Global Biological Safety Testing Market Expected to Reach USD 13.3 Billion by 2033 - IMARC Group

Global Biological Safety Testing Market Statistics, Outlook and Regional Analysis 2025-2033

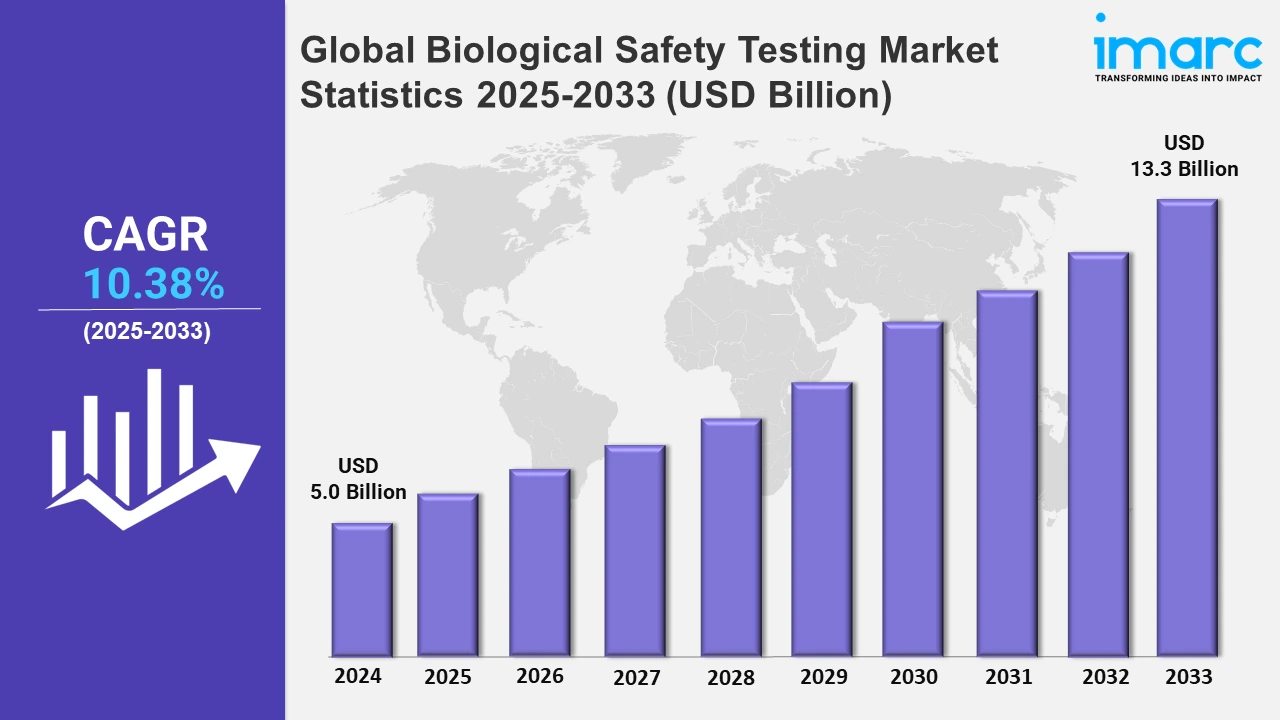

The global biological safety testing market size was valued at USD 5.0 Billion in 2024, and it is expected to reach USD 13.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.38% from 2025 to 2033.

To get more information on this market, Request Sample

The biological safety testing industry is seeing growing investment in modern laboratory facilities to broaden assay capabilities. New protein analysis spaces, such as ELISA assays and immunoassays, meet the demands of biopharma and CDMOs seeking accurate and complete testing solutions. For example, in May 2022, Avance Biosciences announced the completion of its newly acquired 26,000 square feet of laboratory space. This expansion allowed Avance to offer a wider range of protein and cell-based assay services to its biopharma and CDMO clients. The new facilities focus on protein analysis services, including ELISA assays, protein characterization, and immunoassays.

Moreover, the biological safety testing industry is evolving with novel analytical approaches that improve speed, accuracy, and cost-effectiveness. New procedures, such as isotope dilution and LC/MS/MS techniques, enable accurate identification of chemicals across a wide range of sample types, satisfying changing business expectations. For instance, in September 2023, Pace Analytical Services announced the launch of a new PFAS test method that provides reliable results faster and at a lower cost. The method, ASTM D8421/EPA 8327, uses isotope dilution and LC/MS/MS to analyze up to 44 PFAS compounds in aqueous and solid samples. This method offers advantages, such as faster delivery of results, reduced sample size, and reliable quantification. Furthermore, to satisfy strict regulatory requirements, biological safety testing companies are shifting their attention to advanced assays. This is consistent with the increased demand for comprehensive testing techniques in new biopharmaceutical areas. Furthermore, the need for biological safety testing services in developing countries provides profitable development potential for providers. Additionally, high-throughput and automated testing procedures are gaining popularity over traditional human processes because of their efficiency and accuracy in guaranteeing compliance. For example, the growing manufacturing of biosimilars in Asia Pacific, spearheaded by businesses, such as Wuxi Biologics and Biocon, has increased the necessity for rigorous safety testing methodologies. These companies spend extensively on biological safety testing solutions to fulfill global standards and achieve regulatory permission for biosimilar launches, answering the growing healthcare need for cost-effective and safe pharmaceuticals.

