Global Chocolate Market Expected to Reach USD 219.1 Billion by 2033 - IMARC Group

Global Chocolate Market Statistics, Outlook and Regional Analysis 2025-2033

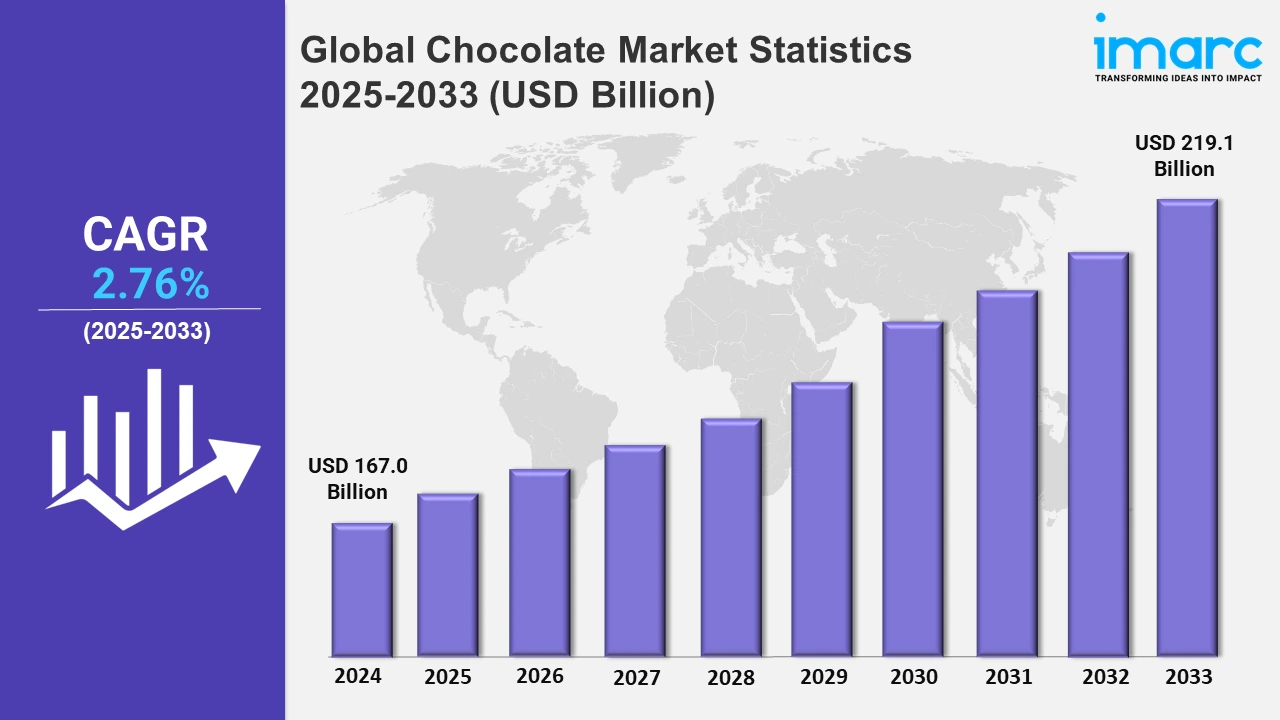

The global chocolate market size was valued at USD 167.0 Billion in 2024, and it is expected to reach USD 219.1 Billion by 2033, exhibiting a growth rate (CAGR) of 2.76% from 2025 to 2033.

To get more information on this market, Request Sample

The global chocolate market is growing rapidly due to a combination of factors that reflect changing consumer preferences, economic trends, and production technologies. Increasing demand for premium and artisanal chocolates is one of the significant drivers, fueled by rising disposable incomes and a growing emphasis on high-quality, indulgent experiences. Consumers are demanding unique flavors and textures, with a raised preference for products that feature exotic ingredients, organic certifications, or ethical sourcing. For instance, in October 2024, To'ak launched the Alchemy Mini series, featuring 65% dark chocolate bars infused with exotic ingredients like Malva flowers, Andean mints, Amazonian ants, Galapagos orange, rainforest nuts, spicy tucupi, caramelized pop amaranth, and golden peanuts. Furthermore, dark chocolate, which has been promoted for its health benefits, including antioxidant properties and cardiovascular support, has further propelled market demand. In addition, increasing use of chocolate in a wide range of products from bakery to confectionery and even beverages are driving growth as it provides ample opportunities for consumption. Seasonal demand for chocolate continues to provide significant sales volumes especially during festive seasons like Christmas, Valentine's Day, and Easter, thereby enhancing the market scope.

