Global Blockchain in Manufacturing Market Expected to Reach USD 95,576.9 Million by 2033 - IMARC Group

Global Blockchain in Manufacturing Market Statistics, Outlook and Regional Analysis 2025-2033

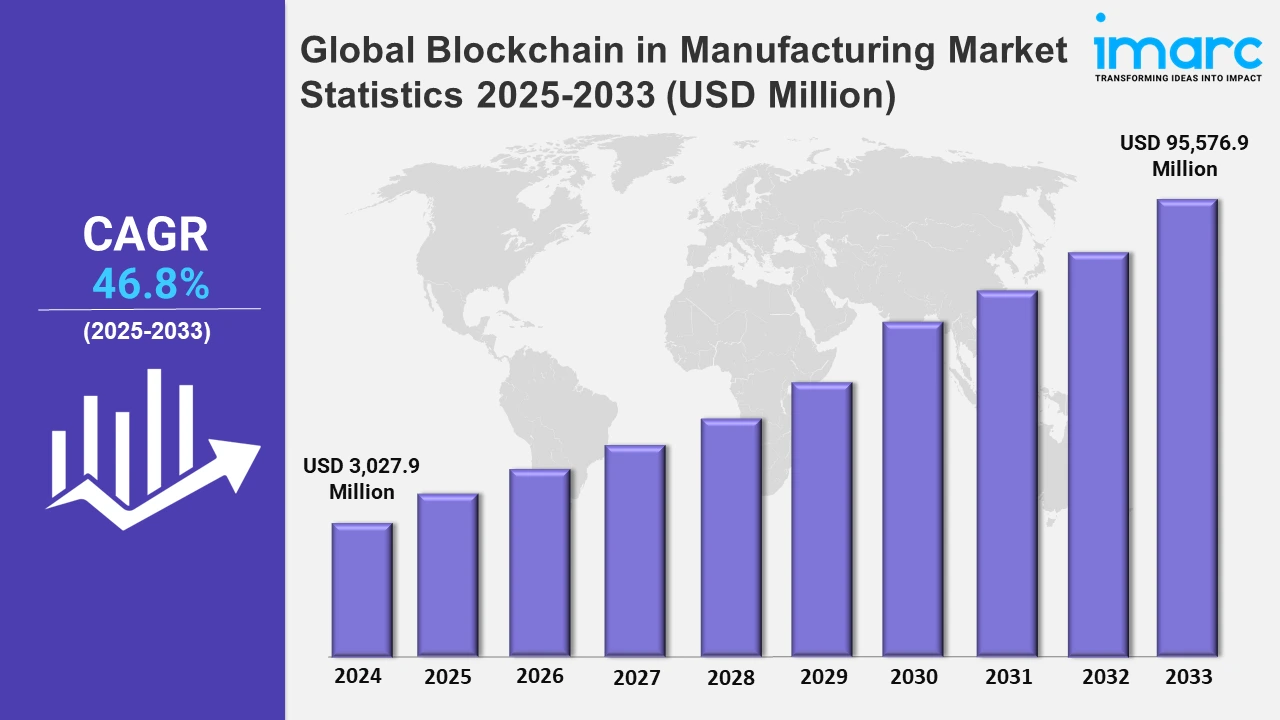

The global blockchain in manufacturing market size was valued at USD 3,027.9 Million in 2024, and it is expected to reach USD 95,576.9 Million by 2033, exhibiting a growth rate (CAGR) of 46.8% from 2025 to 2033.

To get more information on this market, Request Sample

The expansion of industry 4.0 is a significant driver of blockchain adoption in the manufacturing sector. For instance, according to IMARC, the global industry 4.0 market size reached USD 164.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 570.5 Billion by 2033, exhibiting a growth rate (CAGR) of 14.44% during 2025-2033. Industry 4.0 relies heavily on IoT devices that collect data from machines, sensors, and production lines. Blockchain can securely store and manage the data produced by these devices in a decentralized, tamper-proof ledger. This ensures data integrity, accuracy, and transparency, which are essential for smart manufacturing processes.

Moreover, tracking the origins and journeys of raw materials, components, and completed products in traditional manufacturing processes can be time-consuming and inaccurate. Blockchain's decentralized and immutable ledger technology ensures that each transaction or movement is recorded in a tamper-proof way, thereby resulting in an indelible trail of data. This capacity allows manufacturers to precisely trace a product's complete lifecycle, from raw materials to final destination. This increased traceability aids not just in quality control and recall management but also in compliance with numerous regulatory standards. Furthermore, customers and stakeholders are increasingly demanding transparency in supply chains in order to validate ethical sourcing and sustainability policies. Blockchain's transparency enables manufacturers to demonstrate their adherence to these principles, fostering consumer confidence and loyalty. For instance, in March 2022, SAP and Unilever launched a blockchain trial using the GreenToken by SAP solution to improve traceability and transparency in Unilever's worldwide palm oil supply chain. After the "first mile" of the supply chain, raw commodities, such as palm oil, are frequently mixed with physically identical raw materials from verified sustainable and nonverified sources, resulting in either hidden or lost origin information. Unilever used GreenToken to source over 188,000 tons of oil palm fruit. The technology allows Golden Agri-Resources and other suppliers from whom Unilever sources to develop tokens that mimic the material flow of palm oil along the supply chain while also capturing the distinctive qualities associated with its origin.

