Global Bromine Market Expected to Reach USD 5.4 Billion by 2033 - IMARC Group

Global Bromine Market Statistics, Outlook and Regional Analysis 2025-2033

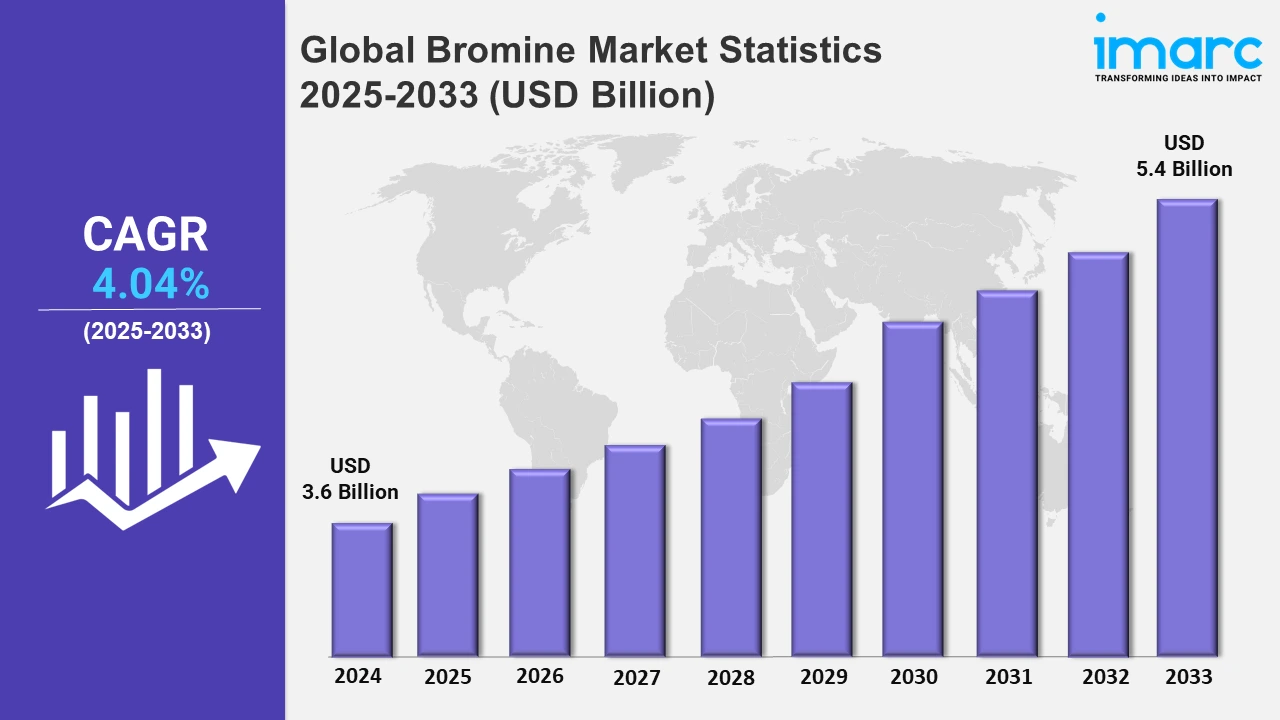

The global bromine market size was valued at USD 3.6 Billion in 2024, and it is expected to reach USD 5.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.04% from 2025 to 2033.

To get more information on this market, Request Sample

The global bromine market is experiencing tremendous growth in the industrial, agricultural, and environmental sectors. The main driver that is boosting the market is the surge in flame retardant applications, where demand increases in such sectors as building, car, and electronic industries. As per the marketresearchblog.org, the flame-retardant market, which is estimated to reach a value of USD 7.9 Billion in 2024, reflects the increasing demand for these vital chemicals. As fire safety regulations are becoming more stringent around the world, the use of bromine-based flame retardants in plastics, textiles, and insulation is increasing. Given these properties, bromine provides the crucial element needed in a broad range of end products for safety and so has been an increasing feature of consumption. Further growth is expected through expanding demand for consumer electronics and electrical appliances, for automobiles, which all increasingly utilize flame-retardant materials. Another key driver behind this market growth is the part bromine plays in manufacturing organobromines- pesticides, solvents, and pharmaceuticals. As these countries need more agricultural produce to feed their ballooning populations, the bromine-based pesticides and fertilizers, which include the soil fumigant methyl bromide, will be used on a more widespread basis in agriculture and other related fields.