Health and wellness trends are also reshaping the chocolate market growth. Low-sugar, sugar-free or plant-based chocolates are becoming highly in trend, which is altering demand in line with the health requirements of health-conscious consumers and diabetic sufferers. Innovations in product formulation, including the incorporation of alternatives for sweeteners such as stevia or monk fruit have allowed this company to target this segment without ever affecting the taste. For example, in January 2024, Luker Chocolate launched its no-added-sugar line combining stevia and erythritol, crafting healthier chocolate alternatives with fewer calories, low glycemic impact, and improved taste after eight years of meticulous development. Moreover, ethical sourcing of cocoa and contributing toward fair trade initiatives form an important part of other sustainability movements that are presently forcing consumers to choose sustainable and responsible brands. Technological innovation in chocolate manufacturing processes, including fermentation techniques for more sophisticated flavor profiles and environment-friendly packaging solutions, attracts a growing number of conscious environment consumers and thus increases market share. Chocolate consumption continues to grow in the Asian-Pacific region with increased urbanization, exposure to western lifestyle, and greater networks of retail chains including Internet platforms that improve product availability. All these drivers, in sum, are making a dynamic and competitive global chocolate market that continues to evolve with changing consumer expectations and preferences.

Global Chocolate Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of high consumer demand for premium and specialty chocolates.

North America Chocolate Market Trends:

North America dominates the global chocolate market, driven by strong consumer demand for premium and specialty chocolates. The region's large disposable income base supports the growth of artisanal and organic chocolate products, catering to health-conscious consumers. Innovative product offerings, such as sugar-free, vegan, and functional chocolates, are capturing diverse market segments. According to the sources in 2024, Macalat, a certified organic chocolate brand based in Durham, North Carolina, introduced its Organic Sweet Dark Chocolate. This innovative product utilizes mushroom mycelium-derived flavor modulation to eliminate the bitterness typically associated with dark chocolate. Furthermore, seasonal sales during holidays like Halloween, Christmas, and Valentine's Day significantly boost chocolate consumption. Furthermore, the presence of major players investing in marketing campaigns and product development ensures a dynamic market landscape. The rising trend of sustainable sourcing and ethical production also resonates with consumers, strengthening brand loyalty. Overall, North America's focus on innovation, quality, and consumer preferences secures its position as the largest chocolate market globally.

Asia-Pacific Chocolate Market Trends:

The Asia-Pacific chocolate market is growing due to a rise in disposable incomes and changing consumer preferences for high-end and imported chocolates. Growing urbanization and westernization are heightening the demand for chocolate-based confectioneries. Raised awareness about health is boosting interest in dark and sugar-free chocolates. Seasonal festivals and gifting traditions, especially in the markets of India and China, further increase sales. Moreover, e-commerce platforms ensure access to a wider range of products.

Europe Chocolate Market Trends:

Europe is an important key player in the international chocolate market due to high demand for good-quality, artisanal chocolates. The region has a rich culture of consuming chocolates which encourages steady growth, innovation leadership is observed among Belgium and Switzerland. Emerging trends of organic, fair-trade, and vegan chocolates are becoming trendy, as consumers are attracted toward ethical, sustainable products. Seasonal events and cultural celebrations will also sustain market demand.

Latin America Chocolate Market Trends:

Latin American chocolate market is stimulated by the production status as a leading producer of cocoa and growing domestic demand for chocolate products. Brazil leads, followed by Mexico which increasingly gains interest in premium, healthy, and other different varieties. Seasonal demand rises because of cultural celebrations and gift-giving. The emergence of middle-class populations along with modern retail channels promotes easier accessibility and awareness of many varieties of chocolates in this region.

