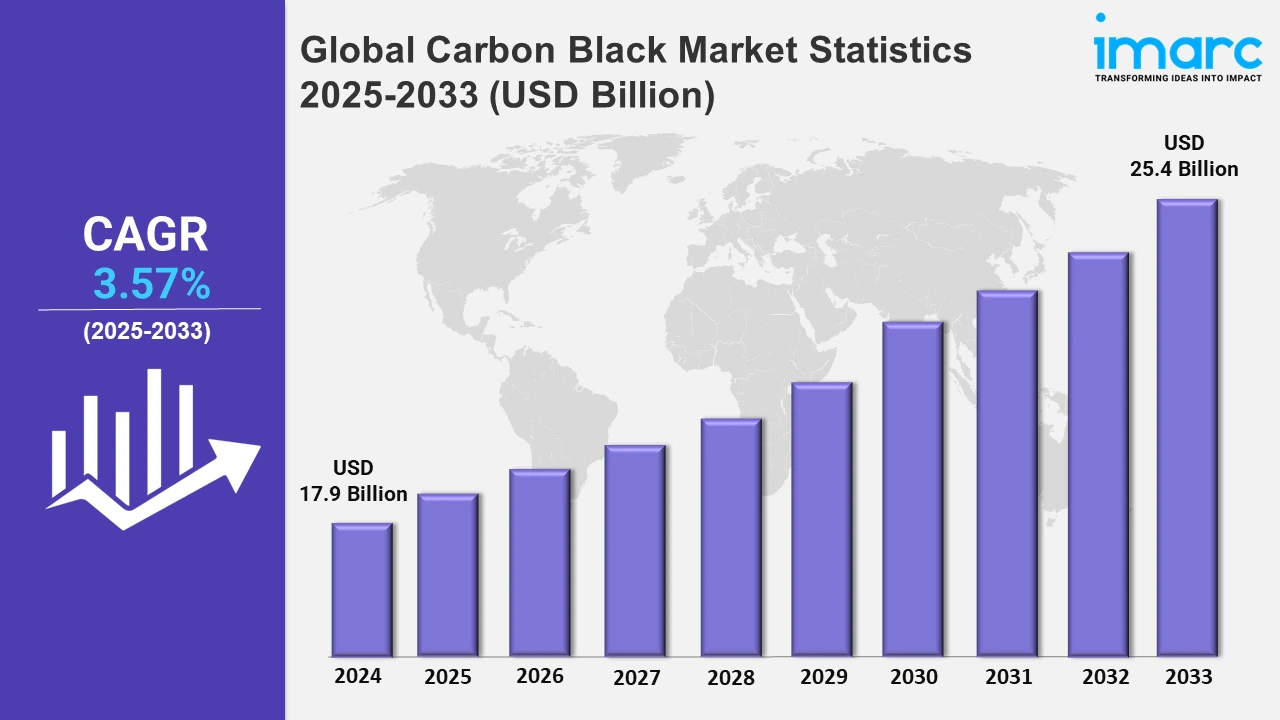

Global Carbon Black Market Projected to Reach USD 25.4 Billion by 2033 - Impelled by Rising Construction Activities Worldwide

Global Carbon Black Market Statistics, Outlook and Regional Analysis 2025-2033

The global carbon black market size was valued at USD 17.9 Billion in 2024, and it is expected to reach USD 25.4 Billion by 2033, exhibiting a growth rate (CAGR) of 3.57% from 2025 to 2033.

To get more information on this market, Request Sample

The rising exports of rubber tires are one of the major factors propelling the growth of the global carbon black market. According to a 2024 research report by Tendata, the global rubber tires export in 2023 was valued at US$ 97.8 Billion. This increase in tire exports translates into a growing demand for carbon black which is an essential component in the production of tires. Carbon black is used to improve the reinforcement and performance of rubber especially in tires which makes it a strategic material in the automotive sector. With the steady increase in exports of tires, especially from developing nations and running production plants, the demand for premium carbon black grades is also increasing. This scenario, in turn, is providing a boost to the carbon black market, fueled by the growth of the automotive industry, which relies on carbon black for tire manufacturing and other rubber applications, thus driving global market expansion.

Considerable growth in the passenger car sector is also a key contributing factor for the growth of the market. As per Statista, the passenger cars market is estimated to generate a revenue of around US$ 2.3 Trillion by the year 2024. It is accompanied by increasing development of the automobile industry around the world, especially in third-world countries. Carbon black is used for both functional and aesthetic purposes in a number of different vehicle components such as tires, coatings, and plastics. With an increase in the production and sales of vehicles, there is also an expected rise in the demand for carbon black, which is a key material in producing the automotive industry’s high-end grade materials. This, in turn, is accelerating the carbon black consumption, thereby providing an impetus to the market.

Global Carbon Black Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest carbon black market share, driven by the growing demand for carbon black in the automotive, rubber, and plastics industries, particularly due to the region's expanding manufacturing capabilities, increasing production of tires, and the rising adoption of carbon black in numerous industrial applications.

