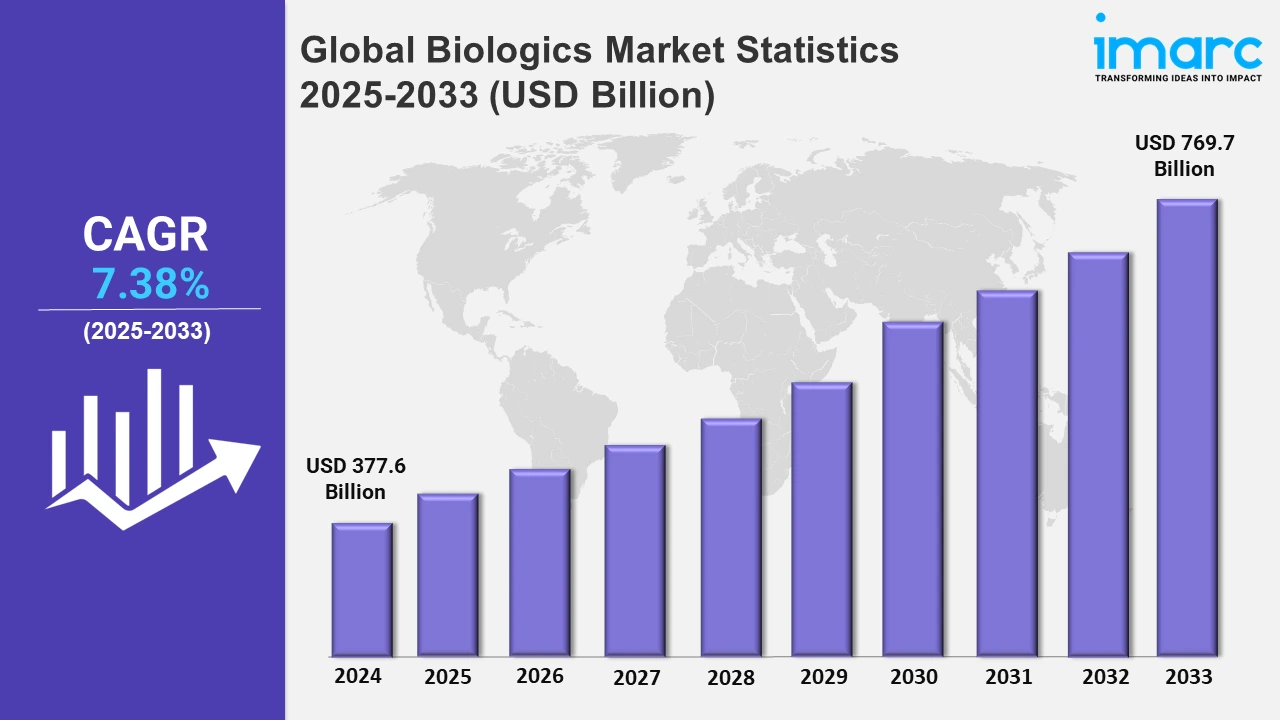

Global Biologics Market Expected to Reach USD 769.7 Billion by 2033 - IMARC Group

Global Biologics Market Statistics, Outlook and Regional Analysis 2025-2033

The global biologics market size was valued at USD 377.6 Billion in 2024, and it is expected to reach USD 769.7 Billion by 2033, exhibiting a growth rate (CAGR) of 7.38% from 2025 to 2033.

To get more information on this market, Request Sample

Continuous innovation in targeted therapeutics is a significant driver of the market. These are medicines that target specific cells or molecules responsible for disease, enhancing therapy efficacy while reducing side effects. Given the severity of diseases, such as cancer and autoimmune disorders, targeted medicines represent a novel and effective treatment option. For example, in March 2024, Caltech researchers created an ultrasound-activated drug-delivery system for cancer treatment, promising tailored therapy with low side effects. This technology uses gas vesicles and mechanophores to precisely activate medications, minimizing injury to healthy tissues. Extensive research has led to improved understanding of disease mechanisms at the molecular level, paving the door for more effective and less harmful treatments than old approaches. These tailored medicines are becoming mainstream as research and development funding increases and a greater emphasis is placed on personalized medicine.

Moreover, the global increase in the elderly population has led to a higher prevalence of age-related diseases, many of which are effectively treated with biological therapies. For instance, as per the World Health Organization (WHO), by 2030, one in every six people in the world will be 60 or older. At this time, the proportion of the population aged 60 and up will rise from 1 billion in 2020 to 1.4 billion. The number of people aged 80 and older is anticipated to treble between 2020 and 2050, reaching 426 million. This demographic shift is a significant driver of demand in the biologics market. Besides this, drug delivery systems are becoming more significant in healthcare, impacting the efficacy and patient compliance of complicated molecular treatments. Innovation in this field takes several shapes, ranging from controlled-release mechanisms to nanotechnology-based delivery systems. For example, in January 2024, researchers at the University of North Carolina introduced the spatiotemporal on-demand patch (SOP), a wireless medicine delivery device. This technology, which resembles a band-aid, may receive wireless commands from computers or cellphones, allowing for exact drug distribution via microneedles. Such innovations make it easier for patients to follow their treatment plans, which improves clinical outcomes.