Global Biological Safety Testing Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest biological safety testing market share, on account of constant innovation and the introduction of new drugs, biologics, and medical devices that necessitate rigorous safety evaluations.

North America Biological Safety Testing Market Trends:

In North America, growing investment in cell and gene therapy is driving biological safety testing, thereby exhibiting a clear dominance in the market. The FDA's clearance of medicines, such as Zolgensma emphasizes the importance of comprehensive safety testing, increasing demand for specialist assays and biopharmaceutical testing services throughout the region.

Europe Biological Safety Testing Market Trends:

In Europe, elevated biosimilar manufacturing is increasing the need for biological safety testing. Companies, such as Novartis, are developing biosimilars for conditions including rheumatoid arthritis, which requires severe safety processes to achieve EMA compliance and market clearance.

Asia Pacific Biological Safety Testing Market Trends:

In Asia Pacific, the thriving biotechnology sector in countries, such as India and China, is hastening biological safety testing. The emergence of new biomanufacturing facilities, including Wuxi Biologics in China, demonstrates the region's emphasis on improved biopharmaceutical testing standards.

Latin America Biological Safety Testing Market Trends:

In Latin America, the rising emphasis on vaccine development, particularly for infectious illnesses, is pushing biological safety testing. Brazil's Fiocruz Institute prioritizes safety evaluations in vaccine manufacture to fulfill rising public health demands.

Middle East and Africa Biological Safety Testing Market Trends:

In the Middle East and Africa region, rising pharmaceutical production capabilities, notably in Saudi Arabia, are driving up demand for biological safety testing. Local manufacturing of biologics and biosimilars is prioritized, assuring compliance with worldwide safety requirements for export and regional healthcare improvement.

Top Companies Leading in the Biological Safety Testing Industry

Some of the leading biological safety testing market companies include Avance Biosciences, Charles River Laboratories, Creative Biogene, Eurofins Scientific, Lonza Group AG, Maravai LifeSciences, Pace Analytical Services Inc., Pacific BioLabs, Sartorius AG, SGS SA, ViruSure GmbH (Asahi Kasei Corporation), and WuXi Biologics, among many others. For example, in May 2022, Charles River Laboratories collaborated with a drug discovery technology firm on Logica, which is an artificial intelligence (AI) tool specially designed to boost the development of new treatments.

Global Biological Safety Testing Market Segmentation Coverage

- On the basis of the product and services, the market has been bifurcated into kits and reagents, instruments, and services, wherein kits and reagents represent the most preferred segment. The increased emphasis on assuring product quality and safety in the food and beverage (F&B) industry, where biological pollutants can pose major concerns, is driving demand for testing kits and reagents for microbiological analysis.

- Based on the test type, the market is categorized into endotoxin tests, sterility tests, cell line authentication and characterization tests, bioburden tests, residual host contaminant detection tests, adventitious agent detection tests, and others, amongst which endotoxin tests dominate the market. The growing emphasis on personalized medicine and biopharmaceuticals, including gene therapies and monoclonal antibodies, requires thorough endotoxin testing to ensure the purity and safety of these new medicines.

- On the basis of the application, the market has been divided into vaccine development, blood products testing, cellular and gene therapy, tissue and tissue-related products testing, and stem cell research. Among these, vaccine development exhibits a clear dominance in the market. The critical global need for safe and effective vaccinations drives the demand for biological safety testing in vaccine development.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 5.0 billion |

| Market Forecast in 2033 | USD 13.3 billion |

| Market Growth Rate 2025-2033 | 10.38% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Products and Services Covered | Kits and Reagents, Instruments, Services |

| Test Types Covered | Endotoxin Tests, Sterility Tests, Cell Line Authentication and Characterization Tests, Bioburden Tests, Residual Host Contaminant Detection Tests, Adventitious Agent Detection Tests, Others |

| Applications Covered | Vaccine Development, Blood Products Testing, Cellular and Gene Therapy, Tissue and Tissue-related Products Testing, Stem Cell Research |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Avance Biosciences, Charles River Laboratories, Creative Biogene, Eurofins Scientific, Lonza Group AG, Maravai LifeSciences, Pace Analytical Services Inc., Pacific BioLabs, Sartorius AG, SGS SA, ViruSure GmbH (Asahi Kasei Corporation), WuXi Biologics, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)