Global Carbide Tool Market Expected to Reach USD 18.3 Billion by 2033 - IMARC Group

Global Carbide Tool Market Statistics, Outlook and Regional Analysis 2025-2033

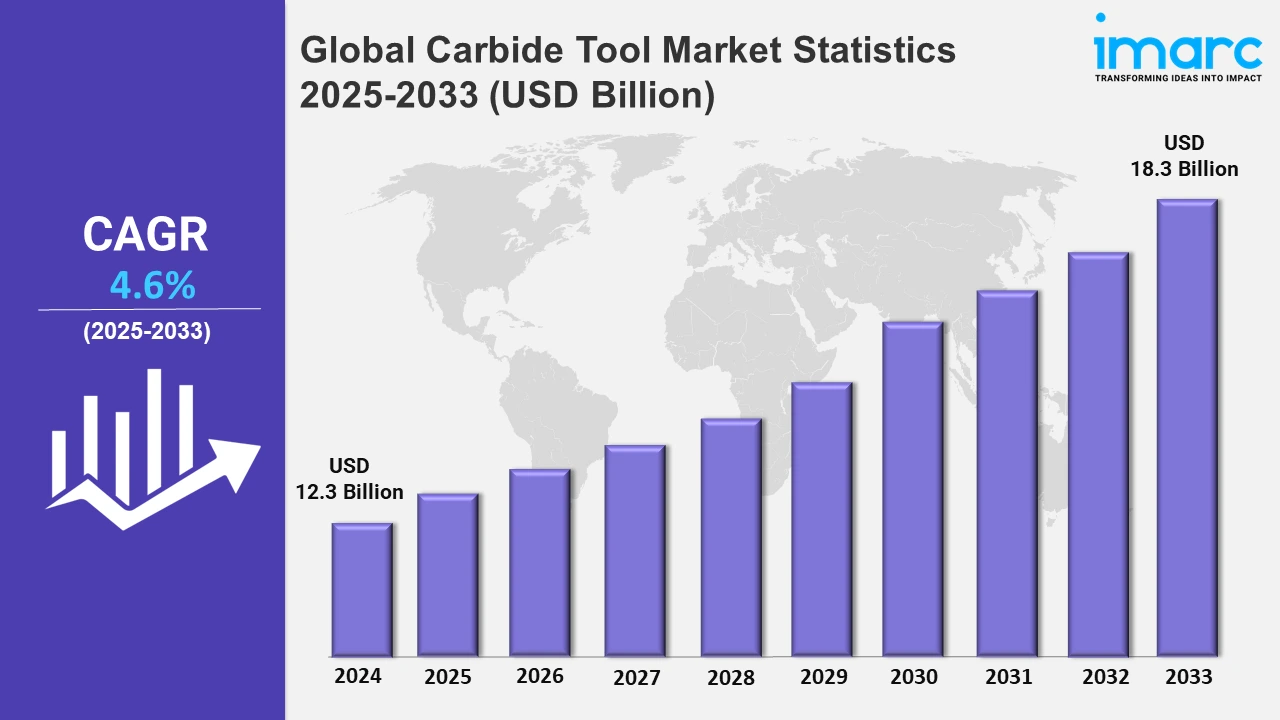

The global carbide tool market size was valued at USD 12.3 Billion in 2024, and it is expected to reach USD 18.3 Billion by 2033, exhibiting a growth rate (CAGR) of 4.6% from 2025 to 2033.

To get more information on this market, Request Sample

The manufacturing sector is making use of carbide tools because they offer higher accuracy in production processes. These tools are also popular among automotive companies due to their wear resistance, long-lived cutting edges, and ability to retain sharpness even in harsh conditions. In April 2024, 23,58,041 vehicles, which include three-wheelers, two-wheelers, and quadricycles were manufactured in India. Besides, the government has said that they will produce 30 percent of new vehicles in electric versions by the year 2030. This increased production has motivated automobile manufacturers to adopt carbide cutting tools that offer lightweight materials such as aluminum and composites. The use of carbide tools is also relevant because they are used to produce delicate parts that must conform to strict standards. This further aids in the trend being drawn through the proliferation of Industry 4.0 practices, which will create the demand for automation and higher-end technologies like computer numerical control (CNC) machines, where carbide tools are used.

The military and aerospace sectors are major contributors to the market for carbide tools. With increasing air traffic, expanding fleets, and advancements in military technology, the global aircraft industry is growing rapidly. For example, in January 2024, 20.468 million passengers traveled via U.S. international airports that were up 13.5% versus January 2023. Components in these aircrafts often require machining of hard-to-cut materials such as titanium alloys, nickel-based superalloys, and composites. Carbide tools are ideal for these applications because of their excellent temperature resistance, cutting edge retention, and ability to operate under great stress. Furthermore, advanced weaponry, planes, and vehicles are becoming mandatory due to the rising budgets for militaries worldwide, notably in countries such as the US, China, and India. These systems require precise manufacturing processes, where carbide tools play a crucial role. The defense budget in China was announced to be 1.67 trillion yuan (US$231 billion), which is a hike of 7.2% over the last year, requiring an increased use of these tools.

Global Carbide Tool Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific held the largest market share due to rapid industrial growth, the expansion of manufacturing sectors, and significant expenditures in infrastructure development and industrialization activities.

