Global Blood Plasma Derivatives Market Expected to Reach USD 75.9 Billion by 2033 - IMARC Group

Global Blood Plasma Derivatives Market Statistics, Outlook and Regional Analysis 2025-2033

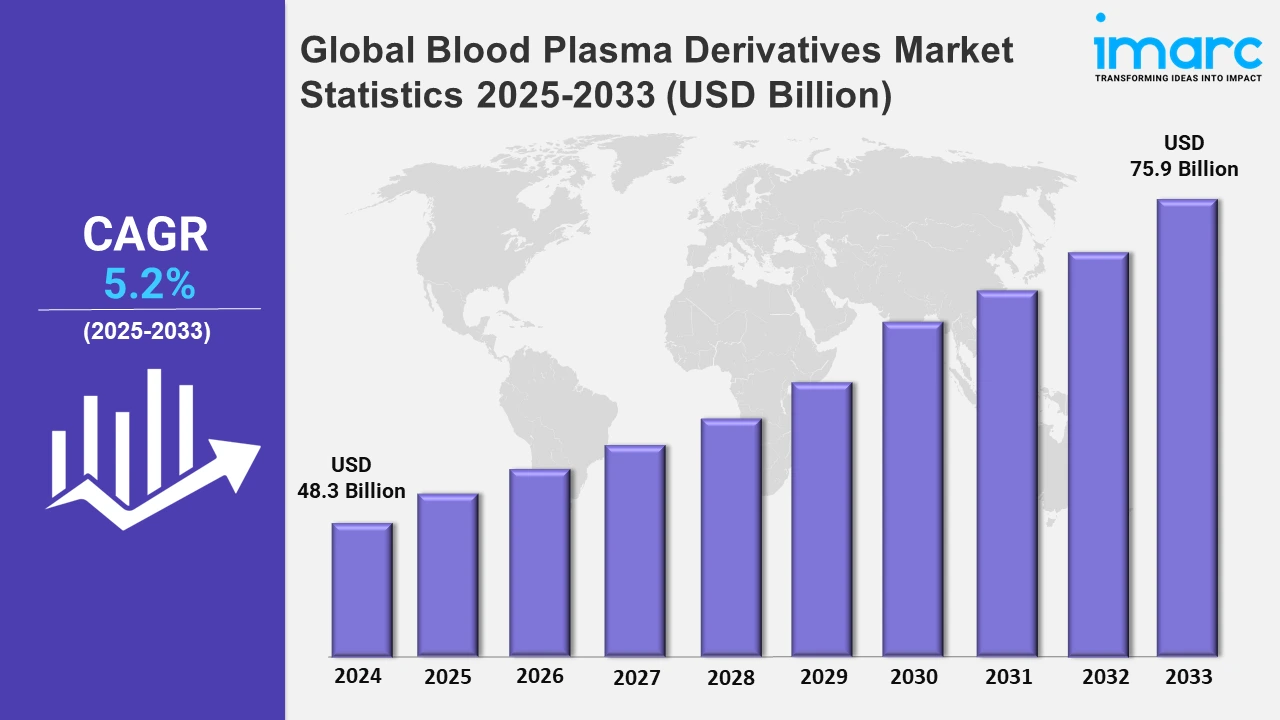

The global blood plasma derivatives market size was valued at USD 48.3 Billion in 2024, and it is expected to reach USD 75.9 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% from 2025 to 2033.

To get more information on this market, Request Sample

The global blood plasma derivatives market is experiencing significant growth, primarily driven by the increasing prevalence of chronic diseases and immunodeficiency disorders. For instance, For example, the worldwide incidence of hemophilia is on the rise, with an estimated 400,000 patients in the world, and an approximate frequency of 1 in 10000 live births, resulting in an increasing need for clotting factor concentrates. Additionally, the aging global population is more susceptible to such conditions, which is further boosting the need for plasma derivatives and thus creating a positive outlook for market expansion. In line with this, ongoing technological advancements in plasma fractionation and purification processes have enhanced the efficiency and safety of plasma-derived products and made them more accessible and appealing to healthcare providers, thus strengthening the market growth. Moreover, the implementation of favorable government initiatives and reimbursement policies have also played a crucial role in market expansion. The U.S. Food and Drug Administration (FDA) has approved several new plasma-derived therapies in recent years, facilitating their market entry and adoption. For example, In November 2023, Takeda received approval from the U.S. FDA for ADZYNMA (ADAMTS13), the first and only FDA-approved recombinant ADAMTS13 protein designed to address an unmet medical need in individuals suffering from congenital thrombotic thrombocytopenic purpura (cTTP).

Besides this, the establishment of thousands of plasma collection centers around the world has strengthened the supply chain, further ensuring a steady raw material supply for the production of derivatives and driving the growth of the market. The Plasma Protein Therapeutics Association (PPTA) revealed that there are more than 900 plasma collection centers in the United States. This depicts a robust network of establishments with significant support towards growth in this market. In addition to this, the growth of healthcare infrastructure in emerging economies has created new markets for plasma derivatives, as countries such as China and India have made heavy investments in healthcare facilities and services. Apart from this, rising chronic diseases, technological advancements, government policies to support the industry, and expansion of plasma collection infrastructure are believed to keep driving the market ahead.