Global Biologics Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share, owing to the rising prevalence of chronic diseases.

North America Biologics Market Trends:

North America dominates the market, owing to its well-developed healthcare infrastructure and substantial investments in biopharmaceutical research. The region is home to various renowned biopharmaceutical businesses and research institutions that promote innovation, resulting in a positive outlook for the market. Furthermore, favorable regulatory assistance in the form of fast-track approvals for biologics and other financial incentives for substantial R&D activities are helping to drive market expansion. Furthermore, increased patient knowledge and readiness to adopt innovative therapies are driving up biologics market demand in North America. Besides this, the aging population is also propelling the market growth. The number of people aged 65 and older in the United States is expected to rise from 58 million in 2022 to 82 million by 2050, with the 65-and-over age group accounting for 17% to 23% of the overall population.

Europe Biologics Market Trends:

The rising incidence of chronic conditions, such as cancer, diabetes, and autoimmune disorders, has heightened the demand for biological therapies. For instance, the prevalence of cancer in Europe is projected to rise from 19.3 million cases in 2020 to 24.6 million by 2030, underscoring the need for effective biologic treatments.

Asia Pacific Biologics Market Trends:

The increasing incidence of chronic conditions such as diabetes and cancer is a major driver. In Asia, approximately 8.5 million deaths annually are attributed to chronic diseases, underscoring the urgent need for effective biologic therapies.

Latin America Biologics Market Trends:

The approval and adoption of biosimilars that are highly similar to already approved reference products are gaining momentum in Latin America. Countries like Brazil, Mexico, Argentina, Chile, and Ecuador have approved various biosimilars, enhancing access to biologic therapies and contributing to market growth.

Middle East and Africa Biologics Market Trends:

The region faces a rising incidence of chronic conditions, such as diabetes, cardiovascular diseases, and cancer. For instance, according to the World Health Organization (WHO), Saudi Arabia has the second highest diabetes rate in the Middle East and seventh worldwide. It is estimated that over 7 million people are diabetic, with nearly 3 million pre-diabetes. This surge has heightened the demand for advanced biologic therapies that offer targeted and effective treatment options.

Top Companies Leading in the Biologics Industry

Some of the leading biologics market companies include AbbVie Inc., Amgen Inc., AstraZeneca plc, F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc, Johnson & Johnson, Merck KGaA, Novartis AG, Pfizer Inc., and Sanofi, among many others. For instance, in August 2023, AbbVie Inc. announced that the European Commission authorized AQUIPTA for migraine prevention in people who suffer four or more migraine days per month. AQUIPTA is the first and only once-daily oral calcitonin gene-related peptide (CGRP) receptor antagonist (gepant) approved in the European Union for the prevention of chronic and episodic migraine. Also, in August 2023, AstraZeneca plc announced that Japan's Ministry of Health, Labour, and Welfare had approved the expanded use of Soliris (eculizumab) for treating juvenile patients with generalized myasthenia gravis who are refractory to existing treatments. The approval follows positive Phase III study results, making Soliris Japan's first targeted medication for this ailment in children and adolescents.

Global Biologics Market Segmentation Coverage

- On the basis of the source, the market has been bifurcated into microbial, mammalian, and others, wherein microbial represented the largest segment driven by its cost-effectiveness and shorter production times compared to mammalian cell cultures.

- Based on the product, the market is categorized into monoclonal antibodies, vaccines, recombinant proteins, antisense, RNAi and molecular therapy, and others, amongst which monoclonal antibodies represented the largest segment, leading the biologics industry statistics due to their specificity in targeting a wide array of diseases including cancers, autoimmune disorders, and infections.

- On the basis of the disease, the market has been divided into oncology, immunological disorders, cardiovascular disorders, hematological disorders, and others. Among these, oncology represented the largest segment driven by the high prevalence of cancer worldwide and an aging population more susceptible to this disease.

- Based on the manufacturing, the market is bifurcated into outsourced and in-house, wherein in-house represented the largest segment. In-house facilities allow for quicker adaptations to market changes and more effective implementation of quality controls.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 377.6 Billion |

| Market Forecast in 2033 | USD 769.7 Billion |

| Market Growth Rate 2025-2033 | 7.38% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sources Covered | Microbial, Mammalian, Others |

| Products Covered | Monoclonal Antibodies, Vaccines, Recombinant Proteins, Antisense, RNAi and Molecular Therapy, Others |

| Diseases Covered | Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, Others |

| Manufacturing Covered | Outsourced, In-House |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | AbbVie Inc., Amgen Inc., AstraZeneca plc, F. Hoffmann-La Roche Ltd, GlaxoSmithKline plc, Johnson & Johnson, Merck KGaA, Novartis AG, Pfizer Inc., Sanofi, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Biologics Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)