Asia-Pacific Carbide Tool Market Trends:

The carbide tools industry has the Asia Pacific region as its largest market region. This domination is fueled by the rapid urbanization and industrialization of nations like South Korea, China, and India. For example, the construction sector in China is growing rapidly at a pace of 4% per year because of smart city efforts and advancements in transportation systems. Furthermore, the region's manufacturing industry is flourishing, as seen by the growing output of electronics, automobiles, and aerospace, all of which raise the demand for carbide tools. There is also unlimited supply of raw materials and cheap labor that complements the growth of the market in this region.

North America Carbide Tool Market Trends:

North America is a leading region in terms of market size for carbide tools where the United States and Canada have the highest demand levels. There are many new commercial projects and residential or industrial projects that further enhance the upsurge of this product in this region. Since most of the metal production required for automotive parts is used in automobile production, the automotive industry has greatly increased the demand for carbide tools. The growth of the industry in North America has largely been affected by the presence of major market players and continual technological developments.

Europe Carbide Tool Market Trends:

Europe is an important participant in carbide tooling due to the strong presence of carbide tooling in nations such as the UK and Germany. The long-established manufacturing industry in the area, especially in aerospace and automotive sectors, adds to the need for extremely precise engineering equipment. This demand for carbide tools in Europe is also designed to cut across modern manufacturing technologies and high-quality production processes.

Latin America Carbide Tool Market Trends:

However, Latin America, consisting of countries like Brazil and Mexico, develops infrastructural projects and industrialize, favoring the expansion of the carbide tools market in the region. This has resulted in a growing trend for carbide tools with increasing emphasis on developing industrial capacities, especially in construction and automobiles. One of the prominent determinants is that the region still invests heavily in industrial growth despite multiple hindrances.

Middle East and Africa Carbide Tool Market Trends:

The market for carbide tools has potential to grow in the Middle East and Africa, mostly as a result of investments in the construction and oil and gas sectors. In countries like South Africa and the United Arab Emirates, the expansion of manufacturing activities and the building of infrastructure projects are driving the need for carbide tools. Diversifying industries in the region are further boosting opportunities for market penetration.

Top Companies Leading in the Carbide Tool Industry

Some of the leading carbide tool market companies include Advent Tool & Manufacturing Inc., Ceratizit Group (Plansee SE), Garr Tool Company, Ingersoll Cutting Tool Company, KYOCERA SGS Precision Tools Inc (Kyocera Corporation), Makita Corporation, Mitsubishi Materials Corporation, OSG Corporation, Rock River Tool Inc., Sandvik AB, Sumitomo Electric Industries Ltd., vHF Camfacture AG, and YG-1 Co Ltd., among many others.

In October 2024, Mitsubishi Materials expanded their MC6100 line to include the MC6135 carbide tool grade. This range is specifically designed for continuous, rough, and interrupted cutting applications. By using crystal orientation control, the MC6135 provides thinner and impact-resistant coatings that are known to improve chipping and wear resistance, with a 50 percent reduction in thickness compared to its prior versions.

Global Carbide Tool Market Segmentation Coverage

- On the basis of the product type, the market has been categorized into drilling tools, milling tools, turning tools, and others, wherein milling tools represent the leading segment. The increasing complexity of machining activities requiring great accuracy and efficiency is the reason for their domination. Additionally, carbide milling tools are crucial for cutting intricate parts from difficult materials like titanium and stainless steel, mostly in the automobile and aerospace sectors.

- Based on the configuration, the market is classified into hand-based and machine-based. Carbide hand tools are popular for manual use and gives precision in activities like turning, cutting, and drilling. While machine-based tools are designed for integration with automated equipment, allowing the achievement of high-speed operations and uniformity in production.

- On the basis of the coating, the market has been bifurcated into coated and non-coated. Among these, coated accounts for the majority of the market share. Its superior performance in rigorous machining conditions is responsible for its market domination. The hardness and heat resistance of carbide tools are greatly increased by coatings like aluminum titanium nitride (AlTiN), titanium carbide (TiC), and titanium nitride (TiN), which enable faster cutting rates and longer tool life.

- On the basis of the end-use industry, the market has been divided into automotive, electronics and electrical, aerospace, marine and defense, plastics, construction and mining, and others. Among these, automotive accounts for the majority of the market share. The rigorous requirements of this industry for precision and efficiency in production processes are a major driver of the need for carbide tools in this sector. Carbide tools are essential in the automobile sector because they can work with tough materials like hardened steel and complex alloys used in vehicle components.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 12.3 Billion |

| Market Forecast in 2033 | USD 18.3 Billion |

| Market Growth Rate 2025-2033 | 4.6% |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Drilling Tools, Milling tools, Turning Tools, Others |

| Configurations Covered | Hand-based, Machine-based |

| Coatings Covered | Coated, Non-Coated |

| End Use Industries Covered | Automotive, Electronics and Electrical, Aerospace, Marine and Defense, Plastics, Construction and Mining, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Advent Tool & Manufacturing Inc., Ceratizit Group (Plansee SE), Garr Tool Company, Ingersoll Cutting Tool Company, KYOCERA SGS Precision Tools Inc (Kyocera Corporation), Makita Corporation, Mitsubishi Materials Corporation, OSG Corporation, Rock River Tool Inc., Sandvik AB, Sumitomo Electric Industries Ltd., vHF Camfacture AG, YG-1 Co Ltd., etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)