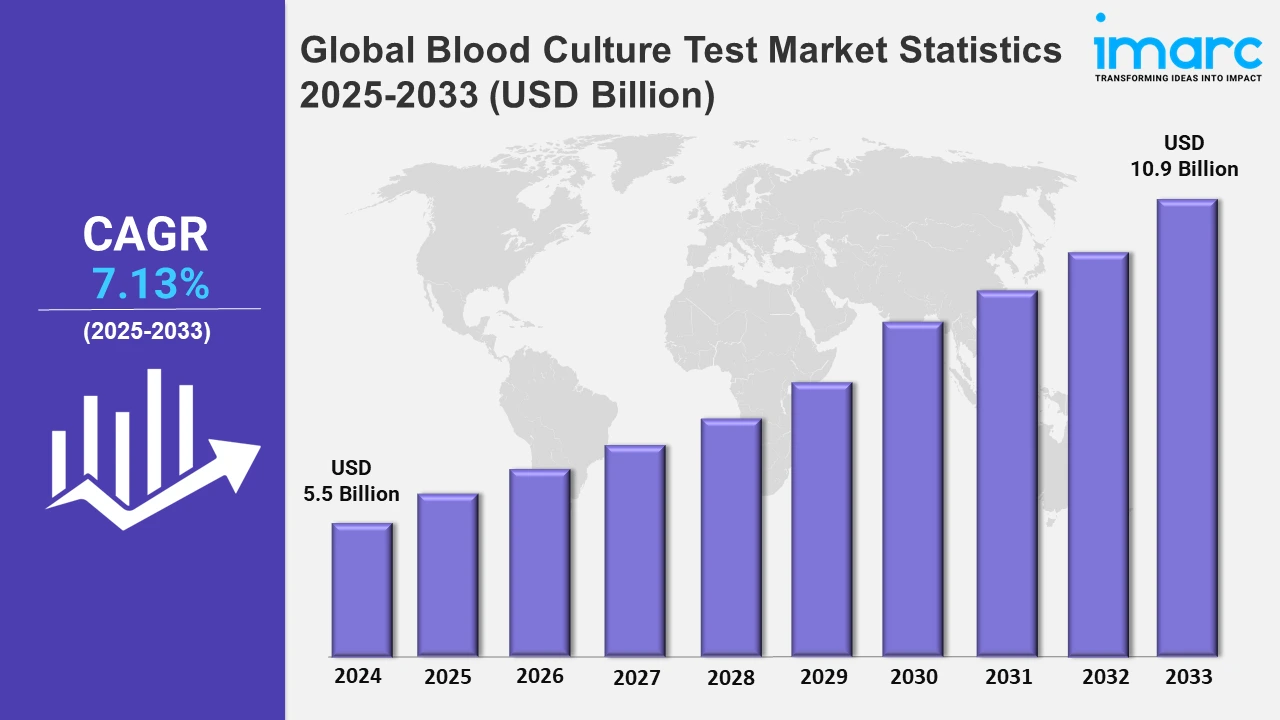

Global Blood Culture Test Market Expected to Reach USD 10.9 Billion by 2033 - IMARC Group

Global Blood Culture Test Market Statistics, Outlook and Regional Analysis 2025-2033

The global blood culture test market size was valued at USD 5.5 Billion in 2024, and it is expected to reach USD 10.9 Billion by 2033, exhibiting a growth rate (CAGR) of 7.13% from 2025 to 2033.

To get more information on the this market, Request Sample

To satisfy rising clinical diagnostic demand, companies are expanding their focus on lab automation beyond conventional research applications. They want to offer comprehensive diagnostic solutions and increase their worldwide footprint in the healthcare business by acquiring specialist enterprises and collaborating on improved automation capabilities. For example, in March 2023, Brooks Automation US, LLC announced the acquisition of Aim Lab Automation Technologies Pty Ltd. to expand solutions within the lab automation segment. This acquisition further expanded Brooks' presence beyond drug discovery into the clinical diagnostics market.

The growing usage of automated blood culture systems, which employ modern edge sensors and software algorithms to identify microbial growth in blood samples more quickly and precisely than older methods, is another key growth driver for the market. For instance, in December 2022, InsilicoMedicine launched Life Star, which was the 6th generation Intelligent Robotics Drug Discovery Laboratory. Additionally, a study published in the Journal of Clinical Microbiology in 2021 compared the performance of two automated blood culture systems, i.e., BacT/Alert Virtuo and BacT/Alert 3D. The research found that the Virtuo system significantly reduced the time to detection (TTD) for bloodstream infections. Furthermore, the rising number of hospitalized patients is causing an increase in HIA cases, which is boosting the market for blood culture tests. For example, the Centers for Disease Control and Prevention issued a Healthcare Associated Infection Progress Report 2020, which indicated that there were nearly 18,416 surgical site infections reported in 2020 in the United States. It also reported that out of this, 6,094 infections were during colon surgery, and 2,173 occurred during hip arthroplasty.

