Global Cancer Biomarkers Market Expected to Reach USD 89.5 Billion by 2033 - IMARC Group

Global Cancer Biomarkers Market Statistics, Outlook and Regional Analysis 2025-2033

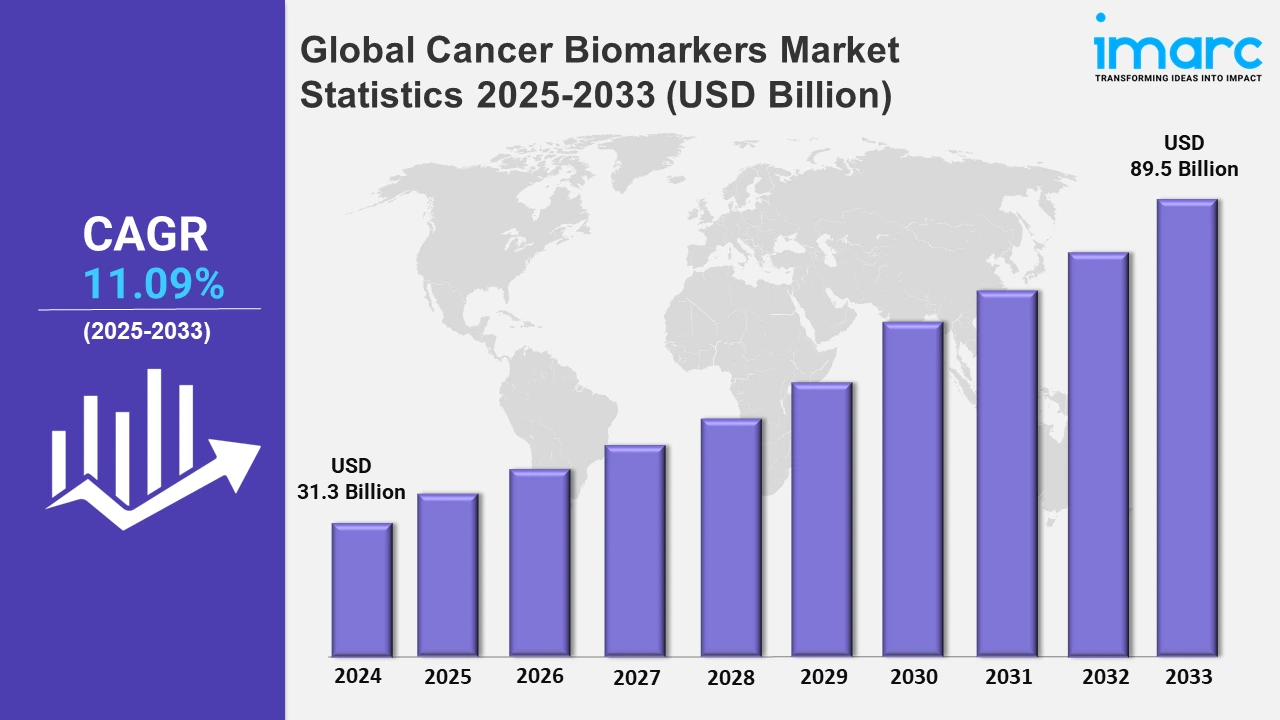

The global cancer biomarkers market size was valued at USD 31.3 Billion in 2024, and it is expected to reach USD 89.5 Billion by 2033, exhibiting a growth rate (CAGR) of 11.09% from 2025 to 2033.

To get more information on the this market, Request Sample

The market is experiencing an increase in demand for specialized training programs targeted at strengthening pathology knowledge and expanding biomarker research, as well as supporting skill development and improving diagnostic accuracy and individualized treatment techniques. For example, in November 2020, Agilent Technologies Inc. launched the Biomarker Pathologist Training Program, a global initiative designed to empower pathologists to score biomarkers accurately and confidently. This program incorporates Agilent's expertise in companion diagnostics and partnerships with leading pharmaceutical companies, aiming to enhance pathologists' skills in biomarker interpretation and scoring techniques.

Moreover, business partnerships are increasingly important in promoting biomarker research and clinical advancement, as prominent firms combine expertise in next-generation sequencing and protein biomarker discoveries to drive innovation and improve diagnostic and therapeutic options. For instance, in January 2022, Illumina Inc., renowned for its pioneering work in next-generation sequencing (NGS), embarked on a significant collaborative endeavor by forming a co-development partnership with SomaLogic. This partnership represents a pivotal moment in the landscape of biomarker research and clinical advancements. Furthermore, cancer biomarker providers are concentrating on improving diagnostic accuracy and precision while adhering to healthcare standards for early identification and individualized therapy. This initiative promotes national healthcare goals and regulatory targets for better cancer management. The expanding usage of biomarker-based diagnostics provides an opportunity for enterprises to broaden their market reach and income. Furthermore, healthcare practitioners are favoring advanced biomarkers over traditional diagnostic procedures due to their more precise accuracy in detecting certain cancer types. For example, in the Asia Pacific region, increased biotechnology investments and the presence of significant firms such as BGI Genomics and WuXi AppTec are boosting the use of new cancer biomarkers, resulting in improved patient outcomes and competitive market dynamics.