Global Blockchain in Manufacturing Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others), Latin America (Brazil, Mexico, and others), and the Middle East and Africa. According to the report, North America accounted for the largest market share, as the region has witnessed significant investment in blockchain technology, both from the private sector and government initiatives.

North America Blockchain in Manufacturing Market Trends:

North America acquires the largest share of the overall market. In the United States, various states are actively promoting the use of blockchain technology. For instance, Colorado passed a Bipartisan Bill exempting cryptocurrency from certain security regulations, encouraging blockchain adoption. Similarly, Oklahoma introduced legislation authorizing the use of cryptocurrency within state government agencies. These initiatives create a favorable environment for blockchain integration in manufacturing.

Europe Blockchain in Manufacturing Market Trends:

Blockchain provides real-time tracking and verification of goods, reducing fraud and errors in the supply chain. Companies in the United Kingdom and the Netherlands are leveraging blockchain to improve supply chain transparency and efficiency, further propelling the market growth. Additionally, France is leveraging blockchain in the food sector, ensuring transparency in sourcing and quality control, with companies like Carrefour leading the way.

Asia-Pacific Blockchain in Manufacturing Market Trends:

The region's manufacturing industry is rapidly expanding, particularly in countries like China and India. This growth is driving the adoption of blockchain technology to enhance operational efficiency and product quality. Besides this, in February 2023, Wipro Limited launched DICE ID by utilizing blockchain. DICE ID leverages the core tenets of this technology to transform the way consumers manage their online identities.

Latin America Blockchain in Manufacturing Market Trends:

Governments across Latin America are actively promoting blockchain adoption to enhance transparency and efficiency in manufacturing, which is fueling the regional market. For instance, Brazil has implemented a national blockchain network to improve public services and industrial processes, further escalating the market demand. Mexico, with its strong automotive industry, is seeing increasing adoption of blockchain for improving transparency and efficiency in cross-border supply chains.

Middle East and Africa Blockchain in Manufacturing Market Trends:

Governments across the MEA region are actively promoting blockchain adoption to enhance transparency and efficiency in manufacturing processes, thereby augmenting the market. For instance, the United Arab Emirates (UAE) launched the Emirates Blockchain Strategy 2021, aiming to integrate blockchain into various sectors, including manufacturing, to streamline operations and reduce costs.

Top Companies Leading in the Blockchain in Manufacturing Industry

Some of the leading blockchain in manufacturing market companies include Accenture plc, Advanced Micro Devices Inc., Amazon Web Services Inc. (Amazon.com Inc.), Infosys Limited, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, and Wipro Limited, among many others. For instance, in February 2023, Wipro Limited launched DICE ID, utilizing blockchain technology. DICE ID uses the fundamental principles of blockchain technology to alter how customers control their online identities. Also, in November 2022, Microsoft Corporation launched the Microsoft supply chain platform, a new design approach for supply chain agility, automation, and sustainability.

Global Blockchain in Manufacturing Market Segmentation Coverage

- On the basis of the provider, the market has been bifurcated into middleware providers, infrastructure and protocols providers, and applications and solution providers, wherein infrastructure and protocols providers accounted for the largest market share attributed to their foundational role in establishing the groundwork for successful blockchain integration in manufacturing.

- Based on the application, the market is categorized into logistics and supply chain management, counterfeit management, quality control and compliance, and others, amongst which logistics and supply chain management accounted for the largest market share. The application of blockchain technology in logistics and supply chain management fosters greater collaboration and trust among different participants, further driving the segment’s growth.

- On the basis of the end user, the market has been divided into automotive, aerospace and defense, pharmaceutical, electronics and semiconductor, and others. Among these, electronics and semiconductor accounted for the largest market share. Integrating blockchain technology within this sector offers transformative potential that addresses critical challenges and capitalizes on opportunities for advancement.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 3,027.9 Million |

| Market Forecast in 2033 | USD 95,576.9 Million |

| Market Growth Rate 2025-2033 | 46.8% |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Providers Covered | Middleware Providers, Infrastructure and Protocols Providers, Applications and Solution Providers |

| Applications Covered | Logistics and Supply Chain Management, Counterfeit Management, Quality Control and Compliance, Others |

| End Users Covered | Automotive, Aerospace and Defense, Pharmaceutical, Electronics and Semiconductor, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accenture plc, Advanced Micro Devices Inc., Amazon Web Services Inc. (Amazon.com Inc.), Infosys Limited, Intel Corporation, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, Wipro Limited etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)