Global Cannabidiol Market Expected to Reach USD 24.4 Billion by 2033 - IMARC Group

Global Cannabidiol Market Statistics, Outlook and Regional Analysis 2025-2033

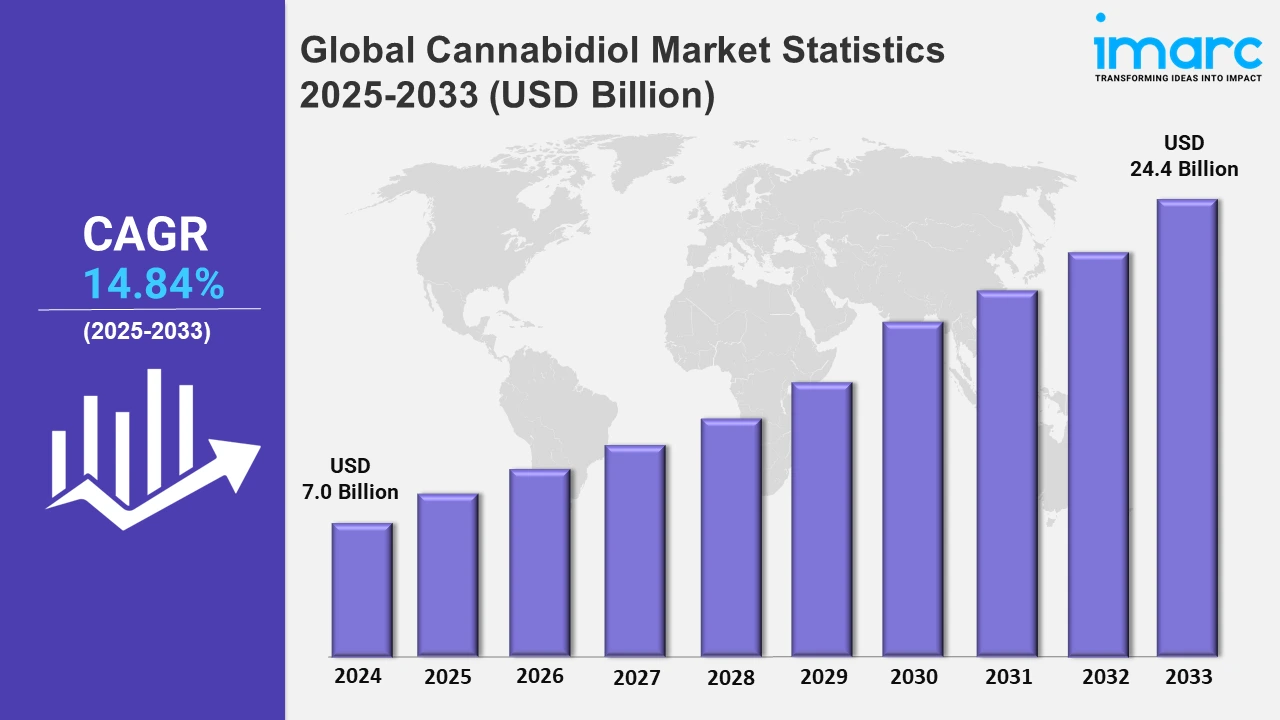

The global cannabidiol market size was valued at USD 7.0 Billion in 2024, and it is expected to reach USD 24.4 Billion by 2033, exhibiting a growth rate (CAGR) of 14.84% from 2025 to 2033.

To get more information on this market, Request Sample

The legalization of cannabis for medical and recreational purposes in various countries is a major driver of cannabidiol market growth. This legislative amendment has expanded the legal framework, allowing for the cultivation, manufacturing, and sale of a variety of CBD products while also legitimizing and increasing customer trust in these goods. Countries, such as the United States, Canada, and several European nations have made significant modifications to their cannabis policy. For instance, in 2018, the United States Farm Bill allowed hemp-derived CBD products, increasing their marketability and use. Similarly, in February 2024, Germany decriminalized marijuana, allowing those over the age of 18 to carry 25 grams and grow up to three plants at home. In addition, cannabis clubs were authorized to have up to 500 members, with a monthly restriction of 50 grams per member. This legal support has resulted in a growing market with increased customer accessibility and compliance with regulatory safety and quality criteria.

Moreover, consumers are becoming more aware of CBD's potential medical benefits as clinical studies and scientific research continue to demonstrate its usefulness in treating a variety of diseases, including anxiety, pain, and inflammation. Its ability to treat more serious disorders, such as multiple sclerosis and epilepsy, is also boosting its market share. The United States Food and Drug Administration (FDA) approved Epidiolex, a drug containing pure cannabidiol extracted from hemp. This drug helps treat rare seizure diseases. According to the FDA study, using this drug is both safe and effective. Furthermore, according to a January 2024 Pew Research Center survey, about 90% of Americans believe marijuana should be legalized for medical or recreational use. An overwhelming majority of U.S. people, accounting for 88%, agree either that marijuana should be allowed just for medicinal use (32%), or that it should be permitted for both medical and recreational use (57%). Apart from this, advances in cannabidiol development are significantly helping market growth. Companies are constantly expanding their product offerings to include CBD-infused items such as oils, capsules, sweets, topicals, and cosmetics. For example, in March 2023, mood enhancement specialist Daytrip Beverages debuted their NightTrip gummies at the Natural Products Expo West. These CBD and CBN-infused gummies are gluten-free and vegan. They are believed to reduce tension and promote comfortable sleep.

