Global Blockchain in Retail Market Expected to Reach USD 26,190.1 Million by 2033 - IMARC Group

Global Blockchain in Retail Market Statistics, Outlook and Regional Analysis 2025-2033

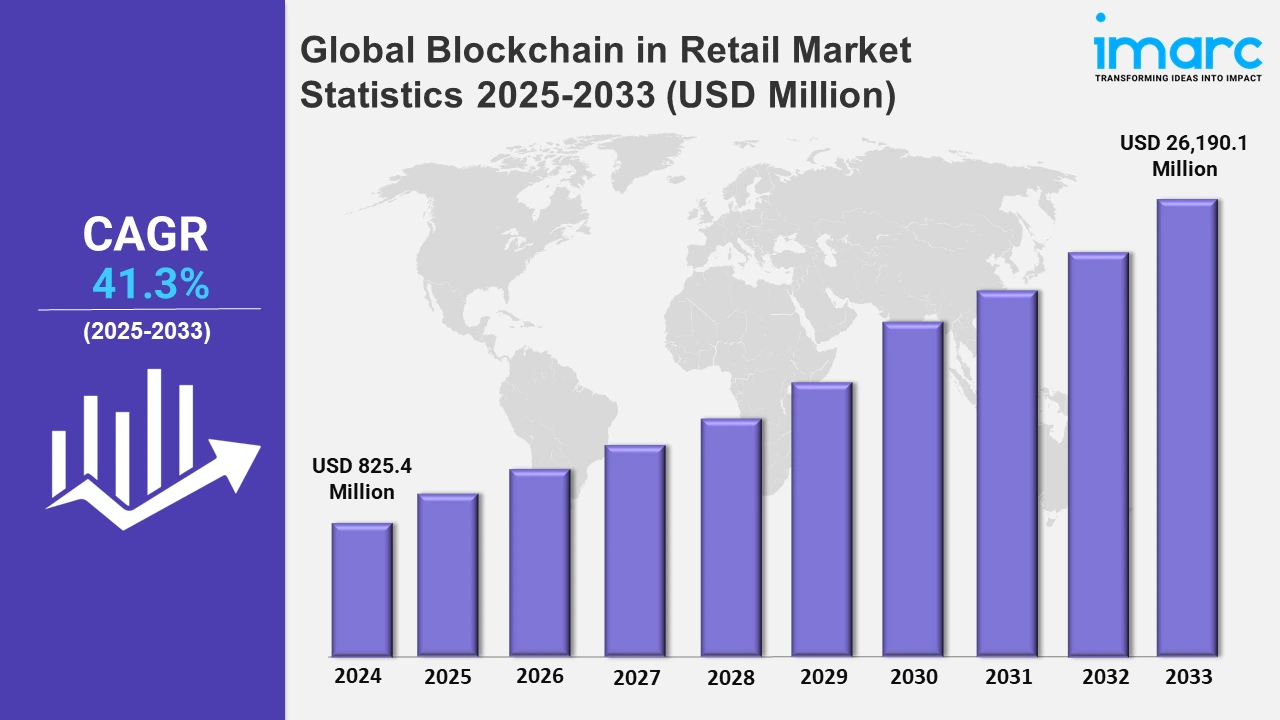

The global blockchain in retail market size was valued at USD 825.4 Million in 2024, and it is expected to reach USD 26,190.1 Million by 2033, exhibiting a growth rate (CAGR) of 41.3% from 2025 to 2033.

To get more information on the this market, Request Sample

Blockchain technology is fundamentally altering the financial transactions landscape in retail. It provides a highly secure platform for payment processes, thereby reducing the risk of fraud and unauthorized activities. Additionally, traditional payment systems often involve multiple intermediaries, each adding a layer of complexity, cost, and potential for error or fraud. Blockchain eliminates these intermediaries, simplifying the transaction process and enhancing security. Financial frauds such as credit card fraud and identity theft cost billions. For instance, according to an article published by Merchant Cost Consulting, global credit card fraud losses are expected to exceed US$ 43 Billion in the coming years. This value is rising from approximately US$ 9.84 Billion in 2011 to US$ 32.4 Billion in 2021. The decentralized and encrypted nature of blockchain makes it exceedingly difficult for fraudsters to manipulate the system. Moreover, transactions can be verified instantly, eliminating delays that could negatively impact business operations. Another advantage is the reduction in transaction costs. Traditional payment systems often involve fees that erode profit margins. By minimizing mediators, blockchain helps in reducing these costs, providing a more cost-effective solution for both retailers and consumers.

