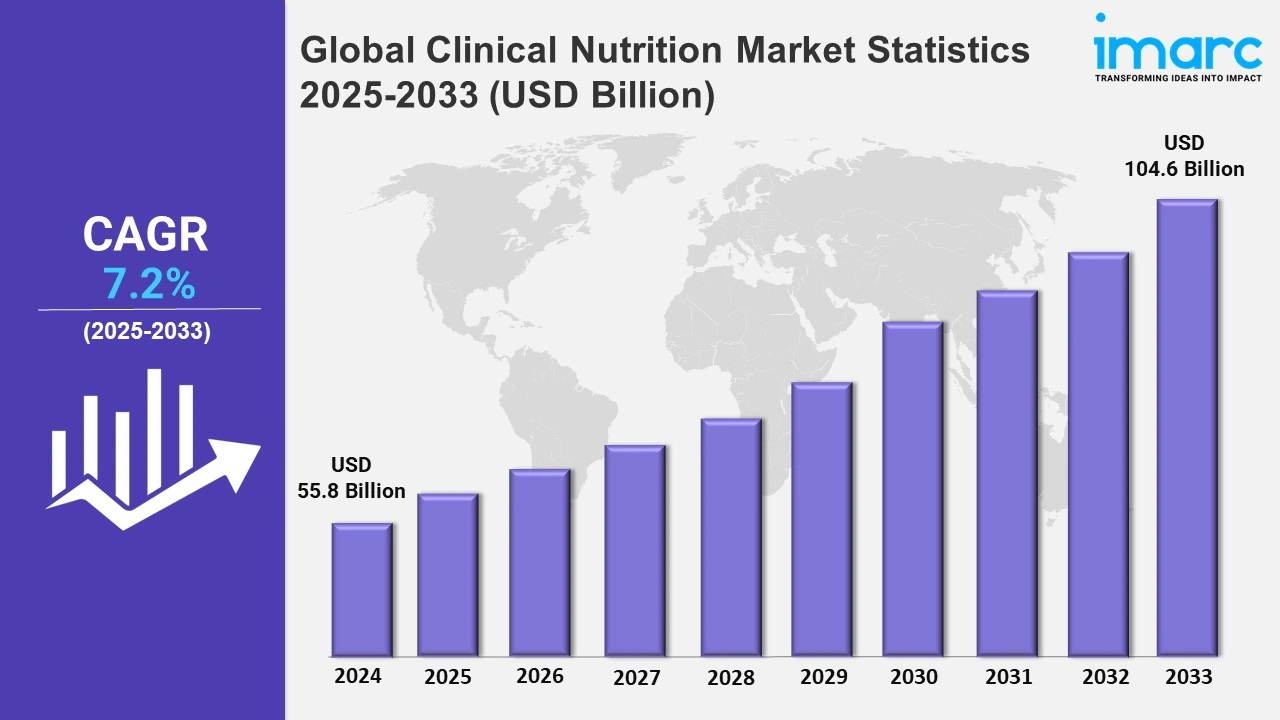

Global Clinical Nutrition Market to Grow at 7.2% during 2025-2033, Reaching USD 104.6 Billion by 2033

The global clinical nutrition market size was valued at USD 55.8 Billion in 2024, and it is expected to reach USD 104.6 Billion by 2033, exhibiting a growth rate (CAGR) of 7.2% from 2025 to 2033.

To get more information on the this market, Request Sample

The clinical nutrition market is primarily driven by the increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and cancer. According to the American Heart Association's diabetes 2024 statistics infographic, 9.7 million adults have undiagnosed diabetes, 29.3 million are diagnosed, and 115.9 million have pre-diabetes, showcasing significant public health challenges and highlighting the need for better screening, education, and preventive measures. Chronic conditions can lead to malnutrition or necessitate specialized dietary management to improve patient outcomes. Clinical nutrition products, including enteral and parenteral formulas, play a vital role in maintaining patients’ nutritional status by providing essential, tailored nutrients. The growing elderly population, who are more susceptible to chronic health issues, increases the demand for targeted nutritional support. Healthcare providers are incorporating clinical nutrition into treatment plans to enhance quality of life and manage disease-related complications effectively, solidifying its importance as an integral part of comprehensive healthcare strategies.

An enhanced focus on preventive healthcare is significantly augmenting the market as awareness of the importance of nutritional status for overall health rises among the masses. Both individuals and healthcare providers are prioritizing early interventions and dietary support to maintain health and prevent diet-related diseases, especially among vulnerable groups, such as infants, the geriatric population, and those with medical conditions. Governments and organizations are launching educational campaigns promoting balanced nutrition and healthy living. The World Health Statistics 2024 report highlights the urgency for global preventive efforts to meet WHO’s “triple billion” targets, aiming for 585 million more people with essential health coverage and 777 million better protected from emergencies by 2025. With 1.5 billion people expected to lead healthier lives, there is a need for intensified preventive actions.

Global Clinical Nutrition Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of its growing geriatric population, high prevalence of chronic diseases, and the growing awareness regarding preventive healthcare measures.

Asia-Pacific Clinical Nutrition Market Trends:

The Asia-Pacific market is rapidly expanding due to the aging population, rising chronic disease rates, and growing health awareness. Government health initiatives and a focus on preventive care are driving consumer demand for nutritional supplements and specialized clinical nutrition products that promote long-term health. Notably, on August 6, 2024, Swisse launched Swisse Ultiboost High Strength Krill Oil, claiming to relieve knee pain and improve mobility for mild to moderate osteoarthritis. Supported by a six-month clinical trial, this product secured AUST-L(A) status for efficacy-based health claims, enhancing joint health offerings and contributing to the region's market growth.