The global apprehension about food safety also contributes to increased demand for the metal bromine for agricultural purposes. To elevate crop production and secure plants and crops, it needs further. A strong interest in environmental sustainability by proper regulatory compliance is another vital growth driver for this business globally. The attention paid to environmental concerns to safeguard production is every day. This includes the production of environmentally friendly bromine-based flame retardants and less harmful bromine chemicals than regular solutions. The use, for instance, of countries that push to use and adopt the alternatives of flammable retardants, preferably halogen-free flame retardants, and other safer chemicals, in return sparks innovative bromine compounds. Parallel regulatory pressures are forcing the industry to take more stringent conditions on chemical safety and environmental impacts, thus fueling demand for sustainable bromine-based products. Owing to its applications in drilling fluids and completion fluids in offshore drilling and fracking, oil and gas remain one of the drivers of the demand for bromine. With increasing global energy demand, particularly in new economies, this is projected to be reflected in the growing demand for bromine applications in the energy sector.

Global Bromine Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share on account of its extensive industrial base and rapidly expanding chemical manufacturing sector.

Asia Pacific Bromine Market Trends:

The Asia Pacific Bromine Market is driven by industrialization rapid urbanization and economic growth, especially in countries like India and China. According to the World Bank by 2036, India's towns and cities will have 600 million people, which is 40% of India's population, accounting for nearly 70% contribution toward the country's GDP. This sharp growth in infrastructure development would also increase the demand for bromine in construction. Flame retardants and fire-resistant material applications in buildings, roads, and other infrastructure construction would be needed. The demand for bromine-based flame retardants in electronic devices, automotive parts, and building materials to meet stringent fire safety regulations is also increasing. Bromine compounds are necessary for fire safety in materials used in consumer electronics and automotive manufacturing, which are growing rapidly in the region. Besides this, the use of bromine in agriculture, where it is used as a pesticide and fertilizer plays a critical role in supporting regional food security, as Asia Pacific is still dealing with such high population densities and necessities to have improved agricultural productivity. The surging demand for consumer electronics and appliances, especially in China, is further driving the consumption of bromine, especially in the form of organobromines used in circuit boards and other electronic components. In addition, the growing industrial base in the region is driving the demand for water treatment chemicals and pharmaceutical intermediates, where bromine is an essential element in disinfection and chemical processes.

North America Bromine Market Trends:

Stringent fire safety regulation in the construction, automotive, and electronics industries is the main driver for the bromine market in North America. Flame retardants in building materials and consumer electronics are in high demand. Advancements in the chemical industry, such as bromine in biocides and water treatment, also positively influence market growth. Major players and significant investments in innovation and sustainability have also led to the increasing bromine market in this region.

Europe Bromine Market Trends:

In Europe, there are regulatory pressures on safer, environment-friendly materials, especially in the automotive and electronics industries. This has resulted in stringent fire safety laws and sustainability concerns for bromine-based flame retardants. This increase in bromine use in the fields of pharmaceuticals, chemicals, and agriculture further remains a crucial trend. Europe has initiatives in reducing the environment and ensuring safety chemicals which leads to an increased demand for greener alternative bromine-based products. With such strength from the industrial sectors, it continues to boost this region.

Latin America Bromine Market Trends:

The Latin American market for bromine is fueled by the increasing use of bromine in agriculture, especially in pesticides and fertilizers, due to the region's huge agricultural sector. The demand for flame retardants in the construction and automotive industries also supports market growth. Economic development and industrialization, especially in countries like Brazil and Mexico, increase the use of bromine in chemical manufacturing. Further, investments in infrastructure and an increased demand for safety products are some factors that are expanding the market for bromine in Latin America.

