Global Champagne Market Expected to Reach USD 7.92 Billion by 2033 - IMARC Group

Global Champagne Market Statistics, Outlook and Regional Analysis 2025-2033

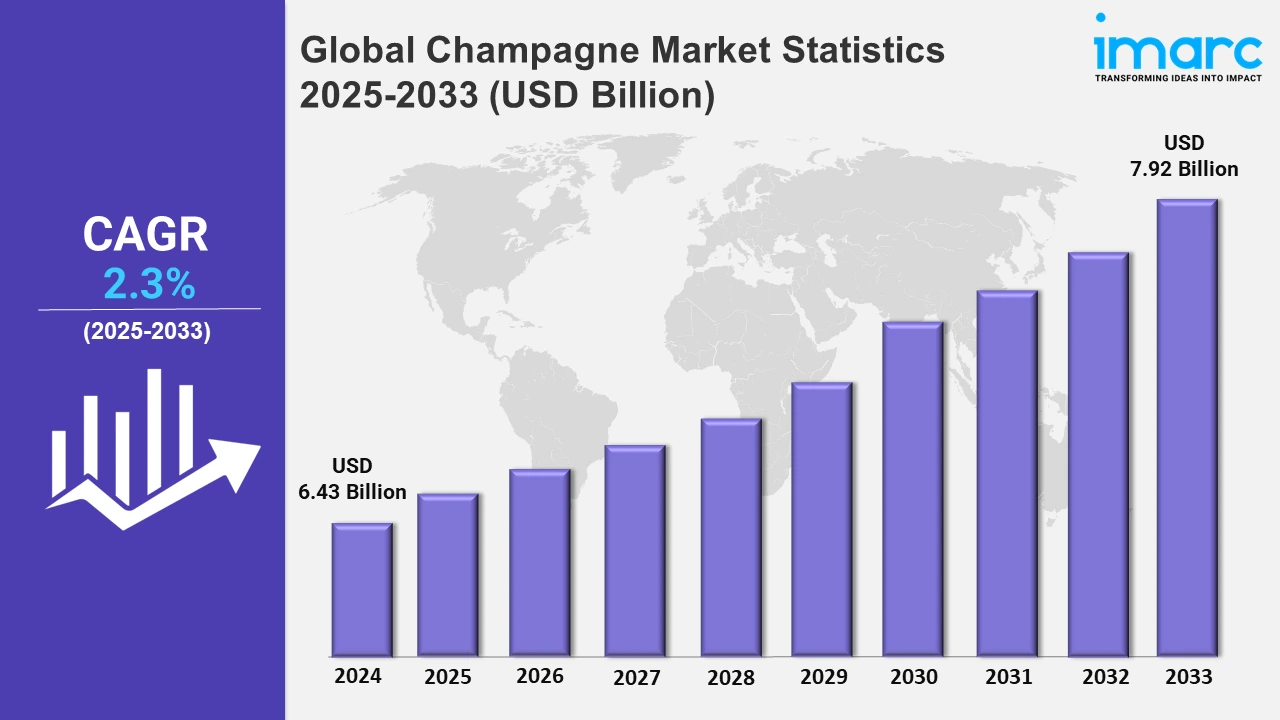

The global champagne market size was valued at USD 6.43 Billion in 2024, and it is expected to reach USD 7.92 Billion by 2033, exhibiting a growth rate (CAGR) of 2.3% from 2025 to 2033.

To get more information on this market, Request Sample

The champagne market is witnessing significant trends driven by consumer preferences for innovation and premium experiences. In line with this, exclusive and limited-edition releases are gaining popularity as luxury consumption grows, particularly in the travel retail sector. For example, in September 2024, Champagne Lanson introduced Le Rosé Création 67 in travel retail, exclusively at Paris-Charles de Gaulle, capturing the essence of a light and floral Champagne with vibrant notes of raspberry, strawberry, and citrus. This release underscores a broader shift toward exclusive offerings tailored to discerning consumers seeking high-end experiences. Furthermore, this trend reflects how champagne producers are positioning themselves to cater to an evolving, experience-driven consumer base that values quality and rarity. At the same time, the increasing demand for more complex and aged varieties is also acting as another significant growth-inducing factor. In December 2024, Champagne Bruno Paillard launched Cuvée 72, a multi-vintage extra brut champagne aged for 72 months. The blend, featuring 45% Pinot Noir, 33% Chardonnay, and 22% Pinot Meunier, highlights the growing consumer interest in more mature and refined wines. This emphasis on aging and intricate blending is in line with the broader trend of consumers moving toward more sophisticated and nuanced champagne experiences.