Moreover, effective inventory management is a perennial challenge in the retail industry. Overstocking results in increased holding costs and potential wastage, while understocking can lead to lost sales. In addition, blockchain technology offers a sophisticated, real-time inventory tracking system, facilitating efficient inventory management. For instance, in November 2024, GearChainTM, a Web3-powered inventory management company, unveiled the world's first mobile inventory management app that incorporates blockchain technology. The app's built-in barcode scanning, automated data sync, and blockchain-backed transaction proof ensure an immutable and trustworthy supply chain. Integrating with Google Sheets Auto Sync to automate real-time updates and reduce manual input errors, ensuring data consistency across all platforms. The app's autolookup feature increases productivity by automatically presenting item details, such as name and photo, when users scan new objects, minimizing the need for repetitive data entering. Moreover, in today’s highly competitive retail landscape, customer experience is a key differentiator. Blockchain offers multiple avenues for improving this critical aspect of retail. Also, loyalty programs can be easily managed through blockchain, creating a more secure and transparent system for tracking and redeeming points. For instance, in September 2024, Forbes Web3 partnered with the Qiibee Foundation to launch a blockchain-powered loyalty scheme. The forthcoming platform will offer Forbes Web3 readers a wide range of reward options, including gift cards for famous brands, such as Amazon and Apple, as well as possibilities to donate to charity or earn airline miles for future travels. The loyalty platform's incorporation of blockchain technology provides users with a transparent and secure environment in which to earn, track, and redeem points from an expanding network of partners.

Global Blockchain in Retail Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America exhibited the largest market segment. The region is home to numerous tech giants and startups focused on blockchain innovation, providing the retail sector with ample options for partnership and technology sourcing.

North America Blockchain in Retail Market Trends:

Regulatory support is making North America the largest leader in the market. The U.S. and Canada have shown openness to blockchain adoption, creating a conducive environment for its growth. Consumer behavior in North America also significantly contributes to this trajectory. Moreover, with a tech-savvy population increasingly demanding transparency, authenticity, and speed in retail transactions, blockchain has become a viable solution to meet these expectations. In addition, there have been rising incidents of cyber-attacks and data breaches in the retail sector. For instance, according to an article published by Cobalt, in North America, retail accounts for 14% of cyberattacks. This adds urgency to the need for secure transaction platforms, which blockchain readily provides.

Europe Blockchain in Retail Market Trends:

European governments are actively investing in blockchain research and development, fostering an environment conducive to technological adoption. For example, the European Union has established regulatory frameworks like the Markets in Crypto-Assets (MiCA) regulation to promote blockchain innovation.

Asia Pacific Blockchain in Retail Market Trends:

Governments in the Asia-Pacific region are actively investing in blockchain applications. For example, in December 2020, the Singapore government announced a US$ 8.90 Million program for the implementation of blockchain applications. This is further driving the demand for blockchain in retail.

Latin America Blockchain in Retail Market Trends:

Governments in the region are increasingly recognizing the potential of blockchain. For instance, Brazil has implemented regulations to govern virtual assets, providing a clearer framework for blockchain applications in retail. Such regulatory support encourages investment and innovation within the sector, further escalating the market’s growth.

Middle East and Africa Blockchain in Retail Market Trends:

The increasing use of digital technologies and government activities are propelling the market's growth. For example, in July 2018, the International Finance Company invested US$ 3 Million in Twiga Foods, a B2B logistics provider that connects small-scale farmers to retailers in East Africa.

Top Companies Leading in the Blockchain in Retail Industry

Some of the leading blockchain in retail market companies include Amazon Web Services Inc. (Amazon.com Inc.), Auxesis Services & Technologies (P) Ltd, Cognizant, Infosys Limited, International Business Machines Corporation, Oracle Corporation, Reply, SAP SE, Sofocle Technologies Pvt. Ltd., and Tata Consultancy Services Limited (Tata Group), among many others. For instance, in January 2023, Tata Consultancy Services Limited (Tata Group) unveiled TCS Customer Intelligence & InsightsTM (CI&I) for Retail 3.0, with the goal of assisting retailers in enhancing their customer relationships by providing hyper-personalized interactions throughout the whole customer experience.

Global Blockchain in Retail Market Segmentation Coverage

- On the basis of the component, the market has been bifurcated into platform/solutions and services, wherein platform/solutions accounted for the largest market share driven by the need for scalable, reliable, and customizable solutions that can seamlessly integrate with existing retail management systems.

- Based on the type, the market is categorized into public blockchain, private blockchain, and consortium blockchain, amongst which private blockchain accounted for the largest market share. Private blockchain offers a higher level of security and control, as access is restricted to authorized participants only, further propelling the segment’s growth.

- On the basis of the organization size, the market has been divided into large enterprises and small and medium-sized enterprises (SMEs). Among these, large enterprises accounted for the largest market share. One of the primary motivators is the complexity and volume of transactions that large enterprises manage, which necessitate highly secure and efficient systems, including blockchain.

- Based on the application, the market is bifurcated into supply chain management, food safety management, customer data management, identity management, compliance management, and others. The inflating need for transparency and traceability throughout the supply chain is fueling the growth of this segment.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 825.4 Million |

| Market Forecast in 2033 | USD 26,190.1 Million |

| Market Growth Rate (2025-2033) | 41.3% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Platform/Solutions, Services |

| Types Covered | Public Blockchain, Private Blockchain, Consortium Blockchain |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises (SMEs) |

| Applications Covered | Supply Chain Management, Food Safety Management, Customer Data Management, Identity Management, Compliance Management, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Amazon Web Services Inc. (Amazon.com Inc.), Auxesis Services & Technologies (P) Ltd, Cognizant, Infosys Limited, International Business Machines Corporation, Oracle Corporation, Reply, SAP SE, Sofocle Technologies Pvt. Ltd., Tata Consultancy Services Limited (Tata Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)