Middle East and Africa Bromine Market Trends:

The Middle East and Africa's bromine market is largely driven by the oil and gas industry as bromine is used in drilling fluids, completion fluids, and other extraction processes. There is a significant growth in exploration and production activities in countries like Saudi Arabia, UAE, and Nigeria. Furthermore, the agricultural sector in North Africa is expanding, and the growing demand for bromine-based pesticides is adding to this demand. The ongoing industrial growth and infrastructural development in these regions are further fueling the bromine market's expansion.

Top Companies Leading in the Bromine Industry

Some of the leading Bromine market companies include Albemarle Corporation, Chemada Industries Ltd., Gulf Resources Inc., Hindustan Salts Limited, Honeywell International Inc., ICL Group Ltd., Jordan Bromine Company Limited, Lanxess AG, Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.), Tata Chemicals Limited, TETRA Technologies Inc., Tosoh Corporation, among many others.

- In August 2024, TETRA Technologies, Inc. completed a formal feasibility assessment for its Arkansas bromine project, converting previously announced bromine resources into reserves. The research projects a 40-year working life and a 62% internal rate of return for the project. Following the final investment decision, the company anticipates increased sales volumes and adjusted EBITDA. The projected payback period for capital expenditures after FID is 5.7 years.

Global Bromine Market Segmentation Coverage

- Based on the derivative, the market is divided into hydrogen bromide, organobromine compounds, bromine fluids, and others. Among them, organobromine compounds account for the highest share of this market. This position can be ascribed to the widespread as well as critical applications organobromine compounds face within multiple industries. The major applications of organobromine compounds include the production of flame retardants, which are needed for improving fire safety in plastics, textiles, and electronic materials. Organobromine compounds also have various applications in agriculture as pesticides and in the pharmaceutical industry as raw materials for the synthesis of various drugs.

- On the basis of the application, the market is segmented into biocides, flame retardants (FR), bromine-based batteries, CBF fluids, and others. Flame retardants represent the largest share. This is due to the rising importance of fire safety and regulatory standards for fire-resistant materials in industries such as construction, automotive, electronics, and textiles. Flame retardants are applied to a vast range of materials, such as polymers, fabrics, and insulation, to inhibit the spread of fire. The demand for fire-resistant materials in consumer electronics, building materials, and automotive parts, coupled with the increasing construction sector, has created a huge demand for bromine-based flame retardants, making it the most important application in the bromine market.

- Based on the end user, the market is segmented into chemicals, oil and gas, pharmaceuticals, agriculture, textiles, electronics, and others. The chemicals accounted for the highest share of the market. There is the most diverse use of bromine products. A broad array of chemicals falls into the category of flame retardants, pesticides, water treatment chemicals, and pharmaceutical intermediates. Another factor is that the use of bromine can also be boosted by the growing demand for advanced materials, agricultural products, and industrial chemicals in a high-chemical industry. Furthermore, bromine compounds are used to an important role in specialty chemicals for use in biocides in sanitizers and disinfectants.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3.6 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Market Growth Rate 2025-2033 | 4.04% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Derivatives Covered | Hydrogen Bromide, Organobromine Compounds, Bromine Fluids, Others |

| Applications Covered | Biocides, Flame Retardants (FR), Bromine-Based Batteries, Clear Brine Fluids (CBF), Others |

| End Users Covered | Chemicals, Oil and Gas, Pharmaceuticals, Agriculture, Textiles, Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Albemarle Corporation, Chemada Industries Ltd., Gulf Resources Inc., Hindustan Salts Limited, Honeywell International Inc., ICL Group Ltd., Jordan Bromine Company Limited, Lanxess AG, Solaris Chemtech Industries Limited (Agrocel Industries Pvt. Ltd.), Tata Chemicals Limited, TETRA Technologies Inc., Tosoh Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Bromine Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)