaming Market Trends:

Telecom providers in Latin America are partnering to improve cloud gaming services and reach a larger audience. Movistar collaborated with gaming platforms to provide cloud gaming packages, allowing consumers to enjoy games without the need for high-end gear, hence increasing industry development.

Middle East and Africa Cloud Gaming Market Trends:

Partnerships with technology businesses to improve infrastructure are driving growth in the Middle East and Africa region. For instance, Huawei worked with local service providers to expand network capabilities, allowing for faster cloud gaming experiences and addressing connection difficulties that had previously hindered industry growth.

Top Companies Leading in the Cloud Gaming Industry

Some of the leading cloud gaming market companies include Utomik B.V., Nvidia Corporation, Numecent Holdings Ltd., RemoteMyApp SP ZOO (Vortex), Parsec Cloud Inc., Paperspace, LiquidSky Software Inc., Simplay Gaming Ltd., Ubitus Inc., Microsoft Corporation, Sony, Amazon web services, Google, IBM Corporation, Samsung electronics, GameFly, and CiiNow Inc., among many others. For example, in November 2019, Google introduced Stadia, a cloud gaming service, and continued to expand its offerings through 2020 and 2021.

Global Cloud Gaming Market Segmentation Coverage

- On the basis of the devices type, the market has been bifurcated into smartphones, smart TVs, consoles, tablets, and PCs, wherein smartphones represent the most preferred segment. Cloud gaming services are available on smartphones through specialized applications. Users may stream games from cloud servers to their smartphones, allowing them to play high-quality games on mobile devices.

- Based on the genre, the market is categorized into adventure/role playing games, puzzles, social games, strategy, simulations, and others. Adventure and role playing games include engrossing tales and character-driven objectives. Puzzle games present players with problem-solving tasks. Social games encourage interaction and community involvement. Strategy games need tactical preparation and competitive play. Simulation games emulate real-world settings to provide lifelike experiences.

- On the basis of the technology, the market has been divided into video streaming and file streaming. Among these, video streaming exhibits a clear dominance in the market. It runs on powerful distant servers in data centers. When a user wants to play a game, it sends input commands to the server, and the game is handled on the distant server.

- Based on the gamers, the market is bifurcated into hardcore gamers and casual gamers, wherein casual gamers dominate the market. Casual gamers play more casually and infrequently. Instead of chasing competitive challenges, they play games for leisure or entertainment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 2,705.9 Million |

| Market Forecast in 2033 | USD 77,711.9 Million |

| Market Growth Rate 2025-2033 | 39.9% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Devices Types Covered | Smartphones, Smart TVs, Consoles, Tablets, PCs |

| Genres Covered | Adventure/Role Playing Games, Puzzles, Social Games, Strategy, Simulations, Others |

| Technologies Covered | Video Streaming, File Streaming |

| Gamers Covered | Hardcore Gamers, Casual Gamers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Utomik B.V., Nvidia Corporation, Numecent Holdings Ltd., RemoteMyApp SP ZOO (Vortex), Parsec Cloud Inc., Paperspace, LiquidSky Software Inc., Simplay Gaming Ltd., Ubitus Inc., Microsoft Corporation, Sony, Amazon web services, Google, IBM Corporation, Samsung electronics, GameFly, CiiNow Inc. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Cloud Gaming Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)