In parallel to this, in September 2024, Veuve Clicquot entered the U.S. market with RICH and RICH Rosé, sweet champagnes containing 55 grams of sugar per liter. This marks the debut of sweeter champagne options, expanding the range of choices for consumers. These wines cater to those who enjoy a richer, sweeter profile, offering a fresh direction in the market with blends of 50% pinot noir, 30% pinot meunier, and 20% chardonnay. The debut of these sweet champagnes signals a shift toward diversifying taste preferences within the champagne segment, with consumers increasingly seeking indulgent, accessible luxury options. Overall, this development, alongside the other trends, illustrates the market’s responsiveness to evolving consumer desires for exclusivity, complexity, and innovation.

Global Champagne Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Europe dominates the champagne market due to its rich heritage, iconic regions, and the continuing demand for premium sparkling wines.

North America Champagne Market Trends:

In North America, the market is witnessing the rising demand for premium and luxury sparkling wines, driven by younger and affluent consumers. In the U.S., Champagne brands are focusing on educational campaigns to enhance appreciation for quality and craftsmanship. For example, in 2023, Moët & Chandon launched a campaign targeting millennials, thereby encouraging exploration of their Champagne range during social gatherings, thus driving the market growth.

Europe Champagne Market Trends:

Europe is leading the market, as the region is home to the most renowned champagne houses, and the market remains the largest consumer of champagne globally. The French champagne region, in particular benefits from its long-established history and expertise in crafting high-quality wines. Also, the growing trend of artisanal and boutique Champagne producers has added to the market's dynamism. For example, in May 2023, Aurélie Ponnavoy and her sister launched Mademoiselle Marg’O Champagne, a brand focused on elegance and femininity, with cuvées like Dame Noire Extra Brut and Osmose Rosé. This artisanal approach reflects a shift toward more personalized and boutique offerings in the European market, thereby catering to discerning consumers.

Asia-Pacific Champagne Market Trends:

In Asia-Pacific, the market is rapidly expanding, driven by the increasing wealth and a taste for luxury products. In Japan, the demand for high-end champagne is surging, with consumers showing a preference for limited-edition and vintage bottles. For instance, in 2023, Dom Pérignon released a special vintage exclusively in Tokyo, catering to affluent buyers, reflecting the region's growing interest in exclusive, premium champagne offerings.

Latin America Champagne Market Trends:

In Latin America, champagne consumption is rising due to a growing middle class and the increasing interest in luxury beverages. In Brazil, it is increasingly popular during celebrations, with a focus on affordable premium brands. For example, in 2024, local distributor Casa Flora launched the Veuve Clicquot Rich in Brazil, aiming to attract younger consumers with its sweet Champagne varieties, which is reflecting a shift toward indulgent tastes in the market.

Middle East and Africa Champagne Market Trends:

In the Middle East and Africa, champagne is becoming a symbol of luxury and celebration, particularly in the UAE. Moreover, the market here is driven by tourism and high-net-worth individuals. For example, in Dubai, high-end hotels and luxury venues frequently feature exclusive Champagne selections. Also, the launch of Cristal Rosé 2009 in 2023 in Dubai emphasized this growing demand for premium and luxurious champagne experiences in the region.

Top Companies Leading in the Champagne Industry

Some of the leading champagne market companies include Arvitis, Centre Vinicole – Champagne Nicolas Feuillatte, Champagne Piper-Heidsieck, Diageo, LANSON-BCC, Laurent-Perrier, LVMH Moët Hennessy Louis Vuitton, Pernod Ricard, Taittinger, and Vranken - Pommery Monopole SA, among many others. In June 2024, Laurent-Perrier launched Heritage, a chardonnay-led multi-vintage champagne, which bridges the gap between its Brut NV and Grand Siècle.

Global Champagne Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into prestige cuvée, blanc de noirs, blanc de blancs, rosé champagne, and others, wherein blanc de noirs represent the most preferred segment. It offers a vibrant bouquet of citrus fruits like lemon, lime, and grapefruit, along with floral notes like white flowers and honeysuckle.

- Based on the price, the market is categorized into economy, mid-range, and luxury, amongst which economy dominates the market. Economy champagne is easily accessible and available at an affordable price range allowing consumers to enjoy high-quality champagne.

- On the basis of the distribution channel, the market has been divided into supermarket and hypermarket, specialty stores, online stores. Among these, supermarket and hypermarket exhibit a clear dominance in the market. These stores provide a wide variety of products, including groceries, beverages, household items, and more.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 6.43 Billion |

| Market Forecast in 2033 | USD 7.92 Billion |

| Market Growth Rate 2025-2033 | 2.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Prestige Cuvée, Blanc De Noirs, Blanc De Blancs, Rosé Champagne, Others |

| Prices Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarket and Hypermarket, Specialty Stores, Online Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Arvitis, Centre Vinicole – Champagne Nicolas Feuillatte, Champagne Piper-Heidsieck, Diageo, LANSON-BCC, Laurent-Perrier, LVMH Moët Hennessy Louis Vuitton, Pernod Ricard, Taittinger, Vranken - Pommery Monopole SA etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Champagne Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)