Global Cancer Biomarkers Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest cancer biomarkers market share owing to the presence of a well-established healthcare infrastructure with advanced medical facilities, research centers, and academic institutions.

North America Cancer Biomarkers Market Trends:

A significant emphasis on customized medicine fuels the need for biomarker-driven approaches to patient treatment. For instance, in May 2023, Danaher Corporation, through its subsidiary Beckman Coulter, unveiled the DxI 9000 access immunoassay analyzer, the most productive immunoassay analyzer per footprint. The DxI 9000 analyzer can run up to 215 tests per hour per square meter (tests/hr/m2).

Europe Cancer Biomarkers Market Trends:

Collaborative projects such as the EU's Horizon 2020 program make substantial advances in biomarker-based cancer diagnoses in Europe. This encourages innovation in early diagnosis and treatment, establishing Europe as a leader in research-driven improvements in the industry.

Asia Pacific Cancer Biomarkers Market Trends:

In Asia Pacific, increased biotechnology investments are driving the market, with China investing in genomics research to improve cancer diagnoses. This regional commitment promotes biomarker discovery, resulting in tailored care and better patient outcomes.

Latin America Cancer Biomarkers Market Trends:

Latin America is making progress in cancer biomarker accessibility as healthcare infrastructure improves, notably in Brazil. Increased public and private investment enables improved diagnostic services, which drives market development and improves patient care alternatives in the region.

Middle East and Africa Cancer Biomarkers Market Trends:

Strategic relationships, such as those between the UAE and worldwide biotech enterprises, are driving market expansion in the Middle East and Africa. These collaborations enhance biomarker-based diagnostic technologies, hence increasing cancer detection and treatment capacities in the region's healthcare system.

Top Companies Leading in the Cancer Biomarkers Industry

Some of the leading cancer biomarkers market companies include Abbott Laboratories, Agilent Technologies Inc., Becton Dickinson and Company, bioMérieux SA, Danaher Corporation, F. Hoffmann-La Roche AG, General Electric Company, Illumina Inc., Qiagen N.V., Sino Biological Inc., and Thermo Fisher Scientific Inc., among many others. For example, in July 2020, Thermo Fisher Scientific signed a companion diagnostic (CDx) agreement with Chugai Pharmaceutical Co., Ltd., a member of the Roche Group, and applied to the Ministry of Health, Labor and Welfare (MHLW) to expand the use of the Oncomine Dx Target Test in Japan.

Global Cancer Biomarkers Market Segmentation Coverage

- On the basis of profiling technology, the market has been bifurcated into omic technologies, imaging technologies, immunoassays, and cytogenetics. Omic technologies assess cancer's molecular makeup and imaging technologies provide non-invasive tumor viewing. Furthermore, immunoassays identify cancer markers, and cytogenetics identifies chromosomal mutations.

- Based on the biomolecule, the market is categorized into genetic biomarkers, protein biomarkers, and glyco-biomarkers, amongst which genetic biomarkers dominate the market. Genetic biomarkers provide information about an individual's genetic susceptibility, mutations, and variances that contribute to illness development.

- On the basis of the cancer type, the market has been divided into breast cancer, lung cancer, colorectal cancer, prostate cancer, stomach cancer, and others. Among these, lung cancer exhibits a clear dominance in the market. Lung cancer has a high global prevalence, being among the top causes of cancer-related fatalities. The significant link between lung cancer and smoking, combined with environmental variables, adds to its widespread prevalence.

- Based on the application, the market is bifurcated into diagnostics, prognostics, risk assessment, drug discovery and development, and others. Diagnostics assist early cancer detection by identifying biomarkers. Prognostics measure disease progression and patient outcomes. Risk assessment reveals those who are more likely to get cancer. Biomarkers are used in drug discovery and development to build tailored and effective medicines, hence improving treatment techniques and patient outcomes.

- On the basis of the end user, the market is segmented into hospitals, academic and research institutions, ambulatory surgical centers, diagnostic laboratories, and others. Cancer biomarkers are used in hospitals to provide accurate diagnoses and individualized therapy. Academic and research institutes prioritize biomarker development and validation. Biomarkers are used in ambulatory surgical centers to guide targeted surgical procedures. Diagnostic laboratories use advanced biomarker testing to identify and monitor cancer accurately.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 31.3 Billion |

| Market Forecast in 2033 | USD 89.5 Billion |

| Market Growth Rate 2025-2033 | 11.09% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Profiling Technologies Covered | Omic Technologies, Imaging Technologies, Immunoassays, Cytogenetics |

| Biomolecules Covered | Genetic Biomarkers, Protein Biomarkers, Glyco-Biomarkers |

| Cancer Types Covered | Breast Cancer, Lung Cancer, Colorectal Cancer, Prostate Cancer, Stomach Cancer, Others |

| Applications Covered | Diagnostics, Prognostics, Risk Assessment, Drug, Discovery and Development, Others |

| End Users Covered | Hospitals, Academic and Research Institutions, Ambulatory Surgical Centers, Diagnostic Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Agilent Technologies Inc., Becton Dickinson and Company, bioMérieux SA, Danaher Corporation, F. Hoffmann-La Roche AG, General Electric Company, Illumina Inc., Qiagen N.V., Sino Biological Inc.,Thermo Fisher Scientific Inc.,etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Cancer Biomarkers Market

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)