Middle East and Africa Chocolate Market Trends:

The chocolate market in the Middle East and Africa is expanding on account of rising urbanization, with demand for luxury and premium products. Consumption has also been driven by a raised young audience and heighted disposable incomes, especially for celebrations and gifting periods like Ramadan. Formulations, such as heat-resistant chocolates also serve to address the climatic conditions in the region. Accelerating channels for retail and e-commerce continue to expand the reach.

Top Companies Leading in the Chocolate Industry

Some of the leading chocolate market companies include Arcor, Barry Callebaut, Chocoladefabriken Lindt & Sprüngli AG, Chocolaterie Guylian, Ferrero International, Mars Incorporated, Meiji Co. Ltd., Mondelez International Inc. (Kraft Foods), Moonstruck Chocolate Company, Nestlé S.A., The Hershey Company, among many others.

- In 2024, Ferrero unveiled a plant-based version of its popular Nutella chocolate spread in Italy, catering to the growing demand for vegan alternatives. The new recipe replaces traditional milk powder with a plant-based ingredient, making it suitable for flexitarians and individuals with lactose intolerance.

Global Chocolate Market Segmentation Coverage

- On the basis of the product type, the market has been categorized into white chocolate, milk chocolate, dark chocolate, and others, wherein milk chocolate represent the leading segment. Milk chocolate is dominating the chocolate market due to its wide acceptance among people, providing a creamy, sweet taste experience. Its availability in various applications-from confectionery products to beverages-and low price compared to high-end brands guarantees its top position. Furthermore, the association with comfort foods and high demand in emerging markets ensure continued popularity.

- Based on the product form, the market is classified into molded, countlines, and others, amongst which countlines dominates the market. It dominates the chocolate market as they represent convenient, portion-controlled treats that cater to on-the-go consumers. Their availability in retail stores and new innovative flavor combinations and packaging all increase their appeal. Brand presence is strong with dynamic marketing strategies which continues to hold their position as the most consumed product form, particularly popular among the younger consumer groups.

- On the basis of the application, the market has been divided into food products (bakery products, sugar confectionary, desserts, and others), beverages, and others. Among these, food products accounts for the majority of the market share. Food products constitute the biggest market share for chocolates as they are highly commonly used in bakery items, desserts, and confectionery. The demand for indulgent and innovative treats is relatively high, which helps in sustaining this segment. Another factor that is contributing to its popularity is the growth in the consumption of chocolate-based snacks and its use in healthy recipes like protein bars.

- Based on the pricing, the market is segregated into everyday chocolate, premium chocolate, and seasonal chocolate, wherein everyday chocolate represents the leading segment. Everyday chocolate captures the largest market share with its affordability and accessibility into the lives of a wide audience. Its consistent availability in each retail channel, coupled with it being suitable for daily consumption, ensures that it is also accepted. Everyday products also enjoy regular promotions and consumer loyalty, which further puts them in a leading position.

- On the basis of the distribution, the market has been divided into direct sales (B2B), supermarkets and hypermarkets, convenience stores, online stores, and others. Among these, supermarkets and hypermarkets accounts for the majority of the market share. Supermarkets and hypermarkets are the leading chocolate distribution channels because of their large outreach and the capacity to exhibit a wide range of products, thus catering to the different consumer preferences. The retailing offers attractive discounts and bundle deals that promote higher volumes of purchases. The advantage of one-stop shopping and increasing availability of supermarkets in urban and suburban areas contribute to supermarket dominance in chocolate distribution.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 167.0 Billion |

| Market Forecast in 2033 | USD 219.1 Billion |

| Market Growth Rate 2025-2033 | 2.76% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | White Chocolate, Milk Chocolate, Dark Chocolate, Others |

| Product Forms Covered | Molded, Countlines, Others |

| Applications Covered |

|

| Pricings Covered | Everyday Chocolate, Premium Chocolate, Seasonal Chocolate |

| Distributions Covered | Direct Sales (B2B), Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arcor, Barry Callebaut, Chocoladefabriken Lindt & Sprüngli AG, Chocolaterie Guylian, Ferrero International, Mars Incorporated, Meiji Co. Ltd., Mondelez International Inc. (Kraft Foods), Moonstruck Chocolate Company, Nestlé S.A., The Hershey Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Chocolate Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)