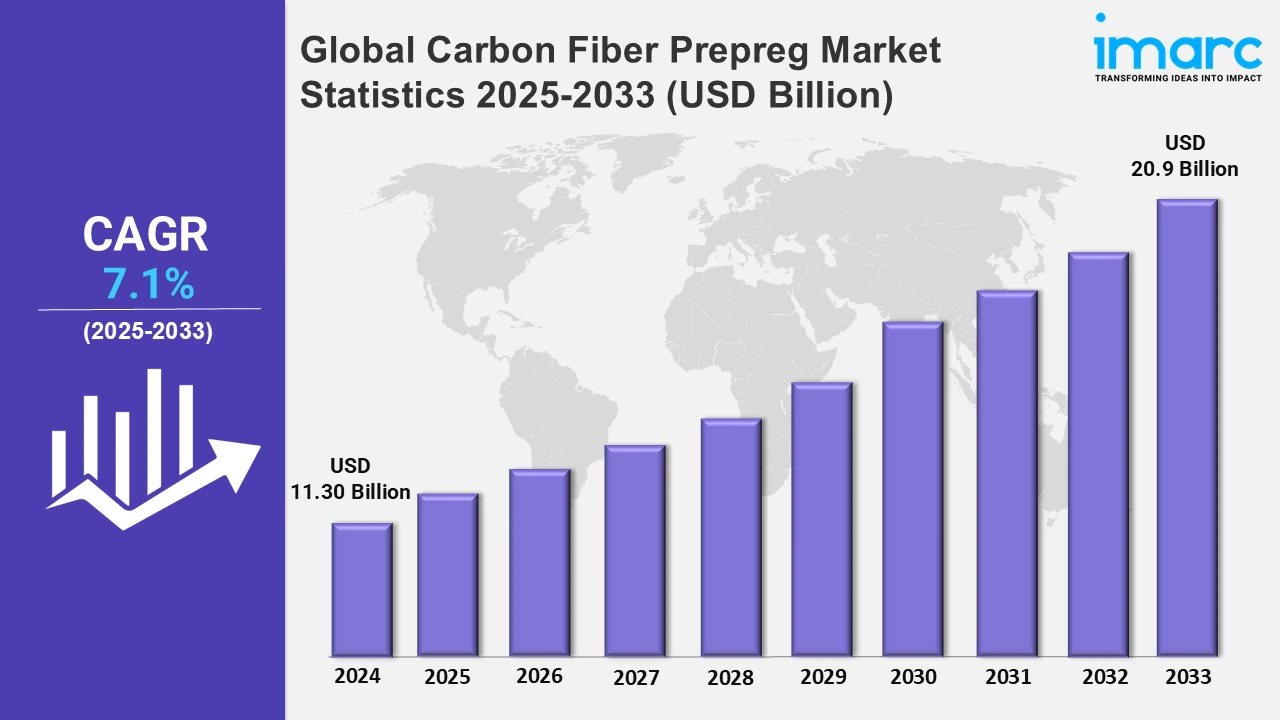

Global Carbon Fiber Prepreg Market Set to Reach USD 20.9 Billion by 2033, North America Led with 35.4% Market Share in 2024 – IMARC Group

Global Carbon Fiber Prepreg Market Statistics, Outlook and Regional Analysis 2025-2033

The global carbon fiber prepreg market size was valued at USD 11.30 Billion in 2024, and it is expected to reach USD 20.9 Billion by 2033, exhibiting a growth rate (CAGR) of 7.1% from 2025 to 2033.