Asia Pacific Carbon Black Market Trends:

The Asia Pacific carbon black market is witnessing robust growth, driven by the expanding tire production and exports in key countries like China. According to the National Bureau of Statistics, domestic production of rubber tires and outer tires reached 91.08 million in July 2024, marking a 7.6% year-on-year increase, while exports grew by 6.8%. From January to July 2024, tire production rose by 10.3%, with exports increasing to 9.9%. This rise highlights the region's growing automotive sector, which is a key consumer of carbon black. The growing demand for durable and high-performance tires is further fueling the need for advanced carbon black formulations in the market.

North America Carbon Black Market Trends:

The growth of the North American carbon black market can be attributed to the high demand for the product in the automotive and construction industries. Furthermore, increasing investments in sustainable production technologies such as emission control systems, come in hand with strict environmental protection laws. Moreover, the region has the advantage of the presence of several key manufacturers and continuous innovations in tire and non-tire rubber products.

Europe Carbon Black Market Trends:

The carbon black market within Europe also grows at a reasonable rate, owing to the developed automotive sector and the focus on the sustainability of the region. In addition, stringent regulations force the manufacturers to embrace low-emission epoxies. There is an increase in high-performance coating and plastics and industrial rubber usage along with electric vehicle manufacturing which further contributes to the demand across Europe.

Latin America Carbon Black Market Trends:

Mexico and Brazil among other countries in Latin America are experiencing increased industrialization and automotive production such that the carbon black market is growing. This region is also experiencing a rising trend towards infrastructure development which is increasing demand for construction materials. Moreover, the utilization of carbon black in agriculture, especially in plastic films and plastic tubing is acting as a major growth-inducing factor for the market.

Middle East and Africa Carbon Black Market Trends:

The carbon black market within the Middle East and Africa is driven primarily by increasing activities in construction and infrastructural development particularly in GCC countries. There is also a growth in the automotive sector and non-tire rubber applications which is providing an impetus to the market. In addition, the leading market players of the region are increasingly adopting modern production technologies to ensure that their products meet international standards, which makes them highly competitive.

Top Companies Leading in the Carbon Black Industry

Some of the leading Carbon black market companies include Cabot Corporation, Birla Carbon, Orion S.A., PCBL Chemical Limited, Tokai Carbon Co., Ltd., Omsk Carbon Group, Anhui Black Cat Material Science Co., Ltd., OCI Company Ltd., and International CSRC Investment Holdings Co., Ltd. On 22nd January 2024, Orion S.A., a global producer of specialty chemicals, announced the completion of upgrades to its air emissions control systems across all four of its U.S. carbon black manufacturing facilities. This marks the company’s most significant sustainability initiative to date. The final phase of the project was completed at the Belpre, Ohio, plant, following earlier upgrades at facilities in Borger, Texas; Ivanhoe, Louisiana; and Orange, Texas. These efforts were part of a broader mandate by the U.S. Environmental Protection Agency (EPA) requiring carbon black manufacturers to reduce emissions. Orion faced various challenges during the process, including contractor delays, supply chain disruptions, and COVID-19-related setbacks, but still managed to finish ahead of many competitors, owing to its larger operational footprint in the U.S. This development is expected to drive the global carbon black market by aligning with growing regulatory and environmental standards, bolstering the market's credibility, and fostering demand for sustainable production practices.

Global Carbon Black Market Segmentation Coverage

- On the basis of the type, the market has been classified into furnace black, channel black, thermal black, acetylene black, and others, wherein furnace black represents the most preferred segment due to its widespread use in various applications, including tires and coatings. Its cost-effectiveness and superior reinforcing properties make it a popular choice across industries.

- Based on the grade, the market is categorized into standard and specialty grades, amongst which standard grade dominates the market due to its extensive application in manufacturing tires and industrial rubber products. The affordability and availability of standard grade carbon black is resulting in the dominance of the segment in the global market.

- On the basis of the application, the market has been divided into tire, non-tire rubber, plastics, inks and coatings, and others. Among these, tire dominates the market due to the high demand for durable and wear-resistant materials in the automotive sector. Carbon black plays a crucial role in this segment, as it enhances the strength and longevity of tires, solidifying its position as an essential component in tire production.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 17.9 billion |

| Market Forecast in 2033 | USD 25.4 billion |

| Market Growth Rate 2025-2033 | 3.57% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others |

| Grades Covered | Standard Grade, Specialty Grade |

| Applications Covered | Tire, Non-Tire Rubber, Plastics, Inks and Coatings, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Cabot Corporation, Birla Carbon, Orion S.A., PCBL Chemical Limited, Tokai Carbon Co., Ltd., Omsk Carbon Group, Anhui Black Cat Material Science Co., Ltd., OCI Company Ltd., International CSRC Investment Holdings Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Carbon Black Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)