Global Ceiling Tiles Market Expected to Reach USD 10.3 Billion by 2033 - IMARC Group

Global Ceiling Tiles Market Statistics, Outlook and Regional Analysis 2025-2033

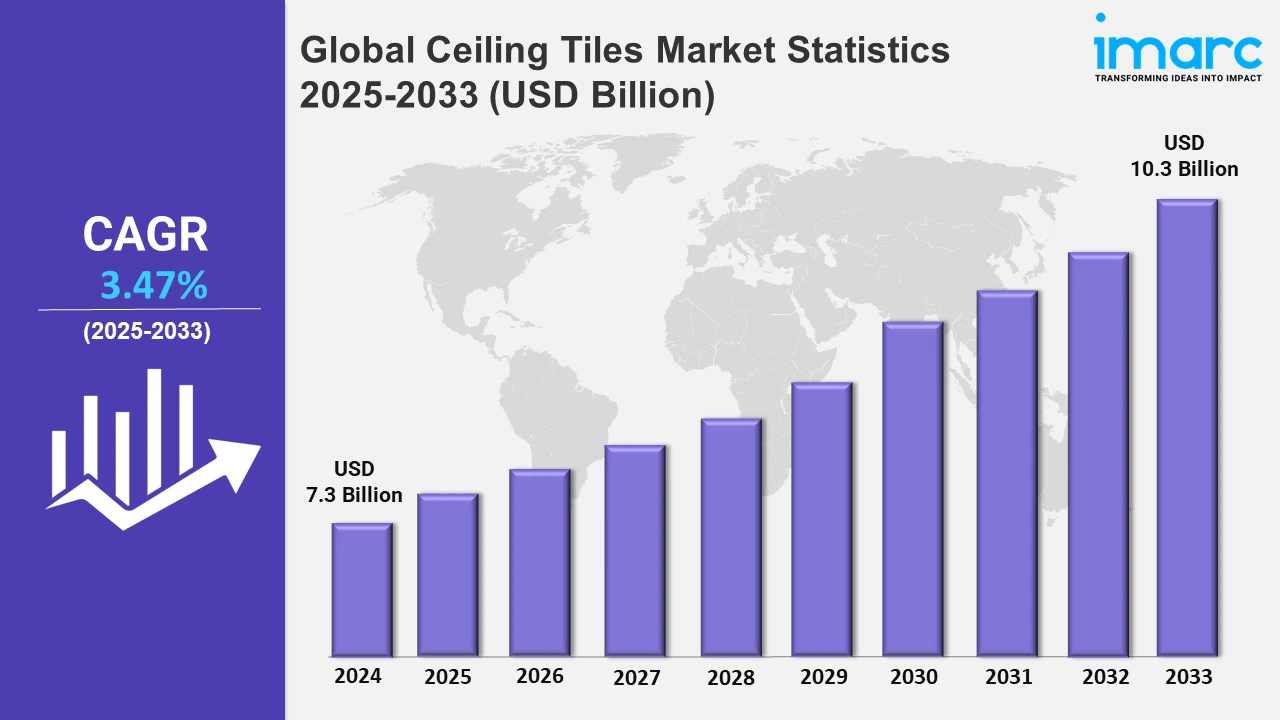

The global ceiling tiles market size was valued at USD 7.3 Billion in 2024, and it is expected to reach USD 10.3 Billion by 2033, exhibiting a growth rate (CAGR) of 3.47% from 2025 to 2033.

To get more information on this market, Request Sample

The global shift towards eco-friendly construction practices is significantly impelling the demand for ceiling tiles made from sustainable materials. Many governments and organizations are adopting stringent green building codes, encouraging the use of recyclable and renewable resources in construction. Ceiling tiles made from recycled materials, such as mineral fiber and metal, are gaining prominence due to their lower carbon footprint. For instance, LEED-certified buildings often utilize such materials, bolstering the market growth. In 2023, approximately 40% of commercial projects globally incorporated sustainable ceiling tiles, reflecting the rising preference for environmentally friendly solutions. Additionally, manufacturers are innovating with bio-based tiles, appealing to eco-conscious consumers. The Asia-Pacific region leads this trend, with a notable increase in adoption across urbanizing nations, including China and India, which contribute to over 60% of new green building projects globally. These developments highlight the increasing reliance on sustainable ceiling tiles in modern construction.

Rapid urbanization and expanding commercial infrastructure globally are significant drivers of the ceiling tiles market. The construction of offices, retail spaces, and healthcare facilities fuels the demand for acoustic and aesthetically appealing ceiling solutions. For example, ceiling tiles designed to enhance soundproofing and insulation are widely used in modern office spaces to boost productivity.