To get more information on this market, Request Sample

Innovations in carbon fiber technology are enhancing its versatility, performance, and accessibility. Advancements in resin formulations improve thermal stability, chemical resistance, and mechanical properties, making carbon fiber prepreg suitable for demanding applications in aerospace, automotive, and wind energy sectors. These improvements allow manufacturers to meet stringent industry requirements for lightweight and durable materials. Moreover, the development of automated production processes streamlines the manufacturing of carbon fiber prepregs to reduce costs and increase scalability. Rapid curing resins and hybrid materials also make prepregs more efficient to use, enabling faster production cycles without compromising quality. Besides this, modern carbon fiber prepregs that utilize nanotechnology offer enhanced strength and conductivity properties for high-performance applications. In January 2024, Toray Industries, Inc., which is one of the leading companies offering industrial products centered on technologies in organic synthetic chemistry, biochemistry, and polymer chemistry, unveiled the development of high tensile TORAYCA™ M46X carbon fiber. The company will implement TORAYCA™ M46X prepreg, with the resin matrix using NANOALLOY1 microstructure control technology to minimize the weight of finished products and make designs more flexible.

The rising investments in carbon fiber production are enhancing the supply chain and reducing the costs of carbon fiber prepregs, making these advanced materials more accessible. Companies are allocating substantial resources to expand production capacities and establish new facilities worldwide. These efforts are aimed at meeting the high demand for carbon fiber prepregs from industries like wind energy and sports equipment. Apart from this, electric vehicle (EV) manufacturers benefit from these investments, as large-scale production of carbon fiber reduces material costs. This affordability is crucial for integrating lightweight prepregs into structural components to improve energy efficiency and performance. Similarly, the aerospace industry is leveraging increased carbon fiber output to create lighter and more fuel-efficient aircraft. Additionally, regional investments are creating localized production hubs, lowering import dependencies, and accelerating delivery times. In March 2024, Jindal Advanced Materials, provider of cutting-edge composite materials, partnered with MAE Italy, a leading machinery manufacturing company, to invest Rs 2,700 crores in India’s first carbon fiber plant of 3,500 metric tons annual capacity. This facility will aim at providing different intermediates, like prepregs and carbon fiber composite materials and building lightweight composite solutions.

Global Carbon Fiber Prepreg Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounts for the largest market share driven by the growing investments in research and development (R&D) activities, rising demand for lightweight materials, and extensive use of carbon fiber prepregs in wind energy initiatives.

North America Carbon Fiber Prepreg Market Trends:

North America is enjoying the leading position in the market due to its well-established aerospace, automotive, and defense infrastructure. The region has a high number of key manufacturers and innovative startups that encourage the use of lightweight materials. Besides this, there is a high demand for high-performance and durable materials to build aircraft and automotive parts with improved fuel efficiency. Moreover, the region emphasizes renewable energy, especially wind power, which creates the need for carbon fiber prepregs in turbine blades. According to the article published on the official website of the US Department of Energy in August 2024, short-term projections for wind energy anticipate an increase to over 15 gigawatts (GW) annually by 2026 and to approximately 20 GW per year by the decade's close.

Asia-Pacific Carbon Fiber Prepreg Market Trends:

Asia-Pacific accounts for a sizeable portion of the carbon fiber prepreg industry owing to its increasing demand in automotive, aerospace, and sports equipment uses. Countries, such as China, Japan, and South Korea benefit from cost-effective manufacturing and a skilled workforce. In addition to this, the rise of electric vehicles (EVs) across the region drives the need for lightweight and high strength prepreg materials.

Europe Carbon Fiber Prepreg Market Trends:

The market for carbon fiber prepreg is expanding gradually in Europe, which can be attributed to the region's focus on sustainable practices and lightweight solutions. In this area, there is a high number of leading manufacturers that use prepregs to reduce emissions through lighter vehicles. Europe’s aerospace sector also heavily relies on carbon fiber prepregs for building fuel-efficient aircraft.

Latin America Carbon Fiber Prepreg Market Trends:

On account of the rising investments in advanced materials, Latin America is experiencing carbon fiber prepreg market expansion. Countries like Brazil and Mexico support domestic manufacturing of carbon fiber prepregs and their export potential. The region’s shift toward clean energy solutions and increased adoption of EVs promotes the usage of carbon fiber prepregs.

