Global Buy Now Pay Later Market Expected to Reach USD 64.0 Billion by 2033 - IMARC Group

Global Buy Now Pay Later Market Statistics, Outlook and Regional Analysis 2025-2033

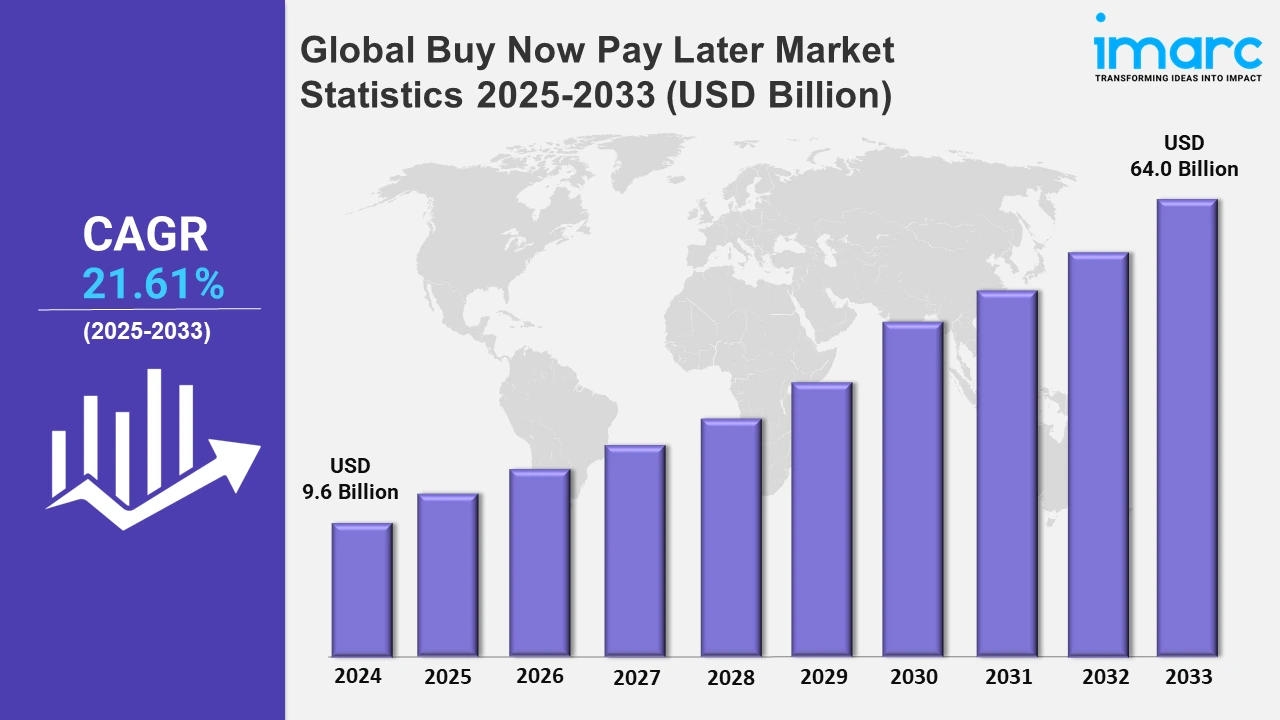

The global buy now pay later market size was valued at USD 9.6 Billion in 2024, and it is expected to reach USD 64.0 Billion by 2033, exhibiting a growth rate (CAGR) of 21.61% from 2025 to 2033.

To get more information on this market, Request Sample

The growing number of smartphone users is one of the major factors propelling the market growth. In 2021, the number of people using smartphones surpassed 6 billion. Also, the smartphone penetration rate across the globe surpassed 65% in 2023. Smartphones make it easy for people to access BNPL services via applications, allowing them to divide payments into smaller quantities. As more people shop online and use mobile devices to pay, BNPL services have grown more.