The construction sector experienced a 13.3% growth in July-September 2023 compared to the same period in 2022 and a 7.9% increase from the previous quarter, contributing significantly to the country’s GDP. Moreover, government investments in public infrastructure, including airports and educational institutions, further stimulate the market. The U.S. alone allocated over $90 billion for public construction projects in 2023, with a considerable portion aimed at modernizing interiors. These investments underline the growing need for versatile ceiling tiles tailored to commercial applications, ensuring both functional and aesthetic benefits.

Global Ceiling Tiles Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America; Asia-Pacific; Europe; Latin America; and the Middle East and Africa. According to the report, North America accounted for the largest market share on account of rising demand for acoustic solutions and an increase in commercial infrastructure projects.

North America Ceiling Tiles Market Trends:

The North America ceiling tiles market is experiencing growth driven by increasing commercial infrastructure projects and heightened demand for acoustic solutions. The region's emphasis on modernizing office spaces and healthcare facilities drives the adoption of innovative ceiling tiles with soundproofing and thermal insulation properties. Sustainability trends are also driving the market, as demand for eco-friendly and recyclable materials is increasing in line with green building initiatives. The U.S. leads the market, as significant investments in commercial construction and renovation projects drive the market. In addition, new ceiling tile designs that are lightweight and customizable cater to changing aesthetics in residential and commercial settings.

Asia-Pacific Ceiling Tiles Market Trends:

The Asia-Pacific ceiling tiles market is driven by rapid urbanization, expanding commercial spaces, and green building initiatives. Along with the growing construction activities in China and India, alongside government investments in infrastructure, propel demand. Lightweight, durable, and eco-friendly tiles dominate as sustainability trends gain traction, especially in burgeoning urban centers across the region.

Europe Ceiling Tiles Market Trends:

In Europe, stringent energy efficiency regulations and a strong emphasis on sustainable construction drive the ceiling tiles market. The rising demand for acoustic and aesthetic solutions in modern office and retail spaces is rising. Key markets like Germany and the UK adopt recyclable materials, supported by advanced technologies for customized ceiling designs, which created a positive outlook for market expansion.

Latin America Ceiling Tiles Market Trends:

In Latin America, growth in residential and commercial construction supports ceiling tile demand. Countries like Brazil and Mexico see increased adoption of cost-effective and lightweight solutions. Also, rising awareness of acoustic insulation and sustainability drives innovations, while economic development fuels infrastructure projects, boosting market opportunities across the region.

Middle East and Africa Ceiling Tiles Market Trends:

The MEA ceiling tiles market benefits from expanding hospitality and retail sectors, especially in the UAE and Saudi Arabia. Modernization projects, including airports and luxury hotels, increase demand for premium tiles. Adaptation to extreme climates with thermal-resistant materials and ongoing urbanization further enhance market growth in the region.

Top Companies Leading in the Ceiling Tiles Industry

Some of the leading ceiling tiles market companies include SAS International, ROCKFON International A/S, USG Corporation, Knauf Gips KG, Odenwald Faserplattenwerk GmbH, among many others.

- In April 2024, Rockfon, part of ROCKWOOL Group, introduced new options for customizing colors in their Mono Acoustic product line. This popular wall and ceiling solution is now also available in Rockfon's curated 33 Colours of Wellbeing palette and any custom color choice. Mono Acoustic provides a unique aesthetic solution that delivers seamless, monolithic, and curved aesthetics; not possible with traditional ceiling tiles. The design easily integrates HVacs and maintenance hatches into the rendered surface with a seamless look.

Global Ceiling Tiles Market Segmentation Coverage

- On the basis of the product type, the market has been categorized into mineral wool, gypsum, metallic, and others, wherein mineral wool represents the leading segment due to its superior thermal and acoustic insulation properties, lightweight nature, and cost-effectiveness. It is widely used in commercial spaces such as offices and educational institutions, its eco-friendly and fire-resistant attributes further enhance its appeal, aligning with increasing sustainability and safety demands globally.

- Based on the application, the market is bifurcated into residential and non-residential applications, amongst which non-residential applications dominate the market. The segment dominates the market due to high demand from commercial spaces such as offices, retail outlets, and healthcare facilities. These sectors prioritize acoustic performance, thermal insulation, and aesthetic appeal, driving adoption. Rapid urbanization and infrastructure investments in modernizing public spaces further bolster the dominance of non-residential applications.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.3 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Market Growth Rate 2025-2033 | 3.47% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Mineral Wool, Gypsum, Metallic, Others |

| Applications Covered | Residential Applications, Non-Residential Applications |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | SAS International, ROCKFON International A/S, USG Corporation, Knauf Gips KG, Odenwald Faserplattenwerk GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Ceiling Tiles Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)