Global Blood Plasma Derivatives Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia-Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to the growing prevalence of chronic diseases and extensive research and development (R&D) activities.

North America Blood Plasma Derivatives Market Trends:

The growth of the North American blood plasma derivatives market is fueled by a rising prevalence of chronic diseases and blood disorders, coupled with advanced healthcare infrastructure. In the U.S., approximately 33,000 males are affected by hemophilia, with 400 new cases of hemophilia A reported annually. Additionally, over 100,000 Americans live with sickle cell disease, a number projected to rise by 30% by 2050. Increased awareness and demand for immunoglobulins and albumin for autoimmune and neurological conditions further bolster market expansion. The region also benefits from extensive plasma collection networks and research advancements in plasma-derived therapies, ensuring sustained market growth.

Asia-Pacific Blood Plasma Derivatives Market Trends:

The Asia Pacific market is gradually growing, driven by increasing expenditure on healthcare, enhanced awareness of plasma-derived therapies, and development in healthcare infrastructure. An increasing prevalence of immunodeficiency disorders also fosters the demand for these products.

Europe Blood Plasma Derivatives Market Trends:

In Europe, the increasing incidence of rare diseases and the implementation of favorable reimbursement policies have heightened the demand for plasma derivatives. Efforts to enhance plasma collection capabilities are also contributing to market growth.

Latin America Blood Plasma Derivatives Market Trends:

In Latin America, the demand is influenced by improving healthcare systems, increased access to medical treatments, and a growing focus on addressing hemophilia and other blood-related disorders. Government initiatives to enhance healthcare access are also playing a role.

Middle East and Africa Blood Plasma Derivatives Market Trends:

In the Middle East and Africa, the rising incidence of infectious diseases, coupled with efforts to improve healthcare infrastructure and access, is driving the demand for plasma derivatives. International collaborations and investments are also contributing to market growth in this region.

Top Companies Leading in the Blood Plasma Derivatives Industry

Some of the leading blood plasma derivatives market companies include Baxter International Inc., Bayer AG, CSL Limited, Fusion Health Care Pvt. Ltd., Grifols S.A., Kedrion S.p.A., LFB S.A., Octapharma AG, Sanofi S.A., and Takeda Pharmaceutical Company Limited, among many others.

- In January 2024, Takeda gained FDA approval for its HYQVIA, a subcutaneous immunoglobulin (SCIG) infusion, used to treat chronic inflammatory demyelinating polyneuropathy (CIDP) in adults.

- In March 2023, Kedrion Biopharma participated in a plasma fractionation workshop in Saudi Arabia, showcasing best practices and experiences in the field. The event, organized by the Ministry of Health and Blood Banks Friends Charity, aimed to support key decision-making.

Global Blood Plasma Derivatives Market Segmentation Coverage

- On the basis of the type, the market has been divided into albumin, factor VIII, factor IX, immunoglobulin, hyperimmune globulin, and others. Immunoglobulins dominate the market due to their critical role in treating immune deficiencies, autoimmune disorders, and neurological diseases. The rising prevalence of these conditions and advancements in therapeutic plasma derivatives further fuel demand, making immunoglobulin a significant segment.

- Based on the application, the market has been segmented into hemophilia, hypogammaglobulinemia, immunodeficiency diseases, Von Willebrand’s disease, and others. The demand for blood plasma derivatives in hemophilia treatment is driven by the necessity of clotting factors to manage bleeding effectively. The treatments of hypogammaglobulinemia patients have exclusively used immunoglobulins to restore antibody levels in affected patients. Immunodeficiency diseases are driving the demand for plasma therapies that enhance the immune response and mitigate infection risks. Von Willebrand’s disease requires specialized plasma-derived concentrates for effective clotting factor replacement. Other applications, including trauma care and surgical procedures, utilize plasma derivatives to stabilize patients and manage coagulation disorders.

- The market has been categorized based on the end user into hospitals, clinics, and others. Among these, hospitals dominate as key end-users because they offer specialized plasma-derived therapies and have a robust infrastructure to support the administration of these treatments for acute and chronic conditions, ensuring better patient outcomes and adherence to stringent safety protocols.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 48.3 Billion |

| Market Forecast in 2033 | USD 75.9 Billion |

| Market Growth Rate 2025-2033 | 5.2% |

| Units | Billion USD |

| Segment Coverage | Type, Application, End User, Region |

| Region Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Baxter International Inc., Bayer AG, CSL Limited, Fusion Health Care Pvt. Ltd., Grifols S.A., Kedrion S.p.A., LFB S.A., Octapharma AG, Sanofi S.A. and Takeda Pharmaceutical Company Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)