Global Cannabidiol Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represents the largest regional market for cannabidiol, owing to the growing consumer interest in the potential health benefits of CBD.

North America Cannabidiol Market Trends:

North America is dominating the market for cannabidiol due to the progressive legislative frameworks that have broadly legalized and regulated the production, sale, and use of CBD products. For instance, in March 2024, the New York governor launched an audit of the state's Office of Cannabis Management (OCM) to find areas for improvement and begin implementing a long-term strategy for the legal cannabis rollout. These regulatory advancements have fostered a conducive environment for growth by enhancing consumer confidence and allowing for extensive market penetration in terms of product diversity and innovation. Moreover, the well-established infrastructure for cannabis research and development (R&D), which supports continuous innovation in CBD products, is fueling the market growth. Additionally, the high consumer awareness and acceptance, coupled with substantial investments in marketing and distribution networks, is propelling the cannabidiol market's recent developments.

Europe Cannabidiol Market Trends:

Many European nations have authorized or are in the process of legalizing CBD products, creating a favorable climate for industry growth. For example, the European Commission decided in December 2020 that CBD should not be classified as a medication but rather as a food, allowing it to be used in a variety of consumer products.

Asia Pacific Cannabidiol Market Trends:

Various initiatives launched by major companies in the region are projected to accelerate the growth of the CBD industry. For example, in February 2023, Awshad, a cannabis wellness firm based in Delhi-NCR, hosted medical cannabis training at New Delhi's PHD Chamber. The major goal of the event was to educate healthcare professionals about the use of CBD. The session would provide useful information about the usage and advantages of CBD. The gathering aimed to raise knowledge and understanding of medical cannabis among healthcare professionals.

Latin America Cannabidiol Market Trends:

Many Latin American countries have enacted laws permitting the use of CBD for medical purposes, creating a favorable environment for market expansion. For instance, in June 2022, Brazil's health regulatory agency, ANVISA, authorized the importation of cannabis plant derivatives, specifically extracts in their raw form, to be purified for pharmaceutical-grade CBD production within the country.

Middle East and Africa Cannabidiol Market Trends:

There's a growing recognition of CBD's therapeutic benefits, leading to higher consumer demand for CBD-infused products. For instance, South Africa legalized the sale of cannabidiol in 2019, paving the way for a burgeoning market.

Top Companies Leading in the Cannabidiol Industry

Some of the leading cannabidiol market companies include Aurora Cannabis Inc., Canopy Growth Corporation, CV Sciences Inc., Elixinol Global Limited, Endoca BV, Folium Biosciences, Green Roads of Florida LLC (The Valens Company Inc.), Isodiol International Inc., Koi CBD, Medical Marijuana Inc., Medterra CBD, NuLeaf Naturals LLC, PharmaHemp d.o.o., and Tilray Brands Inc., among many others. For instance, in January 2023, Medical Marijuana, Inc. announced that HempMeds Brasil introduced two new full-spectrum products in Brazil. The doses vary from 3,000 to 6,000 mg and are available in 30 and 60 mL jars.

Global Cannabidiol Market Segmentation Coverage

- On the basis of the product, the market has been bifurcated into CBD oil, CBD isolates, CBD concentrates, and others, wherein CBD isolates represented the largest segment. The versatility of CBD isolates, as they can be used in various forms, including powders and crystals, and are easily incorporated into edibles, cosmetics, and topical products, is bolstering the segment’s growth.

- Based on the source type, the market is categorized into marijuana and hemp, amongst which marijuana accounted for the largest market share due to its higher levels of THC as it contributes to the entourage effect.

- On the basis of the grade, the market has been divided into food grade and therapeutic grade. Among these, therapeutic grade represented the largest segment. The growing body of clinical research that supports the therapeutic claims of CBD is enhancing the segment’s growth.

- Based on the sales type, the market is bifurcated into B2B and B2C, wherein B2B accounts for the largest market share. The extensive supply chain requirements in the CBD industry and the adoption of high-quality raw materials and refined products by businesses to create several consumer goods, such as wellness supplements and personal care items, are enhancing the cannabidiol market's recent opportunities.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.0 Billion |

| Market Forecast in 2033 | USD 24.4 Billion |

| Market Growth Rate 2025-2033 | 14.84% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | CBD Oil, CBD Isolates, CBD Concentrates, Others |

| Source Types Covered | Marijuana, Hemp |

| Grades Covered | Food Grade, Therapeutic Grade |

| Sales Types Covered | B2B, B2C |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Aurora Cannabis Inc., Canopy Growth Corporation, CV Sciences Inc., Elixinol Global Limited, Endoca BV, Folium Biosciences, Green Roads of Florida LLC (The Valens Company Inc.), Isodiol International Inc., Koi CBD, Medical Marijuana Inc., Medterra CBD, NuLeaf Naturals LLC, PharmaHemp d.o.o., Tilray Brands Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Cannabidiol Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)