North America Clinical Nutrition Market Trends:

North America shows strong demand for clinical nutrition products fueled by the high incidences of lifestyle-related diseases, obesity, and the growing aging demographic. Continual technological advancements and research and development (R&D) activities focusing on clinical nutrition are contributing to product innovations. Consumers are increasingly seeking personalized nutrition options, and healthcare providers emphasize nutritional support as part of comprehensive treatment plans, further propelling the market's growth in this region.

Europe Clinical Nutrition Market Trends:

Europe is witnessing steady growth in the clinical nutrition market, majorly driven by the presence of a robust healthcare system, the rising cases of chronic and age-related diseases, and strong government backing for nutritional initiatives. Awareness campaigns promoting healthy eating and preventive measures also contribute to expansion in the market. The demand for specialized nutrition products in hospitals and homecare settings is also fostering industry development.

Latin America Clinical Nutrition Market Trends:

Latin America is witnessing gradual growth in the market due to the increasing focus on healthcare infrastructure improvements and greater awareness of nutrition's role in health. The rising burden of chronic diseases and a growing elderly population fuel demand for clinical nutrition products. Increasing investments and public-private partnerships are helping to expand access and support market development.

Middle East and Africa Clinical Nutrition Market Trends:

The Middle East and Africa are experiencing a developing clinical nutrition market, driven by growing healthcare investments and efforts to combat malnutrition and chronic diseases. Rapid urbanization and shifting dietary habits are augmenting the demand for nutritional products. The market shows a strong promise of growth, as supported by regional initiatives aimed at improving public health and nutrition access.

Top Companies Leading in the Clinical Nutrition Industry

Some of the leading clinical nutrition market companies include Abbott Laboratories, Ajinomoto Co., Inc., Baxter International Inc., Danone S.A, Fresenius Kabi Ltd, Kate Farms, Medifood, Nestlé Health Science, Perrigo Company plc, and Reckitt, among many others. On May 13, 2024, Baxter International Inc. announced the FDA approval for the expanded use of Clinolipid, a mixed oil lipid emulsion, for pediatric patients, including neonates, enhancing its clinical nutrition offerings. Clinolipid, used in parenteral nutrition (PN), provides essential calories and fatty acids when oral or enteral nutrition isn't feasible. With 80% olive oil and 20% soybean oil, it aligns with modern clinical practices. Clinolipid's omega-9 oleic acid content, stability, and safety, proven through 150 million global doses, support neonatal and pediatric growth and development.

Global Clinical Nutrition Market Segmentation Coverage

- On the basis of the product, the market has been categorized into infant nutrition, parental nutrition, and enteral nutrition, wherein infant nutrition represents the leading segment. This dominance can be attributed to the high demand for specialized products that support growth and development during critical early life stages. Elements such as increasing birth rates, heightened awareness regarding the significance of balanced diets for infants, and a stronger emphasis on tackling malnutrition contribute to market expansion. Formulas infused with vital nutrients address particular dietary requirements, promoting optimal health.

- Based on the route of administration, the market is classified into oral, enteral, and parenteral, amongst which oral dominates the market. The predominant position of this segment in the clinical nutrition sector is due to its practicality, safety, and broad acceptance by patients and healthcare professionals. It is the favored approach for nutritional support since it maintains natural digestion processes, is economical, and seamlessly fits into treatment strategies. Oral supplements address various patient requirements, enhancing compliance and augmenting patient results.

- On the basis of the application, the market has been divided into cancer, malnutrition, metabolic disorders, gastrointestinal disorders, neurological disorders, and others. Cancer holds a significant position in the market, as patients require specialized nutritional support to manage treatment side effects and maintain strength. Malnutrition increases the need for customized nutritional solutions to rectify nutrient shortages and facilitate recovery. Metabolic disorders significantly impact health, necessitating careful nutritional management to control bodily functions. Gastrointestinal issues are significant, requiring specialized nutrition to support digestion and absorption whereas neurological disorders require specific diets for peak brain health, thereby augmenting the market.

- On the basis of the end user, the market is categorized into pediatric, adults, and geriatric. Among these, pediatric accounts for the majority of the market share, due to the critical need for specialized nutritional support for infants and children, particularly those with medical conditions that prevent adequate oral or enteral intake. High malnutrition rates, premature births, and chronic illnesses in young patients increase the need for tailored parenteral and enteral nutrition solutions, ensuring optimal growth, development, and overall health outcomes.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 55.8 Billion |

| Market Forecast in 2033 | USD 104.6 Billion |

| Market Growth Rate 2025-2033 | 7.2% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Infant Nutrition, Parental Nutrition, Enteral Nutrition |

| Route of Administration Covered | Oral, Enteral, Parenteral |

| Applications Covered | Cancer, Malnutrition, Metabolic Disorders, Gastrointestinal Disorders, Neurological Disorders, Others |

| End Users Covered | Pediatric, Adults, Geriatric |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Ajinomoto Co., Inc., Baxter International Inc., Danone S.A, Fresenius Kabi Ltd, Kate Farms, Medifood, Nestlé Health Science, Perrigo Company plc, Reckitt, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Clinical Nutrition Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)