Middle East and Africa Carbon Fiber Prepreg Market Trends:

The market for carbon fiber prepreg in the Middle East and Africa region is distinguished by the increasing adoption of carbon fiber prepregs in renewable energy and construction industries. In the UAE and Saudi Arabia, government agencies spend resources on infrastructure projects and sustainable solutions to promote the use of lightweight materials.

Top Companies Leading in the Carbon Fiber Prepreg Industry

Some of the leading carbon fiber prepreg market companies include Axiom Materials Inc. (Kordsa Incorporated), Gurit, Hexcel Corporation, Mitsubishi Chemical Corporation, SGL Carbon SE, Teijin Limited, Toray Industries Inc., among many others. In March 2024, the Mitsubishi Chemical Group, a prominent manufacturer of industrial materials and performance products, developed a carbon fiber prepreg material that utilizes plant-derived resin and features about 25% of biomass content. The MCG Group seeks to broaden the application of the product to mobility sectors, including materials for both the interior and exterior of vehicles, as well as industrial uses.

Global Carbon Fiber Prepreg Market Segmentation Coverage

- On the basis of the manufacturing process, the market has been bifurcated into hot melt and solvent dip, wherein hot melt represents the leading segment. It ensures uniform resin distribution and consistent quality. It removes the necessity for solvents, making the procedure more eco-friendly and economical. Producers favor hot melt as it offers enhanced control over the resin levels to enhance the final product's performance. This process also provides a higher shelf life for prepregs, which makes storage and handling easier. Its efficiency and reliability make hot melt the most widely used method.

- Based on the resin type, the market has been classified into thermoset and thermoplastic, amongst which thermoset dominates the market. It gives excellent strength, durability, and resistance to heat. It showcases superior adhesion to carbon fibers to enhance the material properties altogether. Manufacturers employ thermoset resins since they cure into a solid form, which makes them fit for highly demanding uses like aerospace, automotive, and sports equipment. Thermoset also resists chemical and environmental degradation to ensure long-term reliability.

- On the basis of the resin, the market has been divided into phenolic, epoxy, bismaleimide, polyimide, cynate ester, PEEK, and others. Among these, epoxy accounts for the majority of the market share because it provides excellent mechanical strength, durability, and adhesion. It adheres effectively to carbon fibers and produces high-performance composites. It also provides excellent resistance to heat, chemicals, and environmental influences, making it ideal for challenging applications. Producers utilize epoxy since it improves curing management and yields reliable outcomes. Its lightweight properties and adaptability render it perfect for the aerospace, automotive, and sporting goods sectors.

- Based on the end use industry, the market has been segregated into aerospace and defense, automotive, wind energy, sports and recreation, and others, wherein aerospace and defense exhibits a clear dominance. This industry needs lightweight and strong materials, such as carbon fiber prepregs so that the aircraft weight can be lowered while enhancing fuel economy and performance. They provide outstanding resistance to heat and wear, guaranteeing longevity in tough environments. These materials are perfect for producing aircraft components, missiles, and defense gear because they are precise. The industry prioritizes advanced materials for safety and performance, and carbon fiber prepregs meet these demands.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 11.30 Billion |

| Market Forecast in 2033 | USD 20.9 Billion |

| Market Growth Rate 2025-2033 | 7.1% |

| Units | Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Manufacturing Processes Covered | Hot Melt, Solvent Dip |

| Resin Types Covered | Thermoset, Thermoplastic |

| Resins Covered | Phenolic, Epoxy, Bismaleimide, Polyimide, Cynate Ester, PEEK, Others |

| End Use Industries Covered | Aerospace and Defense, Automotive, Wind Energy, Sports and Recreation, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Axiom Materials Inc. (Kordsa Incorporated), Gurit, Hexcel Corporation, Mitsubishi Chemical Corporation, SGL Carbon SE, Teijin Limited, Toray Industries Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)