Global Blood Culture Test Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share due to the expanding healthcare infrastructure, which comprises multiple networks of hospitals, clinics, and laboratories.

North America Blood Culture Test Market Trends:

The presence of a well-established healthcare insurance system in the region, which ensures that a large section of the population has access to medical services such as blood culture testing, is helping to drive North America’s growth. For example, in January 2022, Eurofins subsidiary empowerDX launched PFAS Exposure in the United States, the direct-to-consumer at-home test to determine levels of per- and polyfluorinated alkyl substances (PFAS) in a person's blood and measure 47 of the PFAS forever chemical compounds.

Europe Blood Culture Test Market Trends:

In Europe, rising antibiotic resistance is driving demand for blood culture testing, notably in hospitals. For example, the National Health Service in the United Kingdom prioritizes early diagnoses to prevent resistant infections, encouraging medical professionals to use improved culture testing procedures.

Asia Pacific Blood Culture Test Market Trends:

These tests are becoming more popular in the Asia Pacific as sepsis incidence rises, particularly in India and China. Government healthcare programs encourage early infection detection, with diagnostics becoming critical instruments for increasing patient survival rates in hospitals.

Latin America Blood Culture Test Market Trends:

In Latin America, increased healthcare investments are aimed at infectious disease diagnostics, which includes blood culture testing. Brazil's healthcare system, for example, places an emphasis on early infection identification in public hospitals, where diagnostics aid in the containment of regional bloodstream infection epidemics.

Middle East and Africa Blood Culture Test Market Trends:

In the Middle East and Africa, greater emphasis on healthcare infrastructure encourages blood culture monitoring for early infection diagnosis. Saudi Arabia's Vision 2030 healthcare goals support the use of these diagnostics to enhance patient outcomes in infectious illness treatment.

Top Companies Leading in the Blood Culture Test Industry

Some of the leading blood culture test market companies include Abbott Laboratories, Danaher Corporation, Becton, Dickinson and Company, bioMeriux SA, Bruker Corporation, Luminex Corporation, Merck KGaA, Siemens Healthcare GmbH, F.Hoffmann-La Roche Ltd., T2 Biosystems Inc., and Thermo Fisher Scientific Company, among many others. For example, in October 2022, BD (Becton, Dickinson, and Company), a leading global medical technology company, and Magnolia Medical Technologies, Inc., announced a co-exclusive commercial agreement aimed at helping U.S. hospitals reduce blood culture contamination to help improve testing accuracy and ultimately improve clinical outcomes.

Global Blood Culture Test Market Segmentation Coverage

- On the basis of the testing method, the market has been bifurcated into conventional and automated, wherein conventional represents the most preferred segment. Conventional tests are used in hospitals, clinics, and healthcare facilities across the world. They are an important diagnostic technique for determining the presence of bacteria, fungi, or other pathogens in the patient's blood circulation.

- Based on the product, the market is categorized into consumables (blood culture media (aerobic blood culture media, anaerobic blood culture media, fungi/yeast blood culture media, and mycobacteria blood culture media), assay kits and reagents, and blood culture accessories), instruments (automated blood culture systems, supporting laboratory equipment, (incubators, colony counters, microscopes, and gram stainers) ), and software and services, amongst which consumables dominate the market. Consumables are used at numerous critical points in the blood culture process.

- On the basis of the technology, the market has been divided into culture-based technology, molecular technology (microarray, PCR, and PNA-FISH), proteomic technology, and others. Among these, culture-based technology exhibits a clear dominance in the market. Culture-based technology detects and identifies microbial pathogens such as bacteria and fungus in patient blood samples, which is critical in identifying potentially fatal bloodstream infections (BSIs).

- Based on the application, the market is bifurcated into bacterial infections, fungal infections, and mycobacterial infections, wherein bacterial infections dominate the market. Bacterial infections are a major concern in the healthcare industry. These infections can take many different forms, ranging from mild to severe, and successful treatment frequently requires a prompt and correct diagnosis.

- On the basis of the end user, the market is segmented into hospital laboratories, reference laboratories, research laboratories, and others. Currently, hospital laboratories account for the majority of the total market share. Hospital laboratories are equipped with modern equipment and a variety of resources, allowing them to perform tests with great precision and efficiency.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.5 Billion |

| Market Forecast in 2033 | USD 10.9 Billion |

| Market Growth Rate 2025-2033 | 7.13% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Testing Methods Covered | Conventional, Automated |

| Products Covered |

|

| Technologies Covered |

|

| Applications Covered | Bacterial Infections, Fungal Infections, Mycobacterial Infections |

| End Users Covered | Hospital Laboratories, Reference Laboratories, Research Laboratories, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Abbott Laboratories, Danaher Corporation, Becton, Dickinson and Company, bioMeriux SA, Bruker Corporation, Luminex Corporation, Merck KGaA, Siemens Healthcare GmbH, F.Hoffmann-La Roche Ltd., T2 Biosystems Inc., Thermo Fisher Scientific Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

.webp)

.webp)