Moreover, BNPL services have various uses in the healthcare industry. They are commonly used by patients to pay for expensive medical procedures and treatments over time. In addition, BNPL services allow customers to acquire health and wellness products like fitness equipment, and medical devices. Furthermore, the rising collaboration between BNPL service providers and pharmacies to provide flexible payment options is boosting industry growth. Besides this, the increased use of subscription-based healthcare features like telemedicine platforms and mental health counseling is driving market expansion. In May 2022, Navia Life Care introduced Aarogya Pay, which offers a Buy now, Pay Later option. Aarogya Pay helps patients to go through medical procedures at clinics as it allows zero-interest instant worth INR 60,000. People can pay back this loan in three- or six-monthly installments. Additionally, the expanding e-commerce sector is a major driver of the growth of the market. With more people shopping online, BNPL services have become an attractive payment option. Also, many e-commerce platforms now integrate BNPL options to improve customer experience. Apart from this, consumers, especially younger shoppers, prefer these solutions for its simplicity.

Global Buy Now Pay Later Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America represented the largest market segment due to the rapid expansion of the e-commerce sector and strategic partnerships.

North America Buy Now Pay Later Market Trends:

North America dominates the overall market. The growth of the North American region is driven by tech-savvy Gen Z consumers. Moreover, various major players in the region, like Amazon, are integrating into the BNPL option. Also, in 2022, buy now pay later usage increased by more than 20% in the United States, further bolstering the market growth.

Europe Buy Now Pay Later Market Trends:

The strong consumer protection laws in Europe are one of the major factors driving the market growth. In addition, companies like Klarna in Sweden are focusing on the simple integration of these services. BNPL services are also becoming popular in Germany, which is further accelerating the market demand.

Asia Pacific Buy Now Pay Later Market Trends:

The growing smartphone usage in India and China is one of the key factors boosting the Asia Pacific’s growth. Moreover, the tech-friendly people in Philippines and Indonesia prefer the buy now pay later option as it makes the goods more affordable. Besides this, the rising number of e-commerce platforms are also integrating flexible payment options, further supporting the market growth.

Latin America Buy Now Pay Later Market Trends:

BNPL expansion in Latin America is boosted by a lack of traditional credit infrastructures. Moreover, platforms like Kueski Pay in Mexico are also gaining momentum. Also, in 2023, more than 50% of e-commerce users in Brazil adopted BNPL. Besides this, the rising availability of flexible repayment options is propelling the industry’s demand.

Middle East and Africa Buy Now Pay Later Market Trends:

The increasing penetration of the internet across the Middle East and Africa region is one of the key factors driving the market demand. Moreover, there has been a potential increase in the number of people using smartphones in UAE and South Africa, which has further surged the demand for e-commerce.

Top Companies Leading in the Buy Now Pay Later Industry

Some of the leading buy now pay later market companies include Affirm Inc., Afterpay Pty Ltd (Block Inc.), Billie GmbH, Klarna Bank AB, LatitudePay Australia Pty Ltd, Laybuy Holdings Limited, LazyPay Private Limited (PayU), Openpay Group, Payl8r, Paypal Holdings Inc., Splitit Payments Ltd., Zip Co Limited, among many others. In May 2023, Affirm Inc. integrated its BNPL technology with the Amazon Pay option in the United States.

Global Buy Now Pay Later Market Segmentation Coverage

- On the basis of the channel, the market has been bifurcated into online and point of sale (POS), wherein online accounted for the most prominent share. Buy Now Pay Later (BNPL) is a payment system that allows users to buy products online and pay in instalments. This, in turn, makes them inclined towards this option.

- Based on the enterprise size, the market is categorized into large enterprises and small and medium enterprises, amongst which large enterprises represent the largest market segment. It can be used by large enterprises for various purposes, including finance equipment and buying raw materials. Also, these enterprises have the budget to invest in the latest technology.

- On the basis of the end use, the market has been divided into consumer electronics, fashion and garment, healthcare, leisure and entertainment, retail, and others. Among these, retail accounted the largest share. The retail industry often has larger average order values than other sectors, further driving the need for buy now pay later solutions.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 9.6 Billion |

| Market Forecast in 2033 | USD 64.0 Billion |

| Market Growth Rate 2025-2033 | 21.61% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Channels Covered | Online, Point of Sale (POS) |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End Uses Covered | Consumer Electronics, Fashion and Garment, Healthcare, Leisure and Entertainment, Retail, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Affirm Inc., Afterpay Pty Ltd (Block Inc.), Billie GmbH, Klarna Bank AB, LatitudePay Australia Pty Ltd, Laybuy Holdings Limited, LazyPay Private Limited (PayU), Openpay Group, Payl8r, Paypal Holdings Inc., Splitit Payments Ltd., Zip Co Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Buy Now Pay Later Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)